December 2024

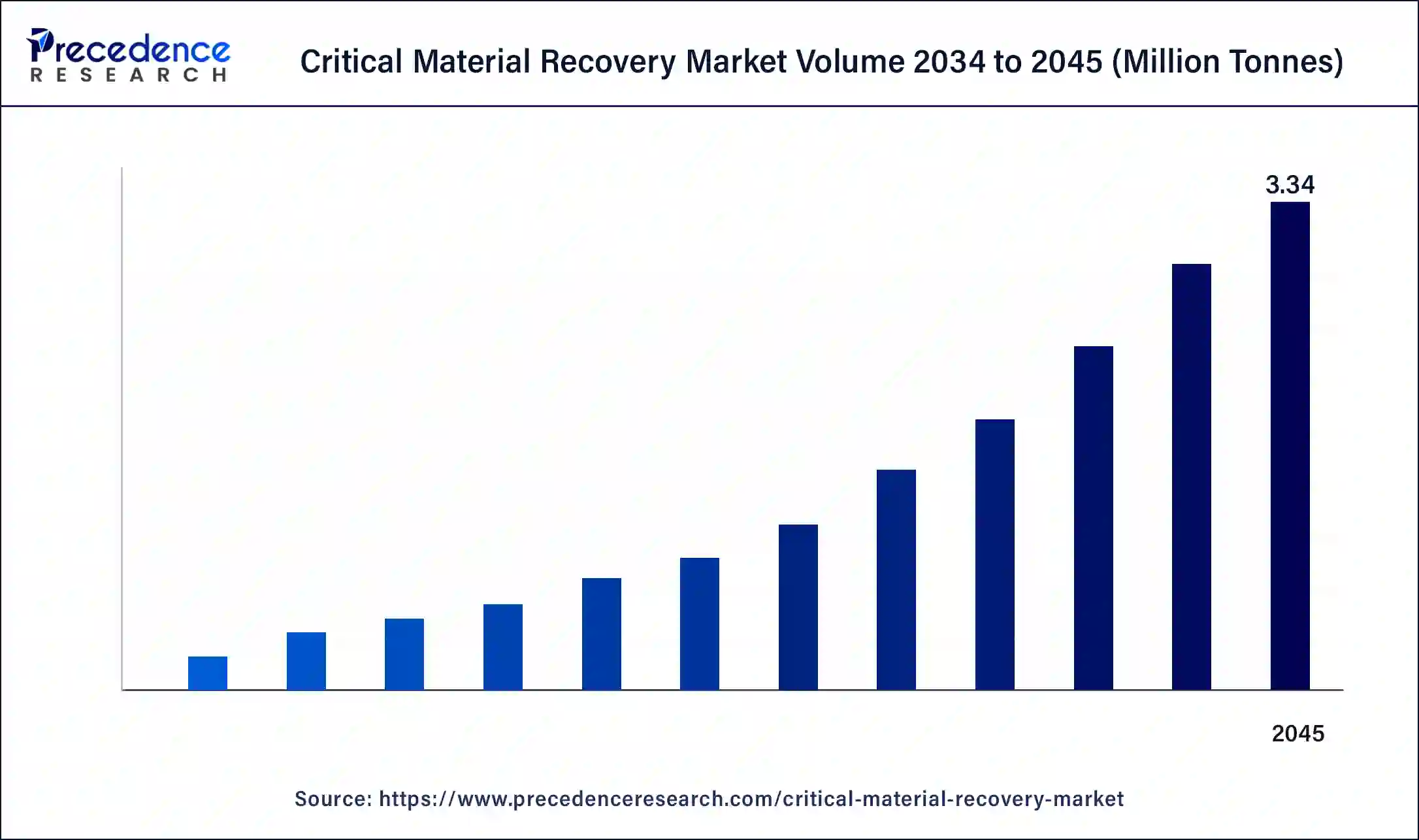

The global critical material recovery market volume is anticipated to hit around 3.34 million tonnes by 2045 and is projected to expand at a notable compound annual growth rate (CAGR) between 2034 and 2045.

The global critical material recovery market volume is projected to reach around 3.34 million tonnes by the end of the year 2045. The critical material recovery market is driven by the increasing constraints on the environment.

The critical material recovery market is the industry devoted to gathering, processing, and recycling materials necessary for technology, manufacturing, and other vital sectors. Rare earth elements, metals, and minerals that are essential for creating sophisticated materials, renewable energy systems, and high-tech electronics are frequently included in these materials. Even though critical materials are frequently costly, they are precious economically. By implementing efficient recovery, manufacturers can lower their expenses and lessen their reliance on erratic international markets. Recycling essential materials helps promote more sustainable practices by reducing the environmental impact of raw material mining and processing.

Government Supporting Lithium Mining

| S.No. | Country | Budget | Aim |

| 1. | India | about 200 crores | This strengthens the bilateral ties between India and Argentina while contributing to the mining sector's sustainable development. It ensures a resilient and diversified supply chain for critical and strategic minerals essential for various industries. |

| 2. | U.S. | about $11.7 billion | A critical component in some renewable energy technology, especially electric vehicle batteries and large grid-scale storage batteries. |

| 3. | Mexico | - | Favoring carbon-intensive electricity epitomizes a strategy that prizes energy sovereignty over sustainability or economic efficiency. |

Asia Pacific’s dominance in the critical material recovery market

Critical commodities, including rare earth elements (REEs), lithium, cobalt, and platinum group metals, are in high demand due to the technology sector's rapid growth, especially in electronics, renewable energy, and electric cars. Nations like South Korea and Japan place a high priority on material recovery technology research and development. As a result, creative techniques for recovering and recycling essential materials have been developed.

A few nations in the region have established strategic reserves of vital resources maintained through recovery and recycling to guarantee a steady supply and lessen reliance on imports.

Critical Material Recovery Market in North America: Opportunities & Innovations

Effective recovery techniques are required due to the growing demand for vital resources like lithium, cobalt, and rare earth elements, which are necessary for electronics, renewable energy technology, and electric cars. Material recovery is becoming more important as supply chains are under pressure to meet the growing demands of consumers and industry for more technologically sophisticated and sustainable products. Critical material recovery is becoming much more efficient thanks to advancements in recovery technologies, including biotechnology, enhanced separation methods, and sophisticated hydrometallurgical processes. Businesses in North America are spending money on R&D to improve these technologies, which will increase the efficacy and economic viability of recovery procedures.

| Report Coverage | Details |

| Market Volume by 2045 | 3.34 Million Tonnes |

| Leading Region | Asia Pacific |

| Forecast Period | 2034 to 2045 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for critical materials

Many essential materials are scarce in nature, and their extraction is frequently localized. For instance, there is a risk of geographic concentration because China is the country that mines most rare earth elements. The likelihood of supply disruptions brought on by trade restrictions, depletion of natural resources, or geopolitical tensions grows with demand. This scarcity necessitates effective recovery techniques to support the primary supply. Critical material extraction frequently entails environmentally detrimental methods, such as high energy use, habitat destruction, and pollution. There is growing demand to lessen the environmental impact of crucial material extraction as the world's attention turns to sustainability.

Critical materials can be recovered and recycled from end-of-life items, providing a more sustainable option that aligns with the ideas of the circular economy. This drives the growth of the critical material recovery market.

Rise of innovative recovery technologies

Critical components in complex waste streams can be optimally identified and sorted using AI and ML algorithms. By enabling more precise identification of essential elements, these technologies lessen the chance of crucial materials being lost during recovery. Governments worldwide are introducing policies requiring the recycling of necessary materials, especially in the electronics, automotive, and energy storage sectors. These requirements are driving the need for more inventive and effective recovery solutions.

Opportunities

Growing demand for sustainable practices

Environmental concerns, especially waste management, resource depletion, and carbon footprints, are becoming increasingly apparent to modern customers. As a result, people now favor goods and services that follow sustainable methods. The pressure on businesses to acquire resources with the least possible negative environmental impact has increased demand for recovered vital components.

Under EPR regulations, manufacturers are held responsible for the complete lifecycle of their products, including recycling and disposal. As a result, businesses are encouraged to add more recyclable and recoverable materials to their goods, which increases demand for vital material recovery services.

Increasing demand for high-tech product

Crucial resources, including rare earth elements, lithium, cobalt, and precious metals, are used extensively in high-tech devices like computers, cellphones, EVs, and renewable energy systems. The requirement for these materials grows as these industries expand quickly due to customer demand and technical advancements. Critical elements are scarce, though, and obtaining them frequently presents geopolitical and environmental difficulties. This scenario reduces reliance on primary resources by providing a substantial incentive for recycling and recovering these elements from used products. This opens an opportunity for the growth of the critical material recovery market.

Restraints

High recovery costs

Material recovery involves energy-intensive procedures. For instance, a large amount of energy is needed to melt metals or dissolve complicated compounds, which raises operating expenses, particularly in areas where energy prices are high. Material recovery uses more energy, which increases carbon emissions. Depending on local laws, this could mean paying extra for carbon credits or penalties. Furthermore, businesses might have to spend more money on greener technology or carbon offset strategies, raising expenses even more.

Limited availability of recyclable materials

Recyclable items frequently contain critical elements in small amounts. For instance, wind turbines and smartphones only contain minuscule amounts of rare earth metals. Due to their modest quantities, it is difficult to recover these materials economically. The rising demand for essential minerals has worsened the issue across several high-tech businesses. Constraints in the supply chain result from the limited supply of recyclable materials being unable to fulfill demand, which puts more strain on recycling systems as these resources are consumed more frequently.

The market value of the recovered materials may not justify the increased recovery costs resulting from the limited availability of recyclable materials. This economic imbalance discourages investment in infrastructure and recovery technologies.

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

March 2025

April 2025

August 2024