November 2024

The global curtain walls market size surpassed USD 47.36 billion in 2023 and is estimated to increase from USD 50.97 billion in 2024 to approximately USD 106.23 billion by 2034. It is projected to grow at a CAGR of 7.62% from 2024 to 2034.

The global curtain walls market size is expected to worth USD 50.97 billion in 2024 and is anticipated to reach around USD 106.23 billion by 2034, growing at a solid CAGR of 7.62% over the forecast period 2024 to 2034. The increasing need for contemporary architectural structures that integrate smart technology to promote environmental sustainability and control indoor temperature is driving growth in the curtain walls market.

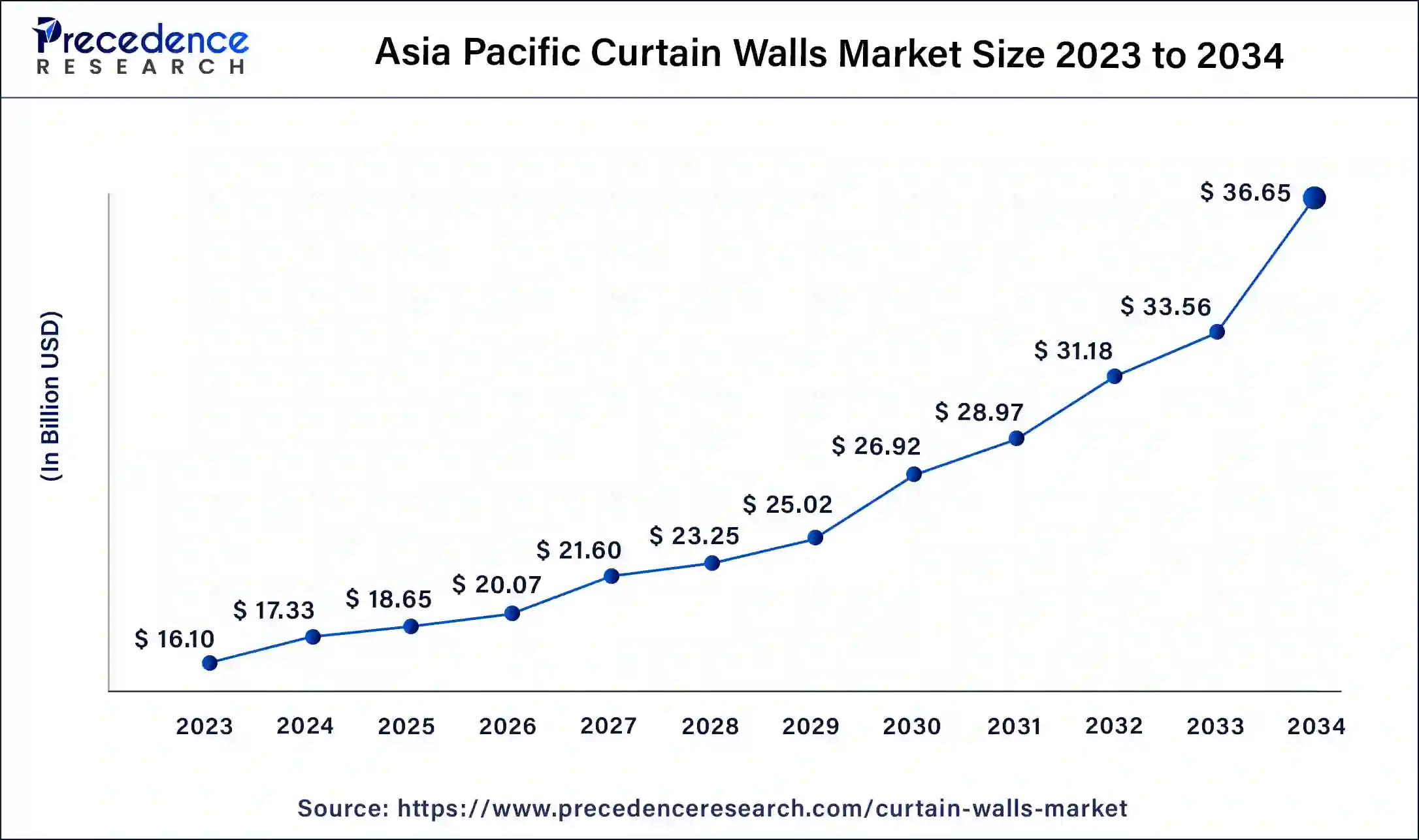

The Asia Pacific curtain walls market size was exhibited at USD 16.10 billion in 2023 and is projected to be worth around USD 36.65 billion by 2034, poised to grow at a CAGR of 7.76% from 2024 to 2034.

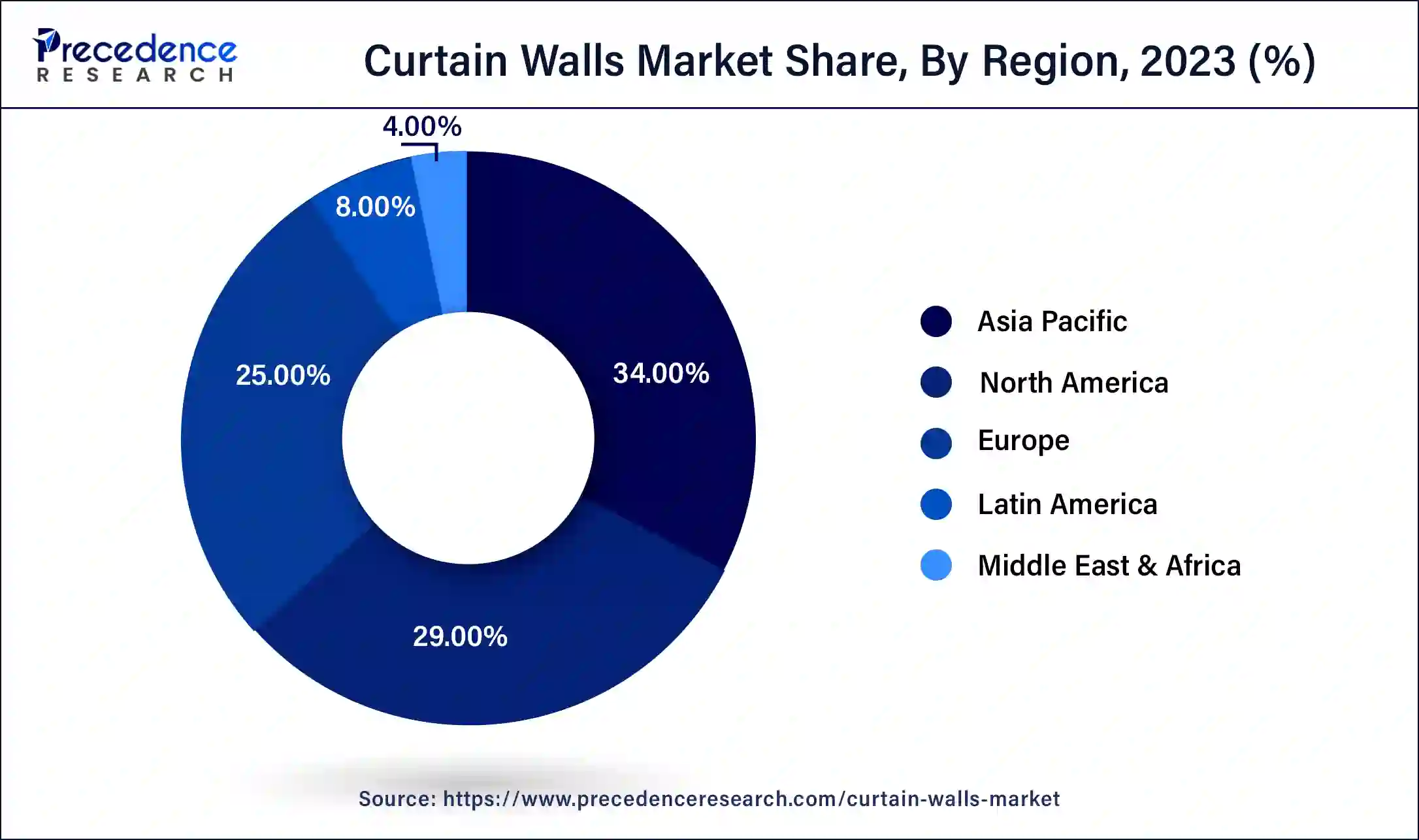

Asia Pacific held the largest share in the curtain walls market. The increase in urbanization, expansion of the construction industry, higher disposable income, and growing emphasis on the aesthetics of living spaces have all contributed to these developments. Nations like India, China, Thailand, and Vietnam are home to rapidly expanding construction industries, which are expected to significantly drive the market growth in the region. Significant expansion has been observed in this area, propelled by pivotal elements such as technological developments and escalating consumer needs. All the factors propel to boost the curtain walls market.

North America is projecting its growth in the curtain walls market. The North American region commands the fastest growing position in this market owing to its robust construction industry, high demand for commercial and residential spaces, and stringent building regulations that prioritize energy efficiency and sustainability. Furthermore, the region's emphasis on contemporary architectural designs, particularly in urban centers, has significantly contributed to the widespread adoption of the curtain walls market.

The curtain wall is the exterior covering for a building creating a protective barrier against weather and harsh outdoor elements. They are non-structural which means they are made from a thin, lightweight material, usually made of aluminum and glass. The prevalent curtain wall systems used in construction include stick-built, unitized, metal or aluminum curtain wall systems, and structural glazing wall systems. They are used on domestic/household and commercial buildings. Curtain walls create a dramatic, attractive face with the ability to resist air and water infiltration. They are seen on some of the world’s renowned buildings such as London’s Gherkin and New York’s Empire State Building.

The lightweight material of curtain walls provides unlimited exposure to natural light with wide visibility of the outside panoramic view. In comparison with traditional buildings, aluminum curtain walls have a high heat transfer coefficient, which makes them a very good conductor of heat. However, the possibility of considerable heat loss through aluminum curtain wall mullions if there are no thermal breaks installed to compensate.

Curtain walls provide an aesthetic appearance and self-cleaning ability with solar control glass.

| Report Coverage | Details |

| Market Size by 2034 | USD 106.23 Billion |

| Market Size in 2023 | USD 47.36 Billion |

| Market Size in 2024 | USD 50.97 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.62% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Fabrication, Construction Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Demand for energy-efficient solutions

Curtain walls contribute significantly to the energy efficiency of buildings with advancements in technology and modern curtain walls are designed. Installation of double-glazed or even triple-glazed glass panels, along with thermal breaks and insulating glass unit materials, minimize heat transfer, enhancing thermal efficiency.

This feature reduces energy consumption for heating and cooling and stabilizes the temperature of the building, it also contributes to the overall sustainability of the building and reduces overall costs. Additionally, curtain walls are engineered to resist building sway in high-rise buildings, ensuring structural integrity while providing thermal insulation. Sustainability is a top priority in modern architecture. Advancements in curtain wall technology focus on improving thermal insulation and reducing energy consumption.

Flexible and modern design

Curtain walls offer design flexibility to architects. The walls are tailored to match the unique vision of each project. The glass panel design creates a beautiful and open atmosphere on both the interior and exterior of the building. The involvement of various materials, colors, textures, and patterns enables architects to craft buildings that stand out and become iconic landmarks in urban landscapes.

Every industry office needs a sleek and contemporary exterior that entices clients, impresses investors and adds an unparalleled sense of professionalism. Curtain walls are ideal for a luxurious office appearance, the abundance of natural light and windows allows for a lively and spacious atmosphere. Architects constantly seek new ways to build visually striking buildings and innovative curtain wall systems provide desired elements for incorporating unique shapes, angles, and material combinations.

High maintenance of curtain wall

Despite the stunning visual effect provided by the glass panels in curtain walls, the biggest challenge of it is maintenance. Regular maintenance by cleaning is a must to keep the exterior wall looking fresh and clean. Getting rid of the accumulated dirt, dust and pollutants is necessary, cleaning will also prevent corrosion and extend the lifespan. Routine inspections are important to reveal any hidden problems with the curtain wall facade.

A visual inspection to pay close attention to any issues with gaskets, seals, and connections must be performed regularly. In case of any cracks or other structural issues must be addressed immediately to prevent further damage to the facade. A high-quality sealant prevents water infiltration, thermal efficiency is maintained only if the water is unable to seep in. Immediate repair and replacement must be performed if any signs of wear or damage are spotted.

Building-Integrated Photovoltaics (BIPV)

Curtain walls have emerged as a popular application for photovoltaic glass in modern buildings. This innovative technology enables property owners to harness power from previously untapped areas of the building, effectively transforming the structure into a functional power plant. Exceptionally, this integration does not impact the building's design appeal, aesthetics, efficiency, or functionality.

In the implementation of PV (Photovoltaic) Glass in curtain walls, the choice between amorphous Silicon and crystalline Silicon glass depends on specific design preferences, energy requirements, and daylight conditions. Additionally, PV Glass for curtain walls is commonly frameless and provides seamless integration into any commercial system. From a mechanical standpoint, the installation of the PV Glass is the responsibility of the glazing contractor, followed by the interconnection of units by the electrical contractor.

Furthermore, there is a flexibility factor in selecting varying levels of visible light transmittance. A common approach involves combining semi-transparent PV Glass for the vision areas with fully opaque glass for the spandrel. This strategic combination serves to optimize energy yield from the elevation while ensuring unobstructed views.

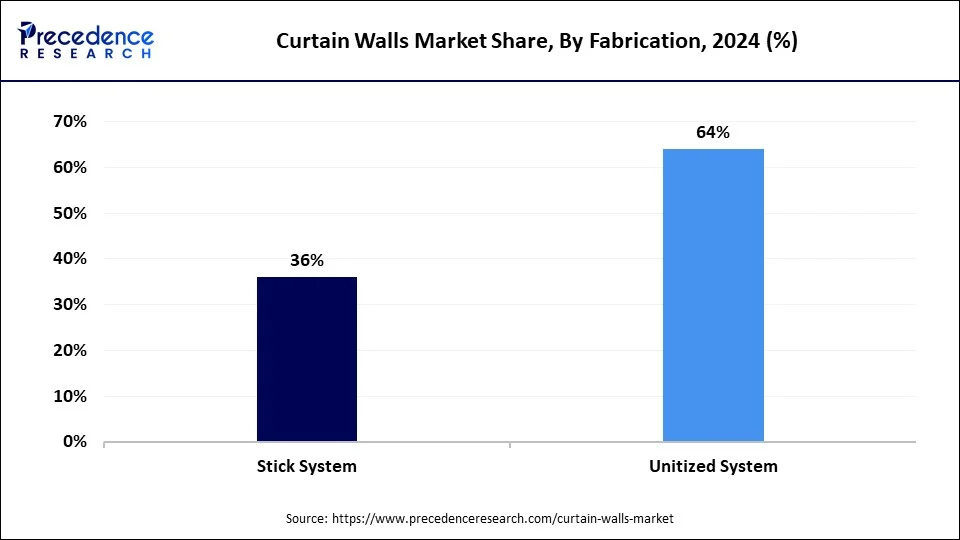

The unitized system segment is dominated the curtain walls market. In unitized systems, the components are already embedded and brought as a single unit to the construction site from the manufacturing factory. This avoids the need for individual installation. The dimensions of the unitized curtain walls correlate directly with the floor-to-floor height of the building structure. They are popularly utilized in high-rise buildings, cranes and scaffolding are not required for external supports; instead, mini cranes are needed. The benefit of a unitized system is it offers quick construction and promises good-quality products. This type of system requires a high shipping charge due to its large size and need for secure protection for transportation to the site.

The stick system segment is observed to in the grow at a notable rate in curtain walls market during the forecast period. In stick systems, the components are attached piece by piece on the supported frame outside the building. This system is usually used for low-rise buildings and small regions due to the inability to reach higher with the help of the exterior case. This system is expected to be flexible given its space on the onsite for adjustment.

Because of its adaptability and affordability, stick systems are generally utilized in shopping centers, as well as low-rise residential and office buildings. The individual components of a stick system are typically manufactured in a factory and subsequently transported to the designated site for installation by a team of specialized professionals. There is a low shipping cost for this system.

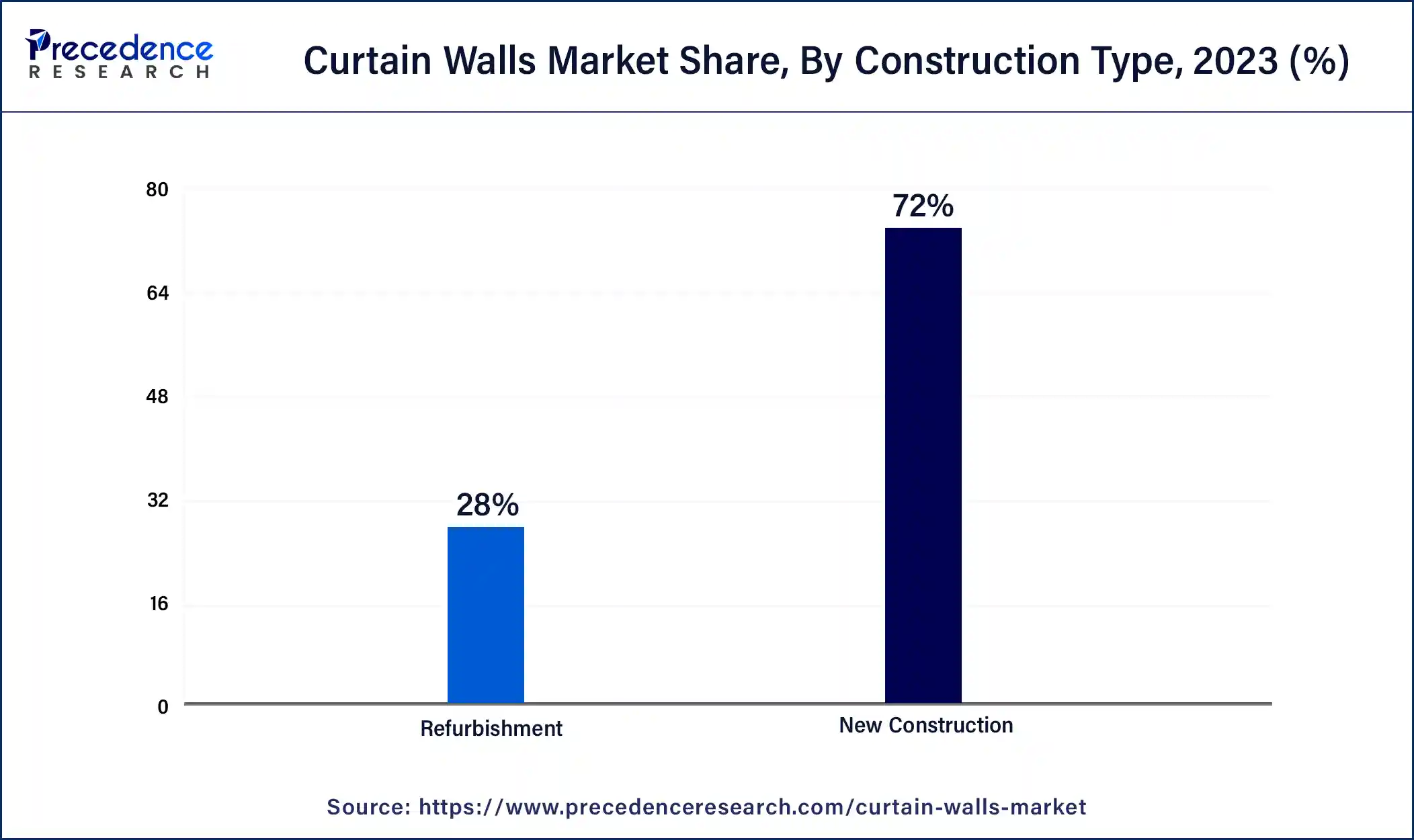

The new construction segment dominated the curtain walls market. In new construction, architects and designers have full creative freedom to integrate curtain walls seamlessly into the building’s design. New construction buildings are designed effortlessly with curtain wall systems from the outset. Installation is typically more straightforward since there are no existing structures to work around.

The refurbishment segment is the fastest growing in the curtain walls market. Retrofitting a curtain wall on an already existing building is a challenging project. The layout of the existing building may not align with a perfect match with the curtain walls system, modification would be needed. Initially, the engineer must take an accurate measurement of the building and install the stick system. Manufacturing the unitized system for a refurbished project is expected to be challenging. Retrofitting can be costlier due to the need for structural modifications and potential disruptions during installation.

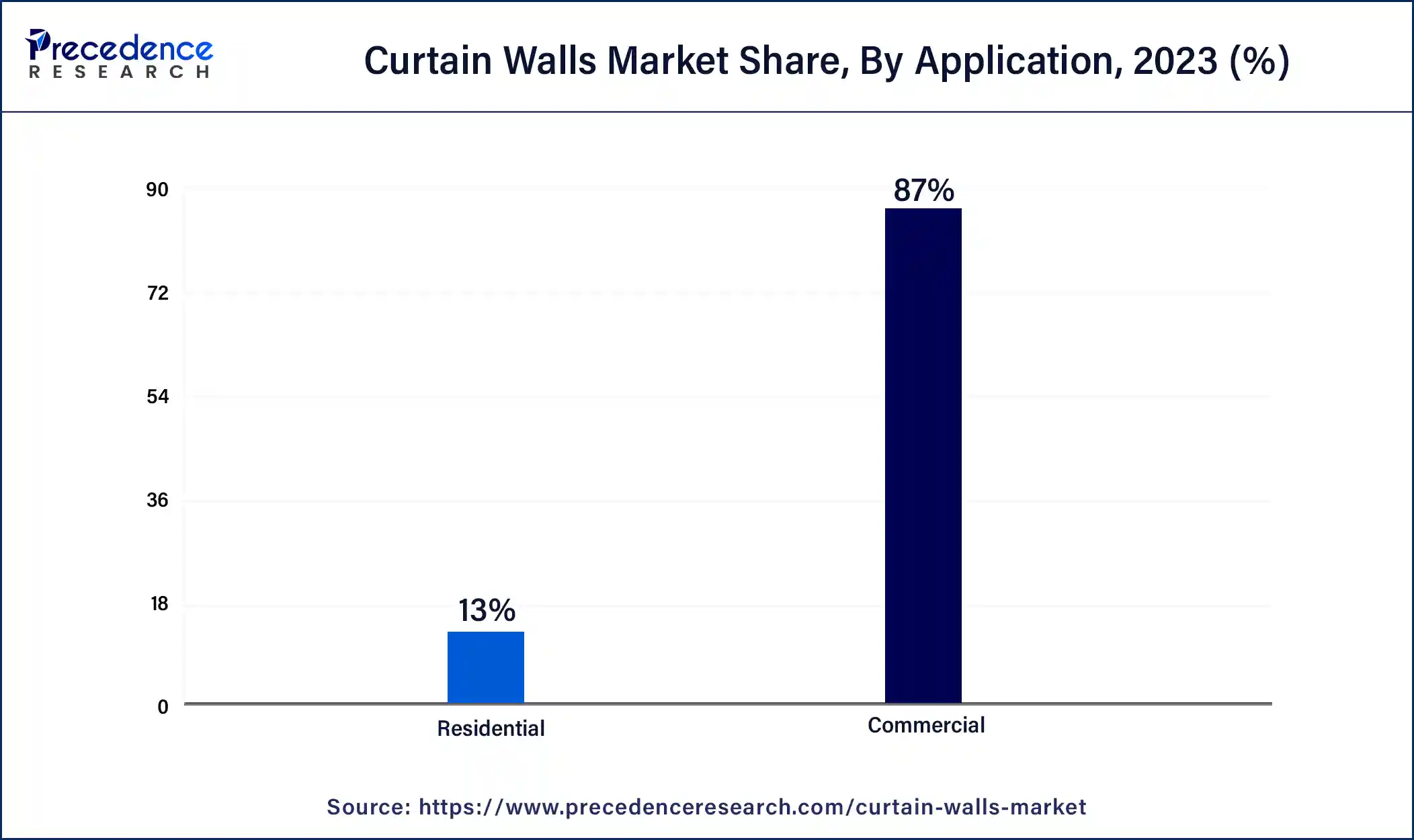

The commercial segment is dominating in the curtain walls market. The high number of installations in commercial buildings such as offices, assembly halls, industrial architecture and restaurants have been witnessed. Due to its high-rise building, large commercial spaces demand a sleek and uninterrupted glass exterior. Unitized systems are utilized for commercial buildings. High-quality curtain walls that offer excellent thermal insulation and enhance energy efficiency are required in commercial spaces.

The residential segment is the fastest growing in the curtain walls market with large shares. Curtain walls are less common in residential settings. Instead of curtain walls, window walls are highly utilized in residential spaces. It is a structural design element that uses large expanses of glass to create a seamless transition between indoor and outdoor spaces. Window walls give the appearance of a continuous glass façade but are structurally different from curtain walls. Window walls are less complex to install compared to curtain walls. Window walls also offer a good insulation performance in controlling heat transfer.

Segments Covered in this Report

By Fabrication

By Construction Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024