Aluminum Market Size and Growth 2025 to 2034

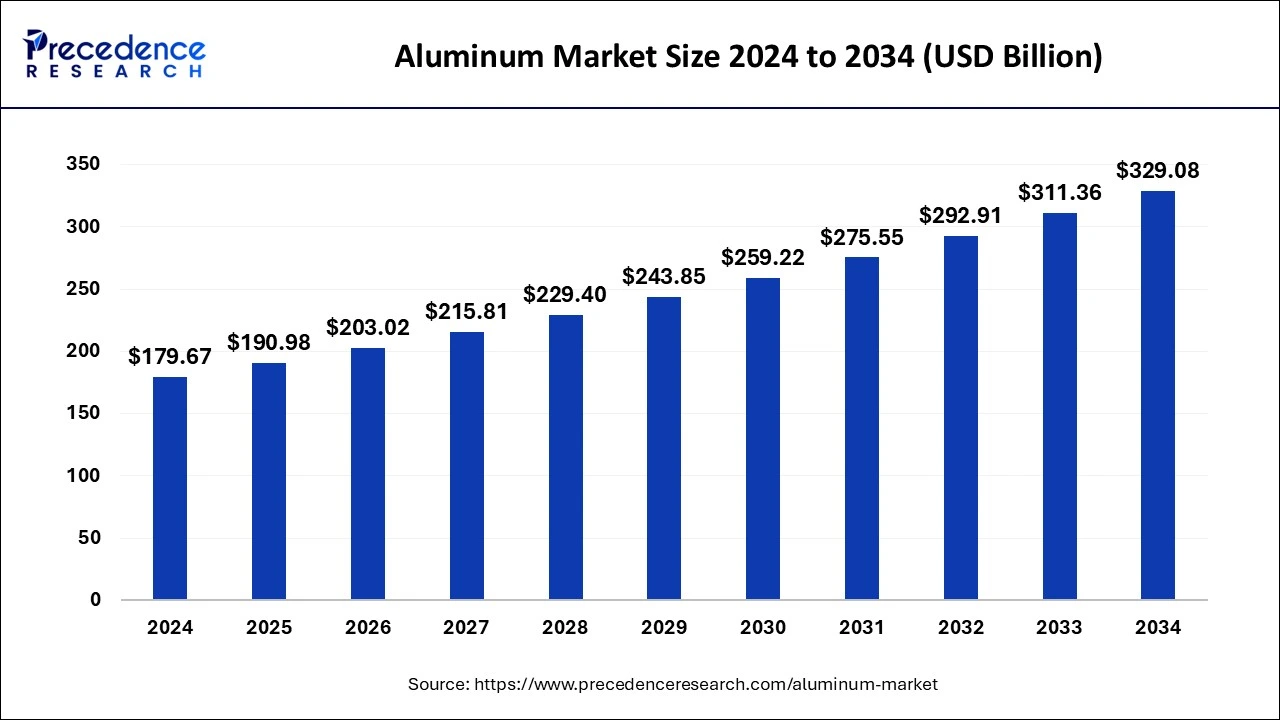

The global aluminum market size was accounted for USD 179.67 billion in 2024, and is expected to reach around USD 329.08 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The market growth is driven by the increasing demand for lightweight and durable materials across industries such as automotive, aerospace, and construction.

Aluminum Market Key Takeaways

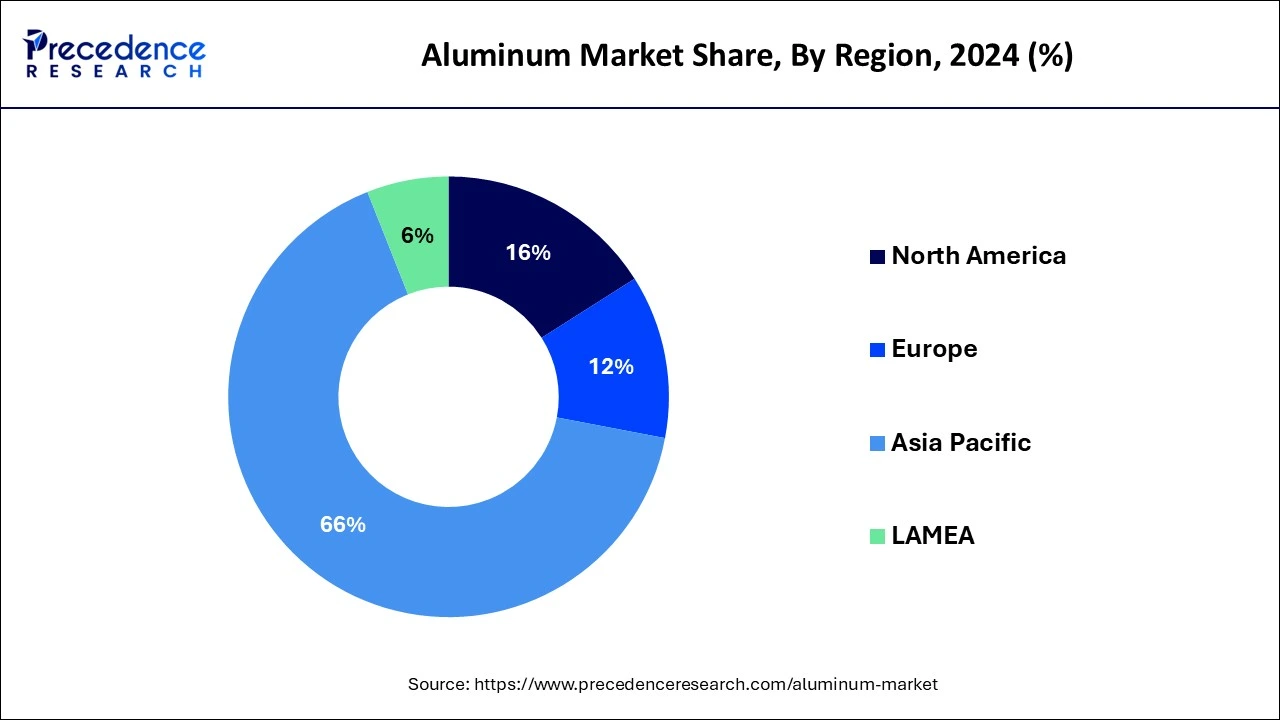

- Asia Pacific led the global market with the highest market share of 66% in 2024.

- By series, series 7 is anticipated is growing faster at a CAGR of 7.2% from 2025 to 2034. The series 1 segment occupied a market share of around 20.5% in 2024.

- By processing method, the rod & bar segment is projected to reach a CAGR of 7.1% over the forecast period.

- By end-use industry, the transport segment accounted for 33% of revenue share in 2024.

Impact of Artificial Intelligence on the Aluminum Market

AI is being used to automate manufacturing processes, making operations easier and, most importantly, saving a lot of money. AI algorithms help in the predictive maintenance of machinery by monitoring their functions and performance in real-time, reducing downtime and production efficiency. They also help in the quality control process, ensuring aluminum products meet necessary quality standards for specific applications. Integrating AI algorithms in the manufacturing processes of aluminum helps optimize energy consumption by automating mundane tasks that require a lot of electricity and time, contributing to sustainability. Moreover, AI technologies help manufacturers manage inventory levels, streamlining the supply chain.

Asia Pacific Aluminum Market Size and Growth 2025 to 2034

The Asia Pacific aluminum market size was estimated at USD 118.58 billion in 2024 and is predicted to be worth around USD 218.84 billion by 2034, at a CAGR of 6.32% from 2025 to 2034.

Due to reasons like rapid and widespread industrialization, quick and widespread urbanization, increasing investment and activities in infrastructure and infrastructure, and development in the automobile industry, Asia-Pacific is predicted to have the fastest expanding market. Because big consumers like Japan, China, and India are present, it is the main factor driving the market's expansion. The region's desire for metal is being driven by the expanding construction and automobile industries. The market is expanding in Europe as a result of factors like the introduction of legislation to reduce automobile pollution and the strong demand from end-use sectors like solar cells and packing.

- China's aluminium production significantly increased, owing to the newer production capacity. According to the data recently published by the National Bureau of Statistics, China's aluminium output in the final month of 2024 rose month-on-month as well as year-on-year by 1.62 per cent and 4.2 per cent, respectively. China's aluminium output in December 2024 stood at 3.77 million tonnes, with daily production averaging 121,612 tonnes.

The automotive and transportation industries' high demand dominates the North American market. One significant reason fueling the market expansion in this region is the use of this material by EV producers to lighten their vehicles. The causes responsible for the rise in Latin America and the Middle East and Africa are the increased demand among end-users for equipment, consumer durables, and construction materials. The market is also expanding as a result of the expanding construction and infrastructure investment projects in these areas' growing nations.

- According to the United States Census Bureau, Total U.S. construction spending reached $486 billion in Q1 2025, up 3% from $472 billion in Q1 2024. Private construction spending grew 2% year-over-year to $384 billion, with residential up 3% to $205 billion. Commercial public buildings (+44%) also recorded strong growth.

Market Overview

The element aluminum has a silver-white sheen and is flexible and non-magnetic by nature. The letter Al stands for aluminum, which is the most prevalent metal in the crust of the world. Metal is seeing strong demand among end customers in the packing, electrical, and aerospace industries. The market is being driven by the increased market for packaged goods and the expanding use of aluminum instead of stainless steel by automakers. The market is expanding as a result of the increasing demand for electric cars and OEM producers. However, it is anticipated that interruptions in the distribution chain caused by periodic mine closures may hurt market expansion.

The second-highest malleable and sixth-most highly flexible material on the planet is aluminum. With a density of just 2.7g/cm, it is incredibly light, dust-resistant, and highly conductive, and when alloyed, it demonstrates great strength. Because it is harmless by nature, maintains food for a long period, and prevents the growth of microbes, it is widely employed in the food and packaging industries as well as the pharmaceutical industry. The worldwide aluminum industry has been expanding due to China's growing need for this plentiful base material.

Aluminum is widely used in China's construction, transportation, packaging, and electrical sectors, to name a few. These four businesses collectively use the majority of the aluminum that the Chinese industry uses annually. Government agencies are working very hard to improve industrialists' accessibility to aluminum.

One of the most prevalent non-ferrous transition metals in the crust of the Earth is aluminum. It is strong, malleable, flexible, lightweight, and resistant to oxidation and corrosion. Because it easily forms combinations with the other chemical components, it is widely used in a wide range of applications. For instance, wheels, motors, chassis, and other components of contemporary automobiles are made of aluminum combined with silicon and magnesium. It is also utilized to make electronic devices.

Aluminum Market Growth Factors

- Increasing demand for aluminum in the automotive and aerospace industries drives market growth.

- Rising focus on sustainable and energy-efficient manufacturing practices is pushing the adoption of advanced technologies in aluminum production.

- Growing urbanization and infrastructure development, particularly in emerging countries, boosts the demand for construction and building materials made from aluminum.

- Technological advancements in recycling processes are expanding the availability of secondary aluminum, supporting market growth.

- The rising production of electric vehicles (EVs) propels the market growth since EVs require lightweight and durable materials.

- Rising investments in the renewable energy sector are increasing the demand for aluminum for use in solar panels and wind turbines.

- Stringent carbon emission regulations encourage manufacturers to adopt cleaner and more efficient aluminum production methods.

Market Scope

| Report Coverage |

Details |

| Market Size in 2025 |

USD 190.98 Billion |

| Market Size by 2034 |

USD 329.08 Billion |

| Growth Rate from 2025 to 2034 |

CAGR of 6.24% |

| Base Year |

2024 |

| Forecast Period |

2025 to 2034 |

| Segments Covered |

Series, Type, Processing Method, and End-Use Industry |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Secondary aluminium's rising popularity will promote growth

- An important portion of the world's usage of aluminum is secondary or recycled aluminum. Because of its cost-effectiveness, scrap from machinery, automobiles, equipment, and beverage cans is recycled and reused. Reprocessing used metal or scrap uses a small portion of the energy needed to make brand-new metal from ore, minimizing the harm to the environment.

- Additionally, initiatives including the creation of car dismantling, shredder, and environmental safety centers are anticipated to promote market expansion. The widespread use of the material in the transportation sector is also predicted to boost aluminum consumption.

Numerous uses across several industries, and expanding building industries

- Due to its distinct physical characteristics, aluminum is in higher demand across a wider spectrum of industries and has more uses. Because metal is lightweight and has good electrical conductivity, aluminum is utilized for long-distance transmitting power. Because it can be easily moulded and worked into the fuselage and wings of light planes, aluminum alloys like 6061 are frequently utilized in this sector. Its high corrosion resistance makes it the perfect material for use in aircraft. Due to its thermal characteristics, aluminum is utilized in refrigeration, air conditioning, and heat transfer systems.

- Additionally, because of its malleability, this metal can be shaped into thin strips and employed in the packaging sector. Siding, roofing, transparent panels, doorframes, window, staircases, central heating,

- , furnishings, air conditioning systems, and many other things are made with it in building projects.

Key Market Challenges

Decarbonization is a challenge for the worldwide aluminum industry

- Decarbonization is one of the main obstacles the world's aluminum sector must overcome. The majority of businesses in the aluminum sector are under intense pressure to green their operations. They can only accomplish this if they employ moderate steel, which is also of poor quality.

Implementing tougher environmental rules to restrain the growth

- Governments and organizations' adoption of rigorous environmental rules will hurt the market. Numerous nations have had to adopt new regulations as a result of the expanding environmental problems and the population growing expectations for government action to reduce pollution levels. The cost of goods has grown as a result of smelting operations being required to fulfill higher emissions requirements. It is also known to harm people, so that is another factor.

- Headaches, asthma, rashes, and sleeplessness are among the side effects of exposure to it. Inhaling the powder form can result in lung fibrosis, and it can explode or detonate on the worksite. It is projected that the aforementioned reasons will impede market expansion.

Key Market Opportunities

Aluminum is good electricity and heat conductivity and is reasonably priced

- Aluminum is flexible, robust, and doesn't easily melt or distort when exposed to high temperatures. Additionally, it is lightweight, will not rust or corrode readily, and is a superior heat and electrical conductor. The worldwide car industry is increasingly preferring aluminum since it is reasonably inexpensive. This is understood by aluminum processors all over the world. To strive to build future generations of automotive components that are better in all of the aforementioned features and at a significantly lower cost point, they are spending a lot of money on development and research.

Series Insights

In 2024, the series 1 category dominated the worldwide aluminum market, and it is anticipated that it will continue to grow at the quickest rate throughout the forecast period. The production of items like foil, drawn tubes, sheets, chemical apparatus, dishes, and metal glassware uses this kind of Series 1 aluminum (sugar bowls, coffee pots, creamers, and others).

Processing Method Insights

With a share of the market of approximately 31.5% in 2024, the extrusion sector is anticipated to increase at a significant rate throughout the projected period. Radiators and air conditioning units for automobiles, condensing pipes, nuclear-powered apparatuses, sound equipment, and communications, among other things, are using extruded aluminum products more and more.

End-Use Industry Insights

In terms of the end-user, the transport sector held the biggest market share. This market's expansion is being driven by the growing use of metal in automobiles due to its lighter lightweight and improved physical characteristics. Many emerging countries are making significant investments to build out their infrastructure. These countries are likewise progressing quickly. As more people throughout the world own cars, the global aluminum sector is anticipated to grow with the automotive industry worldwide.

Because more people throughout the world drive cars, the transportation sector dominated the global aluminum market in 2023. As a result, expansion in the global transportation sector is anticipated to fuel expansion in the global aluminum market. During the projection period, the packing sector is anticipated to increase at a significant CAGR. This industry is expected to increase as a result of the growing demand for aluminum from producers of packaged foods because of its non-permeable properties.

Aluminum Market Companies

- Alcoa Corporation (U.S.)

- Aluminum Corporation of China Limited (CHALCO) (China)

- Century Aluminum Company (U.S.)

- China Hongqiao Group Limited

- China power investment corp. (cpi)

- China zhongwang holdings limited (china)

- Dubai Aluminum Company Limited (U.A.E)

- East Hope Group (China)

- Emirates Global Aluminium (UAE)

- H.P. (Australia)

- Hindalco Industries Ltd. (India)

- Kaiser Aluminium

- Norsk Hydro A.S.A. (Norway)

- Novelis (U.S.)

- Rio Tinto Ltd.

- United Company RUSAL Plc, (Russia)

- Vedanta Aluminium Limited (India)

- Xinfa group co. Ltd.

Latest Announcement by Industry Leader

- In January 2025, Novelis renewed its multi-year partnership with thyssenKrupp Aerospace to supply specialized aerospace-grade aluminum. This renewed agreement strengthens the long-standing collaboration between the two companies, as Novelis has consistently been a trusted supplier of premium aircraft-grade aluminum plates and sheets to thyssenkrupp Aerospace. Patrick Marous, CEO of Business Unit Solutions at thyssenkrupp Materials Services, emphasized the importance of securing a reliable and long-term supply of high-quality aluminum, which is essential for meeting the needs of their customers. Marous also highlighted that this partnership aligns with thyssenKrupp's' Materials as a Service' strategy, reinforcing their commitment to excellence by ensuring material availability and reliability for customers' supply chains. The renewed collaboration promises to continue driving success and reliability within the aerospace sector.

Recent Developments

- In January 2025, Vedanta unveiled its company's INR 1 trillion aluminium refinery and smelter project will be set up in the Raygada district of Odisha. The Rs 1 trillion investment in Odisha is to build a 6 MTPA alumina refinery and a 3 MTPA green aluminium plant. The first phase of the project is expected to be commissioned in the next three years.

- In May 2025, Rio Tinto announced its plan to invest in a Canadian hydro plant for aluminium production. It will invest USD 1.2 billion in its Isle-Maligne hydroelectric power plant. The power plant modernisation is essential to secure the future of low-carbon aluminium production in Saguenay–Lac-Saint-Jean and support the jobs of employees across the region. The project will run until 2032, with an estimated 300 people working on the site at its peak.

- In May 2025, Pure Aluminum formed a partnership with Traxys, a global leader in the physical trading of metals and natural resources, and Consortium Metals to recycle aluminum and manufacture value-added aluminum products. The collaboration is designed to supply critical materials to the steel, aluminum die casting, and primary aluminum industries, including secondary aluminum specification alloys, recycled secondary ingot (RSI), wrought alloys, and aluminum deoxidizers.

- In January 2025, Emirates Global Aluminium (EGA), a leading producer of premium aluminum, announced the completion of civil works of its U.S. recycling subsidiary, Spectro Alloys. The USD 90,000-square-foot expansion, which started construction in March 2024, enables Spectro Alloys to produce billet from post-consumer aluminum scrap. This expansion supports EGA’s commitment to increasing its recycling capacity and contributing to the global effort of reducing waste and promoting sustainability in the aluminum sector.

- In April 2024, BlueTriton Brands introduced new aluminum bottle packaging. Five of its prominent brands—Poland Spring, Deer Park, Ice Mountain, Arrowhead, and Pure Life—led the initiative, marking a significant step towards sustainable packaging solutions.

- In February 2024, Vedanta Aluminium, India’s largest aluminum producer, launched Vedanta Metal Bazaar, an innovative e-superstore aimed at transforming India's primary aluminum buying and selling process. The platform offers over 750 product variants and incorporates AI-based price discovery, allowing customers to benefit from real-time pricing and improved transparency. By creating an online marketplace, Vedanta Aluminium enhances accessibility to aluminum products and offers customers added value, even amidst the volatility of global commodity prices.

Segments Covered in the Report

By Series:

- Series 1

- Series 2

- Series 3

- Series 4

- Series 5

- Series 6

- Series 7

- Series 8

By Type

By Processing Method:

- Flat Rolled

- Castings

- Extrusions

- Forgings

- Pigments and Powder

- Rod and Bar

By End Use Industry:

- Automotive and Transportation

- Construction

- Packaging

- Electrical and Electronics

- Machinery and Equipment

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)