January 2025

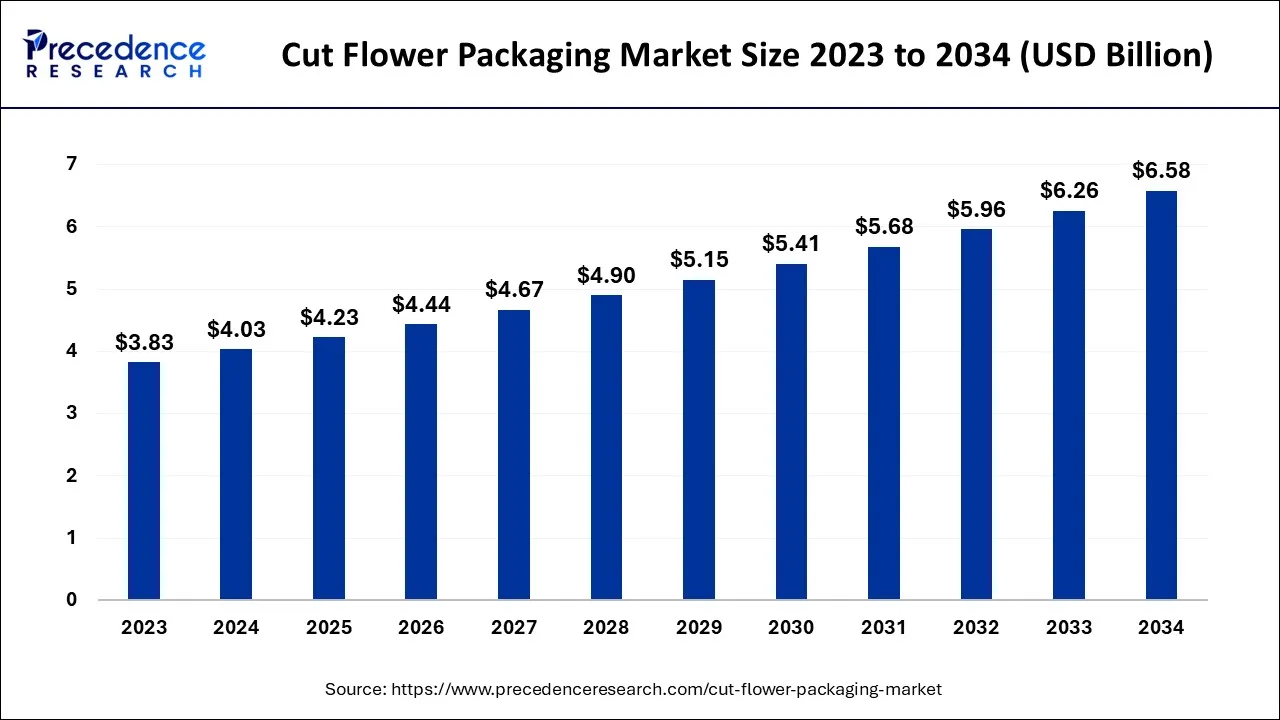

The global cut flower packaging market size accounted for USD 4.03 billion in 2024, grew to USD 4.23 billion in 2025 and is expected to be worth around USD 6.58 billion by 2034, registering a CAGR of 5.02% between 2024 and 2034.

The global cut flower packaging market size is calculated at USD 4.03 billion in 2024 and is projected to surpass around USD 6.58 billion by 2034, growing at a CAGR of 5.02% from 2024 to 2034.

The cut flower packaging market is a global industry that consists of the design, production, manufacturing and distribution of packaging materials / solutions that are specifically used in transporting and presenting cut flowers. Cut flowers are fragile and perishable that require suitable packaging solutions to protect them during the distribution process. The packaging solutions are designed to maintain the freshness and enhance the value of flowers to appeal to consumers.

Cut flowers are typically called stems and leaves removed from flowering plants and used in bouquets, flower arrangements, and other floral products. Cut flowers are biologically vulnerable to aging and degradation during transit, which reduces their worth before being sold on the market. So, it is crucial that the packaging is kept in good condition.

The global cut flower packaging market is expected to witness a significant growth during the forecast period owing to the rising emphasis on gifting flower bouquets on special occasions and events. People prefer premium cut flower bouquets with appealing packaging for events including weddings, birthdays, Valentine’s Day and other special occasions or events.

According to a report published by the U.S. Department of Agriculture in February 2023, almost 22% of Americans bought flowers last year. The single day of flower sales contributed about $2.3 billion to the economy of the United States.

Due to the growing demand for cut flowers during weddings and festivals, the packaging industry is anticipated to grow. In the future, it is also expected that the growth of cut flower packaging will flourish due to the rapid advancement in technologies for packaging to maximize shelf life. Because of the factors mentioned above, the number of flower shops worldwide is expected to increase, as are the purchases made by the millennial population.

The cut flower packaging market will also likely experience significant growth throughout the forecast period owing to the rising demand for safe and protective packaging for flowers. Additionally, during the forecast period, the expansion of the cut flower packaging market is anticipated to be supported by an increase in per capita income, a shift in consumer preferences towards convenience shops, and an increase in online sales channels.

In addition, the increased harvest of multiple varieties of flowers, increased flower seller preference, and increased awareness of the use of environmentally friendly packaging supplies are all expected to present different opportunities for growth for the development of the cut flower packaging market throughout the forecast period.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.83 Billion |

| Market Size by 2034 | USD 5.96 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.03% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Material Type, Sales Channel, Flower Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for the luxurious packaging

Luxury flower boxes are a novel method to present and deliver floral arrangements that are gaining popularity. Traditionally constructed of fine materials, including leather or velvet, these exquisite boxes are increasingly popularly manufactured of environmentally friendly cardboard or paper. They are expertly crafted to preserve and exhibit blossoms beautifully for a very long time. Luxury flower containers have altered how people view their clients' arrangements and given us new ways to enjoy and appreciate flowers.

Luxury flower boxes provide an elevated appearance that is admired and enjoyed, making them ideal for presents or special occasions. These boxes are popular for anniversaries, weddings, birthdays, and other milestone occasions since they offer a more abundant and memorable way to give flowers. Luxury arrangements are made to keep flowers in their best condition for longer. Luxury flower boxes are expertly crafted to keep the flowers and buds fresh and vivid for longer than traditional bouquets, which have a reasonably limited lifetime. Luxury flower boxes offer a more adaptable and customized method for creating floral arrangements.

Limitations with transportation of flowers

There are several challenges involved with transporting cut flowers. Flowers in cardboard containers experience rapid temperature fluctuations with variations in outdoor temperature. Flowers lose more water in high temperatures, which shortens their usable vase lifespan. After shipping, the flowers' ability to retain moisture is also diminished, preventing the flower's standard opening and expansion of the petals. These harmful effects can be minimized by including ice in the shipping crates and pre-conditioning the flowers with the right treatments. Each flower (and occasionally distinct varieties) should have its conditioning solution with unique ingredients. Water quality is also essential for the conditioning treatment to work more effectively. The impregnation of the flower stem bases with a solution of silver salt is another method that has been found successful for carnations (but not for roses).

Advancements in packaging methods

Fresh-cut flower packaging technology shouldn't be restricted to conventional packaging types incorporating fresh-keeping technologies like preservation of fresh flowers, temperature control, and humidity control. In general, the advancements in packaging methods offer a set of lucrative opportunities for the global cut flower packaging market. Advancements such as a method for a high-water vapor barrier or creating a high-humidity environment for storing and transporting fresh-cut flowers using packing materials with a high barrier to water vapor that decrease water loss due to an excessive vapor exposure.

Considering advancements in the packaging industry, a modified packing method for the environment is also observed to offer growth opportunities for the market players. Using cutting-edge packaging technology to provide fresh-cut flowers with a low O2 and high CO2 air environment and lessen the frequency of respiration.

Moreover, a method of chemical preservation, using chemical methods in packaging technology to control the plant's development stage and slow the pace at which senescence-regulating hormones like ethylene are produced is also observed as a advancement in the industry.

The sleeves segment will lead the market for cut flowers and will be the fastest-growing segment during the predicted period. This is because sleeves occupy less space and are thus easier to transport. The segments of boxes, cartons, and metal stands will also grow during the forecast period. They are seeing growing demand as they are better at preserving flowers, increasing their shelf life, and keeping them fresh for longer.

In the material type segment, plastic material is observed as the most cost-effective and easily available material for packaging purposes. The plastic segment of packaging cut flowers will see the most growth. Even though there is growing awareness about the harmful impact of plastic on the environment, it is still very much in use because of its cost-effectiveness and durability. But not using single-use plastic and instead recycling the plastic can solve some of the environmental issues caused by plastic. The metal segment is also going to grow because of the increasing demand for metal containers.

The florist channel segment is going to grow significantly during the forecast period. This might be related to the rising demand for flowers, which make an ideal gift. The ease of availability and convenience for multiple florist shops in every area promotes the segment’s growth.

The online sales segment is expected to be the most attractive segment of the market during the forecast period. Due to the expanded selection and ability to ship flowers to a wider variety of locations, the online sales market is also anticipated to experience substantial growth. Multiple online/e-commerce platforms have

Both the bouquet and single-cut segments will see substantial growth during the predicted period. This is because of the rising demand for flowers for decoration and gifting purposes. However, the versatility of flowers offered by bouquets shows the significance of bouquet segment in the market. Bouquets are usually presented with ribbons, wraps and other gifting materials, this element promotes elegance by making the bouquets appealing for consumers.

Whereas the single cut flower segment will continue to grow during the forecast period as it is observed to be the most cost-effective gifting option.

The cut flower market is the largest in Europe. The expanding significance of flowers for celebrations, decorations, and gifts fuels the European cut flower business. The Netherlands is solidifying its position as a significant trading hub, and the share of flowers from underdeveloped nations in the European market is anticipated to continue to rise. Exporters from emerging countries have opportunities because of the rising demand in Europe.

Furthermore, the cut flower packaging market in Europe is expected to grow during the forecast period with the growing sustainability solutions in the packaging industry. Multiple key players are focused on offering biodegradable packaging materials for cut flowers, this shows a significant growth factor for the market’s growth in the region.

China is and will continue to be one of the markets with the most substantial growth rate. The Asia-Pacific market is anticipated to expand rapidly, with nations like India and South Korea serving as leaders. The penetration of international key players in the Asia Pacific market for cut flower packaging will propel the growth of the market during the forecast period. Rising utilization of innovative packaging solutions, convenient transportation, easy supply chain service and rising demand for personalized gifts are a few of market trends in Asia Pacific that highlight the growth of the cut flower packaging market.

Segment Covered in the Report

By Product Type

By Material Type

By Sales Channel

By Flower Type

By Geography

For questions or customization requests, please reach out to us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

February 2024