September 2024

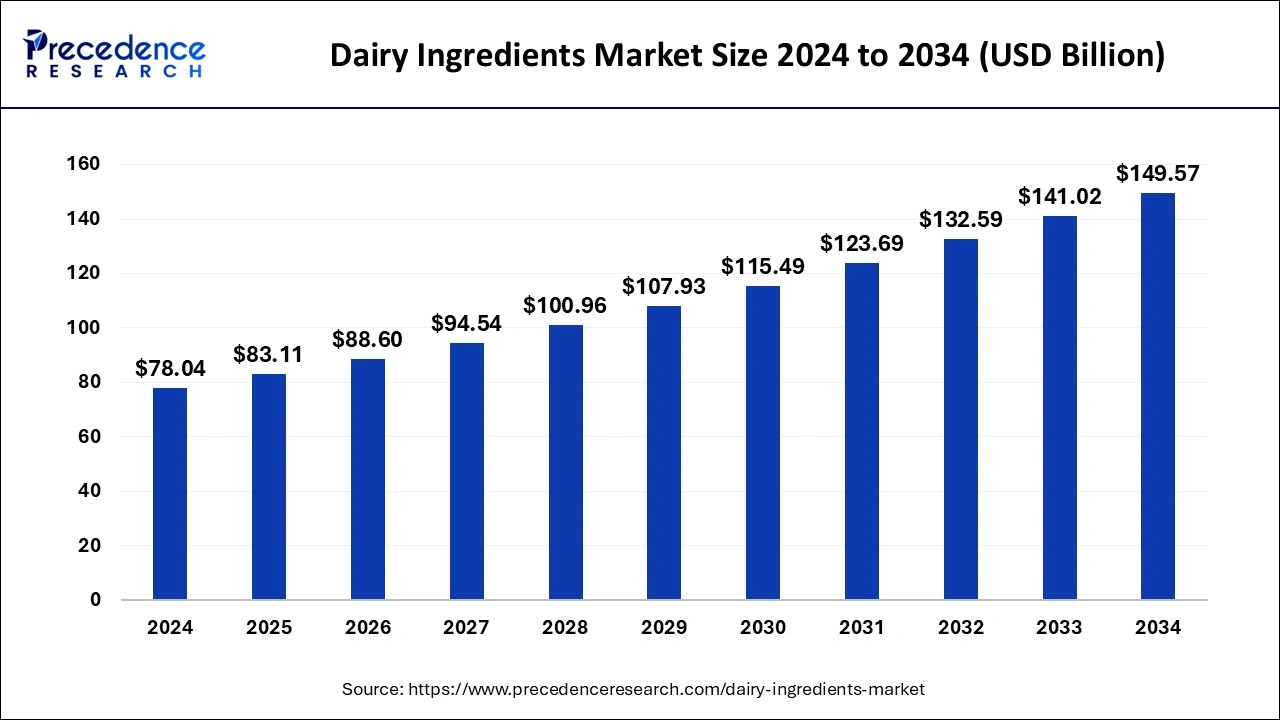

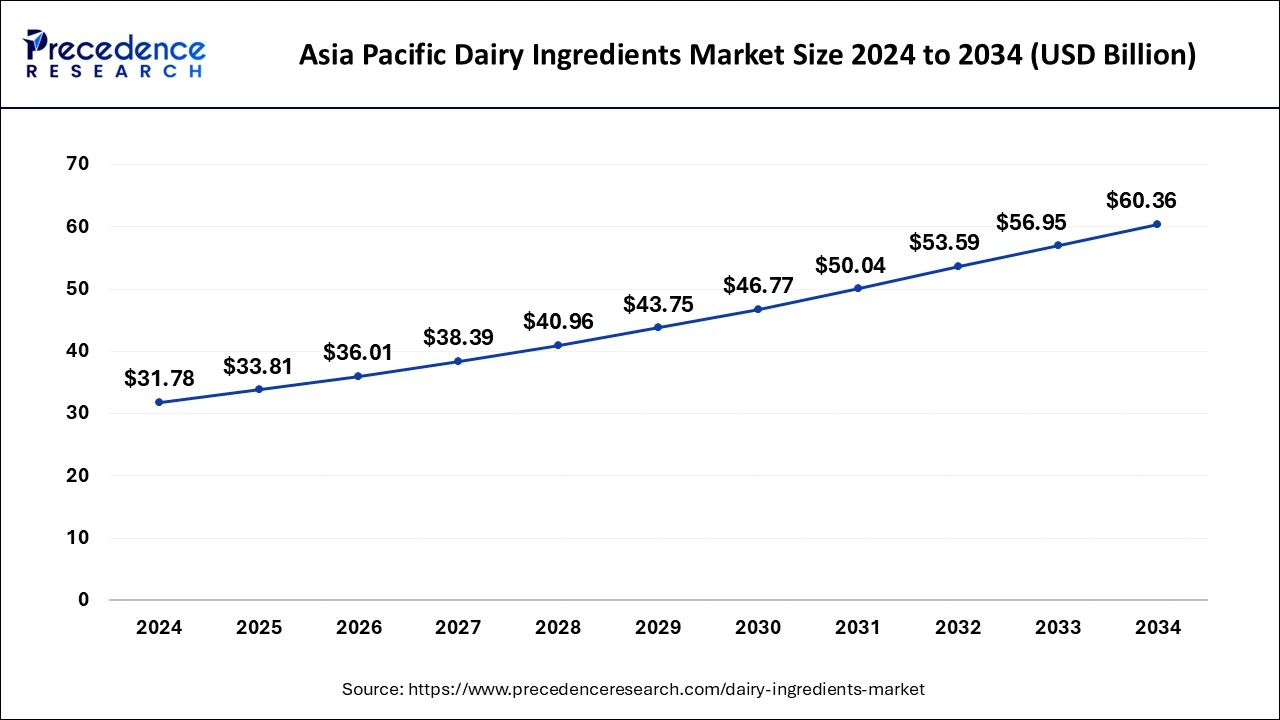

The global dairy ingredients market size is estimated at USD 83.11 billion in 2025 and is predicted to reach around USD 149.57 billion by 2034, accelerating at a CAGR of 6.72% from 2025 to 2034. The Asia Pacific dairy ingredients market size surpassed USD 33.81 billion in 2025 and is expanding at a CAGR of 6.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dairy ingredients market size was estimated at USD 78.04 billion in 2024 and is anticipated to reach around USD 149.57 billion by 2034, growing at a CAGR of 6.72% from 2025 to 2034. Market growth is attributed to the increasing consumer demand for high-quality, functional, and protein-rich dairy ingredients across diverse food and beverage applications.

The impact of artificial intelligence on the primary industries sector has been notable. Using AI technologies helps producers better organize the implementation of manufacturing operations based on large amounts of data obtained at different stages of production. CI Continuous integration capability via AI-based predictive analytics enables organizations to anticipate demand patterns, and better manage their stock and avoid losses. Applying of AI in product development has resulted to new roll of dairy inputs that are trendy in the market like the plant base and functional dairy products. Additionally, the recently implemented advanced automation methods in packaging and distribution departments through AI decrease labor expenses and optimize supply chains.

The Asia Pacific dairy ingredients market size was estimated at USD 31.78 billion in 2024 and is anticipated to be surpass around USD 60.36 billion by 2034, rising at a CAGR of 6.74% from 2025 to 2034.

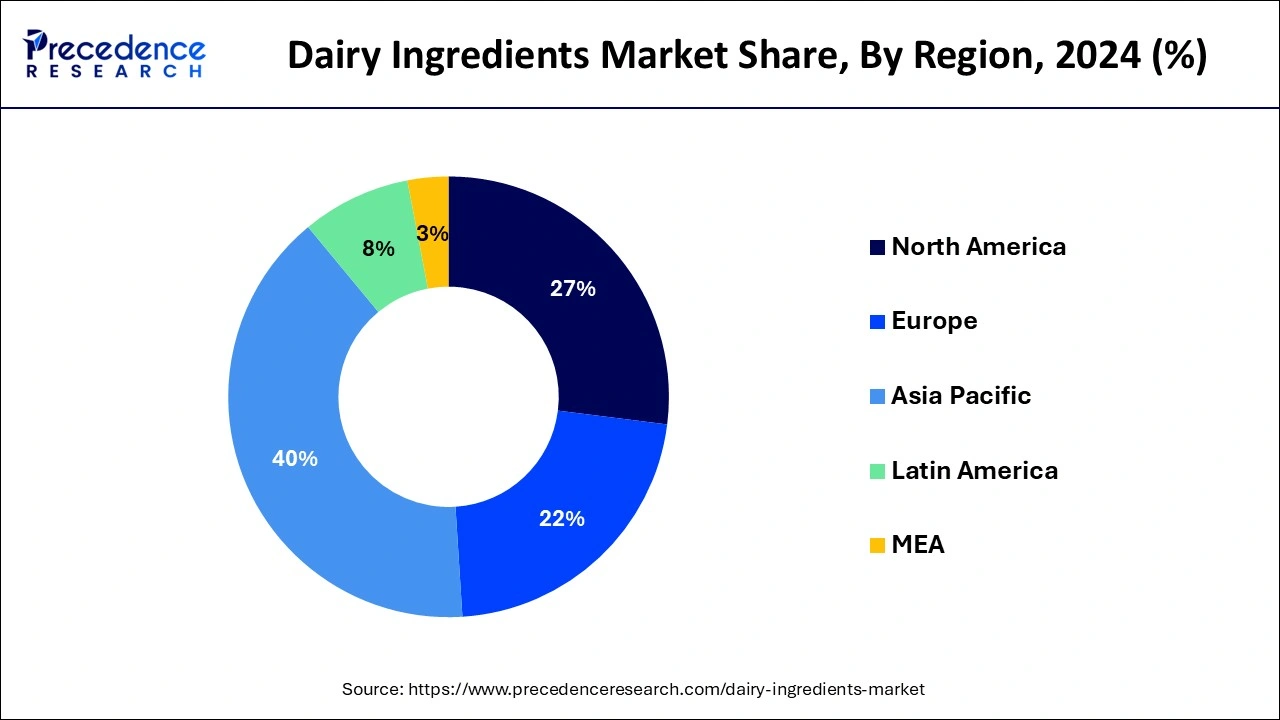

Asia Pacific dominated the global dairy ingredients market with the largest market share of 40% in 2024. The growth of this region is driven by the rising demand for plant-based diary alternatives. A rising number of consumers are adopting a plant-based or flexitarian diet for health, environmental, or ethical reasons. Plant-based dairy substitutes, such as almond milk, oat milk, and soy-based products, are gaining popularity and are being incorporated into a wide range of food and beverage products. For instance, companies like Oatly, a Swedish oat milk producer, have expanded their presence in the Asia Pacific region, capitalizing on the rising consumer interest in plant-based alternatives to conventional dairy. This shift reflects a broader movement toward sustainable and cruelty-free food choices.

In the North American market countries like United Kingdom, France and Germany where proteins are majorly used the demand for infant nutrition or formula food is growing in countries like France and Germany. New Horizons are added to this market by having organic whole milk powder, which has led to a growth in the market. The growth in various regions is primarily because of rapid urbanization, increased convenience stores and advancements in the dairy processing. As the production of milk is good in India, It provides a great potential for the dairy ingredients market to grow in the coming years.

Daily ingredients are there ingredients that are obtained from milk. They provide many health benefits and nutritional benefits, along with a good flavor which helps in the growth as it has a unique texture, flavor and excellent nutritional values. These dairy ingredients are used in many foods. Due to the disruptions in the supply chain and logistics, the pandemic had affected the dairy ingredients market. Due to strict lockdown and government regulations, there was a loss in the demand for liquid milk which also caused the pressure in procurement of milk for various reasons. The industry has grown spontaneously post pandemic. The International dairy trade has increased in the recent years. An extensive use of the dairy ingredients in many baby food products in various nations shall increase the demand for the dairy ingredients market.

| Report Coverage | Details |

| Market Size in 2025 | USD 83.11 Billion |

| Market Size by 2034 | USD 149.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.72% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Livestock, Form, Production Method, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Consumer Demand for Functional Foods

Rising consumer demand for functional foods is expected to drive growth in the dairy ingredients market. These ingredients help with digestion, protection from diseases, and overall health and tastes, including current co-health-based personalized nutrition. Suppliers are creating customized dairy ingredients with vitamins, minerals, and bioactive compounds for acceptance of the vehicles of wellness food. Increased evolution of functional dairy products is reasonably expected to propel innovations in the formulation of yogurts, cheeses, and beverages, thus fuelling the market in the coming years.

Hamper Growth Due to Price Volatility of Raw Materials

The volatility in the price of raw materials, such as milk, whey, and casein is anticipated to hamper the growth of the dairy ingredients market. Weather changes, governments’ actions, and unstable markets for basic supplies make the production of these products unpredictable for producers. This, in essence, is highly undesirable, not only because the price remains volatile with wide fluctuations, which harms manufacturers trying to forecast such expenditures and keep the price of their products reasonable. There are growing trend for dairy ingredient suppliers to change their system of pricing which may hamper the flow of investment or cause higher costs to the end consumer of production. Therefore, manufacturers might find it extremely difficult to maintain the profit margin hence slowing down the growth of the market.

Opportunity

High Demand for Dairy-Based Protein Products

The high demand for dairy-based protein products is likely to create significant opportunities in the dairy ingredients market. Beverage consumers especially of sports nutrition and weight management products are demanding higher quality proteins in their products like whey and casein for muscle building and nutritional benefits. These ingredients supply all-round essential amino acids which make them suitable for protein supplements, functional foods, and drinks. The processors are diversifying their line of dairy proteins to meet such market niches as elderly persons or athletes. Furthermore, the rise in health and fitness concerns continues to promote the need for dairy proteins to be used in the production of health-enhancing goods and services, stimulating market development.

The milk powder segment contributed the highest market share in 2024. Out of all the most common types of dairy ingredients, this segment is expected to grow as it is a direct substitute for fluid milk. It is used in many applications like infant nutrition, bakery and even dairy. The hotel industry uses skimmed milk powder for many of its dishes. As milk powders are easy to store and they have a good shelf life compared to the pure milk. The market for milk powder is also expected to grow during the forecast. Milk powder also has an extensive application in infant foods, tea, coffee and other milk beverages.

The confectionery and the bakery segment dominated the market in 2024. Products like butter are extremely valuable for a bakery industry. It helps in bringing a nice color, taste and texture to various cakes, biscuits and croissants. Use of vvarious ingredients in bakery and confectionery have led to a growth in the market share. Use of butter, is strongly associated with a good image for the product.

By Product

By Application

By Livestock

By Form

By Production Method

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2024

January 2025

December 2024