February 2025

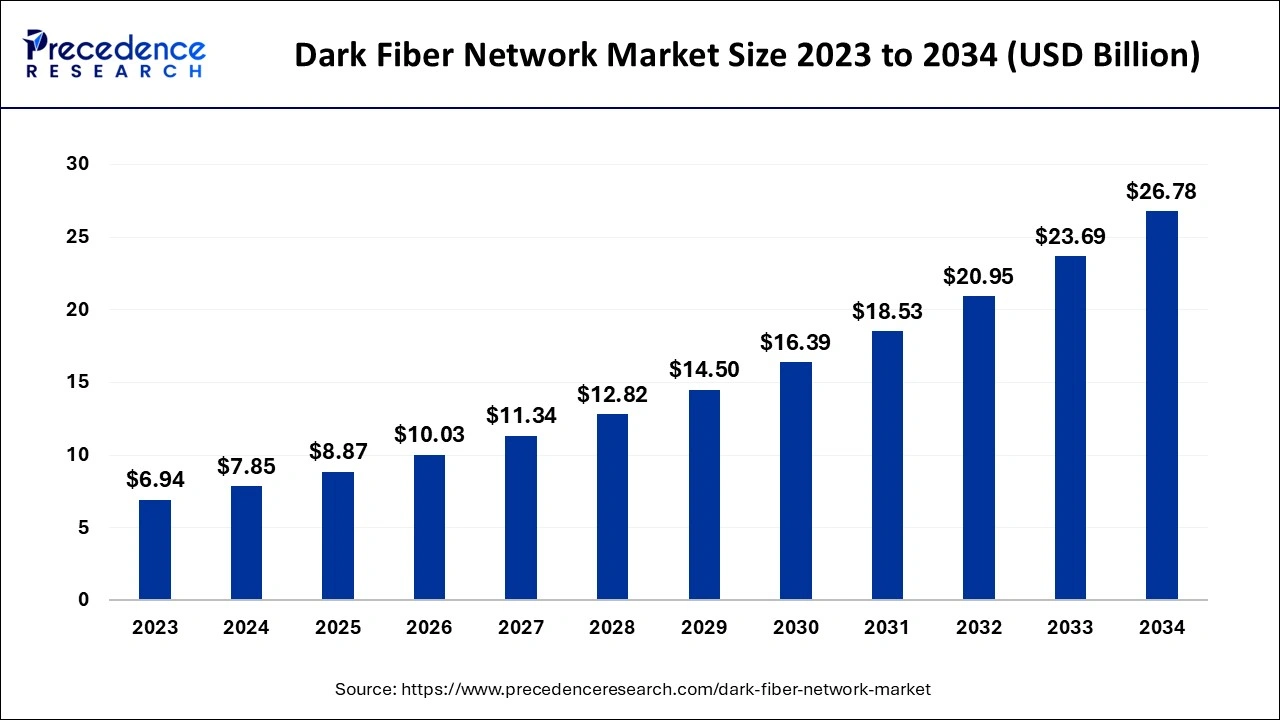

The global dark fiber network market size is calculated at USD 7.85 billion in 2024, grew to USD 8.87 billion in 2025, and is projected to reach around USD 26.78 billion by 2034. The market is poised to grow at a CAGR of 13.06% between 2024 and 2034. The North America dark fiber network market size is predicted to increase from USD 2.51 billion in 2024 and is estimated to grow at the fastest CAGR of 13.23% during the forecast year.

The global dark fiber network market is expected to be valued at USD 7.85 billion in 2024 and is anticipated to reach around USD 26.78 billion by 2034, expanding at a CAGR of 13.06% over the forecast period from 2024 to 2034.

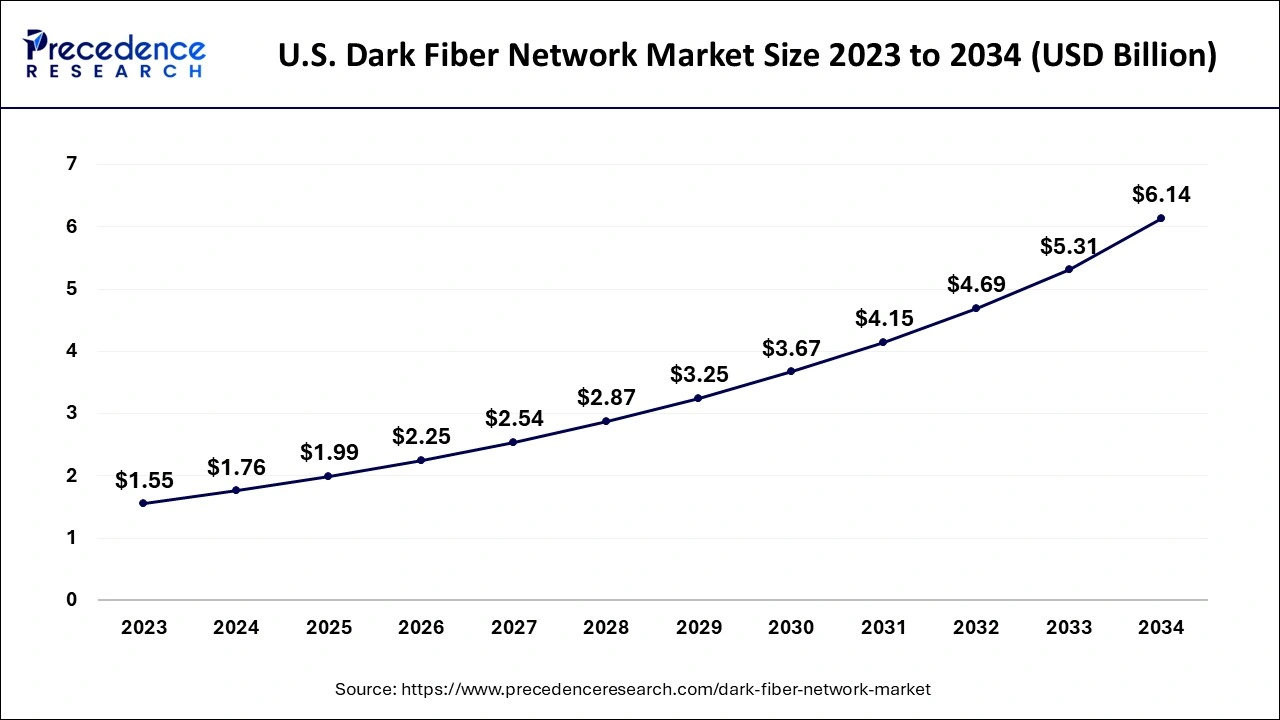

The U.S. dark fiber network market size is accounted for USD 1.76 billion in 2024 and is projected to be worth around USD 6.14 billion by 2034, poised to grow at a CAGR of 13.31% from 2024 to 2034.

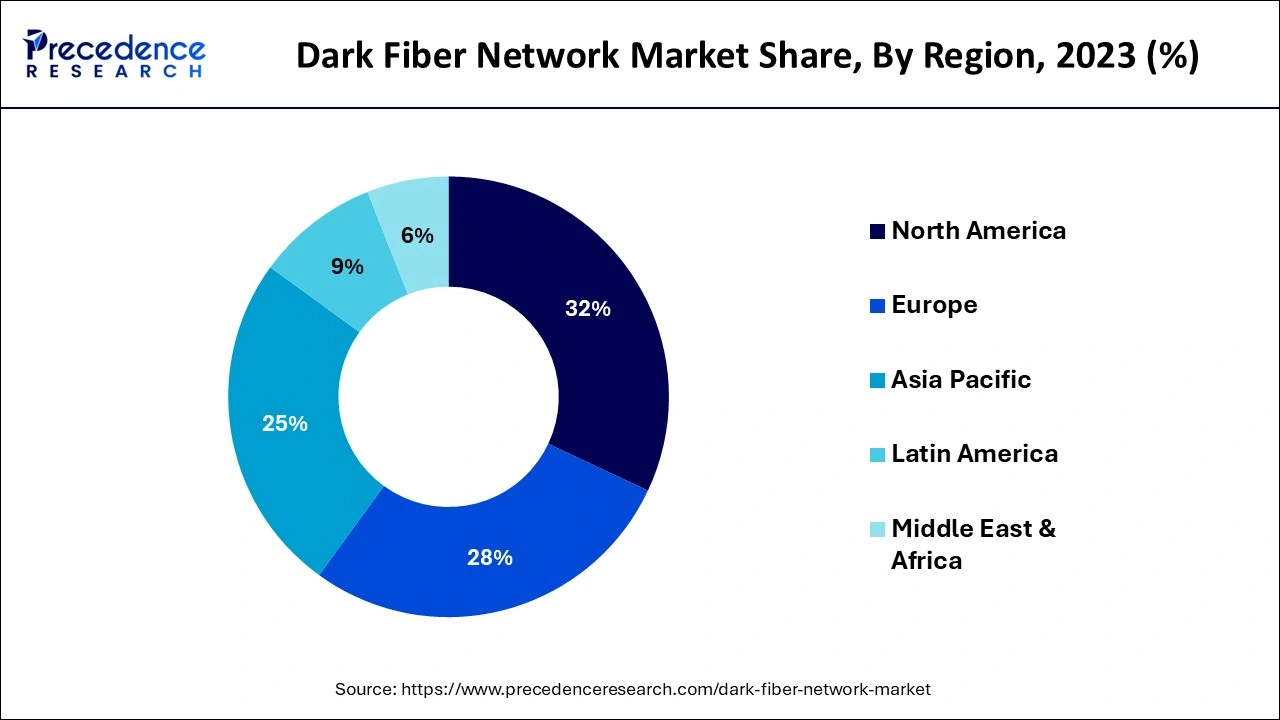

The dark fiber network market held the maximum shares in the North America in 2023. The development of fiber optic networks is only one example of the significant improvements in telecommunications infrastructure that have taken place in the United States. This gave the dark fiber market a solid platform for growth. As internet penetration is more in US, the demand for dark fiber is increasing. Dark fiber networks are now more necessary than ever due to the increasing use of Internet services and the growing need for high-speed access.

The United States has a large concentration of enterprises, organizations, and people that need dependable and high-capacity network connectivity due to its sizeable population and growing urbanization. With a robust ecosystem of businesses engaged in data-intensive industries including technology, media, entertainment, and finance, the United States is a hotspot for digital innovation. These industries depend on dark fiber networks to support their operations and provide flawless and quick data transmission due to their high bandwidth needs.

Significant investments have been made in the telecommunications sector in the US, and leading network operators and telecoms giants are aggressively building up their fiber optic infrastructure. These investments have helped make dark fiber networks more accessible and available, thus enhancing the market's position.

The dark fiber network market refers to the infrastructure of unused or unlit optical fiber cables that are available for lease or sale to private companies or organizations. These fiber optic cables are known as dark. They are not active or are currently not being utilized to transmit data or signals. Dark fiber networks are typically installed by telecommunication companies or network providers to expand their network capacity. By leasing or purchasing these dark fibers, businesses gain control over their own network connections, allowing them to customize and manage their data transmission and bandwidth requirements according to their specific needs.

Dark fiber network demand has been continually expanding due to the growing demand for fast, dependable, and scalable network connections. The need for dark fiber infrastructure has increased with the advent of data-intensive applications like cloud computing, video streaming, the Internet of Things, and 5G connection. Since the network connections are restricted to the company renting or controlling the fiber, dark fiber networks provide increased security and anonymity. Dark fiber networks are therefore particularly appealing to industries with stringent data privacy requirements, such as banking, healthcare, and government. A strong and substantial fiber optic infrastructure is needed for the installation of 5G networks in order to accommodate the increasing data traffic and low-latency specifications.

The use of dark fiber networks to supply the required connection for 5G installations has increased demand for dark fiber. Internet Service Providers (ISPs) are becoming more and more interested in dark fiber networks to improve their service options and increase network coverage. Internet Service Providers (ISPs) may provide high-speed internet connectivity to underserved areas without spending money on expensive network expansions by investing in dark fiber infrastructure.

Due to the continually changing nature of the dark fiber business, precise market share statistics may not be easily accessible, however several locations are renowned for their considerable adoption and growth of dark fiber networks. Given its sizable population, massive telecommunications infrastructure, and great demand for connection, the United States has historically been at the forefront of the dark fiber industry. The dark fiber market is expanding significantly in other regions as well, such as Europe and Asia-Pacific, where measures to increase broadband access, assist innovative technologies, and promote digital transformation are being supported.

The market for dark fiber networks is mostly driven by the rise in demand for fast, dependable internet access. Businesses and individuals alike need more bandwidth capacity to meet the rise in data traffic brought on by the growth of data-intensive apps, cloud computing, Internet of Things, video streaming, and 5G networks. Dark fiber networks offer the infrastructure required to handle these increasing bandwidth demands. Another important element driving the development in the dark fiber network industry is the proliferation of data centers. Organizations need reliable and scalable network connectivity between their sites and the data centers when they move their infrastructure to data centers or use cloud computing services. Dark fiber networks offer the robust connections required for quick access to cloud services and effective data transmission.

The need for dark fiber networks is being fueled by the digital transformation initiatives being implemented by many enterprises across various sectors. Organizations need reliable and secure connection as they digitize their processes, embrace Internet of Things devices, put cloud-based solutions into place, and take advantage of emerging technology. Dark fiber networks provide the capacity and adaptability required to enable these aspirations for digital transformation. The proliferation of dark fiber networks is being driven by escalating worries about data security and privacy. Dark fiber connections are preferred by businesses with sensitive data or regulatory compliance needs due to their control and exclusivity. Dark fiber networks improve security and data protection measures by removing the requirement to share infrastructure with other organizations.

| Report Coverage | Details |

| Market Size in 2024 | USD 7.85 Billion |

| Market Size by 2034 | USD 26.78 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13.06% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Fiber Type, By Network Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Scalability and flexibility

Dark fiber networks provide scalability and flexibility, enabling businesses to tailor their network architecture to their unique requirements. Businesses who are experiencing significant growth or variations in their bandwidth needs would benefit most from this flexibility. The market for dark fiber networks is being significantly fueled by the ever-increasing need for high-speed and dependable internet access. Data security and privacy are improved due to dark fiber networks, which give businesses complete control over their network connections.

Initial investment and ongoing costs

Dark fiber network deployment needs a sizable upfront expenditure, which includes the cost of renting or buying the fiber strands as well as the related installation and maintenance costs. For businesses with low resources, these upfront fees may be a barrier. Dark fiber network management and operation may require specialized knowledge and technical proficiency. Organizations could have trouble finding and keeping the right talent, or they would need to rely on outside service providers, which would raise total expenses, thus impacting the growth of the market.

Internet service providers

Dark fiber networks give Internet Service Providers (ISPs) the opportunity to reach more people with their network, improve the quality of their services, and connect to underserved areas. Internet Service Providers (ISPs) can expand the scope of their networks and provide high-speed internet access to a larger client base by renting or buying dark fiber. A dense and sturdy fiber optic infrastructure is needed for the deployment of 5G networks in order to meet the increasing data traffic and low-latency requirements. Telecommunications companies and network operators have a fantastic opportunity to expand their infrastructure in order to accommodate the growing demands of 5G.

Challenge:

Regulatory and legal considerations

Regulation and legal factors, such as getting required permissions, abiding by local laws, and ensuring compliance with data protection and privacy laws, may be relevant to the development of dark fiber networks. For organizations, navigating these requirements may be challenging. As more competitors enter the dark fiber industry, it gets more and more competitive. Market saturation, pricing pressures, and the need for distinctiveness to distinguish out from rivals might result from this. Particularly in rural or distant areas, the availability of dark fiber infrastructure may be constrained in some places. Accessing and using dark fiber networks may be difficult for businesses operating in these regions.

Single-mode fiber held a dominant market share in the dark fiber network market in 2023. Single-mode fiber is designed to transmit a single mode of light, enabling it to carry data over longer distances with minimal signal loss. Single-mode fiber is ideal for long-distance transmission, making it suitable for intercity or international connections. It can transmit data over tens or hundreds of kilometers without significant signal degradation. Single-mode fiber has a smaller core size, allowing it to support higher bandwidth capacities.

Shorter-distance data transmission is made possible by multi-mode fiber's ability to transport numerous light modes concurrently. Multi-mode fiber is generally utilized in data centers, campus settings, or metropolitan area networks for shorter transmission lengths. It works well in situations when shorter links are adequate. Compared to single-mode fiber, multi-mode fiber has a greater core size, making it easier to couple light sources and produce less expensive transmitters and receivers.

By network metro networks held the maximum share in 2023. Metro networks, commonly referred to as metropolitan area networks, serve a particular city or metropolitan region. These networks offer connection over a comparatively smaller area of land. Metro networks are primarily concerned with offering dependable high-speed connection inside a single city or metropolitan area. They provide for the networking requirements of local enterprises, and organizations.

Long-haul networks link cities, regions, and even entire nations over great distances. These networks are made for sending data over vast distances, frequently between large cities or between many regions. Since they enable seamless communication and data transfer over great distances, long-haul networks are crucial for connecting rural places. They are the foundation of both the domestic and global communication infrastructures.

In 2023, telecom industry held the maximum share, since dark fiber networks provide consistent, high-speed connectivity to telecommunication service providers.

Dark fiber application is also growing in the medical field like telemedicine, healthcare data exchange, and medical imaging. These networks allow for the quick and secure exchange of medical information and photographs, as well as high-quality video consultations.

Segments Covered in the Report

By Fiber Type

By Network Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

November 2024

January 2025

November 2024