January 2025

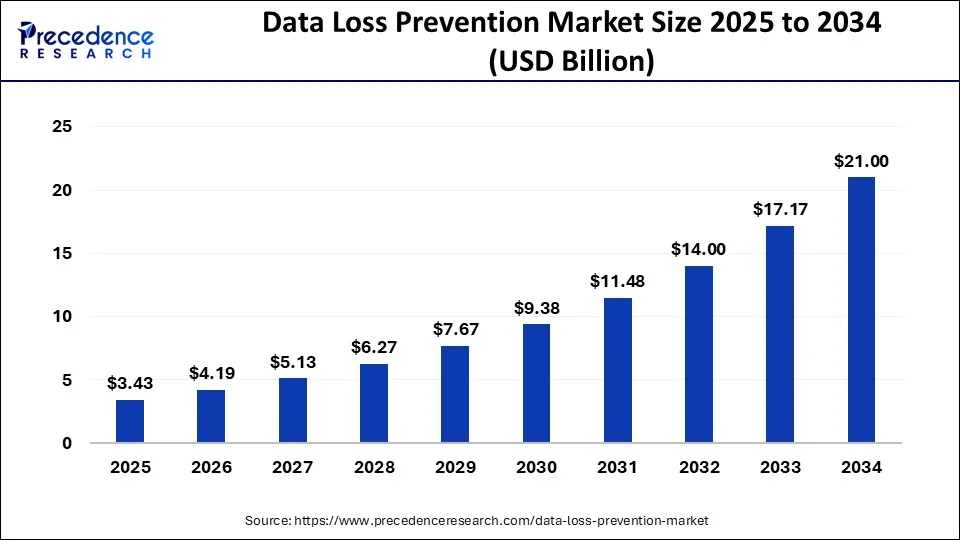

The global data loss prevention market size was USD 2.29 billion in 2023, calculated at USD 2.80 billion in 2024 and is expected to be worth around USD 21 billion by 2034. The market is slated to expand at 22.32% CAGR from 2024 to 2034.

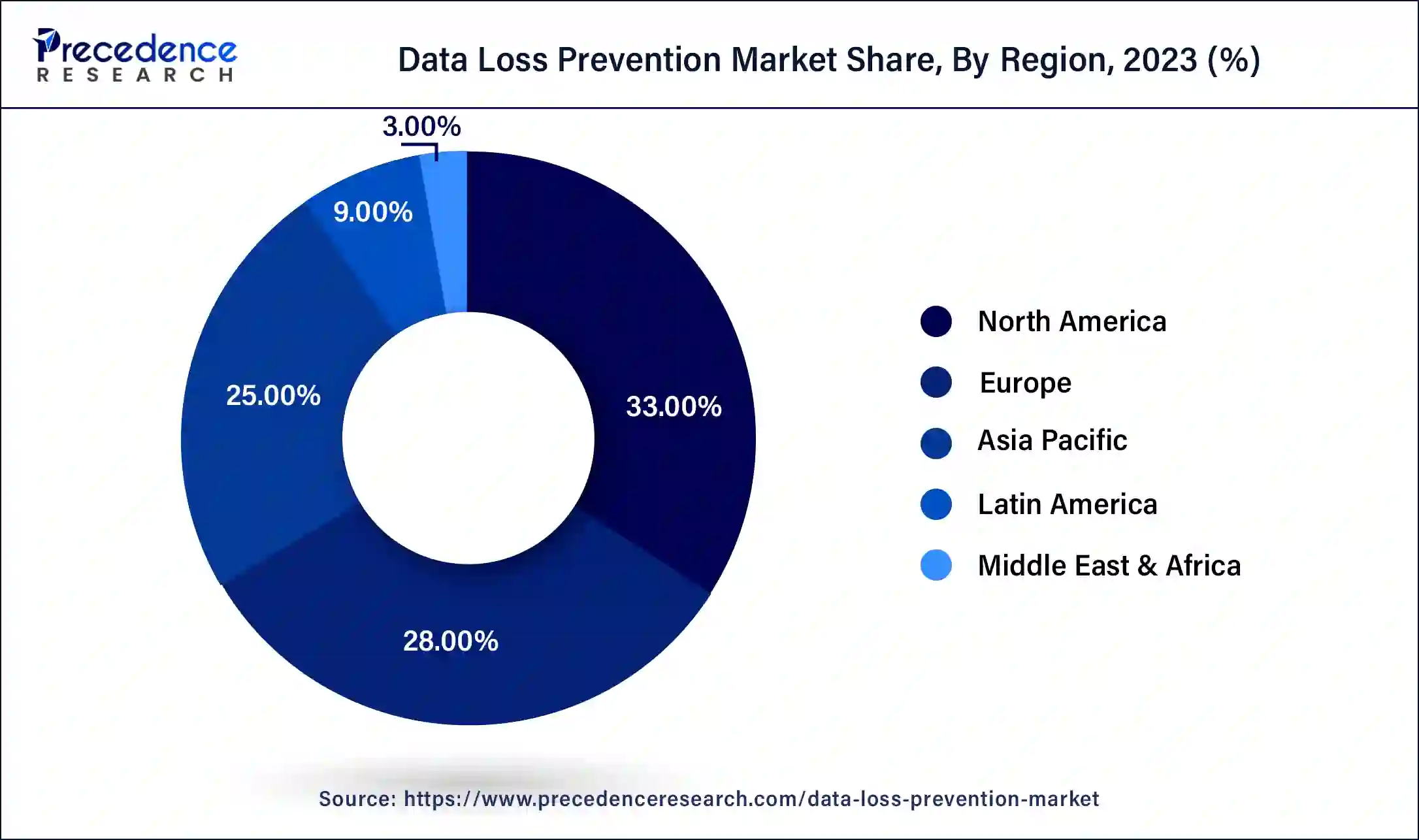

The global data loss prevention market size is projected to reach around USD 21 billion by 2034 from USD 2.80 billion in 2024, at a CAGR of 22.32% from 2024 to 2034. The North America data loss prevention market size reached USD 760 million in 2023. The increasing number of cybercrime cases across the world is driving the growth of the data loss prevention market.

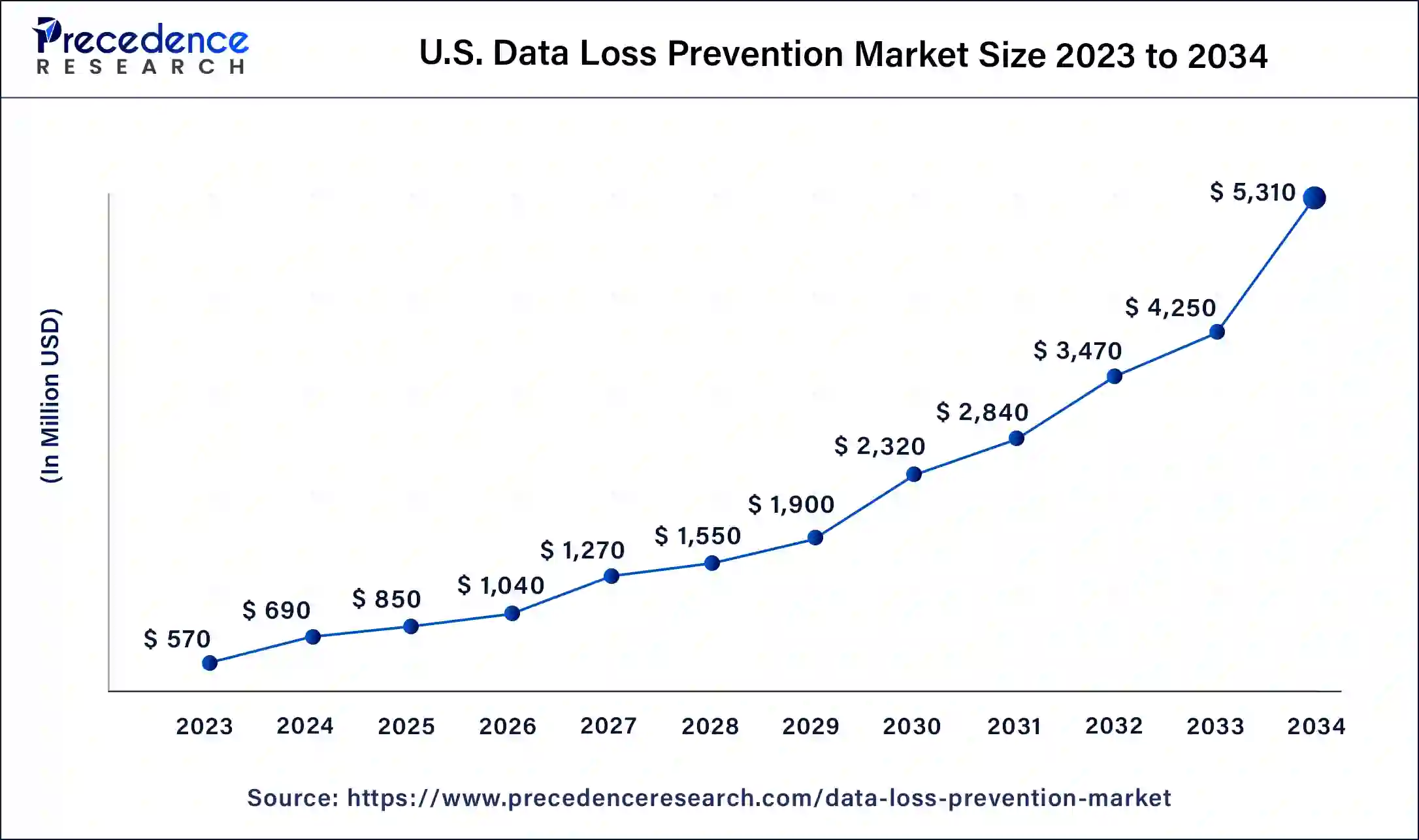

U.S. Data Loss Prevention Market Size and Growth 2024 to 2034

The U.S. data loss prevention market size was exhibited at USD 570 million in 2023 and is projected to be worth around USD 5,310 million by 2034, poised to grow at a CAGR of 22.49% from 2024 to 2034.

North America occupied more than 33% of the market share in 2023. The market's growth in this region is mainly driven by rising advancements in the IT sector and growing government investment in developing the cybersecurity sector in countries such as the U.S. and Canada.

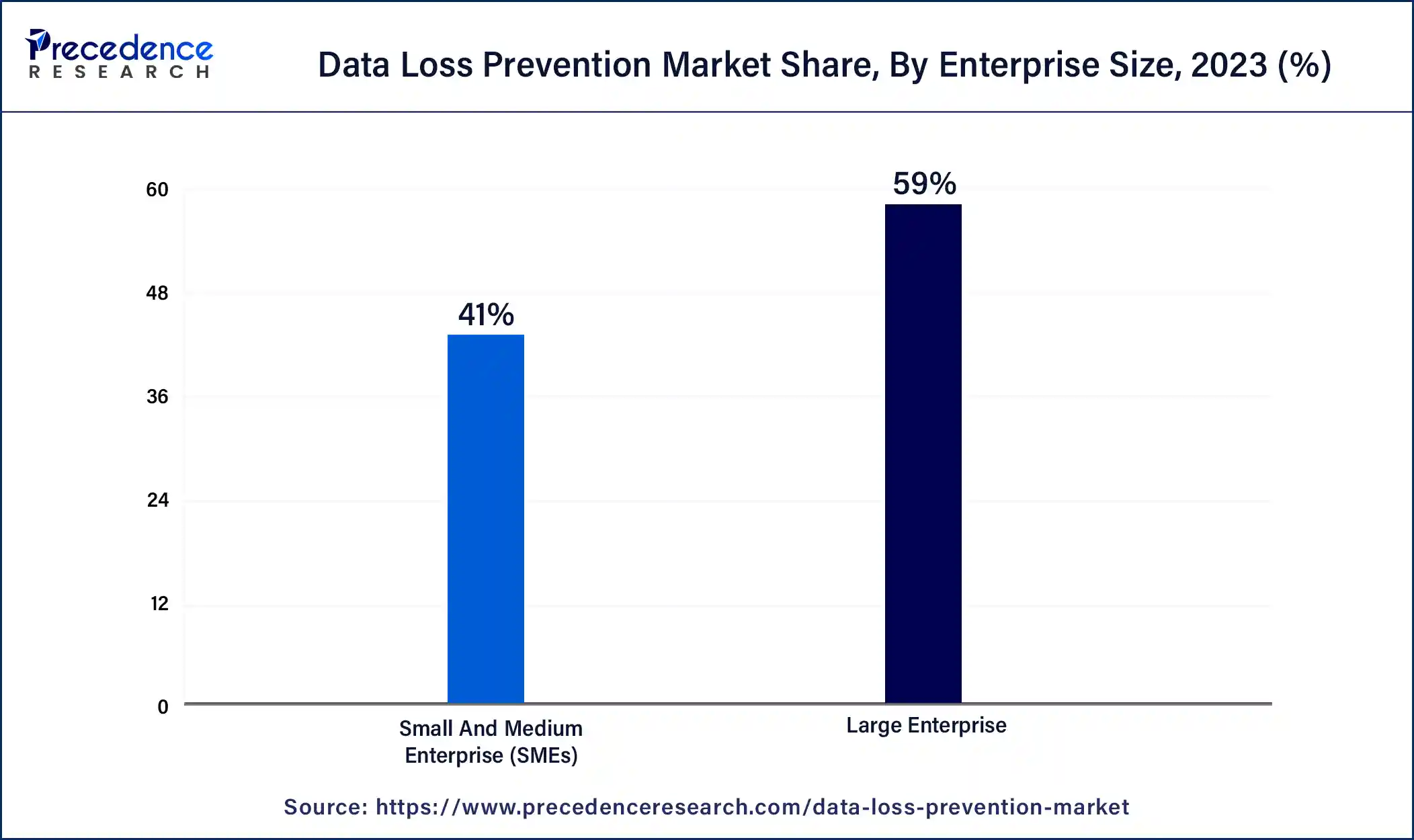

The growing developments in the BFSI sector, along with the increasing demand for data loss prevention software by the manufacturing and telecommunication industries, have driven the market growth. Also, the increasing application of DLP software by large enterprises coupled with the upsurge in demand for network DLP software is likely to drive the market growth to some extent.

Moreover, several local market players of data loss prevention solutions, such as Nightfall, Google, Microsoft, and others, are constantly engaged in developing data loss prevention software and adopting strategies such as partnerships, acquisitions, launches, and business expansions, which in turn drives the growth of the data loss prevention market in this region.

Asia Pacific is expected to expand at a double digital CAGR of 24.72% during the forecast period. The rising development in the data loss prevention industry by private and public entities, along with the growing application of data loss prevention solutions in the healthcare sector in countries such as India, China, Japan, South Korea, and others, is expected to drive the market growth to some extent.

Moreover, the increasing demand for DLP software by the retail and logistics sectors, along with the rise in the number of small and medium enterprises, has boosted the market growth. Additionally, the growing application of DLP solutions by government organizations, coupled with the rising deployment of on-premises solutions, is likely to boost market growth. Furthermore, the presence of various local companies of data loss prevention solutions such as Wroffy, Logon Software Asia, Falcongaze, Synersoft Technologies, and some others are developing advanced DLP software across the Asia Pacific region, which in turn is expected to drive the growth of the data loss prevention market in this region.

The data loss prevention market is one of the most important industries in the ICT and Media sector. This industry deals in developing and distributing high-quality software and solutions to prevent data loss across the world. This market is driven by the growing developments in the IT industry, along with increasing cases of phishing attacks worldwide. This software performs several applications such as encryption, centralized management policy, standards and procedures, web and email protection, cloud storage, incident response, and workflow management. Also, this software is mainly used in several end-user industries, including BFSI, IT and telecommunication, retail and logistics, healthcare, manufacturing, government, and others.

What Are the Benefits of AI in the Data Loss Prevention Industry?

AI plays an important role in the IT security industry. Currently, data loss prevention companies have started to integrate AI into their software to increase security. AI can help identify confidential and high-risk information, automate data management protocols, detect irregularities in unauthorized data usage, and strengthen cybersecurity defenses. Thus, the rising integration of artificial intelligence (AI) in the data loss prevention industry is expected to benefit the data loss prevention industry in numerous ways.

| Report Coverage | Details |

| Market Size by 2034 | USD 21 Billion |

| Market Size in 2023 | USD 2.29 Billion |

| Market Size in 2024 | USD 2.80 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 22.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Software, Deployment, Enterprise Size, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Growing adoption of cloud storage by organizations

The popularity of cloud storage is gaining traction among businesses and people worldwide. In recent times, large and medium-sized enterprises have started using a cloud platform as it provides additional security, convenience, accessibility, and usability for storing important data. Thus, with the rising adoption of cloud storage systems in several organizations, the demand for cloud-based DLP software has increased, thereby driving the growth of the data loss prevention market during the forecast period.

Complexities and security vulnerabilities

The data loss prevention industry has gained prominent attention due to several advantages in protecting data in several organizations. Although DLP solutions have several benefits, there are various problems in this industry. Firstly, some of the DLP solutions are programmed in unique ways that create complexities in users' minds. Secondly, a few DLP applications may cause security vulnerabilities in enterprises. Thus, the complexity associated with DLP solutions and security vulnerabilities is expected to restrain the growth of the data loss prevention market during the forecast period.

Integration of different security solutions in the DLP platform to change the future

Businesses around the world are using DLP solutions to provide additional security for the protection of important data. Nowadays, DLP-developing companies have started integrating intrusion detection systems, identity management solutions, firewalls, and some other security solutions in DLP systems to enhance data prevention capabilities. Thus, the integration of numerous security solutions in the DLP platform is expected to create ample opportunities for market players in the future.

The data center and storage-based DLP segment occupied more than 41% of the market share in 2023.

The rising demand for DLP software to protect data stored in data centers has driven market growth. Also, the increasing application of storage DLP to provide information about the data stored in the server is likely to boost the market growth to some extent. Moreover, the growing use of DLP software in data centers to provide control over information that is transferred from one organization to another is expected to drive the growth of the data loss prevention market during the forecast period.

The endpoint DLP segment is estimated to exhibit the fastest CAGR of 23.84% during the forecast period. The rising proliferation of smartphones has increased the demand for endpoint DLP software to protect sensitive information and has driven market growth. Also, the growing application of endpoint DLP software to identify movement that can cause potential risks in laptops or desktops is likely to boost the market growth. Moreover, the increasing trend of BYOD (Bring Your Own Devices) has increased the demand for endpoint DLP software, thereby driving the growth of the data loss prevention market during the forecast period.

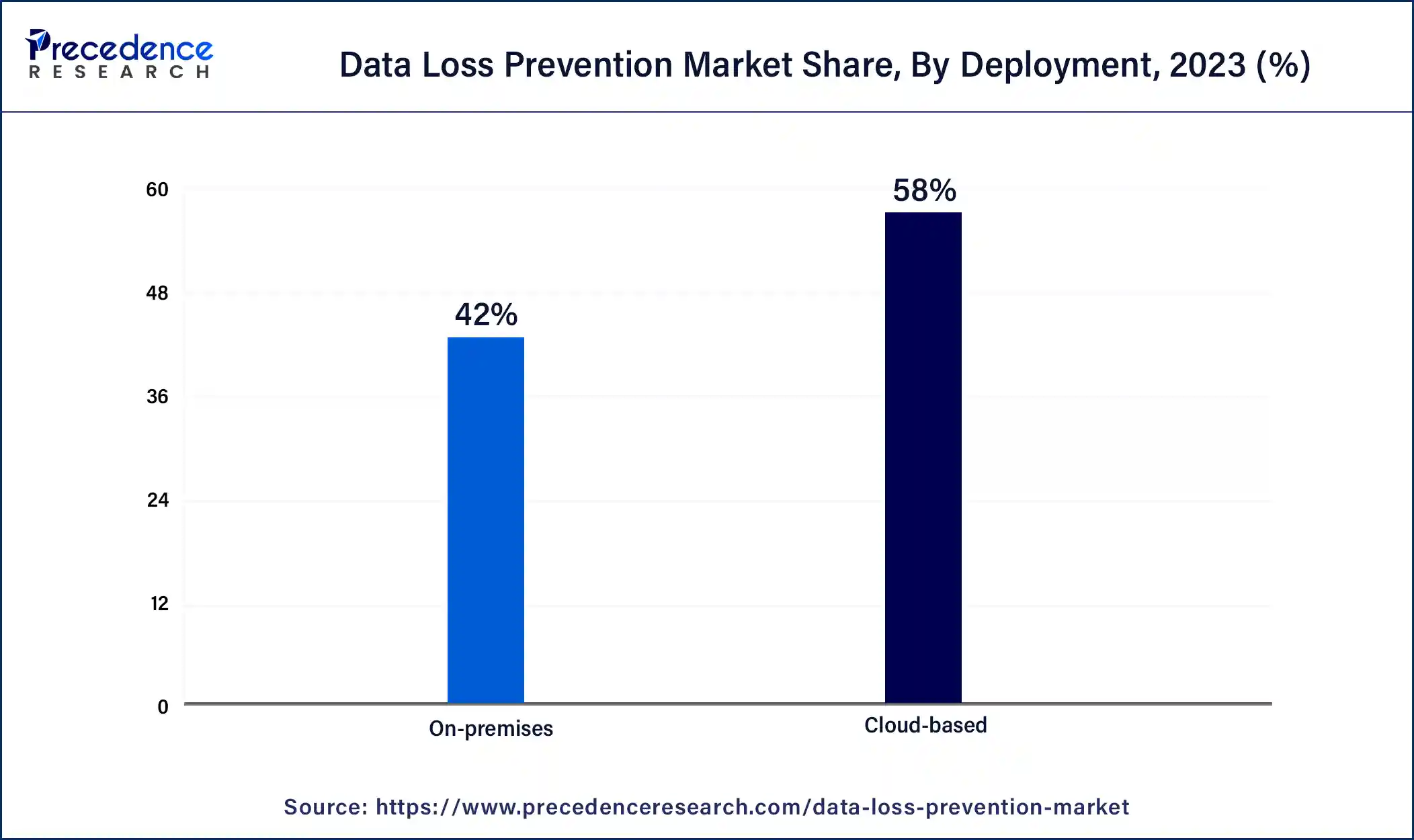

The cloud-based segment dominated the market with the largest market share of 58% in 2023.

The growing demand for cloud-based DLP to monitor network traffic in a cloud environment has driven market growth. Also, the increasing application of cloud-based DLP solutions to prevent exfiltration and leakage of sensitive data will likely foster market growth to some extent. Moreover, the rising demand for cloud-based DLP solutions to maintain regulatory compliances such as HIPAA, PCI DSS, and GDPR is expected to drive the growth of the data loss prevention market during the forecast period.

The on-premises segment is estimated to exhibit the fastest CAGR of 24.62% during the forecast period. The rising demand for on-premises DLP solutions is mainly due to avoiding latency issues, which has driven the market growth. Also, the increasing application of on-premises DLP solutions to directly control cybersecurity without depending on servers will likely propel the market growth to some extent. Moreover, the growing integration of on-premises DLP solutions in BFSI and healthcare sectors is expected to drive the growth of the data loss prevention market during the forecast period.

The large enterprises segment generated the biggest market share of 59% in 2023. The rising demand for cloud-based DLP solutions in large enterprises has driven market growth. Also, the increasing number of cyberattacks in large organizations has increased the demand for advanced DLP solutions for data protection, thereby driving market growth to some extent. Moreover, the growing demand for DLP solutions in large enterprises to comply with regulations and mitigate financial losses is expected to propel the growth of the data loss prevention market during the forecast period.

The SMEs segment is expected to grow with the highest CAGR of 23.23% during the forecast period. The rise in the number of SMEs worldwide has increased the demand for DLP solutions, thereby driving market growth. Also, the growing demand for low-cost DLP solutions in small and medium enterprises will likely boost market growth. Moreover, the increasing demand for DLP solutions for SMEs to provide ease of administration and the ability to solve numerous security issues simultaneously is expected to drive the growth of the data loss prevention market during the forecast period.

The encryption segment occupied more than 24% of the market share in 2023.

The demand for advanced DLP solutions for encryption purposes has increased to provide data access only to authorized users, which in turn drives market growth. Also, the growing trend of data encryption to provide additional layers for important data has increased the demand for DLP software, thereby driving the market growth to some extent. Moreover, the rising integration of symmetric cryptography and asymmetric cryptography in DLP solutions is expected to propel the growth of the data loss prevention market during the forecast period.

The policy, standards, and procedures segment is expected to grow with the highest CAGR of 26.33 during the forecast period. Due to the number of policies and regulations to protect sensitive data, the increasing demand for data loss prevention software has driven the market growth. Also, the growing emphasis of the government on preventing data losses has increased the demand for DLP solutions, thereby driving market growth to some extent. Moreover, the growing applications of DLP solutions to maintain security in government organizations are expected to drive the growth of the data loss prevention market during the forecast period.

The BFSI segment held the largest market share of 22% in 2023

The growing developments in the BFSI sector in developed nations have increased the demand for DLP solutions, thereby driving market growth. Also, the rising use of DLP solutions for monitoring sensitive data throughout the network in the BFSI sector is likely to boost the market growth. Moreover, the increasing application of DLP solutions for identifying suspicious behavior in the banking system is expected to drive the growth of the data loss prevention market during the forecast period.

The manufacturing segment is expected to grow at the fastest CAGR of 26% during the forecast period. The growing number of manufacturing companies worldwide has increased the demand for DLP solutions, thereby driving market growth. Also, the rising application of DLP solutions due to Distributed Denial of Service (DDoS) attacks in the manufacturing sector has propelled the market growth to some extent. Moreover, the increasing demand for DLP software to provide an extra shield against data breaches, safeguard intellectual property, and manage security in manufacturing companies is expected to drive the growth of the data loss prevention market during the forecast period.

Segments Covered in the Report

By Software

By Deployment

By Enterprise Size

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

January 2025

October 2024