May 2025

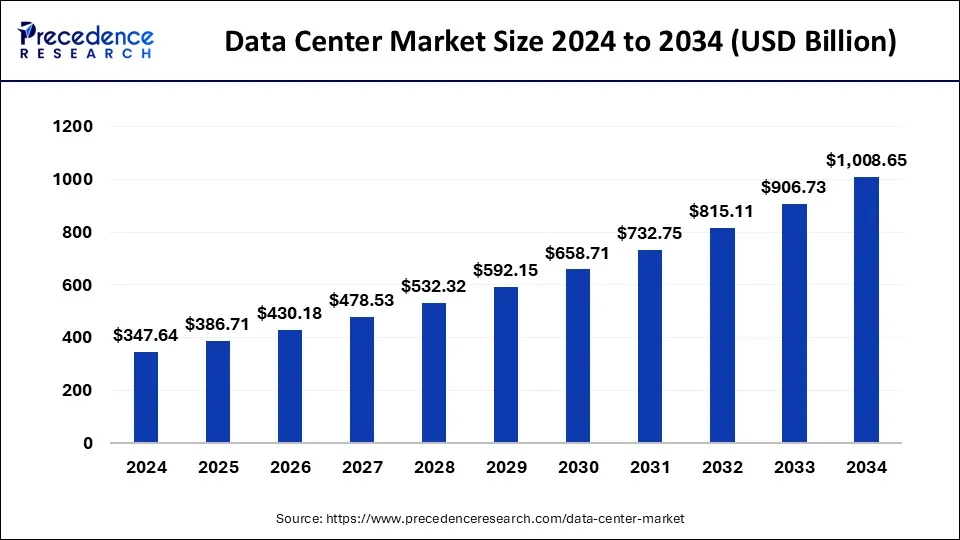

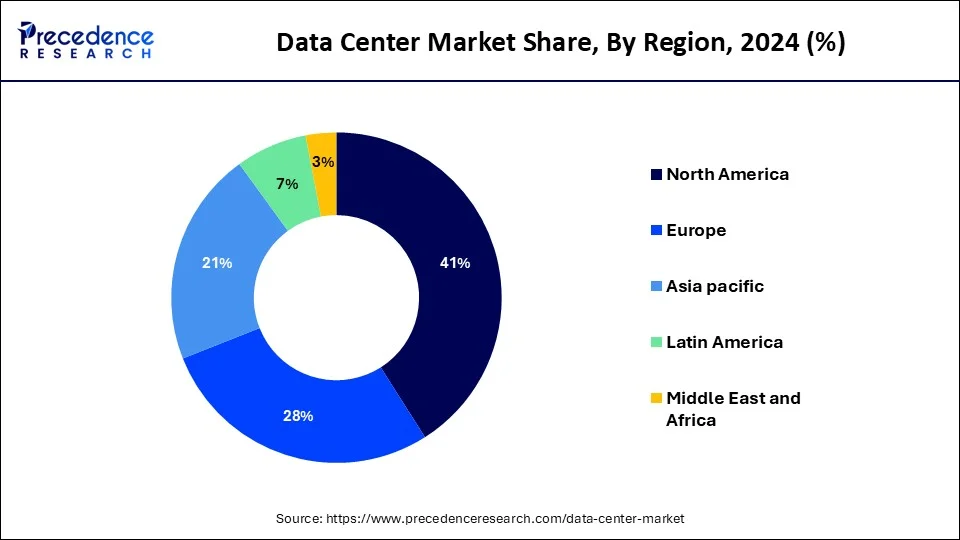

The global data center market size is calculated at USD 386.71 billion in 2025 and is forecasted to reach around USD 1,008.65 billion by 2034, accelerating at a CAGR of 11.24% from 2025 to 2034. The North America data center market size surpassed USD 142.53 billion in 2024 and is expanding at a CAGR of 11.38% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global data center market size was estimated at USD 347.64 billion in 2024 and is predicted to increase from USD 386.71 billion in 2025 to approximately USD 1,008.65 billion by 2034, expanding at a CAGR of 11.24% from 2025 to 2034.

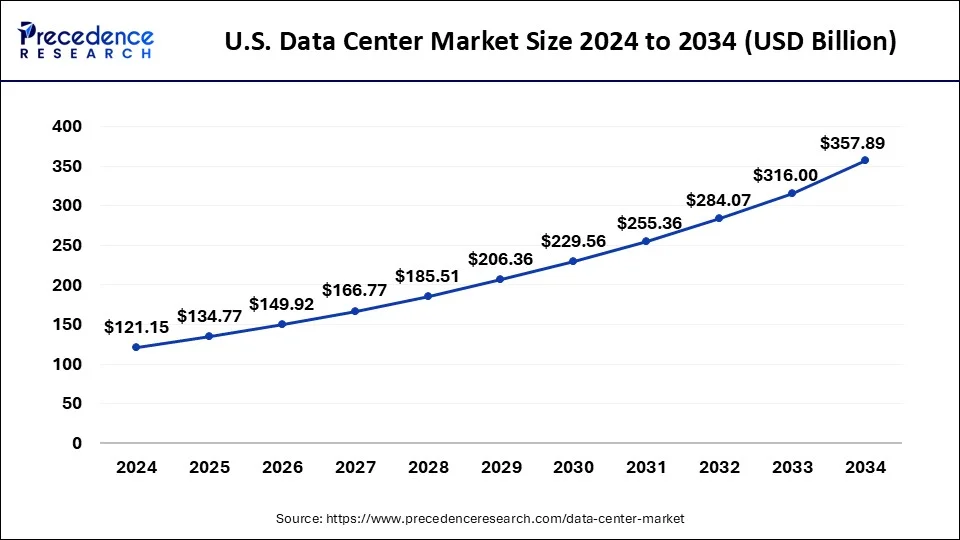

The U.S. data center market size was exhibited at USD 121.15 billion in 2024 and is projected to be worth around USD 357.89 billion by 2034, poised to grow at a CAGR of 11.44% from 2025 to 2034.

North America has held the largest revenue share 41% in 2024. In North America, the data center market is witnessing a surge in hyperscale data center construction driven by the demand for cloud services and digital transformation. The region emphasizes sustainability, with a growing adoption of green data center practices. Hybrid cloud solutions and edge computing are gaining prominence, reflecting the need for flexible and efficient data processing infrastructures to support diverse industries in the evolving digital landscape.

Currently, North America is dominating the data center market. The expansive construction of hyperscale data centers in North America is a major growth factor for this market. The demand for hybrid cloud solutions is significantly high in the data center industry. The well-established technological infrastructure is fostering development in this market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific exhibits a robust data center market marked by substantial investments in data center infrastructure. The region experiences a shift towards modular and prefabricated data centers to address scalability needs. With a dynamic mix of mature and emerging markets, Asia Pacific showcases a strong inclination towards adopting cutting-edge technologies, including AI and edge computing, to meet the increasing demand for digital services and data storage.

In Europe, the data center market reflects a commitment to sustainability and technological innovation. The region witnesses a growing demand for energy-efficient and eco-friendly data centers. Hybrid cloud solutions gain traction, emphasizing flexibility in data processing strategies. Europe's data center landscape showcases a harmonious blend of advancements in AI integration, renewable energy practices, and resilient infrastructure, positioning the continent at the forefront of data center trends.

The data center market refers to the global industry dedicated to designing, building, and managing data centers, essential for storing, processing, and managing vast amounts of digital information. These centers house servers, networking equipment, and storage systems, ensuring seamless and secure data operations for various organizations.

The data center market is propelled by growing demands for cloud computing services, big data analytics, and digital transformation. Key contributors to this dynamic landscape are technology firms, real estate developers, and service providers. Together, they play a vital role in the ongoing evolution of data center infrastructure, adapting to meet the expanding requirements of the digital era and ensuring the seamless operation of critical digital services across various industries.

Technological advancements in the data center market feature cooling technology, cloud computing, and edge computing. The edge computing process data from the most relevant sources. Machine learning, AI, and cloud computing are used to improve data center infrastructure. The hybrid cloud solution is mostly approached by many organizations to achieve success in cloud infrastructure and on-premises. The cooling technology is the primary approach of data centers, like liquid cooling helps eliminate heat from high-density computing equipment.

The most popular AI technology contributes to the optimization of resource allocation and energy consumption. It also supports automation. The green data centers minimize environmental impact and provide sustainable data center operations. These technologies are encouraging development in the data center market globally.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,008.65 Billion |

| Market Size in 2024 | USD 347.64 Billion |

| Market Size in 2025 | USD 386.71 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.24% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Type, Enterprise Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI integration and hybrid cloud environments

The (AI) in the data center market significantly surges market demand by introducing advanced analytics and automation. AI enhances operational efficiency, allowing for predictive maintenance, intelligent workload management, and proactive issue resolution. With AI-driven insights, data centers can optimize resource utilization, improve energy efficiency, and ensure seamless performance, thereby meeting the evolving demands of modern data processing.

The adoption of hybrid cloud environments plays a pivotal role in driving market demand for data centers. Businesses increasingly leverage hybrid cloud strategies, combining on-premises infrastructure with cloud services for enhanced flexibility and scalability. Data centers, acting as the basis of these hybrid setups, facilitate seamless integration, data mobility, and efficient resource allocation. As organizations prioritize a blend of private and public cloud solutions, the demand for data centers that can effectively support and integrate within hybrid cloud environments experiences a substantial surge.

Cybersecurity risks and energy consumption concerns

The data center market faces constraints due to escalating cybersecurity risks, with the increasing sophistication of cyber threats posing a significant challenge. The potential for data breaches, unauthorized access, and cyber-attacks on critical infrastructure raises concerns among businesses and organizations, leading to hesitancy in adopting and expanding data center capabilities. The need for robust cyber security measures and constant advancements to counter evolving threats places a strain on resources, impacting the market's growth potential as stakeholders prioritize security over rapid expansion.

Energy consumption concerns act as a substantial restraint on the data center market. The high-power requirements of data centers contribute to environmental impact and operational costs. With a growing focus on sustainability, businesses are cautious about the ecological footprint of data centers, prompting a shift towards energy-efficient solutions. Balancing the demand for increased computing power with the imperative to reduce energy consumption poses a challenge. Stricter regulations and corporate sustainability initiatives further intensify the pressure, influencing decision-makers to prioritize energy-efficient and environmentally friendly alternatives, impacting the pace of market expansion.

Edge computing solutions and data center expansion

The surge in market demand for the data center market is significantly driven by the adoption of edge computing solutions. As organizations embrace the decentralization of data processing, edge computing brings computing power closer to end-users, reducing latency and enhancing the efficiency of real-time applications. The need for quick decision-making, particularly in applications like IoT devices and autonomous systems, fuels the demand for distributed edge data centers, creating a robust market for compact, high-performance infrastructure.

Data center expansion is a key driver amplifying market demand. With the escalating volumes of digital data generated and processed globally, there's a critical need for expanded data center capacity. The increasing adoption of cloud computing, big data analytics, and digital transformation initiatives further intensify this demand. Companies engaged in data center expansion projects contribute to the market's growth by ensuring scalable, secure, and efficient facilities, catering to the evolving requirements of businesses in the digital age.

According to the component, the solution segment held 65.76% revenue share in 2024. In the data center market, solutions refer to the technological offerings that address specific challenges or fulfill key functionalities within data center infrastructure. This comprises both hardware and software elements, encompassing servers, storage systems, networking equipment, and management software within the data center market.

The prevailing trend in data center solutions centers on the integration of cutting-edge technologies, including edge computing, artificial intelligence, and modular designs. This integration aims to optimize efficiency, scalability, and overall performance, aligning with the dynamic requirements of digital transformation in the contemporary business landscape.

The services segment is anticipated to expand at a significant CAGR during the projected period. Data center services encompass a range of offerings including consulting, maintenance, and management to optimize the performance and reliability of data center infrastructure. As a trend, there is an increasing focus on managed services, where third-party providers offer comprehensive solutions to handle the complexities of data center operations, ensuring seamless functioning, security, and compliance. The service sector is evolving to meet the demand for specialized expertise and support in the dynamic and complex landscape of data center management.

The colocation segment held the largest market share in 2024. Colocation in the data center market refers to the practice of renting space and resources in a third-party facility. Organizations benefit from shared infrastructure, reducing the need for building and maintaining their data centers. Trends include a rising demand for colocation services due to cost-effectiveness, increased security, and the ability to scale resources as needed.

The hyperscale segment is projected to grow at the fastest rate over the projected period. Hyperscale data centers are massive facilities designed to accommodate high-density computing infrastructure. These centers cater to large-scale cloud providers and internet services, addressing the growing demand for expansive and efficient computing resources. Trends include a surge in hyperscale data center construction to meet the escalating requirements of cloud computing, big data, and emerging technologies.

The large enterprises segment had the highest market share in 2024 based on the enterprise Size. Large enterprises in the data center market are organizations with extensive IT infrastructure needs, typically characterized by substantial data storage, processing requirements, and complex networking systems. Trends indicate a growing reliance on hyper-scale data centers to meet the demands of cloud computing, big data analytics, and digital transformation initiatives. Large enterprises emphasize scalability, security, and efficiency, driving investments in advanced data center technologies to support their expansive operations.

The Small & Medium Enterprises (SMEs) segment is anticipated to expand at the fastest rate over the projected period. Small & Medium Enterprises (SMEs) in the data center market comprise businesses with more modest IT infrastructure needs. Trends suggest a rising adoption of colocation services and modular data center solutions among SMEs to achieve cost-effectiveness and flexibility. As SMEs increasingly embrace digitalization, there is a growing demand for scalable and manageable data center solutions that cater to their specific requirements, supporting their journey toward enhanced digital capabilities.

The BFSI segment had the highest market share in 2024 on the basis of the end user. In the data center market, BFSI end-users, including banks, financial institutions, and insurance companies, demand secure and resilient data infrastructure. Trends in BFSI data centers focus on regulatory compliance, enhanced cybersecurity, and the adoption of hybrid cloud solutions for seamless operations. With the growing reliance on digital transactions and data-intensive financial services, BFSI entities drive the need for scalable and efficient data center solutions to ensure uninterrupted financial operations.

The IT & telecom segment is anticipated to expand at the fastest rate over the projected period. The IT & telecom sector, a major end-user of data center solutions, requires robust infrastructure to support the increasing demand for digital services and data storage. Trends in this segment revolve around edge computing integration, 5G network deployment, and modular data center solutions. Telecom companies and IT service providers seek agile and scalable data center architectures to accommodate the evolving landscape of technology, enabling faster data processing, reduced latency, and improved network performance.

By Component

By Type

By Enterprise Size

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

January 2025

May 2025

January 2025