Decentralized Finance Market Size and Forecast 2025 to 2034

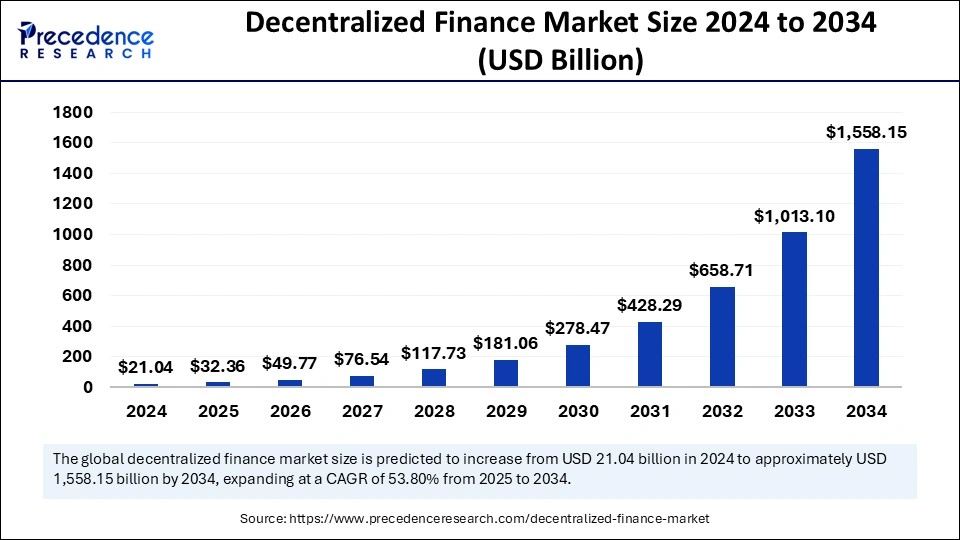

The global decentralized finance market size accounted for USD 21.04 billion in 2024 and is predicted to increase from USD 32.36 billion in 2025 to approximately USD 1,558.15 billion by 2034, expanding at a CAGR of 53.80% from 2025 to 2034. This market is growing due to increased demand for transparent, accessible, and permissionless financial services.

Decentralized Finance Market Key Takeaways

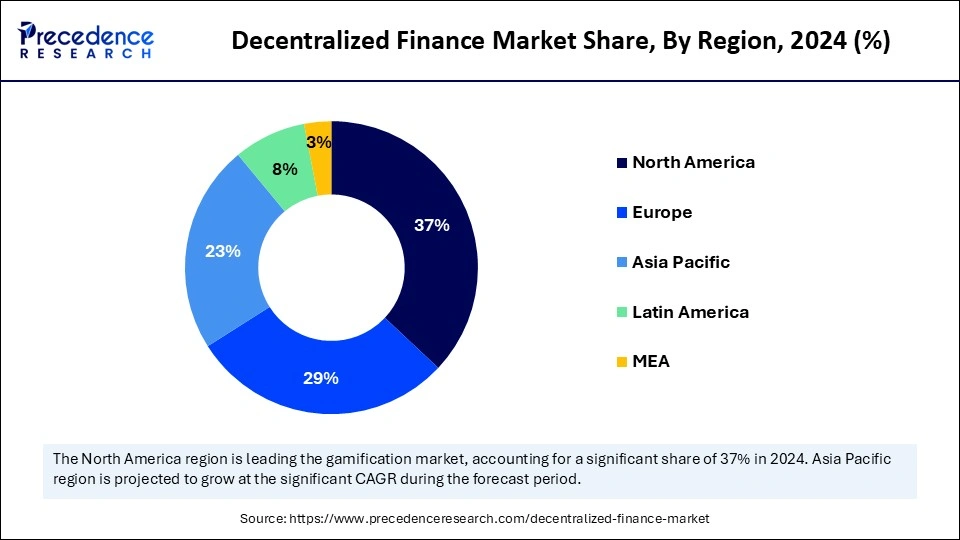

- North America dominated the market with the highest share of 37% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By component, the blockchain technology segment held the major market share of 43% in 2024.

- By component, the smart contracts segment is expected to witness significant growth during the predicted timeframe.

- By application, the data and analytics segment dominated the market in 2024.

- By application, the payments segment is projected to grow at the fastest rate over the forecast period.

How is Artificial Intelligence (AI) Reshaping Risk Management and Fraud Detection in Decentralized Finance (DeFi)?

Emerging technologies are playing a pivotal role in redefining how decentralized finance platforms handle risk and detect fraud. In an environment that lacks centralized oversight, intelligent systems are essential for maintaining security and trust. The real-time processing of enormous amounts of blockchain algorithms can spot odd trends and abnormalities that could indicate dangers like front-running phishing schemes or flash loan exploits. These models can react proactively to changing attack tactics because they are constantly learning from past transactions.

Machine learning tools can monitor wallet interactions, flag suspicious activity, and send out real-time alerts to network participants or smart contracts to detect fraud. Such technology is already used by platforms like Chainalysis and TRM Labs to assist DeFi protocols in adhering to security and anti-money laundering regulations. Intelligent systems are improving operational efficiency and risk control by bringing automation flexibility and accuracy, which will increase the security, dependability, and scalability of decentralized financial services.

U.S. Decentralized Finance Market Size and Growth 2025 to 2034

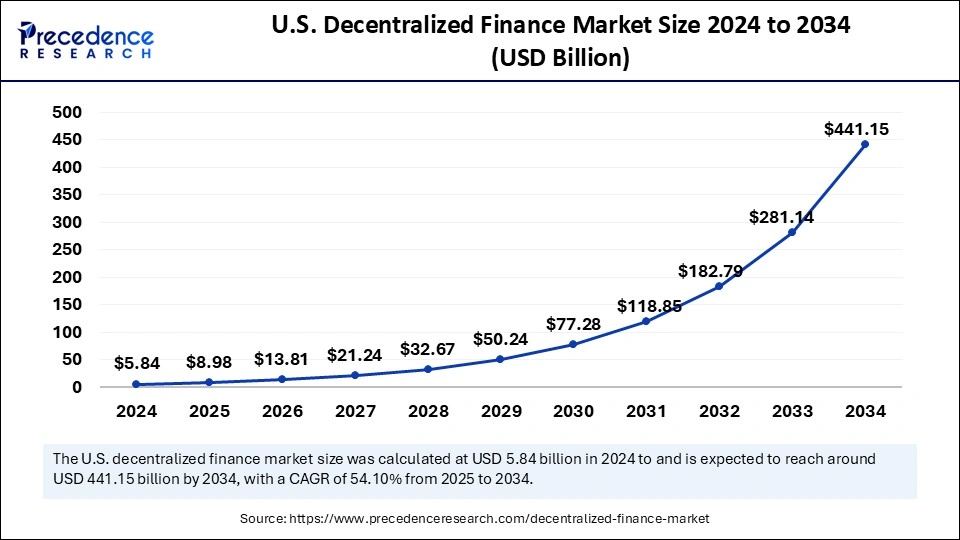

The U.S. decentralized finance market size was exhibited at USD 5.84 billion in 2024 and is projected to be worth around USD 441.15 billion by 2034, growing at a CAGR of 54.10% from 2025 to 2034.

North America dominated the decentralized finance market with the largest share in 2024 due to the early adoption of blockchain innovations and a well-established technological infrastructure. A vibrant developer community, steady venture capital support, and broad awareness of digital assets all help the area. Legitimizing DeFi operations is also being aided by regulatory developments in a few jurisdictions. North America's leadership is being further cemented by prominent institutional partnerships and integration with conventional finance systems. Its innovation advantage is increased by the existence of prestigious blockchain research and academic institutions.

Asia Pacific is expected to grow at the fastest CAGR in the decentralized finance market during the forecast period, driven by a population that is increasingly tech-savvy and a growing desire for financial inclusion. The adoption of DeFi is being accelerated by the growth of mobile-first financial services, expanded internet connectivity, and a passion for digital innovation. Startups in the area are quickly launching user-friendly, scalable DeFi platforms aimed at retail customers. Another factor fueling the upsurge is the speed at which developer training, community involvement, and crypto education are occurring. This area has the potential to develop into a significant worldwide center for DeFi activity as blockchain infrastructure advances.

Europe is growing at a considerable rate in the global decentralized finance market. Supported by robust institutional interest and organized digital finance frameworks. Trust in decentralized platforms has been fostered by the region's balanced approach to innovation and regulation. DeFi protocols are being integrated into conventional systems by an increasing number of fintech companies. An ecosystem of competition is also being shaped by government-supported digital projects and research institutes. The increasing experimentation with on-chain governance and tokenized assets increases Europe's importance in the global DeFi scene.

Market Overview

The decentralized finance market has witnessed rapid growth in recent years, driven by the global push for financial inclusion, growing interest in cryptocurrencies, and the growing adoption of blockchain technology. Using smart contracts on blockchain networks like Ethereum DeFi platforms provides services like lending, borrowing, trading, and yield farming without the need for middlemen. This innovation gives consumers access to a variety of financial tools while preserving complete control over their assets. The DeFi ecosystem is still growing and drawing in both institutional and retail investors looking for better returns and more transparency despite security issues and regulation uncertainty.

Decentralized Finance Market Growth Factors

- Increased adoption of blockchain technology: More users and institutions are embracing blockchain for its transparency and decentralization

- Demand for financial inclusion: DeFi provides access to financial services for the unbanked and underbanked populations worldwide.

- Rise in cryptocurrency usage: Growing interest in cryptocurrencies fuels the use of DeFi platforms for lending, borrowing, and trading.

- Attractive yield opportunities: Yield farming and staking offer higher returns compared to traditional finance.

- Global economic uncertainty: Instability in traditional markets encourages investors to explore decentralized alternatives.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,558.15 Billion |

| Market Size in 2025 | USD 32.36 Billion |

| Market Size in 2024 | USD 21.04 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 53.80% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component , Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Blockchain adoption

Transparency, immutability, and security are three key features that make DeFi appealing, and blockchain technology guarantees these qualities. DeFi platforms profit from the scalability and dependability that decentralized leader systems provide as more developers and businesses use them. It also encourages innovations across sectors like gaming, NFTs, and supply chains, indirectly contributing to DeFi's relevance. Interpretability between blockchains is making DeFi more accessible and efficient. In April 2023, Arbitrum launched its ARB governance token, boosting the adoption of its Layer 2 network and attracting DeFi projects like GMX and Radiant Capital.

Disintermediation

The decentralized finance market enables users to transact directly and take charge of their assets by doing away with banks and brokers. This improves transparency, lowers expenses, and speeds up transactions. The self-custody model also minimizes the risk of platform mismanagement or fraud. This became a significant appeal after centralized exchanges failed. Decentralized identity and trustless verification have also seen faster innovation as a result of the change.

Restraints

Regulatory uncertainty

Due to ambiguous or changing regulations, DeFi operates in a gray area in many nations. Governments are still determining whether to classify DeFi products as commodities securities or something else entirely. For users, developers, and investors in the decentralized finance market, this creates uncertainty because they could be subject to unforeseen limitations or legal action. Institutions and traditional finance layers frequently refrain from fully implementing DeFi due to a fear of compliance risks.

- In March 2023, the U.S. SEC issued a Wells Notice to Coinbase over its staking services, signaling increased scrutiny of DeFi staking models. This caused panic across DeFi staking platforms and slowed growth in the U.S. market.

Poor user experience (UX/UI)

Regulations are ambiguous or constantly changing DeFi operates in a gray area in many countries. The classifications of DeFi products, whether as securities commodities or something else entirely, are still up for debate among governments. For developers, investors, and users in the decentralized finance market, this creates uncertainty because they could be subject to unforeseen limitations or legal action. DeFi adoption is frequently impeded by institutions and traditional finance players' fear of compliance risk. Despite its massive growth, Curve Finance has been criticized for its outdated and unintuitive interface, which deters everyday users even though it handles billions in TVL.

Opportunities

On-chain identify and credit scoring.

Traditional DeFi models lack identity and trust mechanisms they rely on over-collateralization. Users can demonstrate their reliability without disclosing personal information, thanks to on-chain identity solutions' introduction of verifiable credentials, reputation systems, and behavioral analytics. Peer-to-peer reputation systems credit delegation based on wallet activity, and undercollateralized or even unsecured lending is made possible by this. Moreover, identity layers enhance governance, promote regulatory compliance, and guard against Sybil attacks. Advanced use cases such as privacy-preserving authentication, personalized financial products, and whitelisted access are made possible by them. Using chain identities, users can create a financial reputation that is transferable between blockchains and dApps. As a result, the DeFi environment becomes safer, more effective, and more scalable.

Real-world asset (RWA) tokenization

Factional ownership, worldwide liquidity, and 24-hour trading are made possible by tokenizing real-world assets such as real estate private equity invoices and carbon credits. By cutting down on middlemen and transaction times while increasing accessibility and transparency this upends traditional finance. By gaining access to high-value or illiquid assets in smaller amounts, investors can diversify their holdings. Additionally, it lowers the expenses related to custodianship, legal structures, and paperwork. RWA tokenization preserves ownership records and chain variability while providing the public with new investment opportunities. It also offers businesses simplified asset management and new tools for raising capital. Governments and institutions are being compelled by this change to investigate blockchain-based asset issuance and registry.

Component Insights

The blockchain technology segment dominated the decentralized finance market with the highest share in 2024. It offers the fundamental framework for safe, open, and impenetrable transactions across DeFi applications. Blockchain removes the need for conventional middlemen by facilitating peer-to-peer transfers, decentralized data storage, and real-time transaction validation. DeFi's broad adoption in lending, staking, and trading services is still supported by its scalability and dependability.

Ethereum, the most widely used blockchain platform for DeFi protocols, hosts applications like MakerDAO and Synthetix. Binance Smart Chain offers low-cost and high-speed alternatives, powering platforms such as PancakeSwap. Polygon enhances scalability through Layer 2 solutions and supports projects like Quick Swap and Aavegotchi.

The smart contracts segment is expected to witness significant growth during the predicted timeframe. These self-executive codes enable financial transactions to take place without human supervision or the involvement of third parties by automatically enforcing the terms and regulations of agreements. For DeFi use cases like yield farming insurance lending and decentralized exchanges, smart contracts add automation efficiency and trust. Their versatility and adaptability keep drawing in both developers and users, which fuels the market's explosive expansion.

Companies leading this space include Uniswap, which uses smart contracts to facilitate peer-to-peer token swaps. Aave and Compound automate lending and borrowing with no intermedia diaries involved. Curve Finance utilizes smart contracts for efficient stablecoin trading. As these platforms evolve, smart contracts are enabling increasingly complex and high-value financial interactions on the chain.

Application Insights

The data and analytics segment dominated the decentralized finance market in 2024. Decision-making, risk management, price discovery, and protocol performance tracking all depend on precise real-time data in a decentralized setting. Users and developers can keep an eye on security threats, liquidity fluctuations, token trends, and wallet activity with the aid of analytics tools. The segment's leadership is further supported by the growing need for advanced data insights and on-chain transparency as DeFi ecosystems get more complex.

Dune Analytics, which allows users to create custom dashboards for DeFi data visualization, and Nansen, known for combining chain analytics with wallet labeling. Glassnode offers market intelligence by analyzing blockchain data trends, while Messari provides detailed metrics and research on DeFi tokens and protocols. These platforms empower users with insights that drive informed participation in DeFi markets.

The payments segment is projected to grow at the fastest rate over the forecast period. The way people and businesses transfer value internationally is being revolutionized by DeFi payments, which allow peer-to-peer borderless transactions with lower fees and no middleman. This market is expanding more quickly due to rising stablecoin adoption, wallet integrations, and mobile-first platforms. The need for cross-border payments that are quicker, less expensive, and more transparent sets up this application area for substantial growth in the years to come.

Celo focuses on mobile-based DeFi payments, especially in developing regions. Request network enables businesses to send and receive crypto invoices and payments in a decentralized way. Sablier offers real-time payment streaming through smart contracts, and Ramp Network provides seamless fiat-to-crypto payment infrastructure. These companies are pushing DeFi payments closer to mainstream adoption.

Decentralized Finance Market Companies

- Compound Labs, Inc.

- MakerDAO

- Aave

- Uniswap

- SushiSwap

- Curve Finance

- Synthetix

- Balancer

- Bancor Network

- Badger DAO

Latest Announcements

- In December 2024, the Andhra Pradesh Government announced approval of Rs 1.9 lakh crore investments across key sectors. The chief minister of Andra Pradesh stated that these projects, including the BPCL refinery in Nellore and Reliance's clean energy ventures, will generate approximately 2.64 lakh jobs and significantly boost the state's industrial growth. These investments span renewable energy electronics manufacturing and port-based infrastructures.

- In December 2023, the Bhartiya Janata Party announced Vishnu Deo Sai as the next chief minister of Chhattisgarh and stated that he was committed to fulfilling the promises made during the election campaign and would prioritize providing 18 lakh houses to beneficiaries under the Pradhan Mantri Awas Yojana. He also mentioned plans to support farmers through timely procurement and input subsidies. Infrastructure improvements in tribal and backward regions will be a focus of the administration.

Recent Developments

- In February 2024, PayPal's move allowed PYUSD to be used in DeFi lending, trading, and liquidity pools across Ethereum-based protocols. This step marks a significant bridge between traditional payments and decentralized finance ecosystems. It empowers users to leverage a globally trusted stablecoin for on-chain activity while expanding PayPal's crypto ecosystem.

- In October 2023, the pilot explored using blockchain to enhance transparency in the carbon offset market through traceable tokens. This aligns with Mastercard's ESG goals while demonstrating DeFis's role in sustainability finance.

Segments Covered in the Report

By Component

- Blockchain Technology

- Decentralized Applications (dApps)

- Smart Contracts

By Application

- Assets Tokenization

- Compliance and Identity

- Marketplaces and Liquidity

- Payments

- Data and Analytics

- Decentralized Exchange

- Prediction Industry

- Stablecoins

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content