July 2025

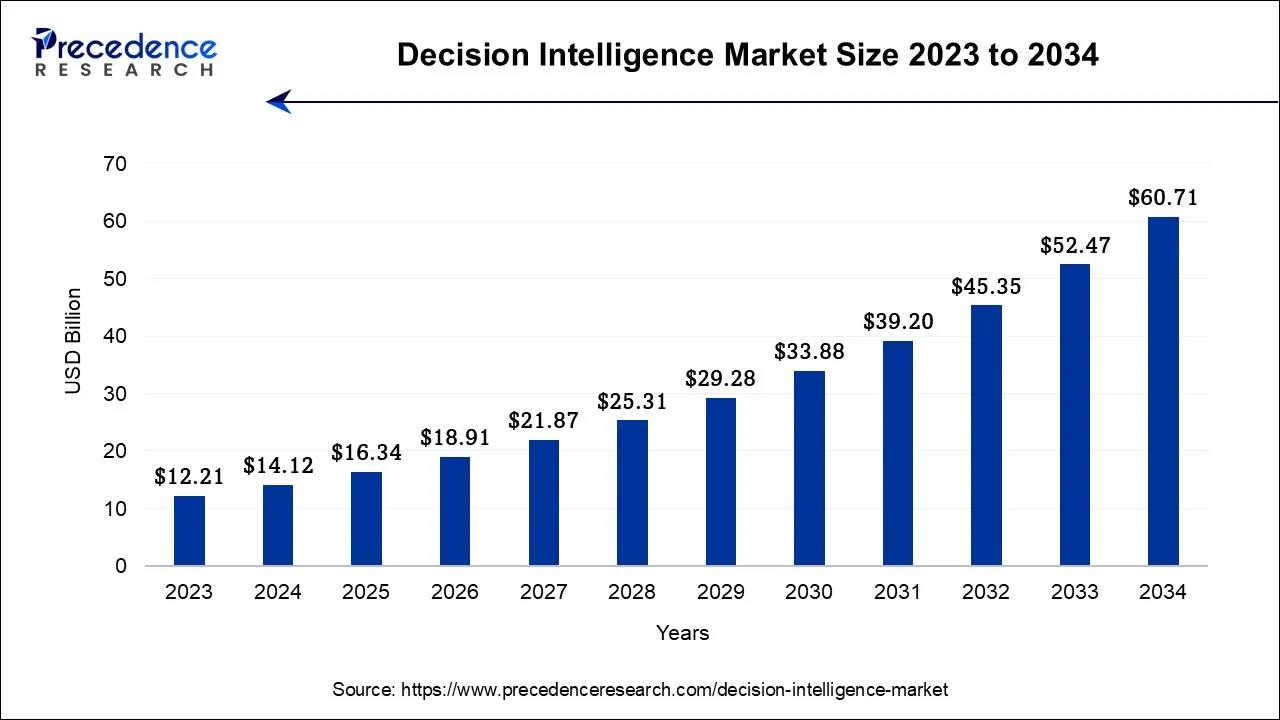

The global decision intelligence market size is expected to be valued at USD 14.12 billion in 2024 and is anticipated to reach around USD 60.71 billion by 2034, expanding at a CAGR of 15.7% over the forecast period from 2024 to 2034.

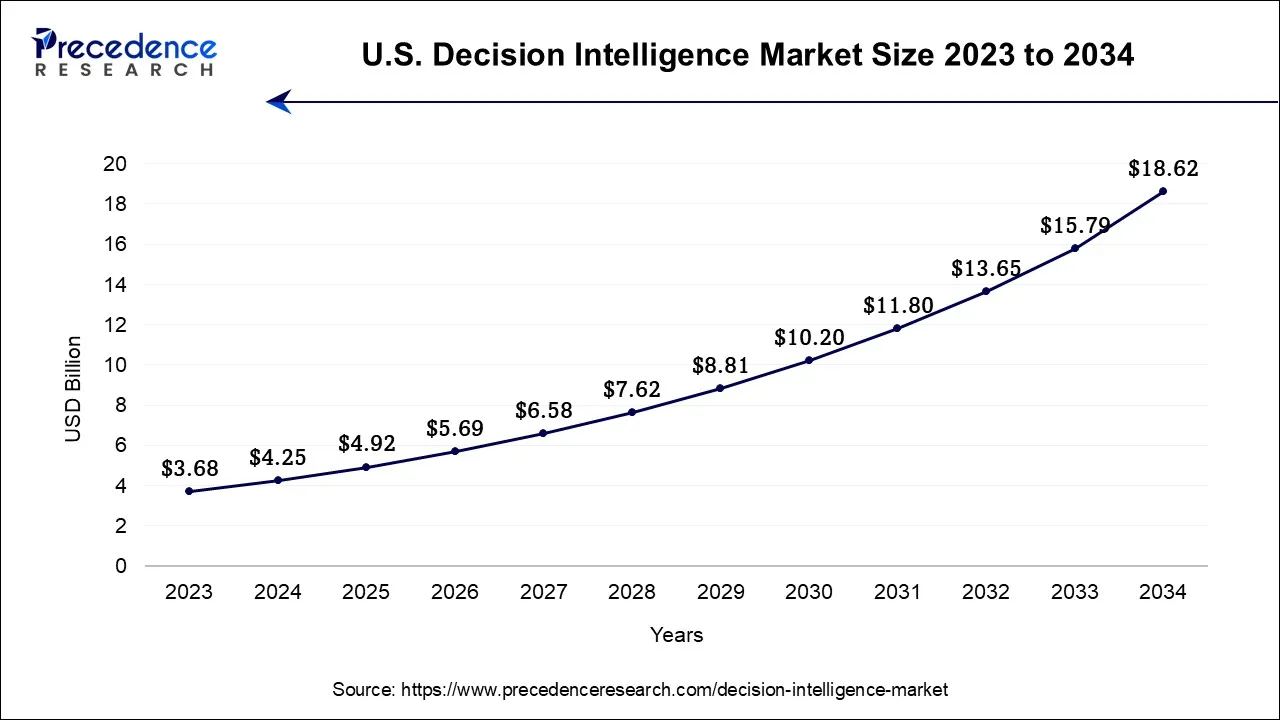

The U.S. decision intelligence market size is accounted for USD 4.25 billion in 2024 and is projected to be worth around USD 18.62 billion by 2034, poised to grow at a CAGR of 15.92% from 2024 to 2034.

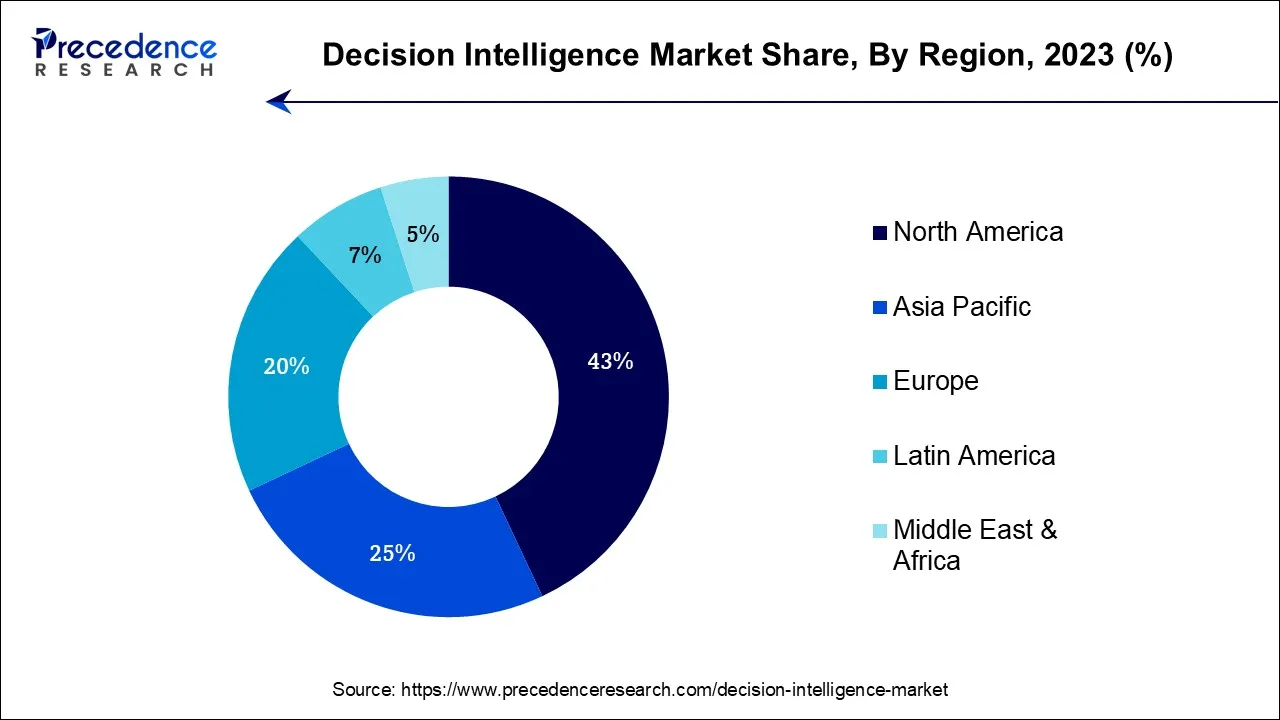

North America has held largest revenue share 43% in 2023.

Asia-Pacific is estimated to observe the fastest expansion.

The decision intelligence market represents the flourishing realm dedicated to leveraging cutting-edge technologies like artificial intelligence, machine learning, and data analytics to enhance the art of decision-making across diverse industries. It encompasses the development of sophisticated tools and platforms that empower organizations to acquire, scrutinize, and decipher data, enabling them to make judicious choices, optimize their operational processes, and prognosticate future outcomes.

Decision Intelligence solutions find utility across sectors like finance, healthcare, supply chain management, and marketing, facilitating businesses in gaining a competitive edge by converting data into actionable and strategic insights. This market's growth is fueled by the escalating significance of data-centric decision-making in today's intricate and competitive business environment.

One noteworthy trend prevailing in the decision intelligence market is the escalating embrace of data-centric decision-making methodologies. Corporations are increasingly realizing the immense value residing within data, propelling the demand for decision intelligence solutions. Furthermore, the proliferation of IoT (Internet of Things) devices has led to a deluge of data, creating expanded opportunities for the application of decision intelligence. Concurrently, the relentless advancement in machine learning algorithms and natural language processing is amplifying the capabilities of decision intelligence systems, rendering them more efficient and precise.

Several factors are propelling the decision intelligence Industry forward. Firstly, the imperative for businesses to remain agile and adaptable amid swiftly shifting market dynamics fosters the adoption of decision intelligence solutions. Secondly, the surge in big data volume and the mounting intricacies in decision-making processes within our interconnected world fuel robust demand for data analytics tools. Lastly, the COVID-19 pandemic has underscored the critical significance of data-driven decision-making in crisis management and readiness, further amplifying the market's growth trajectory.

Despite its promising prospects, the decision intelligence market grapples with certain challenges. A primary hurdle pertains to the intricacy of integrating these technologies into existing infrastructures, demanding substantial time and resources. Concerns regarding data privacy and security persist prominently, and organizations must navigate the regulatory terrain meticulously. Moreover, the scarcity of skilled professionals proficient in decision intelligence technologies poses an impediment.

Within the decision intelligence industry, myriad business opportunities are ripe for the taking. Firms specializing in crafting user-friendly, scalable, and adaptable decision intelligence solutions are poised for substantial expansion. Service providers offering consultancy, training, and support for entities embarking on decision intelligence system implementation also hold promising prospects. Furthermore, as diverse industries increasingly discern the potential benefits of data-driven decision-making, opportunities for forging partnerships and collaborations to tailor solutions for specific sectors are abound.

In synthesis, the decision intelligence sector is undergoing remarkable expansion owing to the escalating appetite for data-driven decision-making, technological strides, and the growing complexity of business operations. While challenges such as implementation intricacies and data safeguarding persist, enterprises capable of delivering innovative solutions and comprehensive support services stand to reap the rewards from the multitude of opportunities this market presents.

| Report Coverage | Details |

| Market Size in 2024 | USD 14.12 Billion |

| Market Size by 2034 | USD 60.71 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 15.7% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advanced analytics

The burgeoning market of decision intelligence is experiencing substantial growth, largely propelled by the influential role played by advanced analytics. These cutting-edge analytical methodologies, enriched by the prowess of artificial intelligence, machine learning, and predictive modeling, stand as a driving force in reshaping decision-making processes across various sectors. First and foremost, advanced analytics serves as a catalyst for organizations to delve deeper into their data reservoirs, unveiling intricate patterns, emerging trends, and hidden correlations that traditional approaches might overlook.

This newfound clarity empowers enterprises to make decisions with a higher degree of precision and foresight. Furthermore, advanced analytics offers the capability to predict future outcomes with remarkable precision, revolutionizing strategic planning. Decision intelligence solutions, fortified by advanced analytics, can anticipate market dynamics, customer behaviors, and potential risks, facilitating proactive adjustments in strategies and risk mitigation. Real-time data analysis, made possible by advanced analytics, provides an invaluable edge for organizations in swiftly responding to dynamic conditions.

This agility is particularly advantageous for effective crisis management and the timely seizing of emerging opportunities. Additionally, as advanced analytics technologies evolve, they become increasingly accessible and user-friendly, democratizing their utility across a broader spectrum of businesses. This broadening reach is a key driver of market growth, as organizations across various industries acknowledge the pivotal role of advanced analytics in gaining a competitive edge and enhancing operational efficiency in today's business landscape.

Complex implementation

The intricate nature of implementing decision intelligence solutions presents a substantial impediment to the market's growth. The challenges associated with seamlessly integrating these technologies into existing organizational structures can be formidable. Moreover, the intricacy of these implementations can lead to unforeseen cost escalations. Budgets can quickly spiral out of control as unexpected hurdles arise during the integration process, imposing a heavy financial burden, especially on smaller enterprises.

Additionally, the necessity for specialized expertise exacerbates the complexity. Organizations frequently require highly skilled professionals capable of navigating the intricate nuances of decision intelligence technology. Yet, the recruitment and retention of such talent can pose significant challenges, further complicating the implementation process. Lastly, the fear of implementation failure can dissuade certain organizations from embracing Decision Intelligence solutions. The potential for setbacks and challenges during implementation may deter investments in technology perceived to carry such risks. Collectively, these complexities act as formidable barriers, inhibiting market growth by deterring potential adopters and decelerating the adoption rate of decision intelligence solutions across various industries.

Operational efficiency

Operational efficiency stands as a paramount avenue for creating opportunities within the decision intelligence market. Organizations, driven by the imperative to optimize resource utilization, reduce costs, and streamline processes, are increasingly turning to decision intelligence solutions. These solutions offer the potential to dissect operations with unparalleled precision, identifying bottlenecks, inefficiencies, and areas for improvement. Moreover, the agility afforded by Decision Intelligence in adapting to changing market dynamics and demand fluctuations further underscores its role in operational excellence. As businesses continue to prioritize efficiency in today's competitive landscape, the pursuit of operational optimization through decision intelligence remains a prominent opportunity for market growth and innovation.

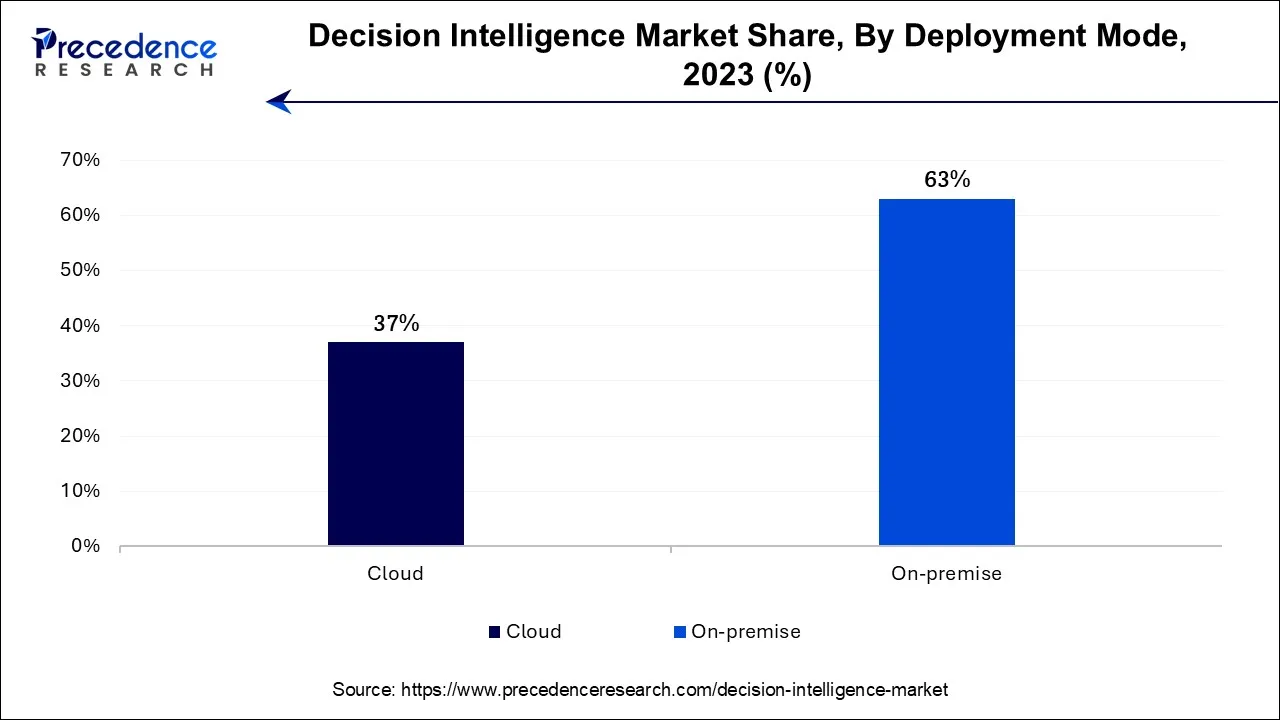

According to the Deployment Mode, the on-premises sector has held 63% revenue share in 2023. The on-premises segment holds a major share in the market due to several factors. Many enterprises prefer on-premises solutions for data security and compliance reasons, as they retain direct control over sensitive information. Additionally, industries with stringent regulatory requirements, like finance and healthcare, often opt for on-premises setups. Moreover, legacy systems and infrastructure investments can make migration to cloud-based solutions challenging, keeping organizations reliant on on-premises options. While cloud adoption is on the rise, the on-premises segment remains a substantial choice for those prioritizing data control, compliance, and seamless integration with existing systems.

The cloud sector is anticipated to expand at a significantly CAGR of 13.1% during the projected period due to its scalability, accessibility, and cost-efficiency. Cloud-based solutions offer organizations the flexibility to deploy and scale Decision Intelligence tools without the need for significant upfront investments in hardware and infrastructure. Additionally, they enable remote access to data and analytics, facilitating real-time decision-making, especially crucial in today's remote working environment. Cloud solutions also provide seamless integration with other applications and services, making them a preferred choice for businesses seeking agile and scalable decision intelligence solutions, thus driving their dominance in the market.

Based on the component, solutions is anticipated to hold the largest market share of 39% in 2023. The solutions segment holds a major share in the market due to the fundamental role it plays in addressing specific business needs. Decision intelligence solutions provide organizations with the tools and technologies necessary to collect, analyze, and act upon data effectively. These solutions are tailored to diverse industries and applications, allowing businesses to make data-driven decisions, optimize operations, and gain a competitive edge. As organizations increasingly prioritize data-driven strategies, the demand for comprehensive growth, contributes significantly to the segment's dominant market share.

On the other hand, the services sector is projected to grow at the fastest rate over the projected period. The services segment holds a major growth rate in the market because it plays a crucial role in the successful implementation and ongoing support. Organizations often require specialized expertise for consulting, customization, training, and maintenance. Service providers offer tailored solutions that align with specific business needs, ensuring optimal utilization of Decision Intelligence tools. Additionally, the services segment helps address the shortage of in-house talent, making it easier for businesses to harness the power of decision intelligence effectively, driving its adoption and market dominance in this segment.

The large enterprise Sector segment held the largest revenue share of 72% in 2023. The large enterprise segment commands a major share in the market due to its substantial resources and complex operational needs. Large enterprises have the financial capacity to invest in advanced decision intelligence solutions, enabling them to optimize intricate processes, enhance decision-making, and gain a competitive edge. Additionally, these organizations often generate vast amounts of data, making Decision Intelligence a crucial tool for extracting insights. Moreover, large enterprises are typically early adopters of technology trends, further solidifying their dominance in driving market growth and innovation.

The small & medium enterprises sector is anticipated to grow at a significantly faster rate, registering a CAGR of 15.9% over the predicted period. Small and medium enterprises (SMEs) hold significant growth in the market because these businesses increasingly recognize the competitive advantage offered by data-driven decision-making. Unlike larger enterprises, SMEs often have more agility to adopt and implement. They find these solutions cost-effective and adaptable, helping them optimize operations, enhance customer experiences, and remain competitive in dynamic markets. Moreover, as technology providers tailor solutions to SMEs' specific needs and budget constraints, this segment continues to contribute significantly to the market's growth and evolution.

The healthcare sector has generated a revenue share of 18.1% in 2023. The healthcare segment holds a significant share in the decision intelligence market due to its critical need for data-driven decision-making. Decision Intelligence solutions offer healthcare providers the ability to enhance patient care through personalized treatments, optimize resource allocation, and improve operational efficiency. Additionally, these solutions aid in medical diagnosis, treatment planning, and predictive analytics, resulting in better patient outcomes. The healthcare sector's increasing reliance on advanced technologies to address complex challenges and deliver high-quality care has propelled its substantial presence in the market.

The IT & telecom sector is anticipated to grow at a significantly faster rate, registering a CAGR of 19.8% over the predicted period. The IT and telecom segment holds significant growth in the decision intelligence market due to its intrinsic reliance on data-driven decision-making. These industries require real-time analysis for network optimization, cybersecurity, and customer experience enhancement. Decision intelligence provides crucial insights into network performance, threat detection, and predictive maintenance. Additionally, the rapid technological advancements and data proliferation within IT and telecom create a fertile ground for decision intelligence applications. As these sectors prioritize efficiency and customer satisfaction, they continue to drive substantial demand.

Segments Covered in the Report

By Component

By Deployment Mode

By Enterprise Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2025

October 2024

June 2025

March 2025