January 2025

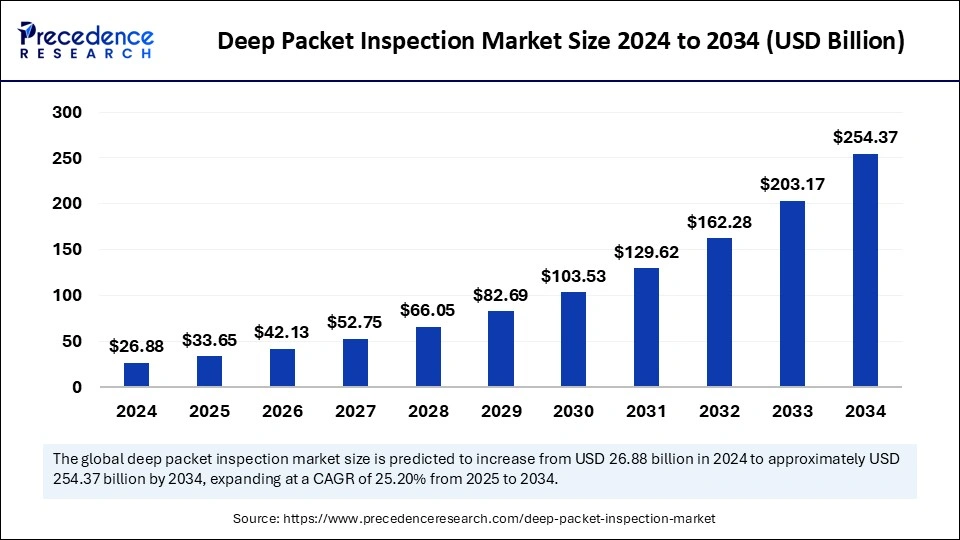

The global deep packet inspection market size is calculated at USD 33.65 billion in 2025 and is forecasted to reach around USD 254.37 billion by 2034, accelerating at a CAGR of 25.20% from 2025 to 2034. The North America market size surpassed USD 10.48 billion in 2024 and is expanding at a CAGR of 25.36% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year

The global deep packet inspection market size was estimated at USD 26.88 billion in 2024 and is predicted to increase from USD 33.65 billion in 2025 to approximately USD 254.37 billion by 2034, expanding at a CAGR of 25.20% from 2025 to 2034.The growth of the deep packet inspection market is driven by the increasing concerns about network security and performance optimizations.

Integrating Artificial Intelligence in deep packet inspection (DPI) improves threat detection accuracy, thereby improving network security. AI can analyze vast amounts of network data to identify anomalies in the network. It greatly enhances network filtering and traffic detection capabilities. AI-powered DPI can further optimize network performance by analyzing traffic patterns and reducing latency. AI-driven DPI solutions effectively prevent and detect fraudulent activities, addressing security challenges.

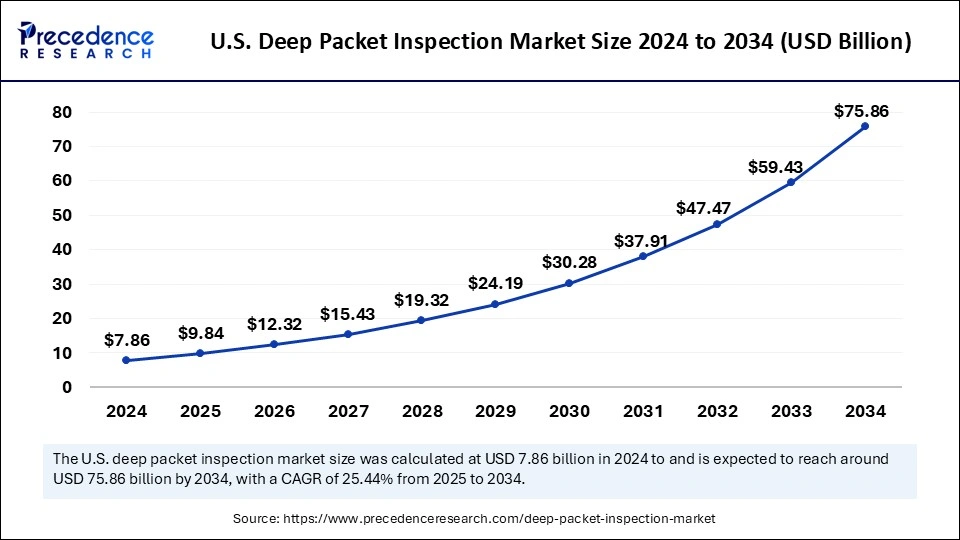

The U.S. deep packet inspection market size was exhibited at USD 7.86 billion in 2024 and is projected to be worth around USD 75.86 billion by 2034, growing at a CAGR of 25.44% from 2025 to 2034.

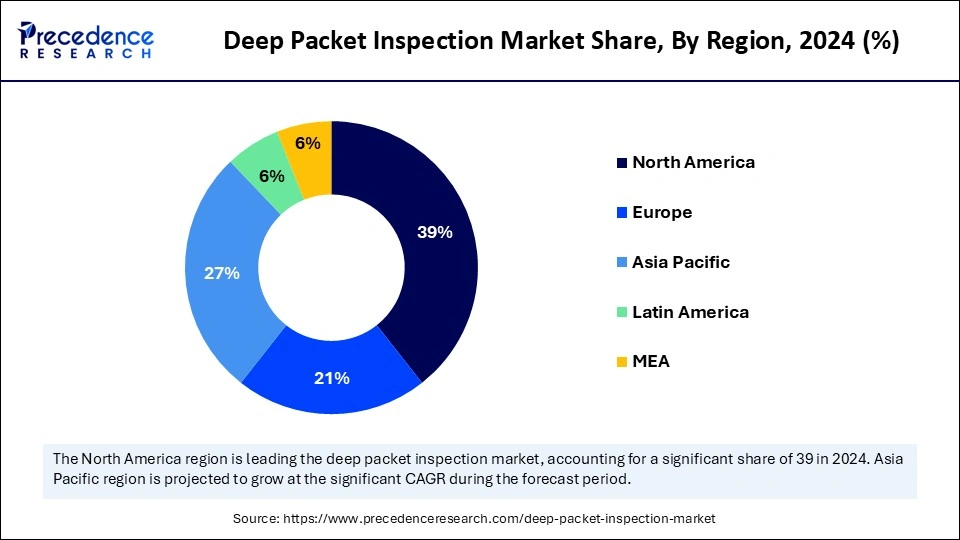

North America’s Sustained Dominance in the Market

North America dominated the deep packet inspection market by capturing the largest share in 2024. This is mainly due to its robust IT infrastructure that accelerated the deployment of DPI solutions. The region is known as the early adopter of DPI solutions. There is a significant increase in cybersecurity solutions due to the increase in cyberattacks. North American companies spent heavily on cybersecurity services to mitigate the risk of data breaches. The region also boasts major DPI solutions providers, such as Cisco Systems Inc., Palo Alto Networks Inc., IBM, and Extreme Networks Inc., contributing to regional market growth.

The U.S. is a major contributor to the North American deep packet inspection market. The U.S. has a strong regulatory framework for network monitoring and compliance, like FedRAMP, Sarbanes-Oxley (SOX), PCI DSS, and ISO. There is high adoption of 5G networks, requiring efficient solutions, like DPI, to optimize security and network performance. The increasing telecommunication services further drives market growth.

Europe: The Fastest-Growing Region

Europe is expected to observe the fastest growth in the market in the coming years. This is mainly due to the emergence of new technologies, such as 5G and Internet of Things, generating significant network traffic. Deep packet inspection (DPI) permits network operators to monitor and analyze network traffic. Many European organizations invest heavily in cybersecurity solutions to improve their digital infrastructure.

The UK and Germany are expected to lead the European deep packet inspection market. Increasing telecommunication services and the presence of major telecommunication companies, including BT Group and Virgin Media, are boosting the need for network management and optimization solutions. With the rising digital economy, there is a high demand for DPI technology to optimize network performance, contributing to market expansion.

Asia Pacific to Witness Notable Growth

Asia Pacific is observed to grow at a significant growth rate in the upcoming period. The rapid adoption of cloud computing is boosting the demand for DPI solutions to manage and secure traffic across cloud environments. The proliferation of the 5G network and increasing instances of cyberattacks and data breaches further support market growth. Moreover, the rising digitalization, increasing internet penetration, and the rapid expansion of IT and telecommunication sectors are expected to support regional market growth.

The deep packet inspection market is witnessing rapid growth due to the increasing focus on optimizing network performance. DPI is a technology that enables network operators to analyze traffic in real-time and differentiate them according to their payload. It finds applications in network security and traffic management, improving network performance. Private and public entities use DPI to examine the content of data packets. It emerged as a key tool for government organizations to detect threats and cyberattacks that are unseen in the content of data packets. The increasing need for network security further propels the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 254.37 Billion |

| Market Size in 2025 | USD 33.65 Billion |

| Market Size in 2024 | USD 26.88 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.20% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Installation, Enterprise Size, Application, End-user and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of Zero-Trust Security Frameworks

The zero-trust security framework approval is a significant factor driving the growth of the deep packet inspection market, as various organizations prioritize real-time network traffic monitorization, continuous security validation, and authentication. This type of framework is mainly significant for cloud environments, new IT deployments, and remote work organizations, where other perimeter-based safety models are inadequate. Integration of DPI in zero-trust strategies mitigates malware challenges, improves threat detection, and streamlines safety operations in an increasingly complex digital site. Moreover, increasing concerns about network security and compliance contribute to market expansion. DPI helps organizations comply with regulatory requirements by controlling the flow of sensitive data.

Complexity and Security Risks

The complexity of integrating DPI in existing firewalls and security infrastructures creates challenges in the market. DPI can introduce latency if not implemented properly. Thus, it requires specialized software, hardware, and skilled personnel to implement DPI in the existing system, which further increases implementation costs. To maintain optimal network performance, DPI needs to upgrade continuously, leading to resource-intensive maintenance. Moreover, DPI analyzes and filters network traffic, increasing concerns about data security.

Development of Next-gen DPI

The development of next-generation deep packet inspection (DPI) creates immense opportunities in the deep packet inspection market. Advancements in technology have paved the way for the development of next-gen DPI. It is applied in security service edge (SSE) and next-generation firewall (NGFW) solutions. Next-gen DPI uses AI and Machine Learning algorithms to improve threat detection abilities. Next-gen DPI allows organizations to proactively mitigate and detect sophisticated cyber challenges, comprising malware and ransomware, by lowering data volumes while enhancing the precision of threat detection.

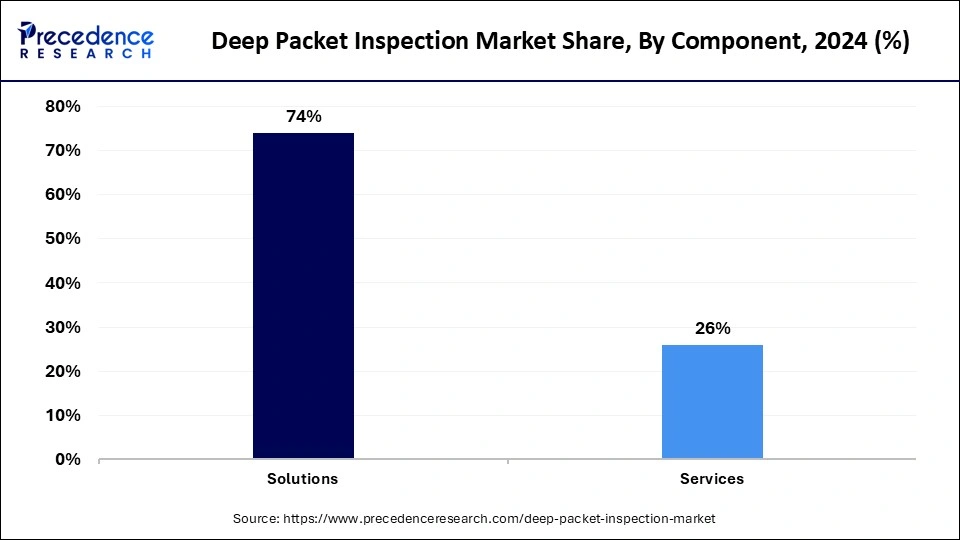

The solutions segment held the largest share of the deep packet inspection market in 2024. With the increased digitization and data traffic, the adoption of DPI solutions has increased. These solutions are ideal in preventing threats, such as malware, ransomware, spam, cyberattacks, and unauthorized access. Moreover, these solutions monitor and analyze the content of packets in real time. They are essential for optimizing network performance.

The services segment is expected to grow at the fastest rate over the forecast period as DPI involves investigating not only packet header data but also the packet payload, allowing for the identification of different types of network traffic and behaviors, such as video traffic, encrypted BitTorrent traffic, malicious activities, and use of social media. DPI services protect the network by filtering data packets in real-time.

The on-premises segment led the market with the largest share in 2024. On-premises deployment allows an organization to identify usage patterns and prevent malware activities and data leaks. This deployment is well-suited to address security challenges. The on-premises deployment provides organizations with greater control over data and network security, reducing malicious behavior or illegal access.

The cloud segment is expected to grow at the highest CAGR over the forecast period. This is mainly due to its robust scalability and real-time threat detection capabilities. The cloud deployment model is a preferred choice, especially among large enterprises, owing to its ability to quickly adapt to evolving cybersecurity threats. Moreover, cloud-based DPI can manage large volumes of data across distributed networks.

The integrated segment dominated the deep packet inspection market by holding the largest share in 2024. This is mainly due to its greater efficiency and cost-effectiveness. Integrated installation of DPI monitors and analyzes internet traffic at various network checkpoints with packet filtering, effectively addressing cyber challenges and optimizing data flow across networks.

The standalone segment is projected to grow at the fastest rate over the studied period due to the greater control over network monitoring. Standalone installation of DPI brings network capabilities to the endpoint, permitting greater flexibility and precision. There is a low risk of data breaches or illegal access in a standalone installation.

The large enterprises segment accounted for the largest market share in 2024 as large enterprises often handle vast amounts of data, requiring efficient solutions, such as DPI, to analyze and monitor data through networks. DPI technology helps these enterprises optimize network performance and mitigate threats by monitoring and analyzing network traffic.

The small and medium enterprises (SMEs) segment is anticipated to grow rapidly in the foreseeable future. This is mainly due to the increasing concerns regarding cybersecurity among SMEs. DPI technology helps SMEs detect and mitigate potential threats by recognizing unsafe data packets that may slip by regular firewalls. DPI provides SMEs with advanced solutions to control the traffic flowing through the networks.

The network security segment held the largest share of the deep packet inspection market in 2024. With the increased digitization across various industries, concerns about network security have also increased. However, DPI technology helps optimize network security by identifying and intercepting viruses and other types of malicious activities. It also helps with network management, thereby improving security functions.

The banking, financial services, and insurance (BFSI) segment dominated the market with a significant share in 2024. With the increased use of mobile banking, fraudulent activities and cyberattacks have increased rapidly. DPI enables BFSI companies to protect sensitive information, such as financial details, preventing cybersecurity threats. In addition, the increased network security concerns among BFSI companies augmented segmental growth.

The retail segment is projected to witness significant growth in the coming years. Retail companies heavily rely on digital platforms. Thus, they require network optimization solutions to enhance customer engagement and satisfaction. DPI helps these companies track the usage of precise applications, such as point-of-sale systems, and identify potential issues, which enhance customer experience.

By Component

By Deployment

By Installation

By Enterprise Size

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

October 2024

July 2024