January 2025

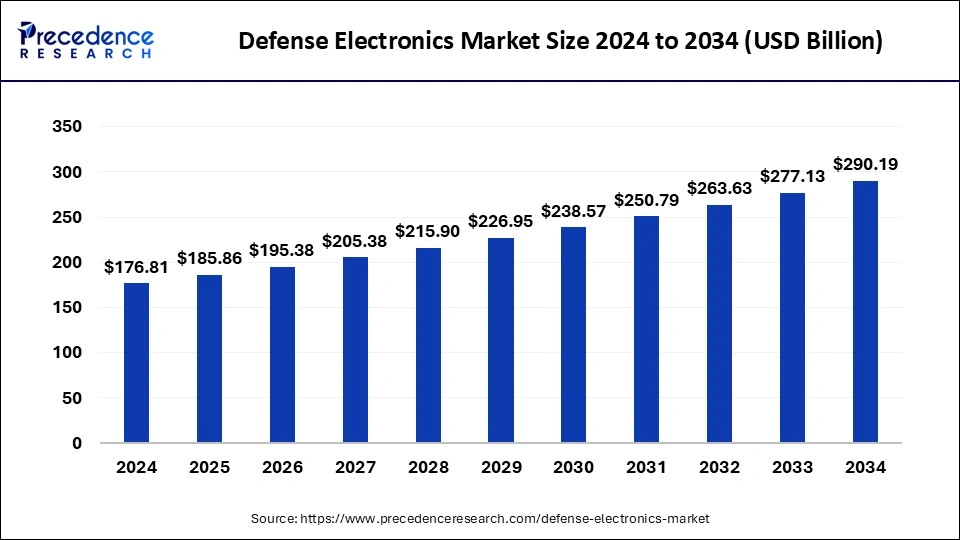

The global defense electronics market size is accounted at USD 185.86 billion in 2025 and is forecasted to hit around USD 290.19 billion by 2034, representing a CAGR of 5.08% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global defense electronics market size accounted for USD 176.81 billion in 2024 and is predicted to increase from USD 185.86 billion in 2025 to approximately USD 290.19 billion by 2034, expanding at a CAGR of 5.08% from 2025 to 2034. The defense electronics market is driven by the growing need in military operations for Internet of Things (IoT) and artificial intelligence (AI) gadgets.

Defense electronics are electronic systems and components intended for technological superiority in national defense. Cybersecurity breaches, low-profit margins, and supply chain concerns are just a few of the growing issues facing the defense sector. Production and technological grounds for defense are essentially defense capabilities in and of themselves. To preserve and fortify them, comprehensive actions are required.

The defense electronics market provides products and services for vehicle communications and data systems, surveillance systems, weapon systems, fire control systems, maritime tactical systems, soldier systems, and electronic warfare systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 290.19 Billion |

| Market Size in 2025 | USD 185.86 Billion |

| Market Size in 2024 | USD 176.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.08% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing defense expenditure

Due to increased defense resources, governments can purchase state-of-the-art radar systems, communication networks, electronic warfare systems, and surveillance equipment. The modernization of military forces and the improvement of their operational capabilities depend heavily on these technologies. As cybersecurity threats increase, defense electronics become essential for protecting military networks and information systems. The development of cyber defense systems, encryption technologies, and secure communication channels is funded by governments, which propels the expansion of the defense electronics industry. This drives the growth of the defense electronics market.

Growing cyberattacks on defense related data

Resolving cyberattacks requires large financial resources for improving cybersecurity, restoring systems, and mitigating harm. The cost of cyber insurance is rising along with cyber threats, raising the overall operating costs for defense businesses. Frequent cyberattacks have the potential to damage defense firms' reputations with government agencies, resulting in strained relations and fewer contracts. Stock values may fall, and investment may diminish because of investors losing faith in military electronics businesses. This limits the growth of the defense electronics market.

Increasing demand for defense electronics in border security

Global territorial conflicts and rising geopolitical tensions are the main causes behind the demand for stronger border security. Governments make significant investments in defense electronics to protect their borders from attackers. The security of borders has been completely transformed by advancements in surveillance technologies, including radar, satellite systems, and drones. Improved monitoring and threat identification are made possible by high-resolution cameras, thermal imaging, and night vision capabilities. This opens an opportunity for the growth of the defense electronics market.

The airborne segment dominated the defense electronics market in 2024. Airborne platforms equipped with cutting-edge electronics make mission-critical functions, including target acquisition, surveillance, reconnaissance, and precision strikes, possible. These capabilities are critical to modern defensive plans for both conventional and asymmetric combat scenarios. Airborne electronics are strategically essential for military, national security, and geopolitical stability. Deterrence and preserving military balance in diverse global locations depend heavily on the capacity to sustain air superiority and carry out efficient airborne operations.

The space segment is observed to be the fastest growing in the defense electronics market during the forecast period. The use of military and government satellites for navigation, communication, surveillance, and reconnaissance has increased significantly. Sophisticated electronics are needed for high-resolution imagery, real-time situational awareness, and secure data transfer on these satellites. Globally, governments depend more and more on assets located in space to improve their defense capacities. This covers space-based missile defense systems, satellite-based information gathering, and satellite constellations for international communication networks. Advanced electronics specifically designed for space settings are required for each application.

The optronics segment dominated the defense electronics market in 2024. Advanced sensor technologies including electro-optical (EO) and infrared (IR) systems are used in optics. These sensors offer vital functions like thermal imaging, night vision, and target acquisition for military operations involving surveillance, reconnaissance, and targeting. Optronics improve situational awareness by giving real-time visual information even in dimly lit areas or inclement weather. For military operations where visibility may be impaired, this skill is essential.

The communication and display segment is observed to be the fastest growing in the defense electronics market during the forecast period. Communication technology, such as satellite communication, secure communication systems, and cutting-edge encryption methods, have improved significantly. These developments push the need for sophisticated communication devices, which are essential to contemporary defense operations. Defense electronics are in greater need of secure communication solutions due to the increasing cybersecurity threats. The need for secure networks and encryption technologies to maintain data integrity and secrecy motivates investments in communication systems.

Asia-Pacific dominated the defense electronics market in 2024. Over half of the world's population resides in Asia. Over the past ten years, Asia has contributed 43% of startup investment, 51% of R&D spending, and 52% of the global growth in tech company revenues. Asia has made remarkable advancements in human development, literacy, and innovation during the past ten years, as well as economic progress, thanks to the expansion of its infrastructure and technological capacities. Asia has embraced the digital revolution in several sectors, including banking, manufacturing, e-commerce, transportation, retail, and finance.

Asian businesses are putting a high priority on and investigating cutting edge technologies, such as big data, robots, digital ledger technologies, artificial intelligence, machine learning, and cryptography. These technologies have the power to completely transform society and the global economy. The epidemic showed how quickly technology is developing.

North America shows a significant growth in the defense electronics market during the forecast period. Improving military capabilities is becoming increasingly important due to changing geopolitical dynamics and new threats. This involves expenditures on advanced electronic systems to guarantee better communications on the battlefield, command and control, and situational awareness. Defense contractors, IT companies, and academic institutions can form strategic alliances to further speed up innovation and create state-of-the-art defense electronics solutions. These partnerships frequently provide cutting-edge goods that are suited to certain defense requirements.

By Platform

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2023

August 2024