January 2025

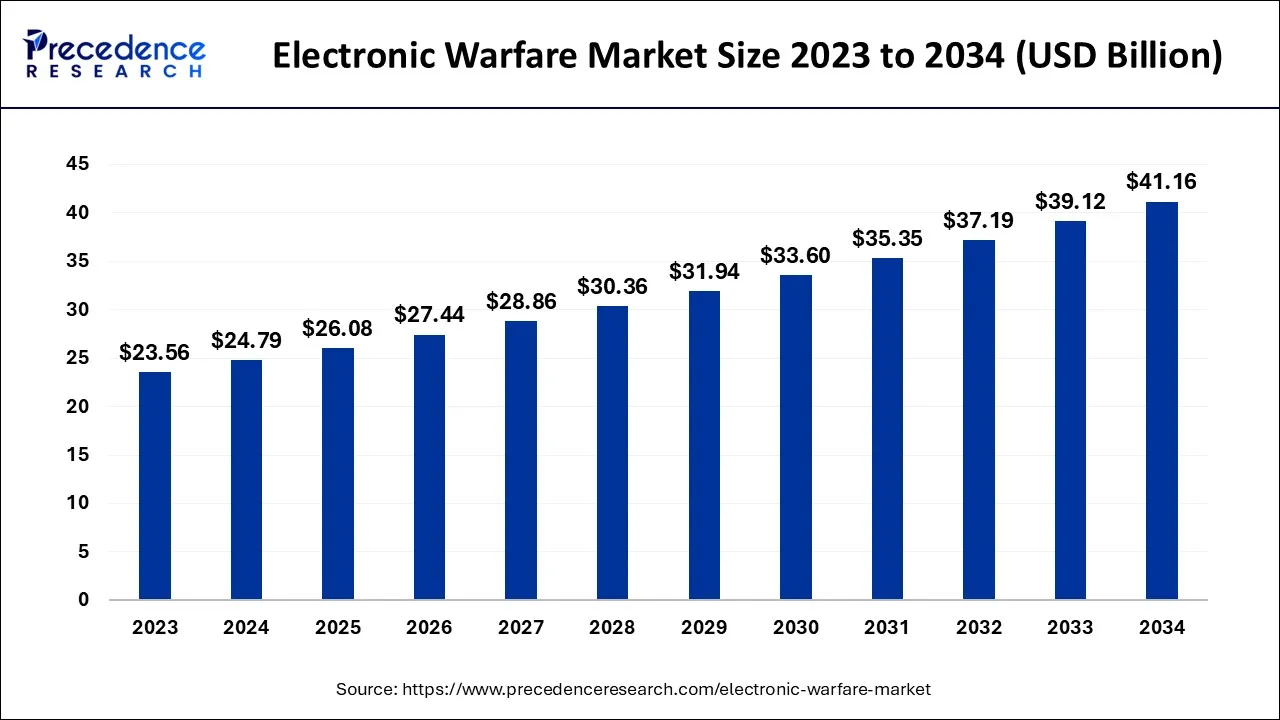

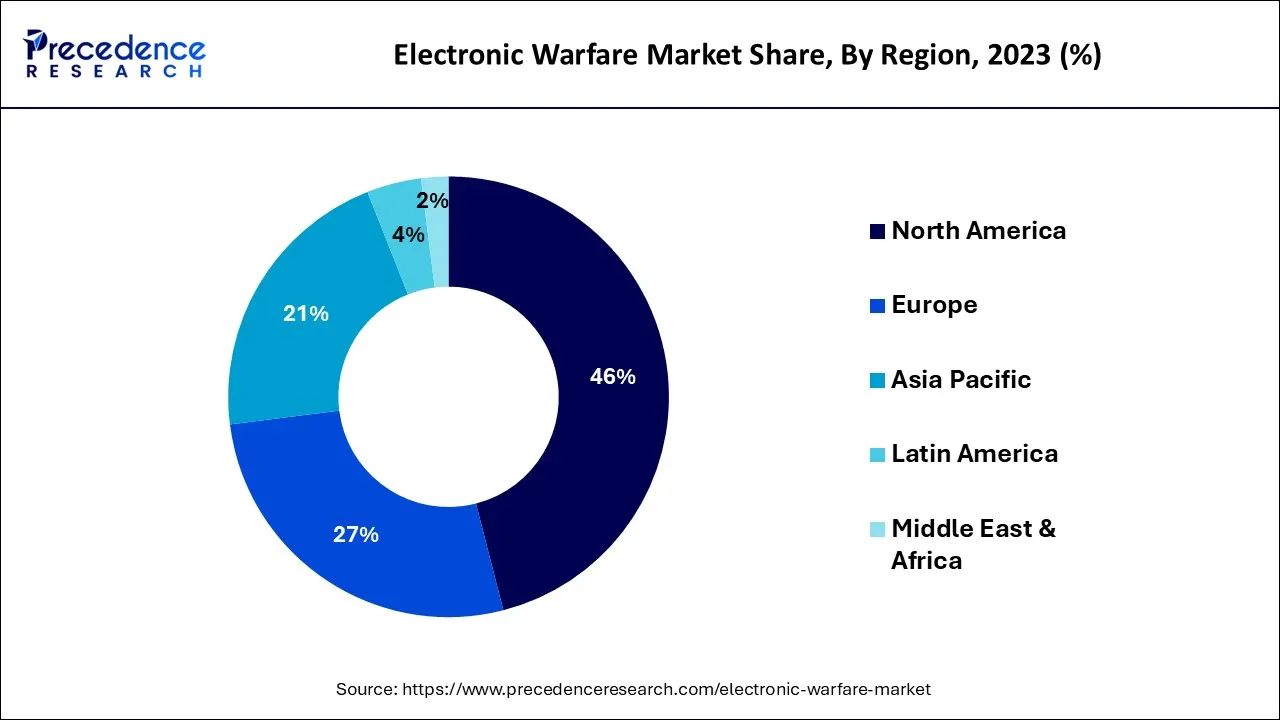

The global electronic warfare market size is calculated at USD 24.79 billion in 2024, grew to USD 26.08 billion in 2025, and is predicted to hit around USD 41.16 billion by 2034, poised to grow at a CAGR of 5.2% between 2024 and 2034. The North America electronic warfare market size accounted for USD 11.40 billion in 2024 and is anticipated to grow at the fastest CAGR of 5.31% during the forecast year.

The global electronic warfare market is expected to be valued at USD 24.79 billion in 2024 and is anticipated to reach around USD 41.16 billion by 2034, expanding at a CAGR of 5.2% over the forecast period from 2024 to 2034.

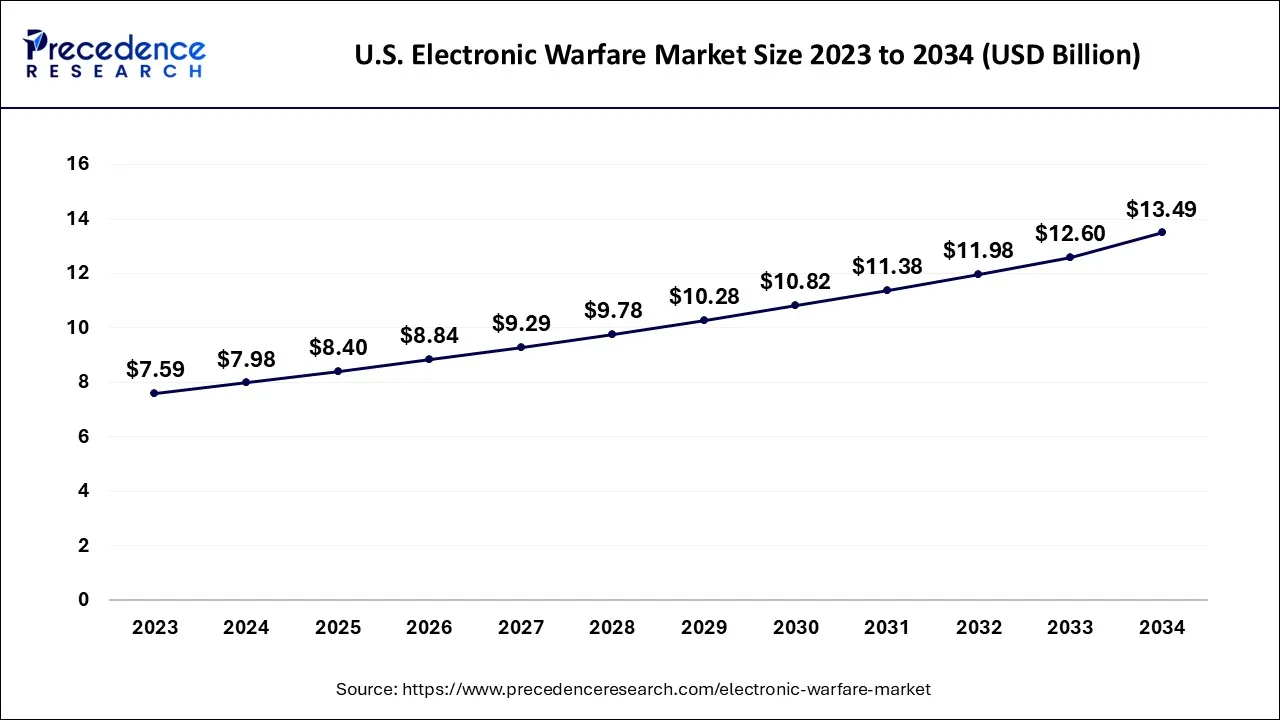

The U.S. electronic warfare market size is accounted for USD 7.98 billion in 2024 and is projected to be worth around USD 13.49 billion by 2034, poised to grow at a CAGR of 5.39% from 2024 to 2034.

North America has held the largest revenue share in 2023. The region's growth is primarily due to greater funding in electronic warfare technologies by nations such as the United States in the region. The United States electronic warfare market provide a robust ecosystem for defense contractors, research institutions, and government agencies dedicated to advancing electronic warfare capabilities. North American companies, including industry giants such as Lockheed Martin, Northrop Grumman, Raytheon Technologies, and BAE Systems, are renowned for their innovations in electronic warfare systems and technologies. Furthermore, U.S. government allocates substantial budgets to support the development and procurement of advanced electronic warfare solutions. For instance, in 2021, the U.S. government announced that it has allocated USD 3.17 billion for 45 electronic warfare programs across the military service departments and other platforms.

Asia-Pacific is estimated to observe the fastest expansion in the electronic warfare market. Growing demand for advanced electronic warfare capabilities, driven by geopolitical tensions, military modernization efforts, and evolving threat scenarios. Several countries in the Asia-Pacific region, including China, India, South Korea, and Japan, have been actively investing in electronic warfare research, development, and procurement to enhance their national security and strategic positioning. These investments encompass a wide range of electronic warfare systems, including electronic attack, electronic protection, and electronic support measures.

Due to Russia's weapon modernization, market share in Europe is projected to rise significantly over the projected period. European nations, including the United Kingdom, France, Germany, and Italy, have been active in developing and deploying advanced electronic warfare systems to safeguard their national interests and contribute to international security efforts. The market is driven by various factors, including the evolving threat landscape, regional security concerns, and investments in military modernization programs. European defense organizations and industry leaders are committed to enhancing their electronic warfare capabilities, focusing on electronic attack, electronic protection, and electronic support measures.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.79 Billion |

| Market Size by 2034 | USD 41.16 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.2% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Domain, By Equipment, and By Platform |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Geopolitical tensions and conflicts

In an increasingly interconnected world, nations are grappling with heightened security concerns and the imperative to safeguard their interests, both regionally and globally. As rivalries intensify and uncertainties persist, governments are allocating substantial resources to bolster their defense capabilities, prominently including electronic warfare systems. These tensions necessitate a robust response to emerging threats, such as the proliferation of advanced electronic systems, radar networks, and communication technologies employed by potential adversaries.

The need for effective countermeasures to protect critical military infrastructure and maintain operational superiority is paramount. Consequently, defense agencies and armed forces are investing heavily in electronic warfare technologies that can detect, disrupt, and neutralize these threats, ensuring the protection of national sovereignty and security interests.

Furthermore, geopolitical tensions often prompt alliances and partnerships among nations seeking to enhance their collective defense capabilities. This collaboration fosters the exchange of electronic warfare expertise and technologies, stimulating research and development efforts and creating opportunities for international cooperation in the electronic warfare market. For instance, in August 2022, U.S. announced that Russia-Ukraine war is motivating the U.S. Army to get its own in-development jammers deployed as soon as possible. Thus, the electronic warfare market thrives in an environment where geopolitical tensions and conflicts underscore the critical importance of electronic dominance and the protection of sensitive electronic assets, propelling innovation and driving sustained growth in the industry.

Technological complexity

These systems are designed to counteract advanced threats and ensure national security, their intricate nature can present several challenges that may hinder their widespread adoption and utilization. Cost associated with developing, manufacturing, and maintaining technologically complex electronic warfare systems one of the primary concerns in the electronic warfare market. The research, engineering, and integration efforts required can result in high procurement costs, straining the budgets of governments and defense agencies. This can lead to limited investments in these systems, potentially slowing down the growth of the electronic warfare market.

Moreover, the specialized training and expertise required to operate and maintain these complex systems can be a deterrent. Personnel must undergo rigorous and ongoing training to effectively utilize these technologies. This need for highly skilled individuals can create human resource challenges and increase the overall operational cost.

Integration complexities can also impact the demand for electronic warfare systems. The process of integrating diverse components and ensuring their interoperability can be time-consuming and error-prone, potentially delaying the deployment of critical systems. In addition, the vulnerability of complex electronic warfare systems to cyber-attacks raises security concerns. Ensuring the cyber security of these systems demands extra resources and measures, adding to the overall complexity. Thus, technologically advanced electronic warfare systems offer unparalleled capabilities, their complexity can limit demand due to cost constraints, training requirements, integration challenges, and cyber security vulnerabilities.

Increasing integration of cyber electronic warfare capabilities

As modern conflicts extend into the digital domain, the synergy between cyber and electronic warfare has become critical for military operations and national security. This convergence offers several compelling opportunities. Firstly, it enables more comprehensive and adaptive responses to threats. By combining cyber and electronic warfare capabilities, military forces can disrupt enemy communications, deceive their sensor networks, and simultaneously launch cyberattacks, creating a multifaceted assault that overwhelms adversaries. Furthermore digitalization of critical infrastructure continues, the need to protect it from cyber threats becomes paramount. This opens a significant market for electronic warfare systems designed to safeguard essential sectors such as power grids, telecommunications, and transportation networks.

Moreover, the integration of these capabilities fosters cross-disciplinary collaboration between electronic warfare and cyber security experts. This knowledge exchange drives innovation, leading to the development of cutting-edge technologies and tactics that can counter emerging threats effectively. The cyber and electronic warfare also accelerates the adoption of artificial intelligence and machine learning in these fields. These technologies improve real-time data analysis, enabling for quicker and more precise decision-making in complex electronic and cyber environments. Thus, the integration of cyber and electronic warfare capabilities not only enhances military capabilities but also unlocks a wealth of opportunities within the electronic warfare market.

According to the domain, the electronic support segment held the highest revenue share in 2023 and is anticipated to expand at a significantly CAGR during the projected period. Electronic support measures involve the passive collection, analysis, and identification of electromagnetic signals for intelligence gathering and situational awareness. ESM systems are used to detect and locate enemy radar, communication networks, and other electronic emissions, providing critical information for decision-making.

Electronic support, protection and attack domains work together to provide comprehensive electronic warfare capabilities. Electronic attack seeks to disrupt or incapacitate enemy systems, electronic protection safeguards friendly systems, and electronic support measures gather intelligence and identify threats, allowing for informed responses. This segmentation helps defense organizations and manufacturers design and develop electronic warfare systems that can effectively fulfill their roles within the electromagnetic spectrum.

Based on the equipment jammers is anticipated to hold the largest market share in 2023 and projected to grow at the fastest rate over the projected period. Jammers are electronic warfare devices designed to disrupt, block, or deceive enemy communication systems, radar, or other electronic signals. They are used in electronic attack operations.

Each equipment serves specific roles in electronic warfare operations, allowing military forces to detect, manipulate, and protect against electronic threats while conducting both offensive and defensive electronic warfare missions.

In 2023, the land-based had the highest market share on the basis of the platform. Land-based electronic warfare systems are positioned on the ground and used to protect military installations, defend borders, and support ground operations. They include ground-based radars, jamming equipment, and other electronic warfare capabilities deployed on land.

The air-based segment is anticipated to expand at the fastest rate over the projected period. Air-based electronic warfare systems are installed on aircraft, including fighter jets, reconnaissance planes, electronic warfare aircraft (such as the EA-18G Growler), and unmanned aerial vehicles (UAVs). These systems are essential for both offensive and defensive electronic warfare operations in the air domain.

Segments Covered in the Report

By Domain

By Equipment

By Platform

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025