January 2025

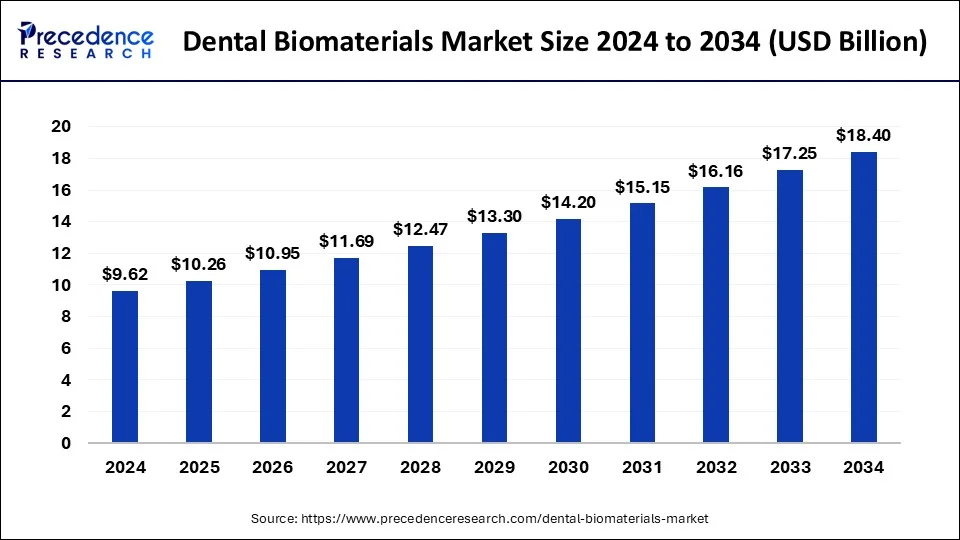

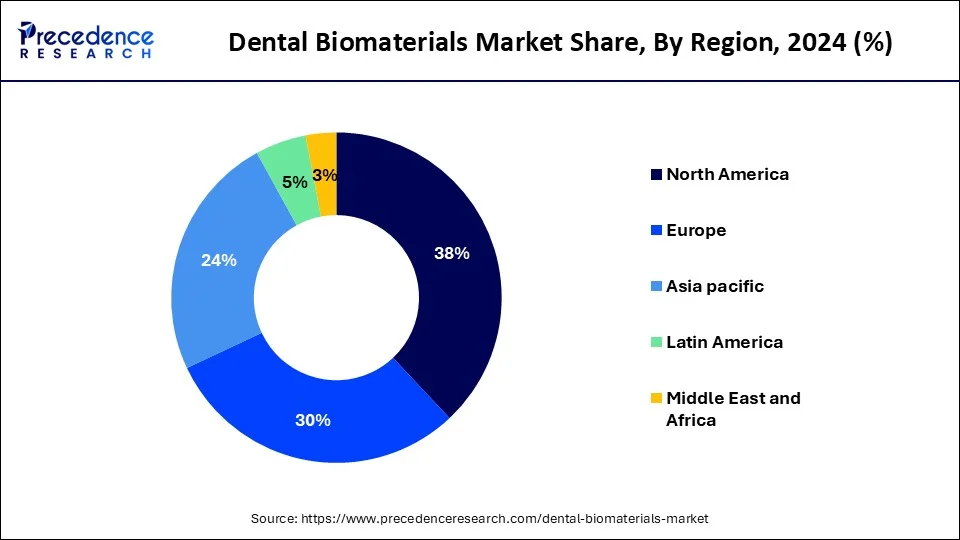

The global dental biomaterials market size is calculated at USD 10.26 billion in 2025 and is forecasted to reach around USD 18.4 billion by 2034, accelerating at a CAGR of 6.7% from 2025 to 2034. The North America dental biomaterials market size surpassed USD 3.66 billion in 2024 and is expanding at a CAGR of 6.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental biomaterials market size was estimated at USD 9.62 billion in 2024 and is predicted to increase from USD 10.26 billion in 2025 to approximately USD 18.4 billion by 2034, expanding at a CAGR of 6.7% from 2025 to 2034.

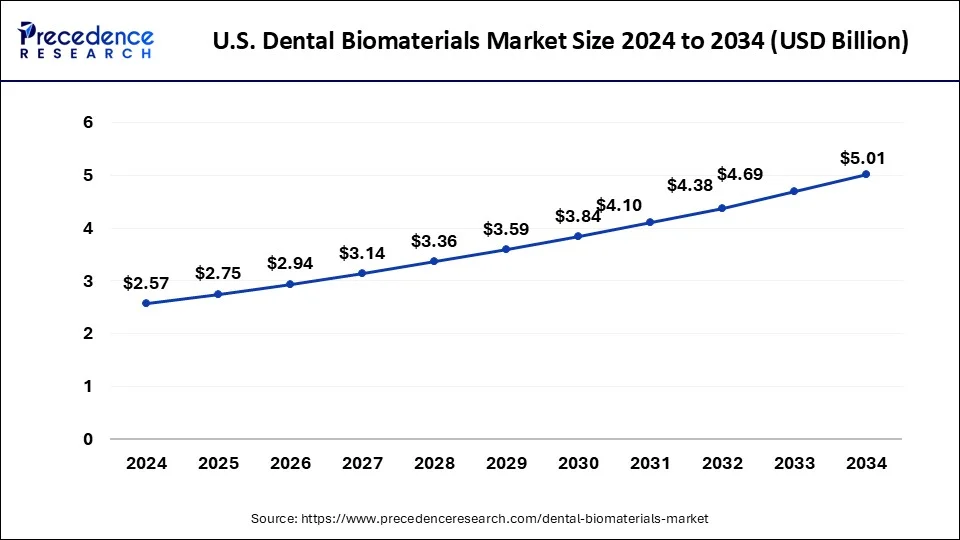

The U.S. dental biomaterials market size was estimated at USD 2.57 billion in 2024 and is predicted to be worth around USD 5.01 billion by 2034, at a CAGR of 6.9% from 2025 to 2034.

North America dominated the dental biomaterials market in 2024. One of the key factors driving the growth of dental biomaterials market in North America region is growing dental disorders. According to the American Dental Association 2020, over 5 million Americans aged 65 to 74 have lost all of their teeth, including approximately 3 million edentulous. On the other side, tooth loss is largely concern for the elderly. This is because 91% of persons aged 20 to 64 have dental caries with 27% of them staying undiagnosed. Other factors driving the regional market growth are growing geriatric population and government initiatives.

Asia-Pacific, on the other hand, is expected to develop at the fastest rate during the forecast period. China and India dominate the dental biomaterials market in Asia-Pacific region. The market for dental biomaterials is growing in Asia-Pacific region due to rising prevalence of tooth and oral diseases. According to 2018 Global Burden of Disease report, the Asia-Pacific region has a significant burden of oral disorders. Furthermore, the growing trend of medical tourism is also boosting the growth of dental biomaterials market in Asia-Pacific region.

The factors such as growing geriatric population, surge in number of dental implants, and rising dental disorders are driving the demand for dental biomaterials in the global market. One of the main concerns among people is regarding tooth decay and dental caries. Dental caries afflicted 3.58 billion people worldwide in 2016, as per the World Health Organization (WHO). As a result, the market for dental biomaterials is expanding at rapid pace over the forecast period.

Another prominent factor boosting the expansion of global dental biomaterials market is growing trend of dental tourism. Citizens in the U.S. spent more than $5 billion on dental tourism in 2019. Not only the U.S., but also the other developing nations such as Mexico, Spain, and Indonesia are spending large amount on dental tourism. In addition, India has emerged as top most destination for dental tourism in Asia-Pacific region. Thus, the global dental biomaterials market is expected to grow in coming years.

As per the research study released in the Journal of the Korean Association of Oral and Maxillofacial Surgeons, roughly around 69% of adult population in the U.S. aged 35 to 44 years lost one of the permanent teeth in 2014 owing to an accident, unsuccessful root canal, or gum disorders. Furthermore, the research study estimated that between 100,000 and 300,000 dental implants are implanted annually in the nation. This statistic shows the importance of dental implants. This is directly driving the growth and development of global dental biomaterials market.

In addition, the market for dental biomaterials is also growing due to rising favorable government regulations in favor of dental industry. Furthermore, the growing investments by government as well as major market players are supporting to the growth of global dental biomaterials market.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.62 Billion |

| Market Size in 2025 | USD 10.26 Billion |

| Market Size by 2034 | USD 18.4 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End Use, Bone Graft Material Type, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The metallic biomaterials segment dominated the dental biomaterials market in 2024. The ceramic dental biomaterials segment is growing due to the rising trend of dental implants and surgeries. The usage of implants has increased considerably in recent years, owing to the growing geriatric populations in developed nations and patients’ desire to retain their engagement and standard of living. As a result, there has been a steady increase in the usage for high quality of implantable biomaterials that can solve specific dental issues.

The composite biomaterials segment is expected to witness strong growth from 2025 to 2034. Composite dental biomaterials are manmade materials made up of two or more elements that have vastly different physical and mechanical properties. The specific qualities of the constituent parts as well as their respective volume fractions and configurations in the material system, determine the composite materials’ distinguishing properties.

The orthodontics segment accounted largest revenue share in 2024. The demand for dental biomaterials in orthodontics is growing due to the surge in number of dental disorders and tooth decays. In addition, rising disposable income as well as rising medical tourism trend is driving the growth of segment all around the globe. The market for dental biomaterials for orthodontics is also growing due to rising trend of dental implants.

The implantology segment is fastest growing segment of the dental biomaterials market in 2024. Implantology is a discipline of dentistry concerned with the permanent placement of prosthetic teeth in the jaw. The wide range of biomaterials is used in dental implants or implantology. In addition, the growing demand for cosmetic dentistry is also driving the demand for dental biomaterials for implantology in the global market.

The dental laboratories segment dominated the dental biomaterials market in 38% in 2024. The factors such as growing disorders and infections regarding teeth, growing consumer awareness regarding oral hygiene and health, and growing demand for dental implants and surgeries are driving the growth of dental biomaterials for dental laboratories. In addition, the growth of global dental biomaterials market is also attributed due to growing research and development activities all around the globe.

The dental hospitals and clinics segment is expected to grow at a fastest CAGR from 2025 to 2034. The dental biomaterials are used in dental hospitals and clinics on a large scale. The growing consumer preference for dental implants and growing consumer awareness for health and well being is driving demand for dental biomaterials in dental hospitals and clinics. Thus, the global dental biomaterials market is expected to expand due to this in near future.

By Type

By Application

By End Use

By Bone Graft Material Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023