January 2025

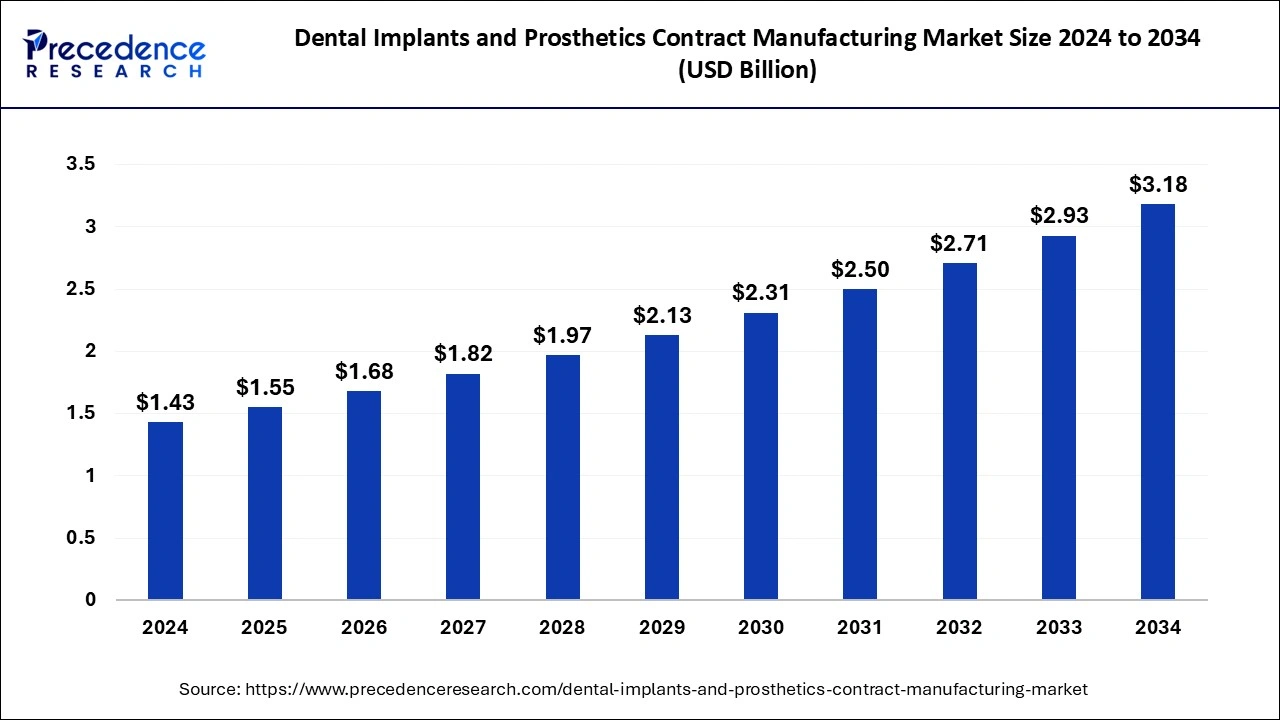

The global dental implants and prosthetics contract manufacturing market size is accounted at USD 1.55 billion in 2025 and is forecasted to hit around USD 3.18 billion by 2034, representing a CAGR of 8.31% from 2025 to 2034. The North America market size was estimated at USD 510 million in 2024 and is expanding at a CAGR of 8.37% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental implants and prosthetics contract manufacturing market size was calculated at USD 1.43 billion in 2024 and is predicted to reach around USD 3.18 billion by 2034, expanding at a CAGR of 8.31% from 2025 to 2034. The increasing demand for expertise in the manufacturing of dental implants and prosthetics, scalable and cost-effective alternatives to dental device manufacturing, is driving the growth of the dental implants and prosthetics contract manufacturing market.

The association of Artificial Intelligence with a wide range of healthcare applications, such as the dental implants and prosthetics contract manufacturing market, is accelerating the innovations and advancements in the industry. AI offers prominent benefits to dentistry, such as improvement in diagnostic accuracy. AI offers several benefits, such as predictive treatment plans, rapid image analysis, enhanced patient experience, optimized orthodontic care, routine task automation, and reduced time and cost of operations.

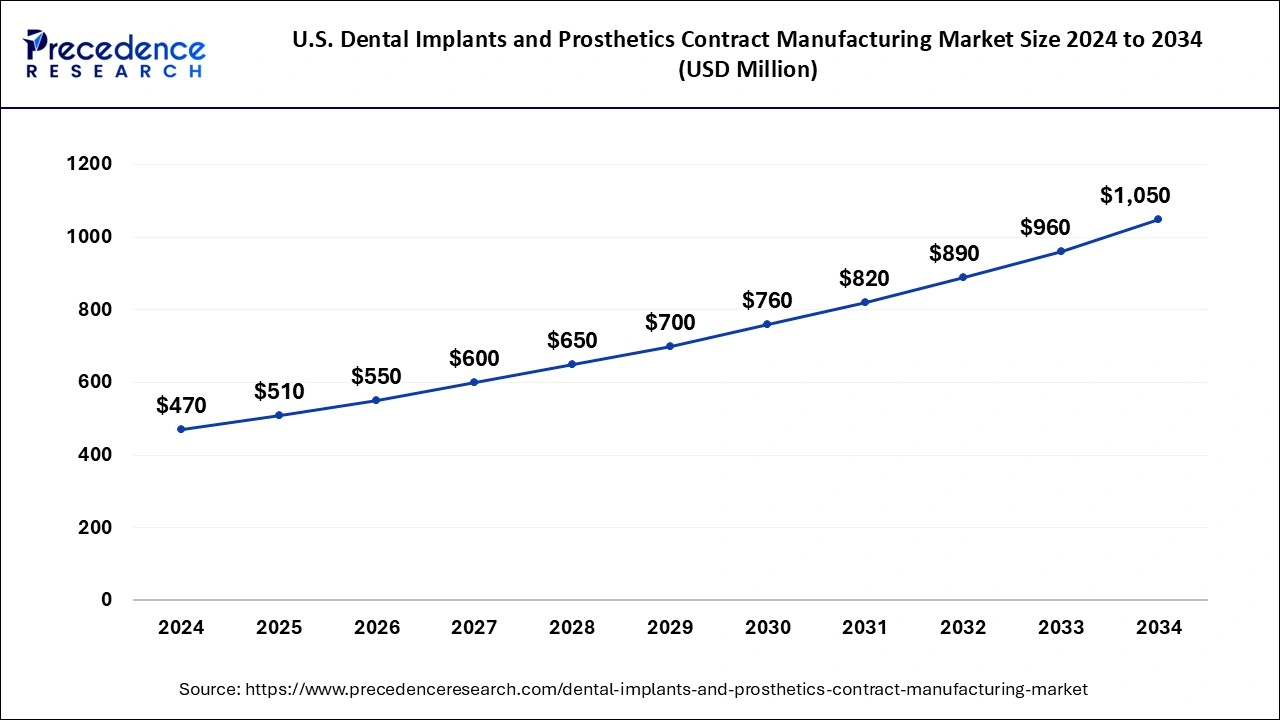

The U.S. dental implants and prosthetics contract manufacturing market size was exhibited at USD 470 million in 2024 and is projected to be worth around USD 1.05 billion by 2034, growing at a CAGR of 8.40% from 2025 to 2034.

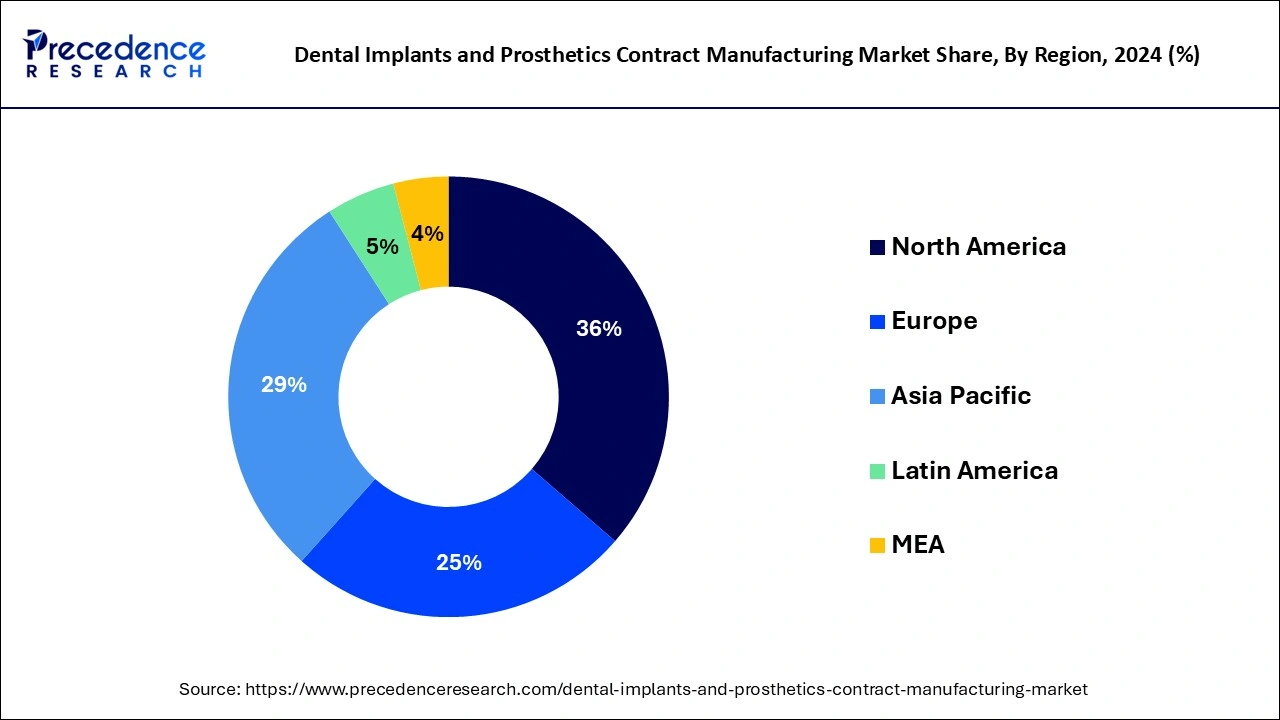

North America dominated the global dental implants and prosthetics contract manufacturing market in 2024. The growth of the market is attributed to the rising demand for dentistry or dental treatment due to the higher presence of the aging population, which causes a higher demand for healthcare infrastructure. The increasing presence of leading dental companies and the early adoption of technologies into the healthcare sector boost efficiency in the dental contract manufacturing industry.

Leading countries in the North American dental implants and prosthetics contract manufacturing market, such as the United States, Canada, and regional governments, are spending a significant amount on R&D to enhance the efficiency and technological advancements in dentistry. The increasing prevalence of oral problems such as tooth decay, cavities, and others is driving the demand for dental devices or equipment manufacturing.

Asia Pacific is expecting substantial growth in the dental implants and prosthetics contract manufacturing market during the predicted period. The growth of the market is attributed to the rising development of the contract manufacturing sector, owing to the rising demand from the different industries due to the specialized outsourced manufacturing of products with enhanced quality and cost efficiency, which drive the expansion of the sector. Additionally, the increasing demand for outsourced manufacturing from Asian countries due to more affordability and cost efficiency compared to other countries is accelerating the expansion of the dental implants and prosthetics contract manufacturing market across the region.

The dental implants and prosthetics contract manufacturing market is one of the most important parts of dentistry. Contract manufacturing allows the efficient manufacturing of medical or dental devices in the most cost-effective and innovative manufacturing process. The contract manufacturing process is the process of outsourcing the product manufacturing to a third-party manufacturer. The rising healthcare industry and the expanding demand for medical devices are contributing to the growth of the market.

| Report Coverage | Details |

| Market Size by 2024 | USD 1.43 Billion |

| Market Size in 2025 | USD 1.55 Billion |

| Market Size in 2034 | USD 3.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.31% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End Use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Trends towards the adoption of contract manufacturing

The rising inclination towards contract manufacturing from different industries is owing to its associated benefits, such as efficient manufacturing of complex product structures, cost-effectiveness, improved manufacturing time, reduced product launch periods, enhanced technical insights, and improved employee efficiency. Dentistry in healthcare is one of the highly expanding sectors, which causes the increased demand for the dental implants and prosthetics contract manufacturing market.

Lack of transparency

In the case of outsourced manufacturing, the control of product manufacturing is over the contract manufacturing companies. This sometimes causes conflict between the client and the manufacturing company, which hampers the growth of the dental implants and prosthetics contract manufacturing market.

Technological integration and advancements in the manufacturing process

Emerging trends and technologies towards the designing and manufacturing of dental equipment and devices, such as digital dentistry, 3D printing, and CAD/CAM into the manufacturing process, are driving the growth opportunity in the dental implants and prosthetics contract manufacturing market. Additionally, the rising spending on the use of advanced materials while manufacturing dental implants and prosthetics is also contributing to industry expansion.

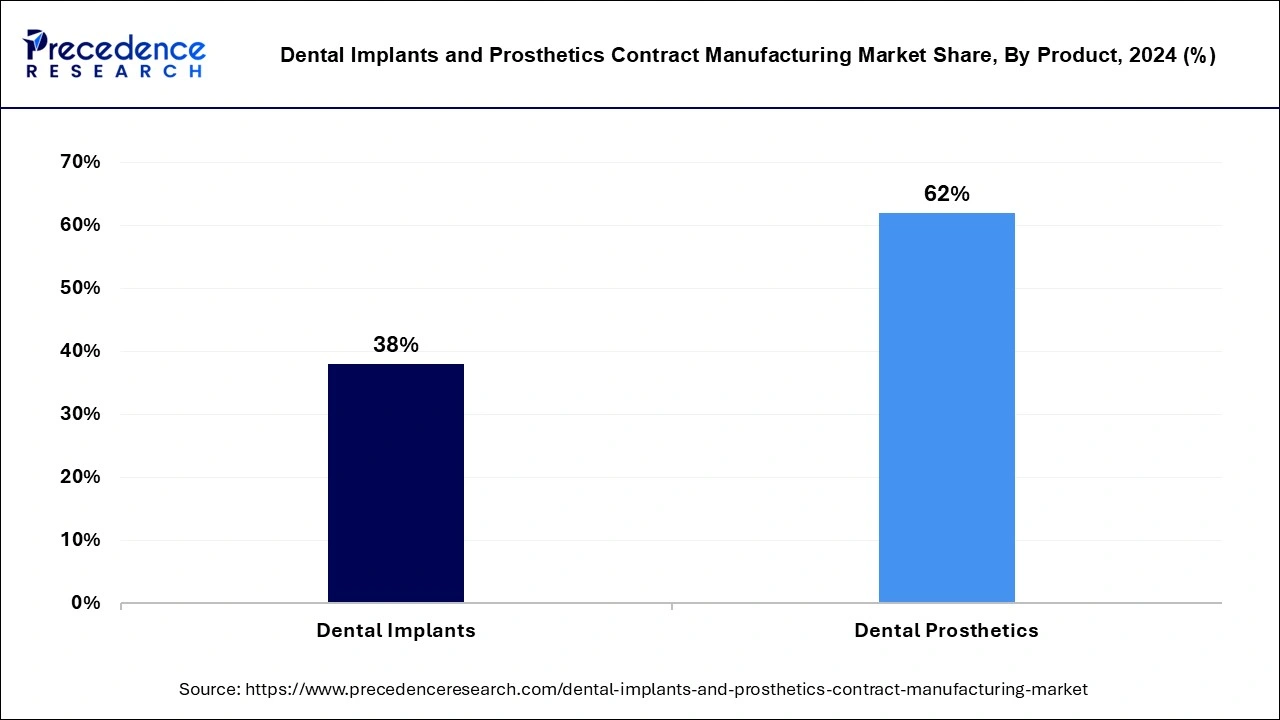

The dental prosthetics segment dominated the dental implants and prosthetics contract manufacturing market in 2024. The increasing demand for dentistry in the world is due to the rising demand from the population. Dental prosthetics are one of the highly demanded dentistry treatments due to the rising aging population that leads to the loss of teeth due to aging factors and other factors such as changing lifestyle preferences and eating habits are likely to expand the chance of tooth decay over the time in younger generation also which collectively driving the increased demand for the dental prosthetics. There is a rising demand for contract manufacturing for the development of dental prosthetics with the integration of new technologies and materials for the manufacturing or development of dental prosthetics.

The dental implants segment expects notable growth in the dental implants and prosthetics contract manufacturing market during the forecast period. Dental implants are a type of dentistry treatment that is used to support dental prosthetics such as single-tooth replacements, crowns, or bridges. It is the treatment of missing teeth replacement. It is one of the highly adopted dentistry treatments. The increasing demand for advanced material dental implants by the patient or the consumer is driving the demand for the contract manufacturing process. Titanium is one of the emerging types of material used to manufacture dental implants. Single tooth implants, multiple tooth implants, completely edentulous mouth implants, implant applications with bone graft, implant applications with sinus lift, all-on-four implant applications, all-on-six implant applications, immediate load technique, zygomatic implants, and basal implants are some of the highly adopted dental implants treatments.

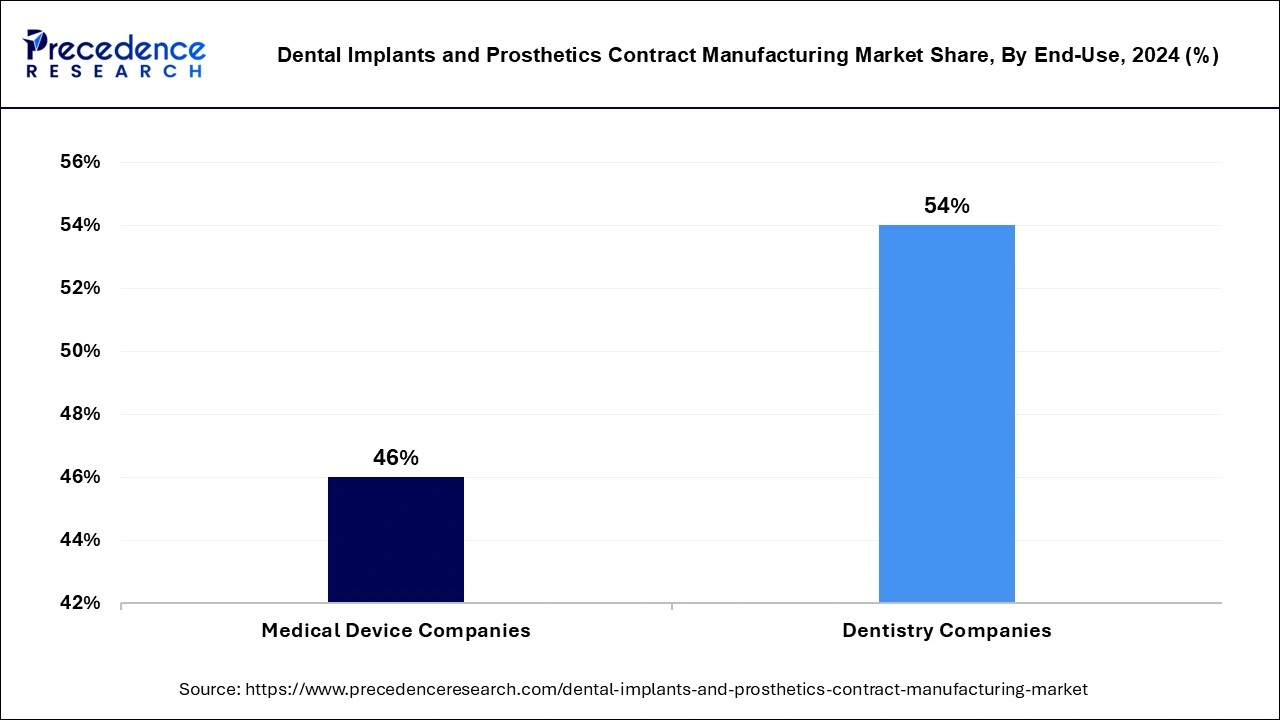

The dentistry companies segment led the dental implants and prosthetics contract manufacturing market in 2024. Contract manufacturing by dentistry companies provides enhanced solutions and offers several benefits regarding materials, development strategies, technologies, and other related factors. The dentistry companies specialize in the manufacturing of small components and micromachining. Dentistry companies offer custom dental prosthetics and implants as per the demand or requirement of patients. They have full control over small product manufacturing, tools, micro assemblies, and instrument-guiding processes.

The medical device companies segment will witness the fastest growth in the dental implants and prosthetics contract manufacturing market during the predicted period. There are several associated benefits of medical device companies' manufacturing of dental implants and dental prosthetics due to their robust technological infrastructure, cost efficiency, quality, flexibility, regulatory expertise, and efficiency in the manufacturing process.

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023