January 2025

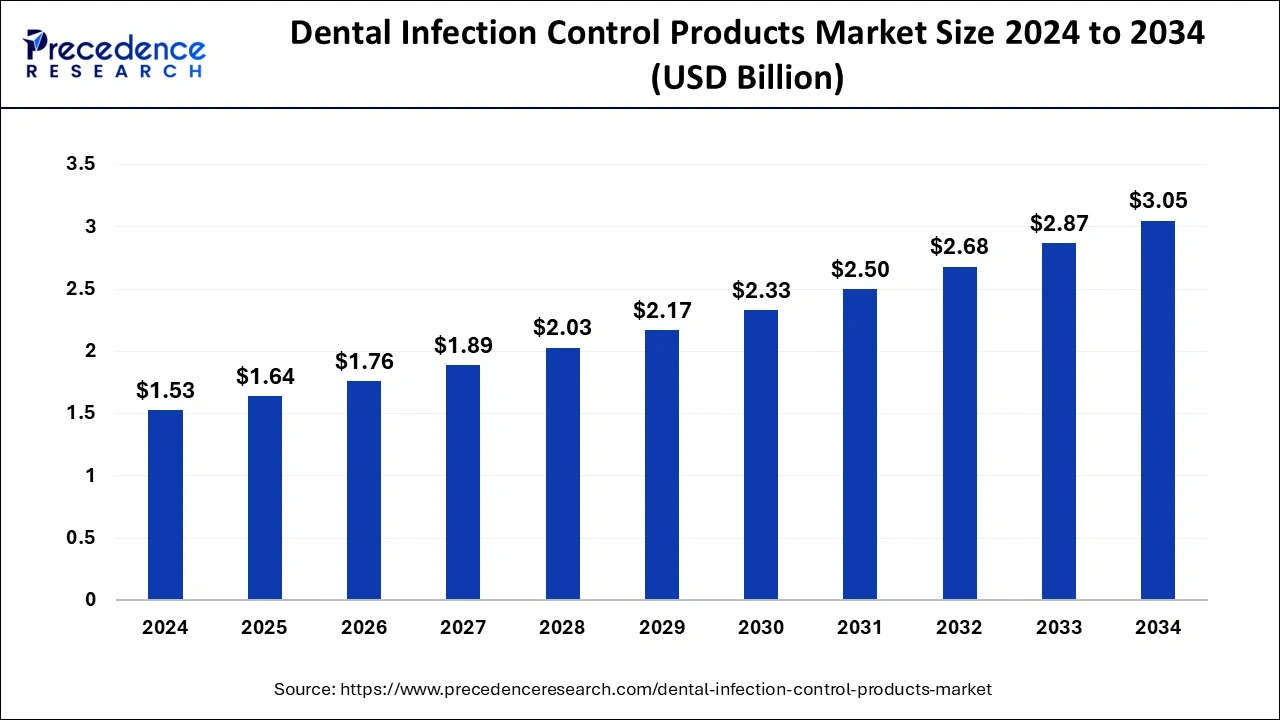

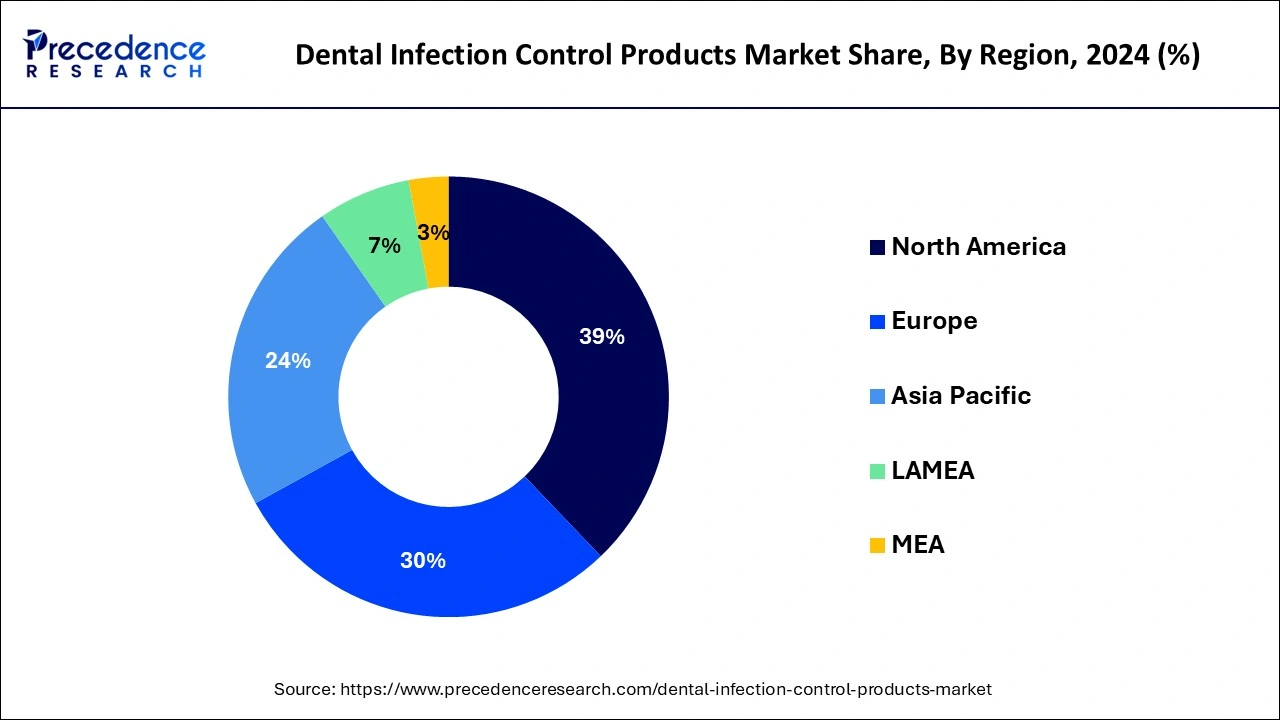

The global dental infection control products market size is accounted at USD 1.64 billion in 2025 and is forecasted to hit around USD 3.05 billion by 2034, representing a CAGR of 7.14% from 2025 to 2034. The North America market size was estimated at USD 600 million in 2024 and is expanding at a CAGR of 7.20% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental infection control products market size accounted for USD 1.53 billion in 2024 and is predicted to increase from USD 1.64 billion in 2025 to approximately USD 3.05 billion by 2034, expanding at a CAGR of 7.14% from 2025 to 2034. The dental infection control products market is driven by the rising incidence of dental conditions.

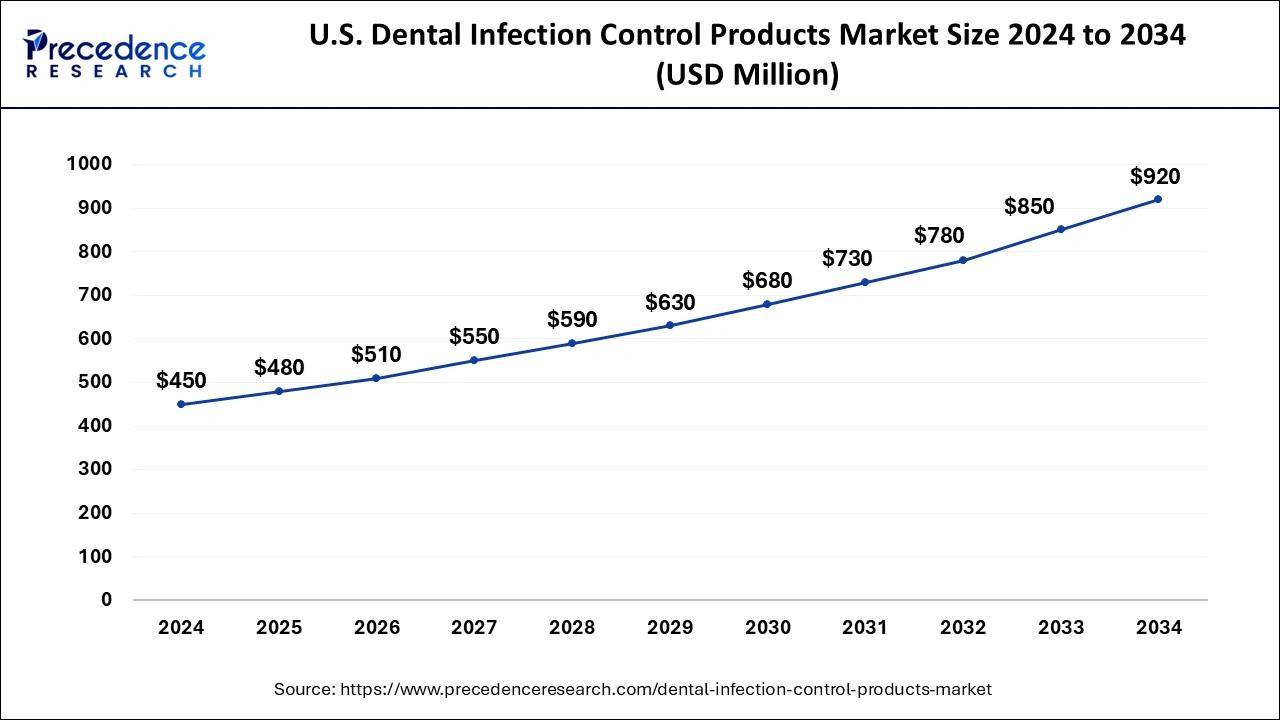

The U.S. dental infection control products market size was exhibited at USD 450 million in 2024 and is projected to be worth around USD 920 million by 2034, growing at a CAGR of 7.41% from 2025 to 2034.

North America had the dominating share of the dental infection control products market in 2024. The region is also observed to sustain the position during the forecast period. Dental care is expensive in North America for private patients and those covered by insurance. Therefore, to preserve patient happiness, safety, and trust, dental professionals prioritize infection control.

This emphasis on infection prevention fuels the constant need for high-quality infection control products. Public health education and knowledge of the value of infection control in dental settings are highly prioritized. Patients are becoming more aware of the dangers of untreated infections and the importance of good infection control practices, and dental staff undergo extensive training in infection prevention techniques. This increased awareness fuels the need for infection control products that adhere to strict safety regulations.

Europe is observed to grow at a notable rate in the dental infection control products market during the forecast period. Europe's dentistry market is expanding rapidly due to aging populations, rising disposable income, and dental operations and technology improvements. The need for infection control solutions to uphold hygiene and stop the spread of infections grows along with the number of dental treatments and patient visits. Growth in the European market is driven by the mutually beneficial interaction between the growing dentistry industry and the need for infection control solutions.

The healthcare business segment that focuses on creating and distributing a range of goods intended to prevent and control infections in dental settings is known as the dental infection control products market. These goods include cleaners, sterilizers, masks, gloves, gowns, other personal protective equipment (PPE), and various other cleaning and sterilizing supplies and instruments.

The market for dental infection control products is essential because it plays a vital role in protecting patients' and dentists' health and safety. During dental operations, one must come into intimate contact with human fluids and surfaces that could be home to hazardous pathogens like viruses and bacteria. Inadequate infection control procedures increase the possibility of infectious disease transmission between dental personnel and patients.

Dental Infection Control Products Market Data and Statistics

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.14% |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2024 | USD 1.53 Billion |

| Market Size by 2034 | USD 3.05 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing awareness of infection control

Product innovation and technological advancements have accelerated the creation of more efficient infection control solutions suited to dental environment requirements. Dental practitioners can maintain a sanitary environment and stop the spread of infectious agents by using various solutions, from antimicrobial surface disinfectants to sterilization tools and personal protective equipment.

Further, to keep their staff members informed about the most recent infection control recommendations and best practices, dental offices are investing in ongoing education and training and adopting evidence-based methods. This dedication to continuous learning and development highlights the need to prioritize patient safety and demonstrates a proactive approach to infection control. Thereby, such rising awareness of infection control among the practitioners as well as population acts as a driver for the dental infection control products market.

Increasing dental procedures

Globally, there is an increase in the frequency of dental conditions such as oral cancer, periodontal infections, and caries. As a result, more dental procedures are being done to identify, address, and cure these disorders. Effective infection control strategies are essential to prevent nosocomial infections and cross-contamination when more procedures are performed. The necessity of infection control in healthcare settings, particularly dentistry practices, has been highlighted by the rise of infectious disorders like COVID-19.

Because of the pandemic, there is a renewed focus on developing stringent infection control policies and a heightened awareness of disease transmission in healthcare facilities. Dental offices spend money on superior infection control supplies to reduce the chance of spreading illness and guarantee patient security.

Limited adoption in developing countries

Dentists may not be aware of the risks associated with insufficient measures and the significance of infection control methods in particular areas. Furthermore, patients might not be aware of infection control procedures and might not ask their dentists to follow them. Adopting infection control products is still low, and no effective education and awareness initiatives exist. Distribution networks might not be able to reach isolated or rural locations where a sizable fraction of the population dwells, even if oral infection management treatments exist on the market. The adoption of these items is further hampered by limited availability, exacerbating the healthcare services gap between urban and rural communities.

Growing emphasis on preventive healthcare measures

Consumers are becoming more conscious of good oral hygiene's role in avoiding dental infections. People are looking for goods and services emphasizing prevention over treatment as they become more aware of the connection between oral health and general well-being. This reduces the possibility of microbial contamination in dental settings and includes routine dental examinations, good oral hygiene habits, and infection control tools.

The focus on prevention offers dental professionals a chance to take the initiative in infection control. Dental experts are now implementing preventive measures into their practices to lessen the chance of infections developing in the first place instead of only treating current illnesses. This entails using premium infection control solutions, adhering to strict sterilization procedures, and educating patients about preventive oral care practices. Thereby, as the emphasis on preventive healthcare rises, the dental infection control products market is observed to witness a sustained growth factor.

The consumables segment dominated and sustained to be the fastest growing in the dental infection control products market.

The dental sector is always seeing improvements in goods and methods for infection prevention. Manufacturers create innovative consumables with enhanced safety features, usability, and efficacy. Disposable goods, for instance, have improved chemical resistance and barrier qualities. The need for infection control solutions is also fueled by the development of dental tourism, which is the practice of people traveling overseas for dental procedures to save money or receive higher-quality care.

Dental offices that treat patients from other countries need to follow strict infection control guidelines to maintain their good name and attract new patients, which increases the need for consumables.

The equipment segment shows a notable growth in the dental infection control products market during the forecast period.

The global growth in dental operations is attributed to the increased desire for cosmetic dentistry and the rising prevalence of tooth problems. The demand for equipment such as dental unit waterlines, chairside aerosol evacuation systems, and surface disinfectants is driven by the increased requirement for efficient infection control measures resulting from increased treatments.

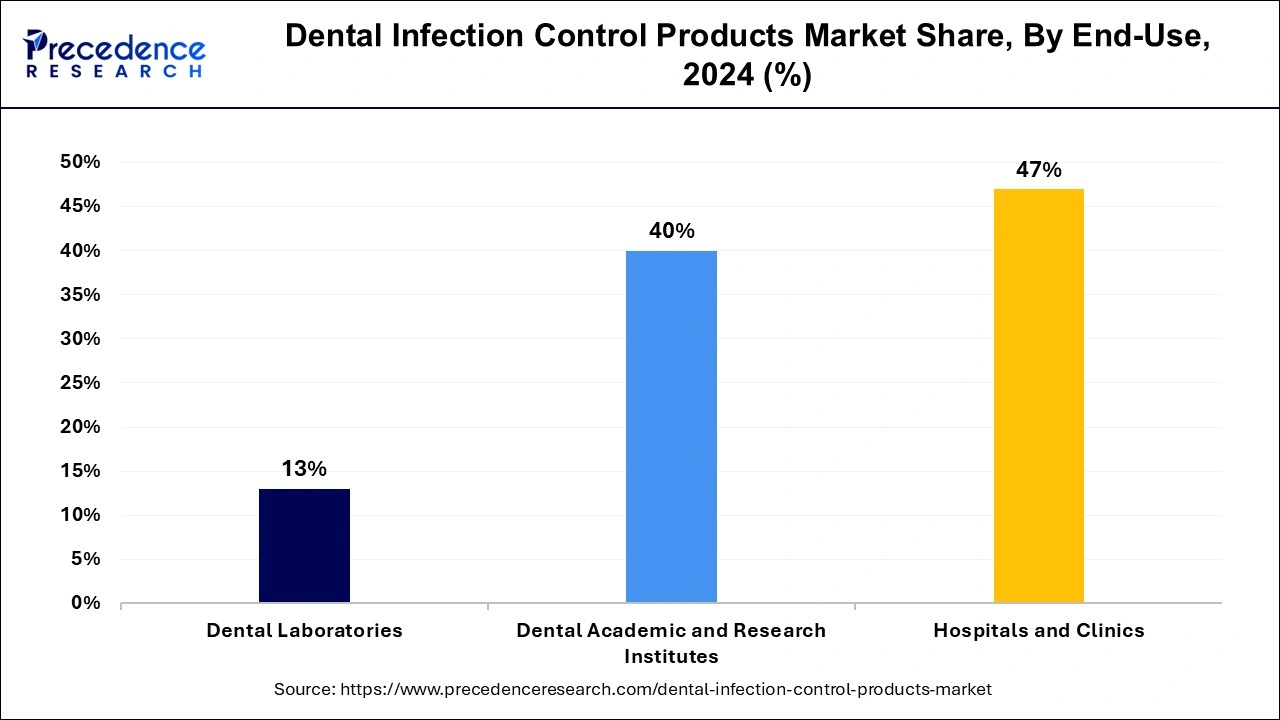

The hospitals and clinics segment dominated the dental infection control products market in 2023. Patients want healthcare facilities, including dental clinics, to protect their safety and well-being and to keep their surroundings tidy and sanitary. Using the correct goods and procedures to control infections in hospitals and clinics can increase patient happiness and trust, ultimately fueling market expansion. The dental laboratories segment is the fastest growing in the dental infection control products market during the forecast period.

Innovations in equipment and infection control solutions are only two examples of the dental industry's quick technical improvements. Manufacturers are introducing innovative technologies with enhanced efficacy and user-friendliness, like autoclaves, ultrasonic cleaners, and surface disinfectants. Dental laboratories are eager to implement these cutting-edge approaches to improve infection control procedures and maintain a competitive edge.

The dental academic and research institutes segment is observed to grow at a rapid pace during the forecast period in the dental infection control products market. Dental academic and research institutes must adhere to strict quality assurance standards and accreditation requirements. Dental infection control products are essential for maintaining a safe and hygienic learning environment, ensuring compliance with infection control guidelines, and demonstrating competency in infection prevention and management practices. Dental infection control products are utilized in clinical simulations to recreate real-life scenarios encountered in dental practice. Simulated dental infections allow students to develop clinical skills, practice infection control protocols, and gain confidence in managing various dental emergencies.

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023