January 2025

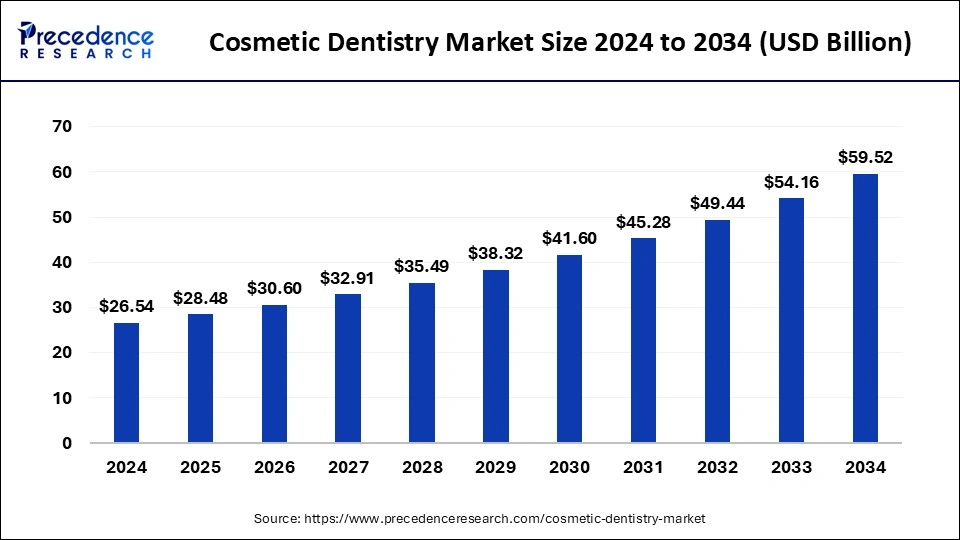

The global cosmetic dentistry market size accounted for USD 28.48 billion in 2025 and is forecasted to hit around USD 59.52 billion by 2034, representing a CAGR of 8.53% from 2025 to 2034. The North America market size was estimated at USD 9.01 billion in 2024 and is expanding at a CAGR of 17.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cosmetic dentistry market size was calculated at USD 26.54 billion in 2024 and is predicted to increase from USD 28.48 billion in 2025 to approximately USD 59.52 billion by 2034, expanding at a CAGR of 8.53% from 2025 to 2034

The practice of cosmetic dentistry includes both the care of one's teeth and the care of their gums. It emphasizes dental aesthetics in order to improve the appearance of the smile, shape, size, alignment, and color of the teeth. Computer-aided design and manufacturing software is used in the creation of dental prostheses and restorations. It has several different end-user applications and is quite common in the dentistry tourism industry. The primary factor fueling the market's growth is the majority of the population's increasing health consciousness as well as the growing importance of aesthetics. Other factors that have helped to generate a positive picture for industry growth include increased disposable incomes and technological improvements.

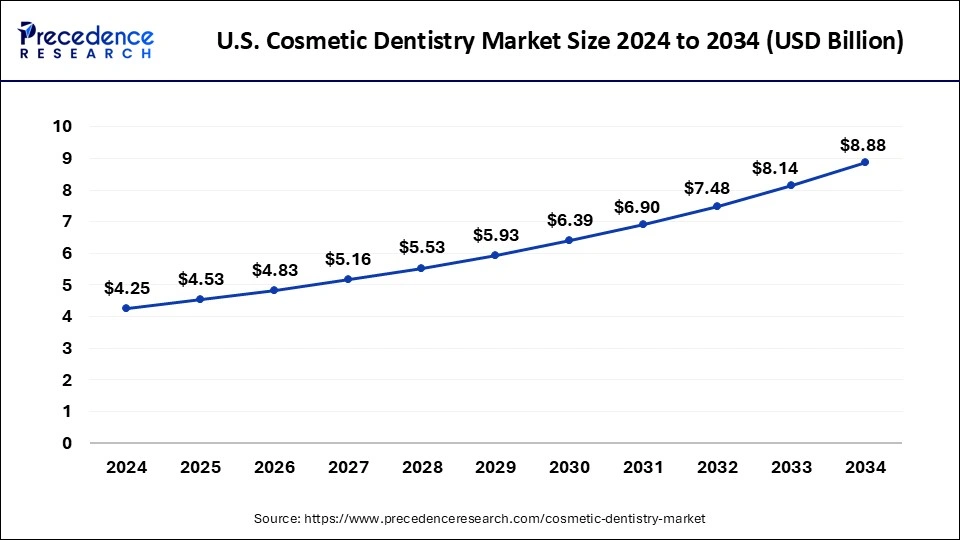

The U.S. cosmetic dentistry market size was exhibited at USD 4.25 billion in 2024 and is projected to be worth around USD 8.88 billion by 2034, growing at a CAGR of 7.76% from 2025 to 2034.

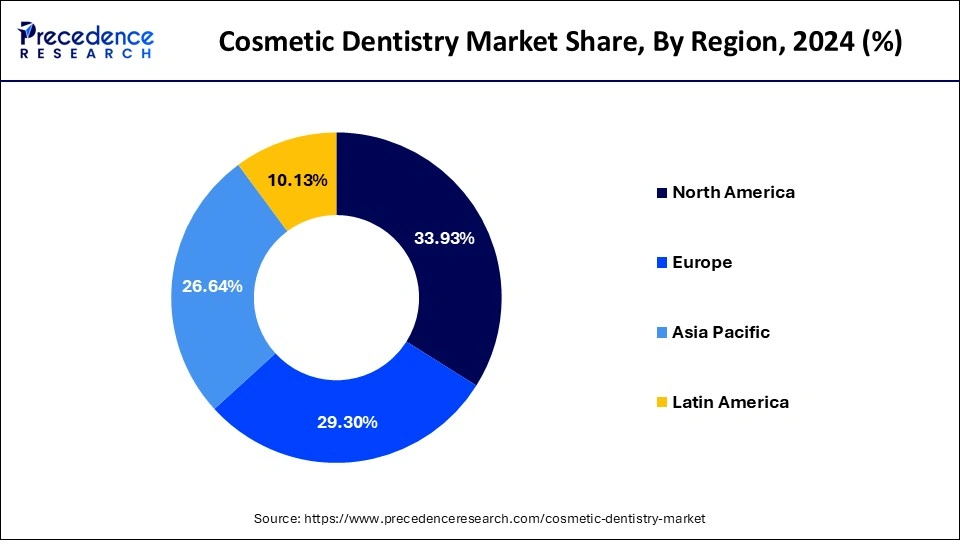

On the basis of geography, the North America region has accounted for the majority of revenue share in 2024. Due to the rising incidence of tooth-related disorders in the aging population, increased desire for medical aesthetics, and technological breakthroughs in cosmetic dentistry in this area, North America is anticipated to have a significant market share in the worldwide market for cosmetic dentistry.

Additionally, the Asia Pacific North America region is anticipated to be more profitable for cosmetic dentistry due to the expanding disposable income in nations with large populations, such as China and India, where people are interested in boosting and improving dental health. Dental tourism has been made possible by a sizable number of dentists and dental facilities, which will favorably affect revenue development. Furthermore, due to the existence of several reputable businesses, Europe is expected to maintain its second-place ranking. In addition to this, increased edentulous rates and greater public awareness would support market expansion in this area.

The Asia Pacific region is expected to expand at the quickest rate of all regions throughout the forecast timeframe. The trend is mostly driven by a rise in the amount of disposable income being produced in developing countries like China and India. Since there are so many people living here, many of them are interested in improving their dental health for aesthetic purposes. The wide variety of dental procedures offered in this area has aided in the growth of dental tourism, which has recently contributed to the rise of the regional market.

The large amount of disposable income generated by emerging countries is the primary driver of the expansion of aesthetic dentistry. The senior population in general has contributed to the growth of this industry because of age-related dental issues.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.53% |

| Market Size in 2025 | USD 28.48 Billion |

| Market Size by 2034 | USD 59.52 Billion |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Age Group |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

On the basis of product, the dental systems and equipment segment has captured the highest revenue share in 2023. This might be explained by the fact that they are used in a wide range of dental applications. Instrument delivery systems, light-curing gear, dental chairs, dental lasers, scaling units, dental handpieces, dental CAD/CAM systems, and radiography gear are a few examples of the numerous kinds of dental systems and equipment.

Additionally, dental devices and equipment are categorized as follows: As the population's desire to improve oral aesthetics has increased, so too has the use of orthodontic braces, which include both fixed and removable braces. People who are recovering from accidents and disfigurements frequently use dental implants, which are made of titanium implants and zirconium implants.

Global Cosmetic Dentistry Market, By Product, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Dental Systems & Equipment | 5,154.2 | 5,470.6 | 5,823.2 |

| Dental Implants | 3,998.9 | 4,272.4 | 4,577.7 |

| Dental Crowns & Bridges | 2,314.2 | 2,464.8 | 2,632.8 |

| Dental Veneer | 1,924.5 | 2,051.6 | 2,193.4 |

| Orthodontic Braces | 3,025.6 | 3,262.5 | 3,528.2 |

| Bonding Agents | 2,635.9 | 2,826.5 | 3,039.8 |

| Inlays & Onlays | 1,580.4 | 1,684.3 | 1,800.3 |

| Whitening | 2,544.8 | 2,735.8 | 2,949.0 |

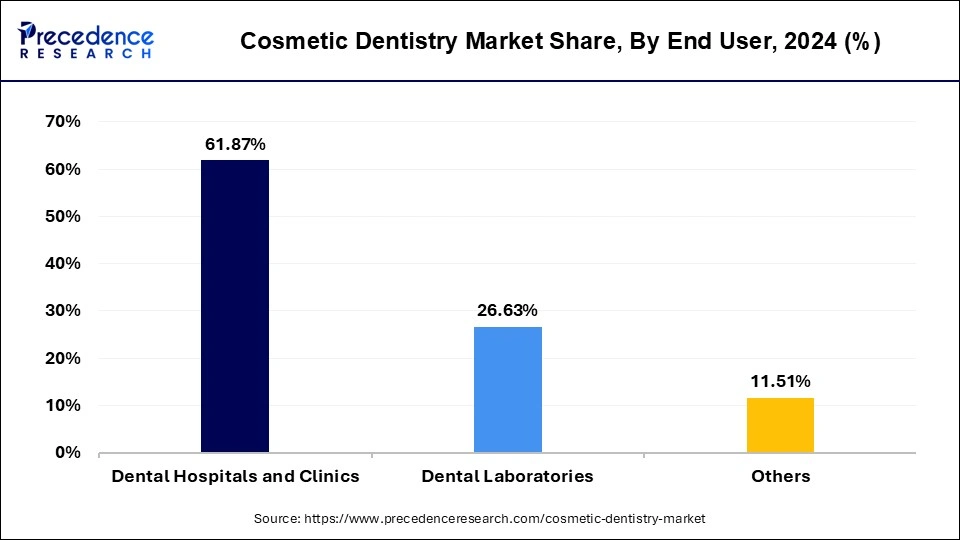

On the basis of end-user, the dental hospitals & clinics segment has captured the highest revenue share in 2024. This is because there are more dental clinics and people seeking cosmetic dentistry procedures at dental offices and hospitals. Additionally, dental treatments are performed by dentists who have gained proficiency in dental procedures. Dental clinics and hospitals are skilled at performing these procedures, which helps to explain the sector's dominance.

Dental laboratories, on the other hand, are predicted to see the quickest increase throughout the projection period. It is the fastest-growing category because government-recognized dentists collaborate with dental labs to create dental prostheses like crowns, bridges, or other dental restorations.

By Product

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

December 2024

February 2025