January 2025

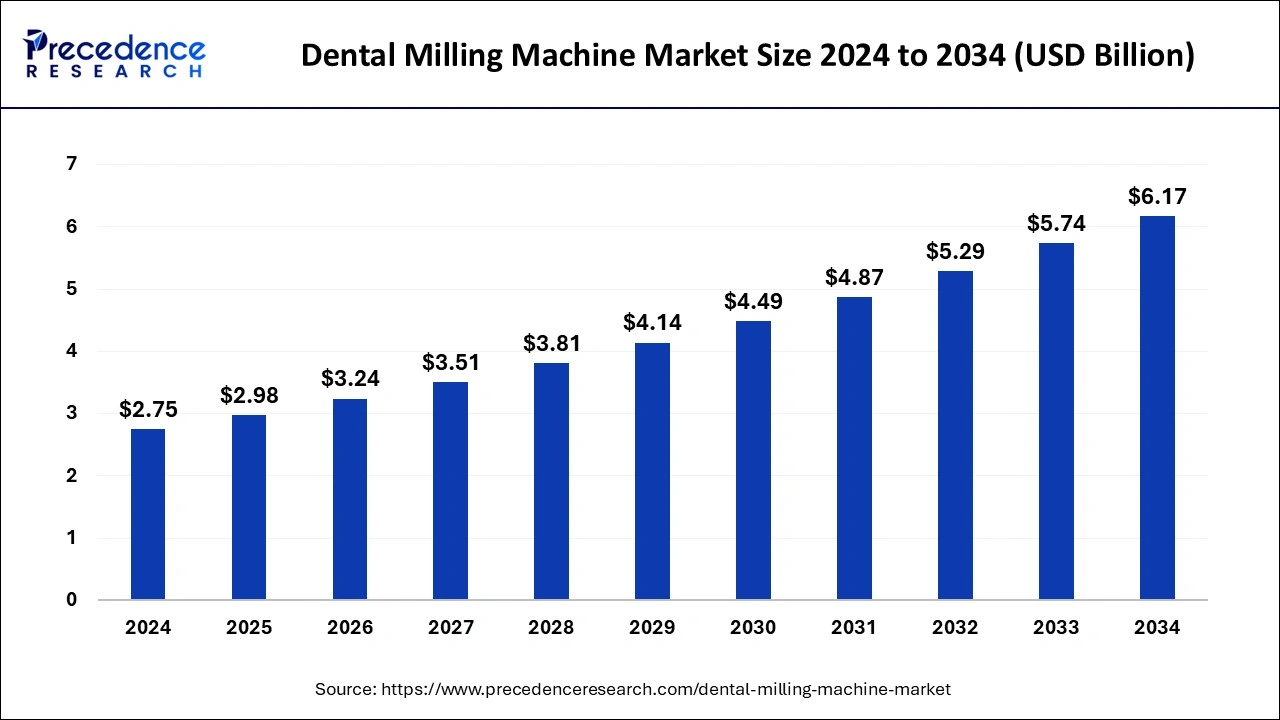

The global dental milling machine market size is calculated at USD 2.98 billion in 2025 and is forecasted to reach around USD 6.17 billion by 2034, accelerating at a CAGR of 8.42% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental milling machine market size was estimated at USD 2.75 billion in 2024 and is predicted to increase from USD 2.98 billion in 2025 to approximately USD 6.17 billion by 2034, expanding at a CAGR of 8.42% from 2025 to 2034. Dental milling equipment has been getting cheaper as technology advances and competition rises. This promotes market expansion by making it more accessible to dental laboratories and clinics of all size.

Significant technological developments have been made in dental milling machines, such as the integration of CAD/CAM systems, which improve precision, efficiency, and customization in the fabrication of dental prostheses. The need for dental milling machines is driven by the aging population and growing awareness of dental aesthetics, which raises demand for restorative dental operations, including crowns, bridges, and implants. Dental laboratories and clinics are increasingly using digital dentistry, which includes CAD/CAM systems and dental milling machines because of its effectiveness, precision, and patient happiness. Dental milling machines are becoming more and more necessary as a result of the rise in dental tourism, especially in areas like Asia and Eastern Europe.

Patients are calling for dental prostheses that are not only more functional but also more aesthetically beautiful and tailored to meet their individual requirements. Dental milling machines are essential in fulfilling these needs because they provide accurate and adaptable solutions. Due to lockdowns and limitations on dental treatments, the COVID-19 pandemic first caused disruptions in the dental industry, especially the dental milling machine business. Nevertheless, the market has proven resilient, gradually rebounding as dental services started up again and establishments adjusted to the new normal. In order to obtain a competitive edge, major players in the competitive dental milling machine market are concentrating on product innovation, strategic alliances, and geographic growth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.42% |

| Market Size in 2025 | USD 2.98 Billion |

| Market Size by 2034 | USD 6.17 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Technology, By Application, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Digital dentistry adoption

High degrees of precision and accuracy are possible when designing and creating dental restorations with digital dentistry. CAD/CAM-equipped dental milling machines may create highly personalized restorations that precisely suit a patient's mouth. Dental milling machines are capable of accurately milling restorations using digital impressions of a patient's mouth, enabling customized care to match each patient's specific requirements. The variety of materials that can be utilized for dental restorations has increased thanks to digital dentistry. With the ability to work with a wide range of materials, such as ceramics, zirconia, and composite resins, modern dental milling machines give dental specialists more options for treatment.

Competition from outsourcing

In the dental milling machine market, outsourcing mostly refers to the production of parts or whole machines by outside businesses, frequently based in nations with lower labor rates. Manufacturers of dental equipment can then include these outsourced parts in their finished products. By utilizing less expensive labor and manufacturing facilities abroad, outsourcing enables producers of dental equipment to reduce production costs. Companies may be able to charge competitive pricing for their milling machines thanks to this cost advantage. Dental equipment producers can diversify their supply chains internationally by outsourcing, which lessens their reliance on a single location for manufacturing or componentry. This can improve production process efficiency and resilience to shocks.

Rising dental tourism

The dental milling machine market is one of the many industries that will be significantly impacted by the growing trend of dental tourism. Dental tourism is the practice of people traveling to other nations for dental care, frequently as a result of more affordable prices, better services, or a mix of the two. Procedures like veneers, crowns, bridges, and dental implants are frequently performed during dental tourism. There is a greater need for dental services in well-known tourist locations as more individuals choose to have dental procedures done overseas. Patients who travel for dental care frequently look for up-to-date, superior service. Modern dental milling equipment can help dental offices that treat patients from abroad provide better care.

The in-lab milling machines segment held the largest share of the dental milling machine market in 2024. Lab milling machines are important in the dental milling machine market. These devices are intended exclusively for use in dental laboratories, where dental technicians make prosthetics according to patient requirements supplied by dentists. High precision, a wide range of material options, and automated features to expedite the manufacturing process are common features of lab milling machines. Accurate fit and aesthetics are essential for dental prostheses. Dental restorations can be milled with extreme precision using lab milling machines, guaranteeing precise outcomes that satisfy each patient's unique requirements. Dental lab workflow productivity is increased by automation features, including multi-axis milling, automatic tool changeover, and CAM software integration.

The in-office milling machines segment is expected to grow rapidly during the forecast period. With the help of in-office milling equipment, dental practices can complete restorations rapidly often in just one visit. Compared to conventional methods, which involve sending impressions to a dental lab and waiting for the restoration to be produced, this method saves time for both the patient and the doctor. Patients no longer have to make several, often inconvenient dental appointments and temporary restorations thanks to in-office milling. Permanent restorations can be provided to patients in one visit, saving chair time and increasing patient satisfaction. An in-office milling machine can save dental clinics money over time by decreasing outsourcing expenses and boosting productivity, even though the initial investment may be high.

The CAD or CAM milling segment held the largest share of the dental milling machine market in 2024. Using specialist tools, digital dental designs are created, modified, and optimized in CAD. Dental technicians and dentists use computer-aided design (CAD) software to create dental restorations such as veneers, crowns, bridges, and implants. The milling machines receive these digital designs and are used to fabricate them. Contrarily, CAM concentrates on the manufacturing process, converting the digital designs produced by CAD into instructions that the milling machine can use to shape the real dental prosthesis out of metal, resin, or ceramic materials. The milling process is controlled by G-codes, which are machine-readable codes that are generated from CAD drawings using CAM software. The workflow requires the use of both CAD and CAM technologies, and many machines offer integrated solutions that allow for a smooth transition from design to manufacturing.

The copying milling machines segment will expand significantly during the forecast period. In the dental milling machine sector, copying mills have long been a necessary equipment. These devices imitate the form of a physical model using a mechanical tracing technique on metal or ceramic dental restorative materials. While CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology has long been in use, recent advances have given rise to digital milling machines, which provide increased precision, efficiency, and variety. In certain situations where traditional procedures are favored, especially for laboratories or clinics that may not have entirely shifted to digital processes, replicating milling machines still have a role in the market.

The bridges segment led the dental milling machine market in 2024. Bridges are dental prostheses used to repair one or more lost teeth in the dental milling machine market. Dental milling machines are essential to the CAD/CAM (computer-aided design/computer-aided manufacturing) process used to create these bridges. These devices carefully grind composite resin or ceramic prosthetic materials in accordance with digitized designs made by dentists. These bridges might be either the more recent, cutting-edge implant-supported bridges or the more conventional fixed bridges. Bridges may now be made specifically for each patient, with the help of dental milling equipment, guaranteeing a flawless fit and natural-looking restoration.

The crowns segment is projected to obtain a significant market share during the forecast period. One of the most popular dental restorations used to repair broken teeth is a dental crown, which restores the size, strength, and form of the tooth. They are frequently used to replace broken or badly worn teeth, shield weak teeth, cover dental implants, and enhance appearance. Dental milling machines may operate with zirconia, lithium disilicate, porcelain, and metal alloys, among other materials that are appropriate for crowns. Every material offers advantages and characteristics of its own in terms of cost, strength, durability, and biocompatibility. Dental crowns can be customized using CAD/CAM technology to meet each patient's specific needs. The form, size, color, and occlusal properties of a patient's natural teeth can all be precisely matched by dental technicians and dentists while creating crowns.

The dental laboratories segment led the dental milling machine market in 2024. Glidewell is a well-known provider of dental supplies and services, and it also offers milling services. With great accuracy, they create crowns, bridges, implants, and other dental restorations using CAD/CAM technology. For dental labs, Ivoclar Digital provides CAD/CAM solutions, including milling tools and supplies. Dental experts can create restorations with superior durability and aesthetics thanks to their equipment. For dentistry laboratories, Straumann provides CAD/CAM systems and milling machines. Their solutions are made to guarantee accurate results for implants, crowns, and bridges while streamlining the production process. Dental laboratories can use the desktop milling machines made by Roland DG. Their small-sized devices are perfect for producing dental restorations on a small scale with excellent accuracy.

The research and academic institutions segment is expected to hold a substantial share during the forecast period. Dental materials and digital dentistry are two areas of dentistry research that NYU Dentistry is well known for. They have been actively investigating the uses of dental milling machines and other CAD/CAM technology in dentistry. Dental materials and CAD/CAM technologies are areas of current research at the University of Michigan School of Dentistry. They carry out research on the functionality, precision, and effectiveness of dental milling equipment. This prestigious academic medical facility in Berlin is well-known for its dental research, which encompasses CAD/CAM and digital dentistry. They investigate the uses of dental milling equipment for both surgical and restorative dentistry.

North America holds the largest share of the global dental milling machine market. These devices are used in dentistry labs to create prosthetic dental restorations, including veneers, crowns, bridges, and inlays and onlays, from a variety of materials, including metals, ceramics, and polymers. Tooth milling machines are becoming more and more popular because of the increased frequency of tooth problems and the growing desire for cosmetic dentistry procedures. Dental milling machines are becoming more and more popular because digital workflows provide better patient results, faster turnaround times, and enhanced accuracy. More people in North America may now afford more advanced dental treatments, such as restorative operations that call for dental milling machines, thanks to rising disposable income.

Asia Pacific is expected to gain a significant share during the forecast period. There is a growing need for dental operations, including crowns, bridges, and implants, as people become more aware of their oral health. Dental technology, particularly CAD/CAM (computer-aided design/computer-aided manufacturing) technologies, has advanced quickly in the area. For less expensive, superior dental care, patients from other nations visit these locations. The need for sophisticated dental equipment, including milling machines, has increased as a result of this trend. Population disposable income has increased as a result of economic expansion in nations like China, India, and Southeast Asia.

By Product

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023