September 2024

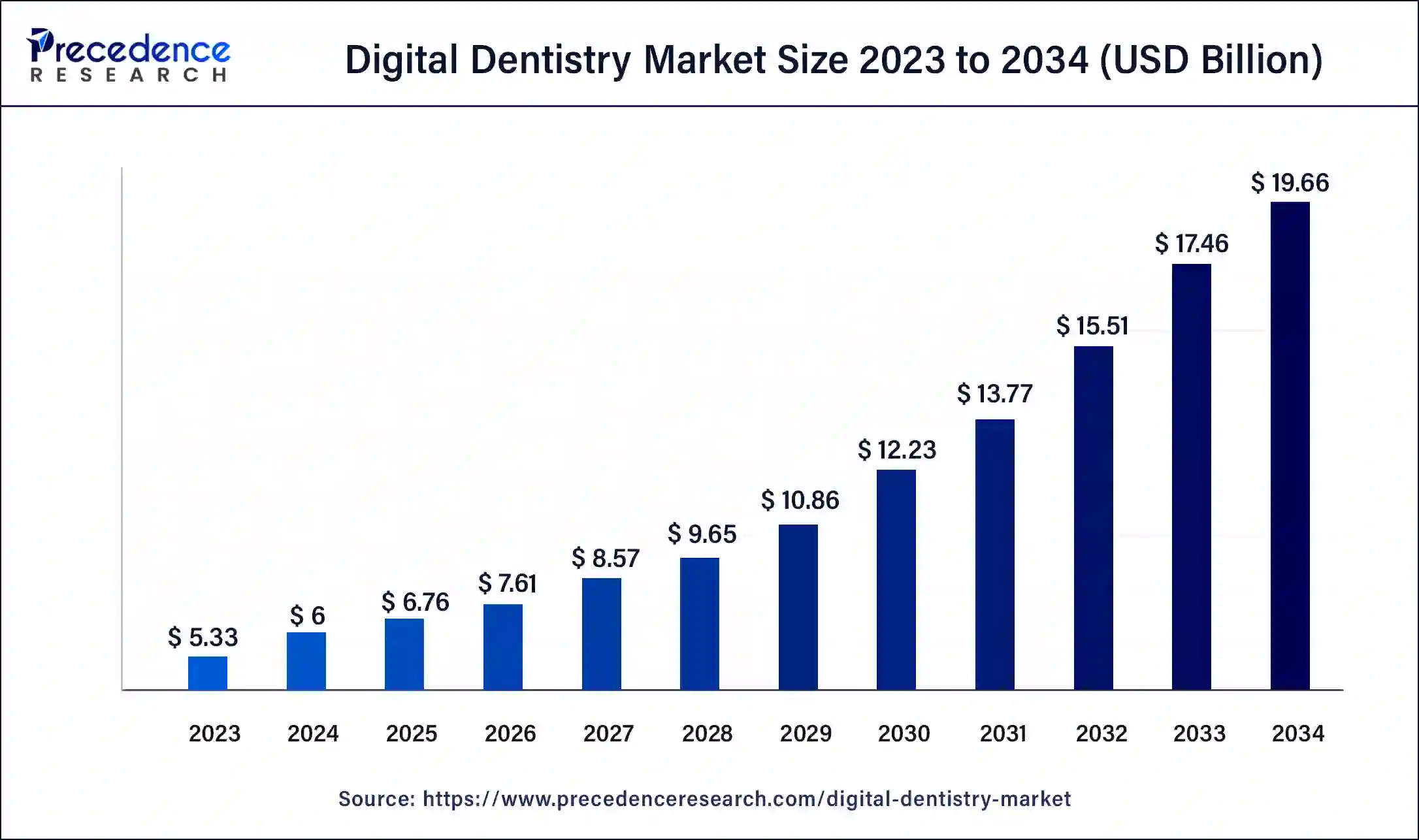

The global digital dentistry market size was USD 5.33 billion in 2023, calculated at USD 6 billion in 2024 and is projected to surpass around USD 19.66 billion by 2034, expanding at a CAGR of 12.6% from 2024 to 2034.

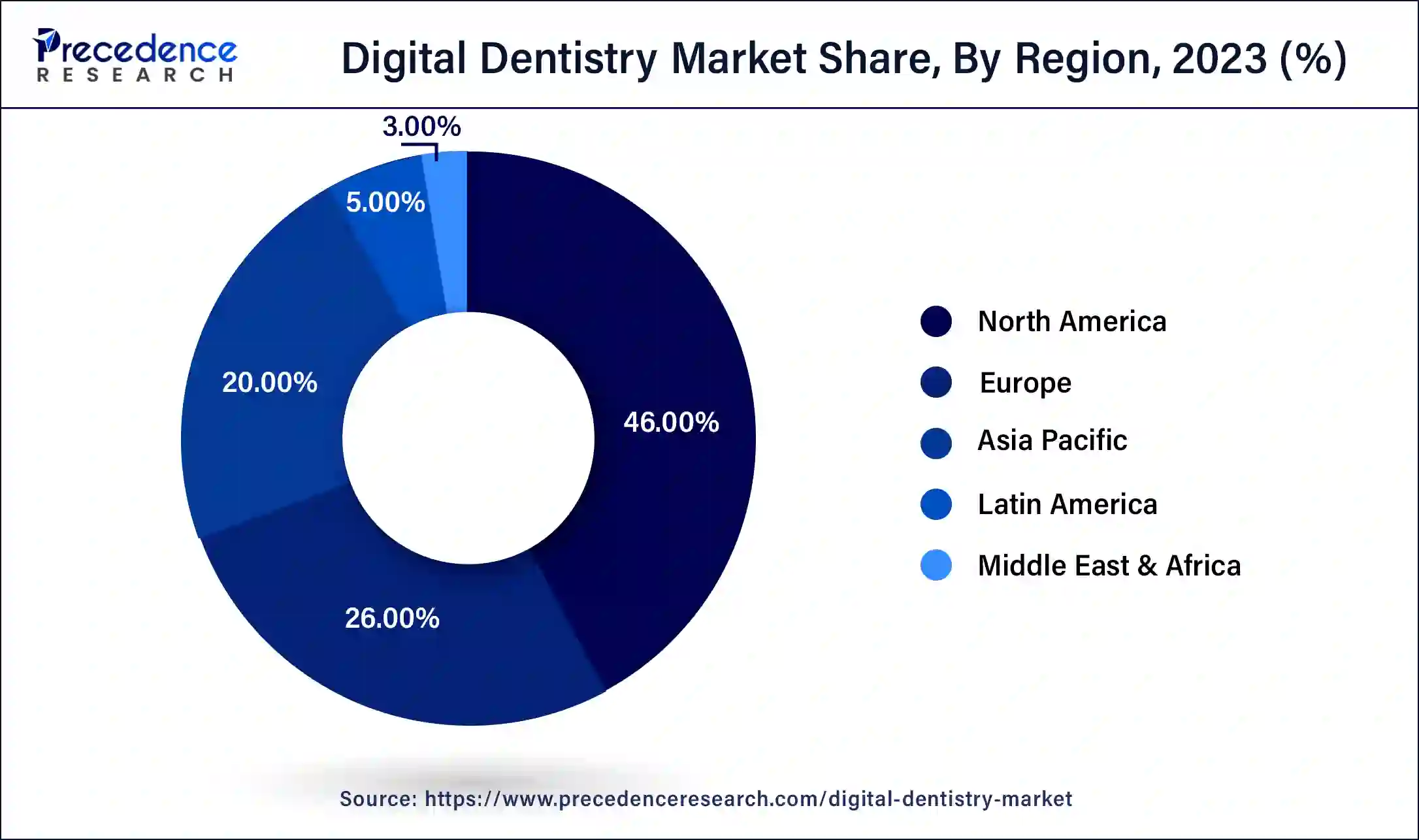

The global digital dentistry market size accounted for USD 6 billion in 2024 and is expected to be worth around USD 19.66 billion by 2034, at a CAGR of 12.6% from 2024 to 2034. The North America digital dentistry market size reached USD 2.45 billion in 2023.

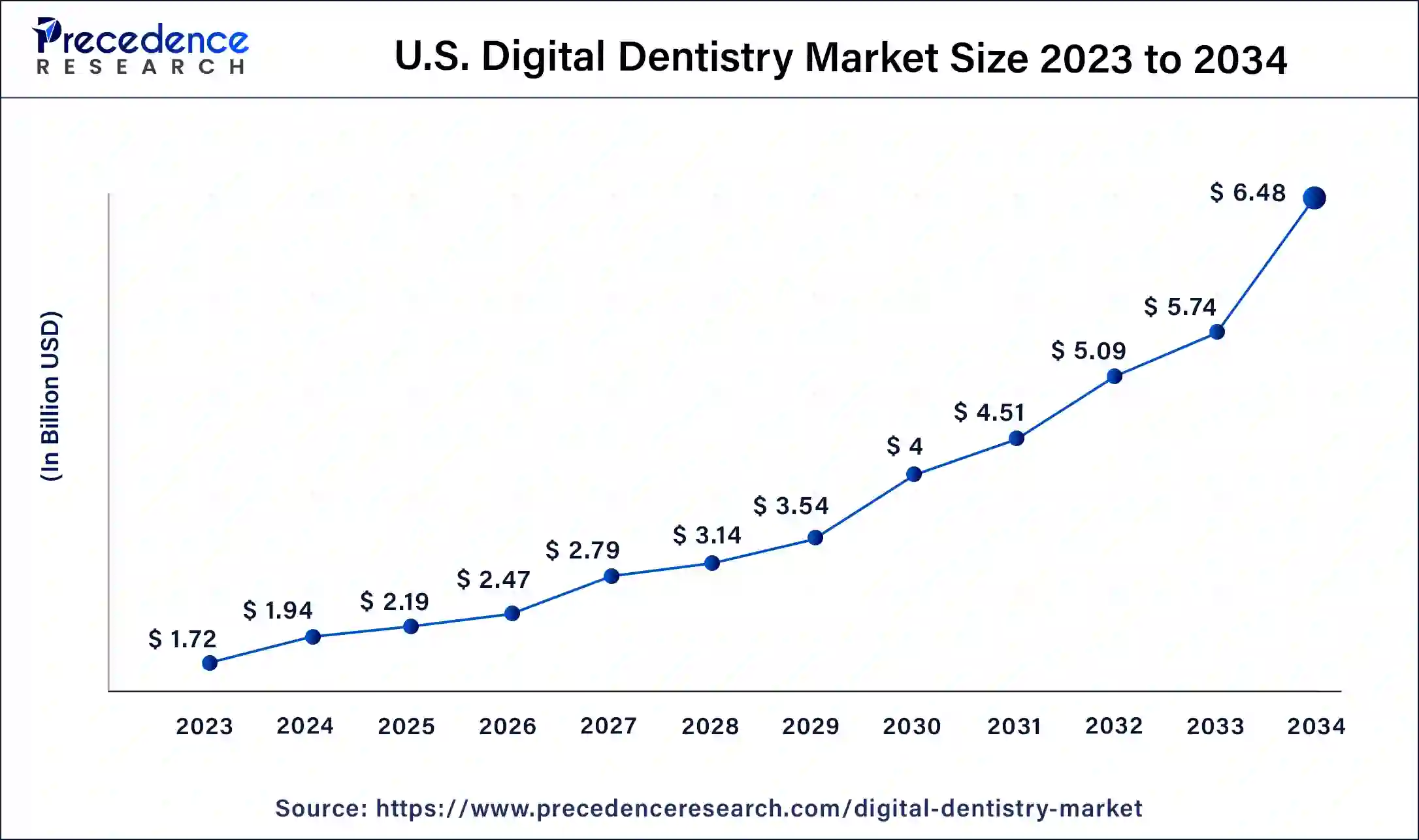

The U.S. digital dentistry market size was estimated at USD 1.72 billion in 2023 and is predicted to be worth around USD 6.48 billion by 2034, at a CAGR of 12.8% from 2024 to 2034.

North America has held the largest revenue share 45% in 2023. North America dominates the digital dentistry market due to its robust healthcare infrastructure, high adoption of advanced technologies, and well-established dental care system. The region's significant share is attributed to increased awareness among both practitioners and patients, substantial investments in research and development, and a higher acceptance of innovative dental solutions. Moreover, favorable reimbursement policies, a strong regulatory framework, and the presence of key market players contribute to North America's leading position in driving the growth of the digital dentistry market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific commands a significant share in the digital dentistry market due to a burgeoning population, rising dental awareness, and increasing healthcare expenditure. The region's rapid economic growth, particularly in countries like China and India, fosters the adoption of advanced dental technologies. Additionally, favorable government initiatives, a growing middle class, and increasing dental tourism contribute to the expanding market. The rising prevalence of dental disorders and the demand for technologically advanced solutions position Asia-Pacific as a key player in driving the growth of the digital dentistry market.

Digital dentistry signifies a modern approach that incorporates cutting-edge technologies into traditional dental processes, boosting accuracy and effectiveness. This comprehensive field includes digital tools like CAD/CAM, intraoral scanners, 3D printing, and advanced imaging systems. Instead of the old-fashioned molds, digital scans create precise 3D models of a patient's mouth. CAD/CAM systems speed up and refine the design of dental restorations, ensuring a perfect fit for items like crowns and bridges. Digital radiography reduces patient exposure to radiation, and intraoral scanners replace the need for uncomfortable traditional impressions.

In essence, digital dentistry streamlines workflows, improves diagnostic accuracy, and elevates overall patient care. This technological evolution marks a significant advancement in dental practices, offering not only enhanced efficiency for dental professionals but also improved comfort and outcomes for patients undergoing various dental procedures.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 12.6% |

| Market Size in 2023 | USD 5.33 Billion |

| Market Size in 2024 | USD 6 Billion |

| Market Size by 2034 | USD 19.66 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Patient-centric care and enhanced diagnostic capabilities

Patient-centric care and enhanced diagnostic capabilities are pivotal factors surging the demand for digital dentistry. The emphasis on patient comfort and convenience aligns with a contemporary healthcare approach, fostering a preference for streamlined and less invasive dental procedures. Digital dentistry's ability to provide a patient-friendly experience, such as the use of intraoral scanners instead of uncomfortable traditional impressions, resonates positively with individuals seeking more pleasant dental visits. Furthermore, the heightened diagnostic precision offered by digital dentistry tools significantly influences market demand. Advanced imaging technologies, coupled with computer-aided design and manufacturing (CAD/CAM) systems, empower dental practitioners with comprehensive and detailed insights into patients' oral health conditions. This not only aids in accurate diagnosis but also facilitates more personalized treatment plans. As patients increasingly prioritize efficient and precise dental care experiences, the integration of patient-centric care and advanced diagnostics becomes a driving force in shaping the expanding landscape of the digital dentistry market.

Resistance to change and data security concerns

Resistance to change and data security concerns act as formidable restraints on the market demand for digital dentistry. Traditionalist sentiments within the dental community can create reluctance among practitioners to shift from conventional methods to digital workflows. This resistance may stem from a comfort with established practices and a hesitation to embrace the learning curve associated with advanced technologies. Overcoming this resistance necessitates targeted education and training programs to familiarize dental professionals with the benefits and ease of use of digital dentistry tools. Simultaneously, data security concerns pose a significant barrier to the widespread adoption of digital dentistry. As patient records and diagnostic data become digitized, the vulnerability of sensitive information to cyber threats becomes a critical issue. Dental practices and patients may hesitate to fully embrace digital solutions without robust assurances of secure data storage and transmission. Establishing stringent data security protocols, compliance with regulatory standards, and fostering awareness about the reliability of digital systems are crucial steps to address these concerns and instill confidence in the adoption of digital dentistry practices.

Rising dental tourism and advancements in artificial intelligence

Rising dental tourism and advancements in artificial intelligence (AI) represent significant opportunities for the digital dentistry market. Dental tourism, driven by cost-effective and high-quality dental procedures, provides a robust market avenue. Digital dentistry's efficiency and precision align with the expectations of dental tourists seeking advanced and streamlined treatments, presenting an opportunity for market expansion in popular dental tourism destinations. The integration of AI in digital dentistry introduces innovative diagnostic and treatment planning capabilities, offering enhanced efficiency and accuracy. AI-driven algorithms can analyze vast datasets, aiding in early disease detection and personalized treatment plans. This not only improves patient outcomes but also positions digital dentistry as a forefront solution in the evolving landscape of AI-driven healthcare. Embracing these opportunities can propel the digital dentistry market forward, catering to a diverse global patient base and driving continued advancements in technology and patient care.

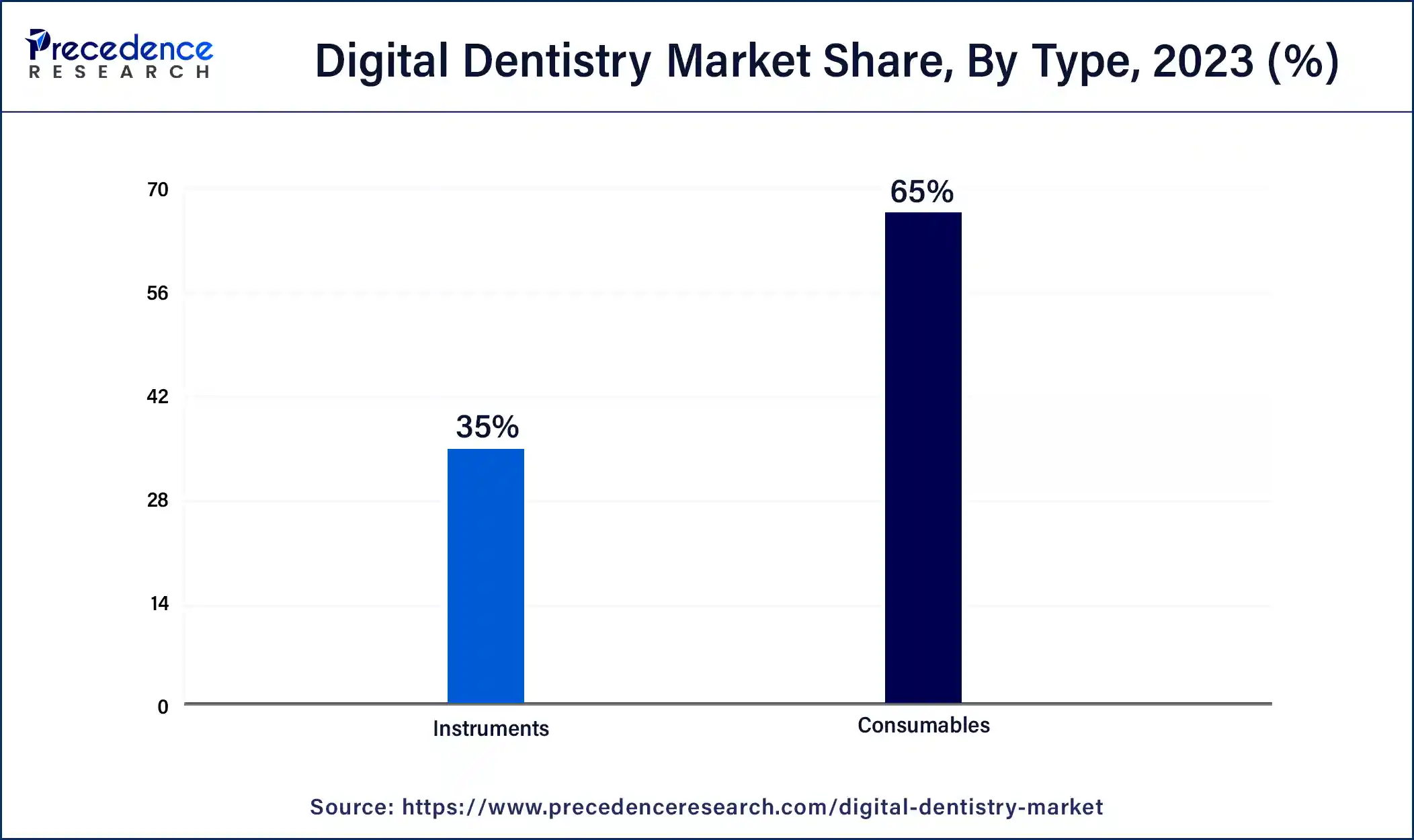

In 2023, the consumables segment had the highest market share of 65% on the basis of the type. In the digital dentistry market, the consumables segment encompasses materials used in various digital dental procedures, including CAD/CAM blocks, dental crowns, bridges, and 3D printing resins. This segment is witnessing a notable trend towards the development of advanced materials with improved aesthetics, durability, and biocompatibility. Innovations in nanotechnology and biomaterials are shaping the consumables market, enhancing the quality and efficiency of digital dentistry procedures, and addressing the demand for patient-specific, high-performance dental solutions.

The instruments segment is anticipated to expand at a significant CAGR of 14.5% during the projected period. In the digital dentistry market, the instruments segment encompasses a range of advanced tools used for diagnostic imaging, intraoral scanning, and precision manufacturing. These instruments include intraoral scanners for creating digital impressions, 3D printers for fabricating dental prosthetics, and imaging devices such as CBCT scanners. A notable trend in this segment involves the continuous enhancement of precision and speed in digital workflows, leading to more efficient and accurate diagnostics and treatment planning. Additionally, the integration of artificial intelligence in digital dentistry instruments is a prominent trend, offering sophisticated data analysis and further optimizing clinical outcomes.

According to the end user, the hospitals segment held 45% revenue share in 2023. In the digital dentistry market, the hospital segment refers to dental departments within healthcare institutions that leverage advanced digital technologies. A growing trend in hospitals involves the integration of digital dentistry tools like intraoral scanners and CAD/CAM systems. This allows hospitals to enhance diagnostic capabilities, streamline treatment workflows, and improve overall patient care. The adoption of digital dentistry in hospitals signifies a commitment to cutting-edge dental practices, contributing to more efficient and precise oral healthcare services within a comprehensive healthcare setting.

The dental clinics segment is anticipated to expand fastest over the projected period. Dental clinics, as end-users in the digital dentistry market, refer to facilities where dental practitioners provide a range of oral healthcare services. The trend in dental clinics involves a rapid adoption of digital technologies, including CAD/CAM systems, intraoral scanners, and 3D printing, to enhance diagnostics, treatment planning, and patient care. This integration streamlines workflows, improves precision in prosthetic design, and elevates overall efficiency, allowing dental clinics to offer advanced and patient-centric services, marking a paradigm shift in traditional dental practices.

Segments Covered in the Report

By Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025