January 2025

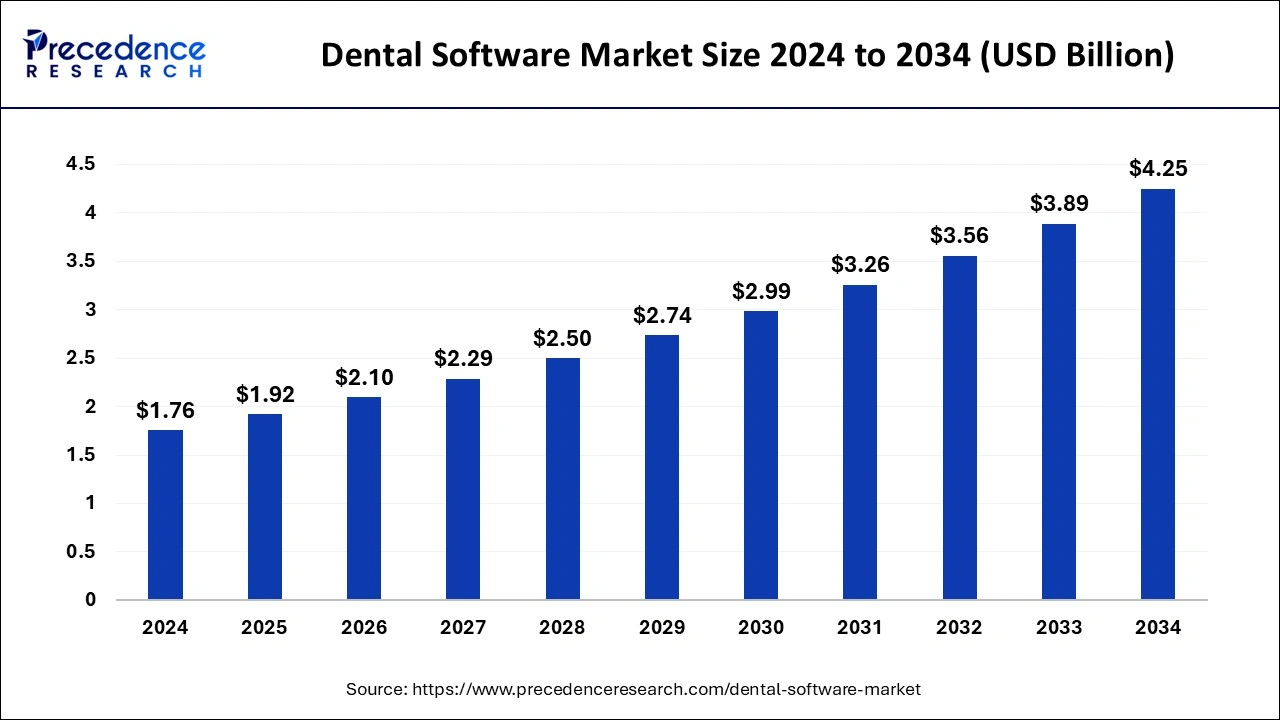

The global dental software market size is calculated at USD 1.92 billion in 2025 and is forecasted to reach around USD 4.25 billion by 2034, accelerating at a CAGR of 9.22% from 2025 to 2034. The North America dental software market size surpassed USD 700 million in 2024 and is expanding at a CAGR of 9.41% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental software market size was estimated at USD 1.76 billion in 2024 and is anticipated to reach around USD 4.25 billion by 2034, expanding at a CAGR of 9.22% from 2025 to 2034. The beneficial aspects of the dental software such as automatic updates and continuous backups, billing and invoicing, standardization of workflow, data protection, treatment planning, payment processing, etc. surge the growth of the dental software market

Artificial intelligence algorithms help analyze dental images and detect early signs of tooth decay. They also help in diagnosis, drug discovery, treatment planning, and patient monitoring. AI helps doctors with real-time recommendations based on medical evidence and guidelines. It analyses electronic medical records and genetic information and can also predict certain diseases and patient outcomes. AI algorithms can analyze medical images such as 3D scans and X-rays to detect abnormalities and perform diagnosis.

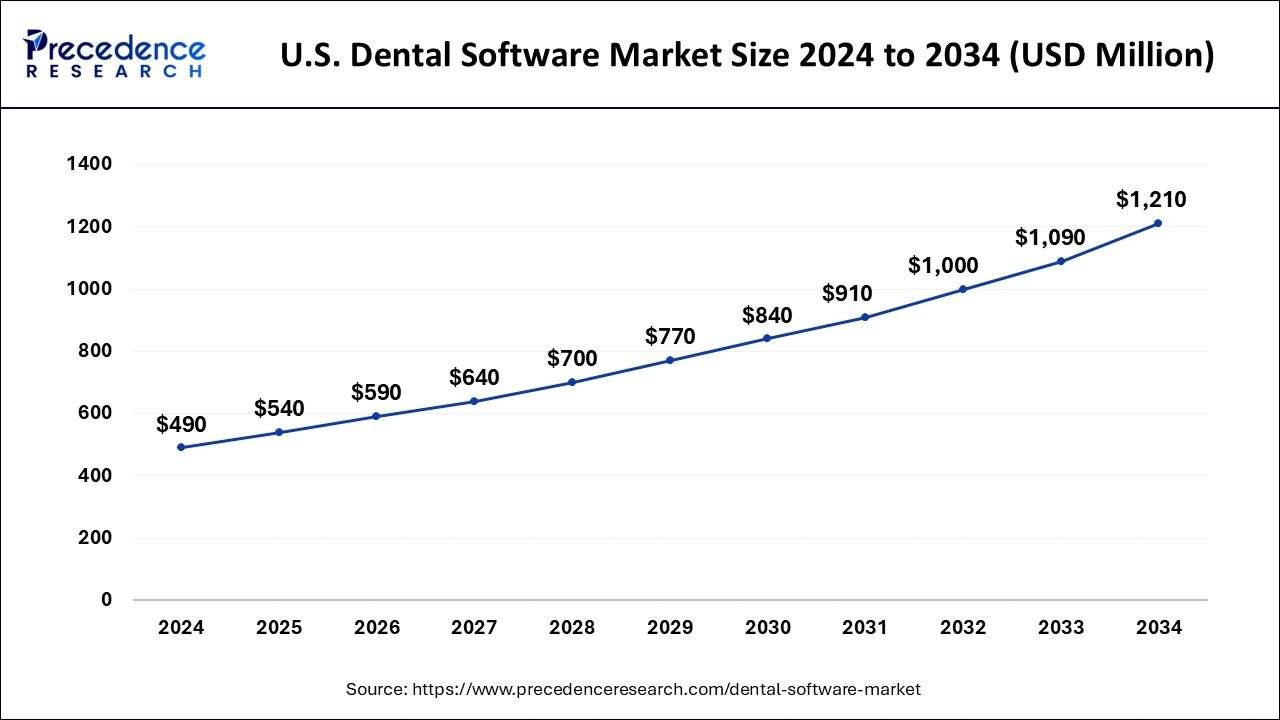

The U.S. dental software market size was evaluated at USD 490 million in 2024 and is predicted to be worth around USD 1210 million by 2034, rising at a CAGR of 9.46% from 2025 to 2034.

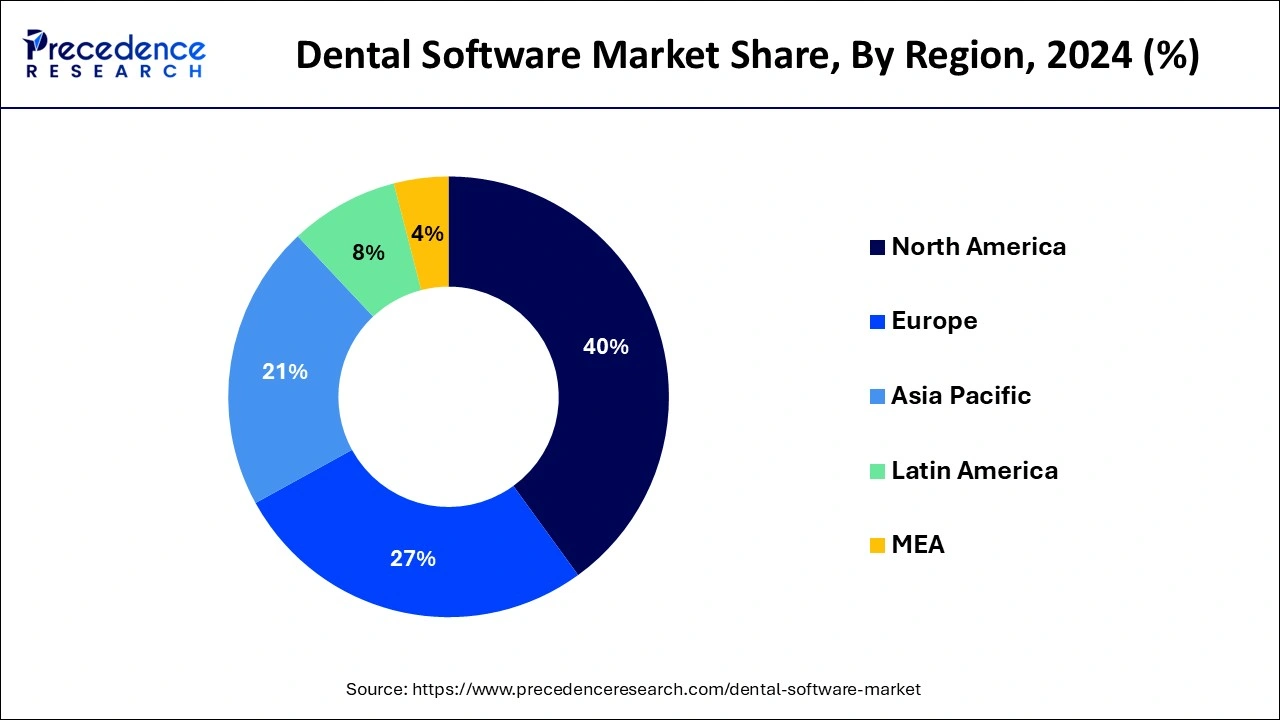

North America dominated the global dental software market with the largest market share of 40% in 2024. In comparison to other regions, North America has been the first and fastest to use dental software. For the treatment of a variety of dental diseases, more dental laboratories are using 3D printers, CAD/CAM systems, and digital design software.

The supportive government regulations for healthcare information technology, the rising disposable income, and a huge elderly population in the U.S. and Canada drive the North American market’s growth remarkably. The increasing funding for start-up businesses and the rising adoption of oral care services by baby boomers boost the market’s expansion in this region. The increase in the number of dental practices and dentists in the U.S. surge the demand and need for dental software in the market

Asia-Pacific is projected to expand at the notable CAGR during the forecast period. The increased usage of digital dental radiography devices as well as the ageing population is responsible for much of this growth.

Conversely, Asia-Pacific is expected to develop at the fastest rate during the forecast period. The increased usage of digital dental radiography devices as well as the ageing population is responsible for much of this growth.

The growing investments by healthcare IT companies and the improving healthcare infrastructure and economic conditions favor the market’s expansion in the Asia Pacific region. In Japan, the rising incidence of dental disorders and the presence of strong healthcare infrastructure propel the market’s growth. In India, the huge cases of oral cancer, dental diseases, oral health concerns caused by poor oral hygiene, tobacco use, and a sugary diet accelerate the demand and need for dental software in the regional market.

The dental software market is growing rapidly due to its potential in the management of day-to-day operations in healthcare. It is essential in automatic accounting, doctor-staff-patient communication, inventory management, and clinical efficiency. It can be linked to X-ray sensors, imaging equipment, intraoral cameras, and other dental technologies to preserve patient records electronically. The dental software allows dental practitioners to access data easily as it is available in the form of a service, cloud-based application, or software. With the advancements in dentistry including high-precision digital cameras to capture dental imprints, lasers instead of surgical tools, 3D technology, etc., the demand and need for software in dentistry surges the market’s growth significantly.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.92 Billion |

| Market Size by 2034 | USD 4.25 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment, End User, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing number of dental visits and the rising awareness about oral health in Europe and the U.S. along with rapid technological advancements drive the market’s growth remarkably. The use of health information technology in the United States is accelerated by the Health Information Technology for Economic and Clinical Health (HITEC) Act. The greater adoption of healthcare IT solutions in dental clinics such as oral and dental practices drives the growth of the dental software market remarkably.

The cost of implementing dental practice management software and associated training can impose a financial burden on smaller dental practices. The investments in staff training to ensure proficient utilization of software contribute to raising the financial challenge. The seasoned dental professionals and support staff face the most common challenge related to the resistance to technological change.

Digital dentistry is transforming with the introduction of computer-aided design software (CAD) to dental practices and laboratories. Dental CAD software allows dental clinicians and dental practitioners to design prosthetics like crowns, bridges, splints, implant surgical guides, veneers, etc. Dental CAD software allows the creation of virtual 3D models of a patient’s oral anatomy from digital scans which can be taken intraorally or via impression scanning.

The practice management software segment dominated the dental software market in 2024. The practice management software is software that manages the day-to-day operations of a dental office. This program assists dentists and clinic centers in scheduling appointments and capturing demographics, billing activities, and report generation.

The patient communication software segment is fastest growing segment of the dental software market in 2024. The patient communication software is one of the solutions that has resulted from advances in information technology that are revolutionizing the information sharing systems across the healthcare system.

In 2024, the web-based segment dominated the dental software market. On web-based solutions, dental professionals can delegate task recalls, reminders, scheduling, patient intake, and other tasks. These platforms can run on any computer or mobile device, regardless of the operating system that is installed.

The cloud-based segment, on the other hand, is predicted to develop at the quickest rate in the future years. Cloud based dental software, with exception of web based dental software, makes data or information available across many, interconnected servers via cloud hosting with multi-tenancy.

The hospitals segment dominated the dental software market in 2024. The hospitals and medical and other professional establishments that employ organized medical and other employees. Inpatient facilities are available as well as dental, nursing, and other related services, which are available 24/7.

The dental clinics segment is fastest growing segment of the dental software market in 2022. Dental clinics are dental healthcare facilities that are administered by a single or group of dentists or physicians. They are often smaller than a hospital and offer only outpatient treatments.

By Type

By Deployment

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023