Dental Market Size and Forecast 2025 to 2034

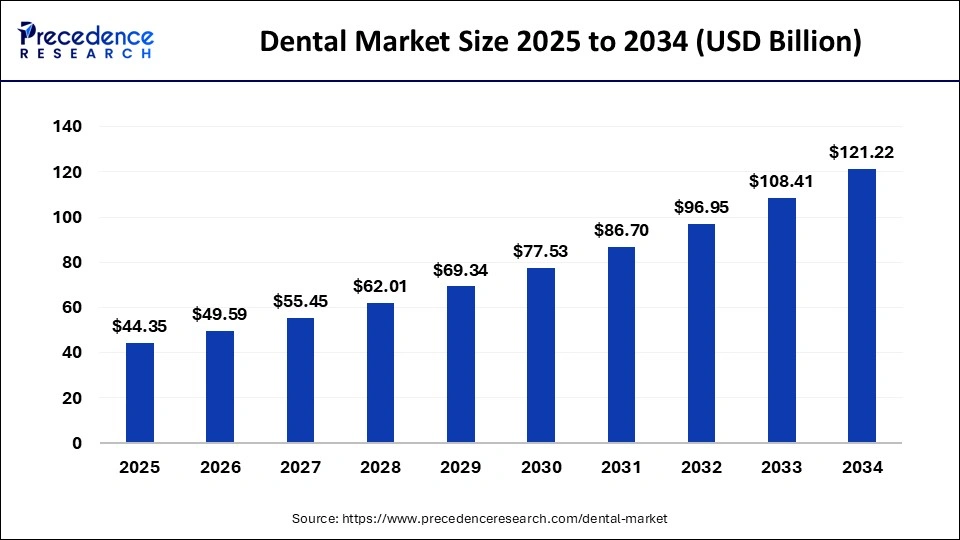

The global dental market size was calculated at USD 39.66 billion in 2024 and is projected to surpass around USD 121.22 billion by 2034, expanding at a CAGR of 11.82% from 2025 to 2034. The dental market is rapidly rising due to the increasing people's awareness of oral health, the elderly population, advancement in technologies, demand for aesthetic dental procedures, and an increased number of dental practices, and services.

Dental Market Key Takeaways

- In terms of revenue, the market is valued at $44.35 billion in 2025.

- It is projected to reach $121.22 billion by 2034.

- The market is expected to grow at a CAGR of 11.82% from 2025 to 2034.

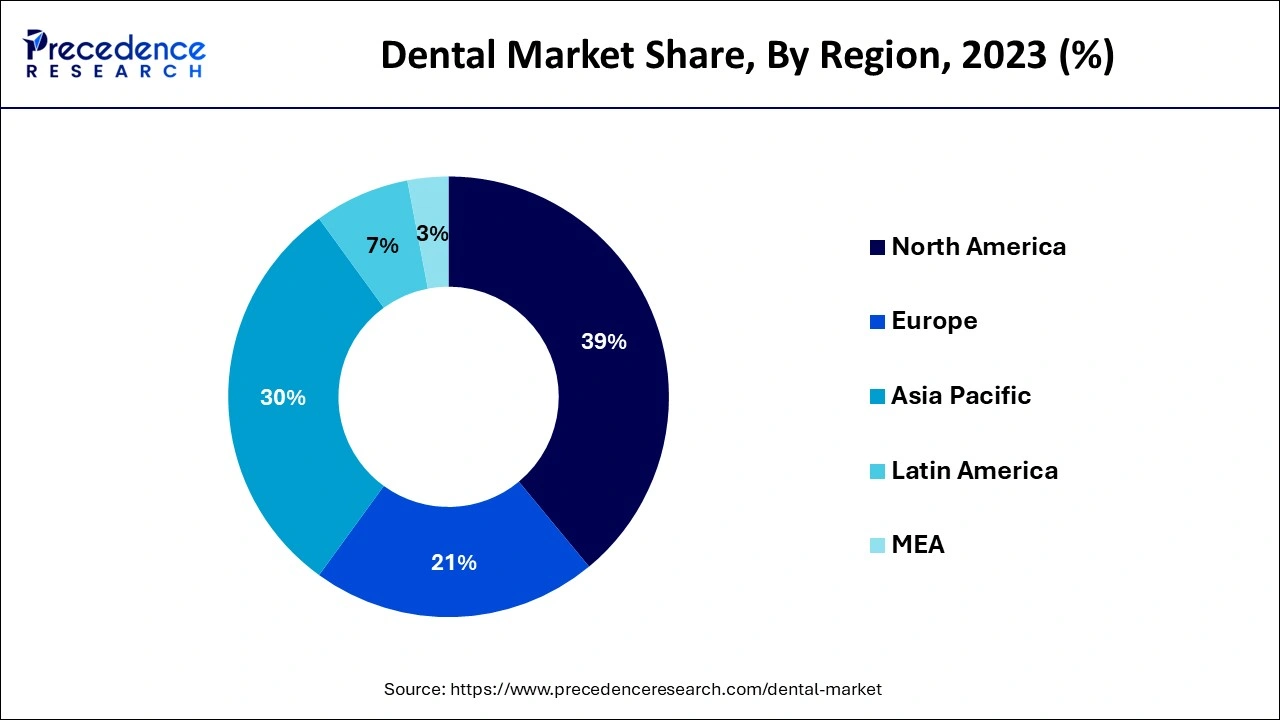

- North America dominated the dental market with the highest market share of 39% in 2024.

- Asia Pacific is anticipated to witness the fastest growth in the market during the forecasted years.

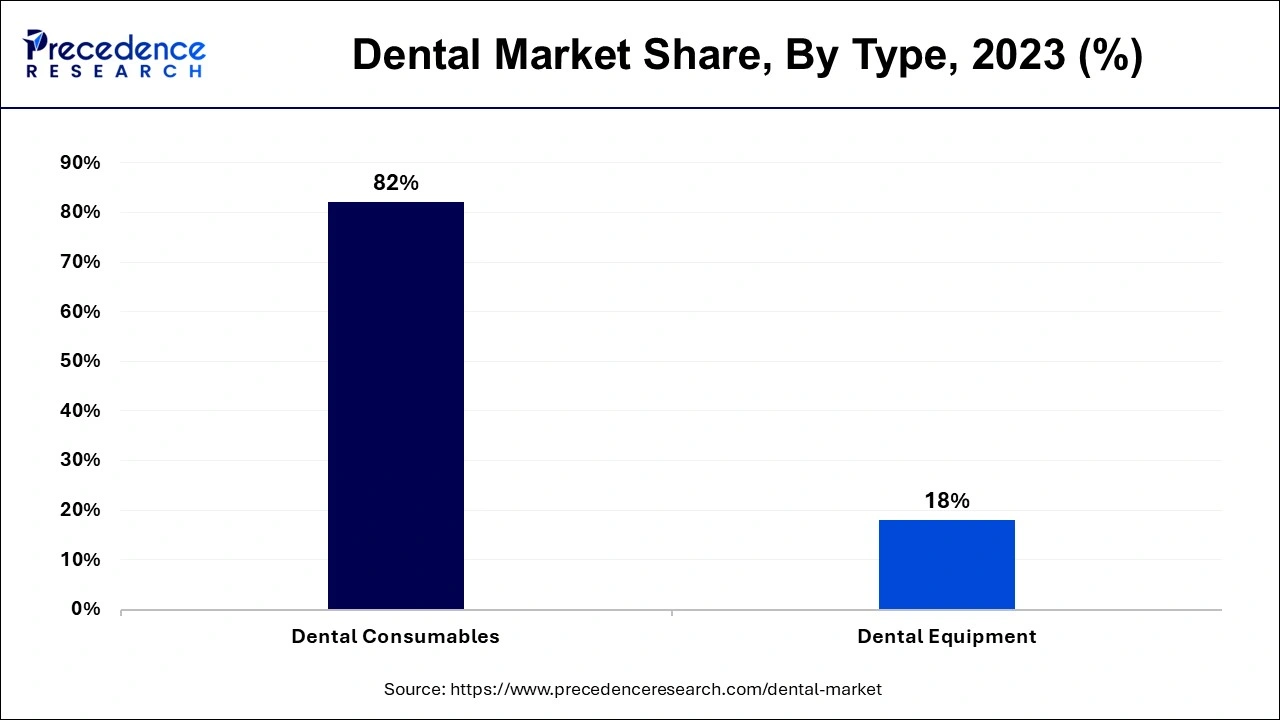

- By product type, the dental consumables segment dominated the market with a 34.60% share in 2024.

- By product type, the dental implants segment is expected to grow at the highest CAGR of 9.80% in 2024.

- By treatment type, the restorative segment led the market by holding 31.20% share in 2024.

- By treatment type, the cosmetic segment is expected to grow at the highest CAGR of 10.20% in 2024.

- By age group, the adult dentistry segment held a 64.30% market share in 2024.

- By age group, the geriatric dentistry segment is expected to grow at the fastest, highest CAGR of 8.70% in 2024.

- By end user, the dental hospitals and clinics segment dominated the market with a 54.80% share in 2024.

- By end user, the DSOs (Dental Service Organizations) segment is expected to grow at the highest CAGR of 10.60% in 2024.

How Does AI Impact the Dental Market?

Artificial intelligence (AI) has been increasingly adopted in the dental market to advance treatments, functionality, and promotional techniques. They also have the capability to identify concerns like cavities, fractures, and tumors, and this makes the work of a dentist easier in diagnosing conditions at early stages, thus increasing patients' outcomes. AI-enhanced image analysis systems have found their place in tools that dentists and other clinicians use to diagnose. AI develops innovative predictive algorithms to help dental practices engage potential patients at precisely the right moment. This artificial intelligence analyzes radiographs, intraoral scans, and three-dimensional images with high precision and efficiency.

- In May 2024, Dexis released the Dexis Ti2 Sensor, a new generation of dental intraoral sensors with higher durability, an AI system for the identification of dental findings, and increased image resolution. It also includes a proactive monitoring solution with Dexis Connect Pro for improved performance and maximum availability.

U.S. Dental Market Size and Growth 2025 to 2034

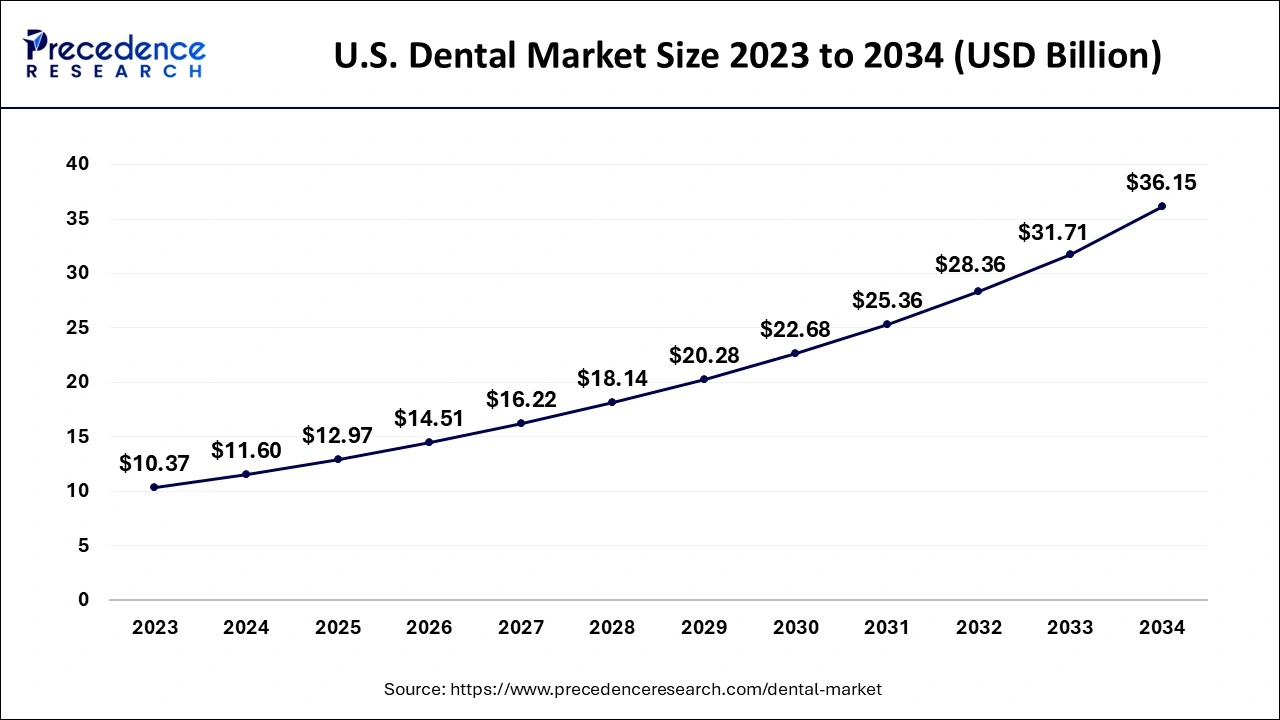

The U.S. dental market size was evaluated at USD 11.60 billion in 2024 and is predicted to reach around USD 36.15 billion by 2034, growing at a CAGR of 12.02% from 2025 to 2034.

North America accounted for the largest share of the dental market in 2024. The North American dental market is categorized by strong growth arising from rising oral health consciousness and rising incidences of oral health diseases. A strong medical infrastructure and a proper reimbursement policy are also playing a significant role and adding significantly to the growth of the market. The increasing aging population and an increasing trend of cosmetic dentistry treatment among people. Currently, there is significant competition among market leaders, and they always engage in marketing, research, and development of new products such as clear aligners and implants.

- According to the statistics in Health Affairs, the spending on dental care in the U.S. is expected to reach more than USD 203.0 billion by 2027 from USD 142.4 billion in 2020.

- According to a Centers for Disease Control and Prevention (CDC) graphical report found that in September 2022, there was a 2.9 % rise in the number of professional dentists per 100000 resident population in the United States.

Asia Pacific is anticipated to witness the fastest growth in the dental market during the forecasted years. Higher healthcare costs, improved dental care needs, and changing demographics of the middle-income population. Countries like China, India, and Japan are gaining the maximum hold with growing investments in the dental industry. The population is becoming more conscious of oral health comprehensively, convoyed by the rising class disbursement resulting in the increasing demand for preventive and aesthetic dental procedures.

- The World Health Organization (WHO) urged Southeast Asian countries to accelerate the application of the Action Plan for Oral Health 2022–2030 on World Oral Health Day in March 2023. The goal of the plan is to achieve universal oral health coverage for all people in the region by 2030.

Market Overview

Dental refers to the care and treatment of the teeth and gums. The dental market is a dynamic and rapidly evolving sector offering a wide variety of goods and services that encompass dental instruments and materials, braces, and professional services, respectively. Computer-aided design/computer-aided manufacturing (CAD/CAM) systems and three-dimensional printing and combining it are remodeling the field, and people are becoming more aware of oral health and are demanding prevention, including cosmetic procedures. It incorporates a variety of practices that involve teeth care, disease prevention, and control of diseases such as caries, periodontal diseases, and tooth loss. Dental care comprises routine procedures like cleanings, fillings, and extractions, as well as more complex treatments such as root canals, crowns, and orthodontics.

Dental Market Growth Factors

- Aging population: The rise in elderly individuals leads to a rise in dental treatments, including restorative and cosmetic procedures.

- Innovations in technology: Digital radiography, additive manufacturing, and laser dentistry are technological advancements in the dental industry.

- Cosmetic dentistry: Growing demand for cosmetic dentistry, driven by the desire for improved aesthetics, has led to a rise in the market for services such as teeth whitening.

- Dental insurance coverage: The general population gains access to better dental insurance policies, and the coverage for dental services is rising.

- Expanding dental practices: The expansion of dental chains and clinics is a positive trend to drive the dental market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 121.22 Billion |

| Market Size in 2025 | USD 44.35 Billion |

| Market Size in 2024 | USD 39.66 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11..82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Drivers

Rising prevalence of oral diseases

In the dental market, the increase in oral health problems like periodontal diseases, tooth decay, and malocclusion has increased tremendously and has thereby increased the purchase and demand for a variety of prosthetics, implants, and intraoral scanners.

- As per the World Health Organization (WHO), the global prevalence of severe periodontal diseases was predicted to be 19% in the adult population in 2020, representing over 1 billion cases across the globe.

- According to the WHO Global Oral Health Status Report released in November 2022, approximately 3.5 billion people worldwide are affected by oral diseases, with nearly 75% of them residing in middle-income countries.

Restraint

The expensive treatment and low wages may significantly limit development of the dental market, mainly in developing states. The high cost leads to delays and even the exclusion of treatments, which provisions the use of other consumables up to an acceptable quantity. Some specific discovery and treatment procedures are costly for many patients in the lower end of the socio-economy. Thus, cost relevance remains a significant barrier to getting dental assistance for a considerable portion of the population.

Opportunity

Increased requirement for cosmetic dentistry

Cosmetic dentistry, recognized as aesthetic dentistry, is a branch of dentistry that focuses on the appearance of the mouth, teeth, and gums. Cosmetic dentistry has come a long way over the years; new dental materials have improved the outcome. Compliance with treatment plans has improved due to the increasing trends in conventional systems and uptake in aesthetic surgery due to higher disposable income and improved aesthetic dental demands. This has been realized across all ages of consumers owing to the predicted aesthetic daily products.

- In August 2021, reported in West Hollywood Holistic Dental Care in an article, the trend indicated that about 15 million people in the U.S. alone had bridge or crown placement procedures done in 2020.

Type Insights

The dental consumables segment dominated the market with a 34.60% share in 2024. The consumables in dental practice contain a wide range of instruments, products, materials, medicaments, and chemicals. In this broad category of consumables, the purpose differs according to the procedure and specialization of dentistry. The consumables are crucial in handling any dental complications, reconstructing teeth, and enhancing the gum tissues. Some of them are used to manage some of the conditions affecting dentition. The global dental consumables market is expected to expand due to dental tourism, especially in the growing markets, and consumers' willingness to spend more on aesthetic dentistry.

- In February 2022, Bausch Health Companies Inc.'s oral health care business, OraPharma, declared the U.S. launch of its OraFit custom clear aligner system for malocclusion correction.

The dental implants segment is expected to grow at the highest CAGR of 9.80% in 2024. The growth of the segment can be attributed to the increasing incidence of dental disorders and innovations in dental technology. Also, dental implants are increasingly used for their aesthetic benefits, because they can enhance facial appearance and restore a natural-looking smile.

Treatment Type Insights

The restorative segment led the market by holding 31.20% share in 2024. The dominance of the segment can be credited to the surge in the aging population, rising incidence of dental disorders, and increasing concerns regarding oral health. Furthermore, growing dental tourism and enhanced access to dental care in developing economies are contributing to the segment expansion further.

The cosmetic segment is expected to grow at the highest CAGR of 10.20% in 2024. The growth of the segment can be linked to the increasing awareness of the connection between oral aesthetics and self-esteem, along with the impact of social media. Moreover, innovations in techniques and materials have led to more minimally invasive cosmetic dental procedures.

Age Group Insights

The adult dentistry segment held a 64.30% market share in 2024. The dominance of the segment can be driven by rising rates of dental diseases, innovations in dental technology, and a surge in awareness of oral hygiene. In addition, a rise in disposable incomes enables people to invest in dental care and cosmetic procedures.

The geriatric dentistry segment is expected to grow at the fastest CAGR of 8.70% in 2024. The growth of the segment is owing to the increasing trend of cosmetic dentistry, such as aligners and teeth whitening, along with the advancements in dental technology, such as restorative materials, implants, and diagnostic tools, which are enhancing the effectiveness and efficiency of treatments for the elderly population.

End-user Insights

The dental hospitals and clinics segment dominated the market with a 54.80% share in 2024. The dominance of the segment is due to the increasing incidence of dental disorders, rising awareness of oral hygiene, and innovations in dental technology. Furthermore, increasing dental tourism, where individuals travel to various countries for more affordable or specialized dental care, is impacting positive segment growth soon.

The DSOs (Dental Service Organizations) segment is expected to grow at the highest CAGR of 10.60% in 2024. A dental support organization DSO is a legal entity that coordinates the non-clinical operations of a dental office, whereas a dental group practice is a practice with more than one location or more than one dentist on the team. Dental group practice can become a DSO if it accredits some of its support functions in one place. DSOs are on the rise because they offer business-critical services to many dental practices. DSOs comprise companies that offer nonclinical support services like marketing and operations, and connect affiliated dental practices.

Dental Market Companies

- 3M (U.S.)

- Institut Straumann AG (Switzerland)

- Henry Schein, Inc. (U.S.)

- Angelalign Technology Inc. (China)

- SHOFU INC. (Japan)

- Dentsply Sirona (U.S.)

- Align Technology, Inc. (U.S.)

- Zimmer Biomet (U.S.)

- Coltene (Switzerland)

- BIOLASE, Inc. (U.S.)

- ENVISTA HOLDINGS CORPORATION (U.S.)

- VATECH (South Korea)

Recent Developments

- In January 2024, iADH signed a four-year strategic partnership agreement with Dentsply Sirona to promote access to oral care for persons with disability.

- In January 2024, Align Technology, Inc. unveiled the iTero Lumina intraoral scanner that offers a 3X wider field of capture in a significantly smaller and lighter iTero Wand for improved scanning performance with increased scan rate, resolution, precision, and patient comfort.

- In October 2023, ZimVie Inc. presented a new group of products called Azure Multi-Platform Product Solutions, which will become a line of restorative components to meet the market needs effectively.

- In April 2023, Biotech Dental S.A.S was acquired by a majority stake by Henry Schein, Inc. to strengthen its digital dental offering with an integrated planning and diagnostic planning solution.

- In March 2023, Institut Straumann AG announced the launch of a new software application for the Virtuo Vivo intraoral scanner in order to enhance the efficiency and precision of digital impressions.

- In August 2022, Envista Holdings Corporation expanded its business with DSO, dentalcorp Holdings Ltd., to provide more dental implants in Canada by leveraging Dentalcorp Holdings Ltd.

Segments Covered in the Report

By Type

- Dental Consumables

- Dental Restoration

- Fillings (direct restoratives)

- Crowns and bridges (indirect restoratives)

- Inlays and onlays

- Dental bonding agents

- Dental impression materials

- Orthodontics

- Brackets

- Archwires

- Anchorage appliances

- Ligatures

- Endodontics

- Root canal files

- Obturators

- Sealers

- Periodontics

- Dental scalers and curettes

- Regenerative materials

- Irrigation solutions

- Prosthodontics

- Denture bases and teeth

- Temporary prosthetic materials

- Infection Control Products

- Disinfectants

- Gloves, masks, and gowns

- Surface barriers

- Dental Equipment

- Diagnostic Equipment

- Digital X-ray systems

- Cone-beam computed tomography (CBCT)

- Intraoral scanners

- Cameras and imaging software

- Therapeutic Equipment

- Dental lasers

- Electrosurgical units

- Air abrasion systems

- General Equipment

- Dental chairs and units

- Compressors and vacuums

- Light-curing equipment

- CAD/CAM systems

- Handpieces

- Hygiene Maintenance Devices

- Sterilizers

- Ultrasonic cleaners

- Waterline cleaning systems

- Dental Materials

- Filling Materials

- Impression Materials

- Cements and Bonding Agents

- Dental Implants

- Dental Software

- Practice Management Software

- Diagnostic Software

- CAD/CAM Systems

By Treatment Type:

- Preventive

- Cleanings

- Fluoride treatment

- Sealants

- Others

- Restorative

- Periodontics

- Endodontics

- Cosmetic

- Teeth whitening

- Veneers

- Cosmetic bonding

- Others

- Others

By Age Group

- Paediatric Dentistry

- Adult Dentistry

- Geriatric Dentistry

By End-user

- Dental Hospitals and Clinics

- Dental Laboratories

- Academic and Research Institutes

- DSOs (Dental Service Organizations)

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting