January 2025

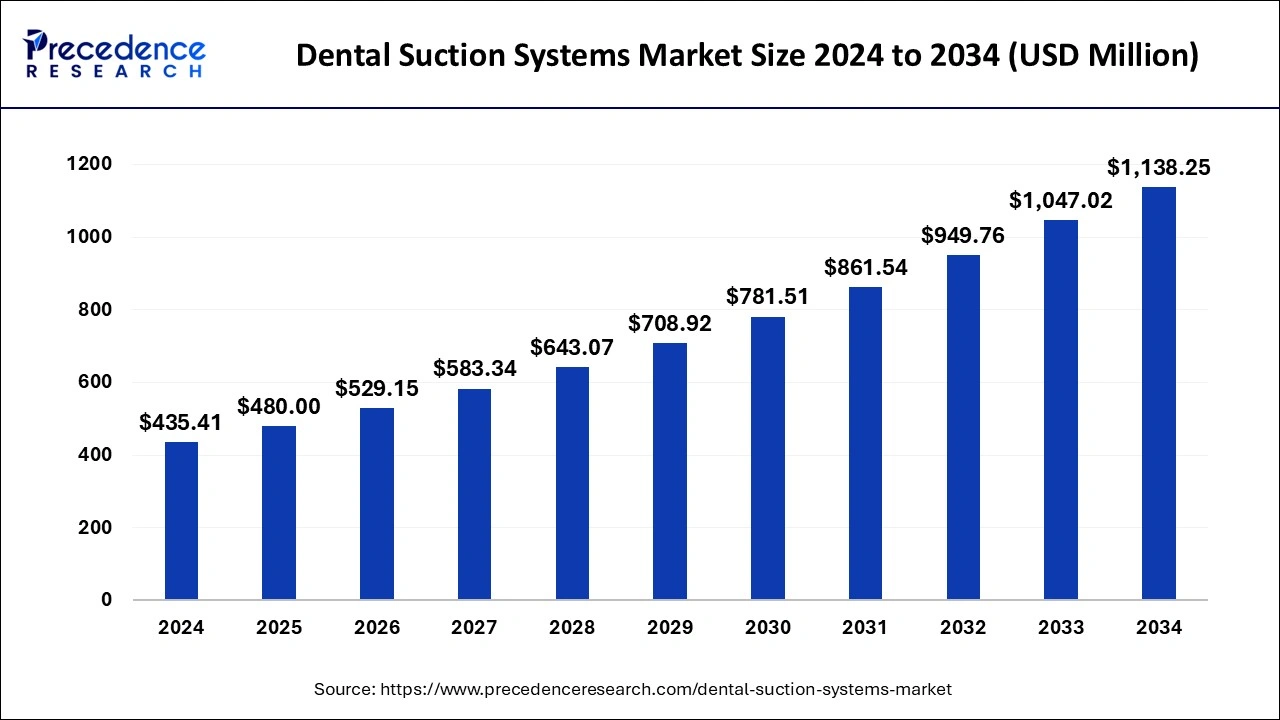

The global dental suction systems market size is calculated at USD 480 million in 2025 and is forecasted to reach around USD 1,138.25 million by 2034, accelerating at a CAGR of 10.09% from 2025 to 2034. The North America market size surpassed USD 178.52 million in 2024 and is expanding at a CAGR of 10.12% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental suction systems market size accounted for USD 435.41 million in 2024 and is predicted to increase from USD 480 million in 2025 to approximately USD 1,138.25 million by 2034, expanding at a CAGR of 10.09% from 2025 to 2034. Newer and more advanced dental suction systems have been developed as a result of ongoing technical breakthroughs. The dental suction systems market is growing because of these systems' increased dependability, comfort for patients, and performance.

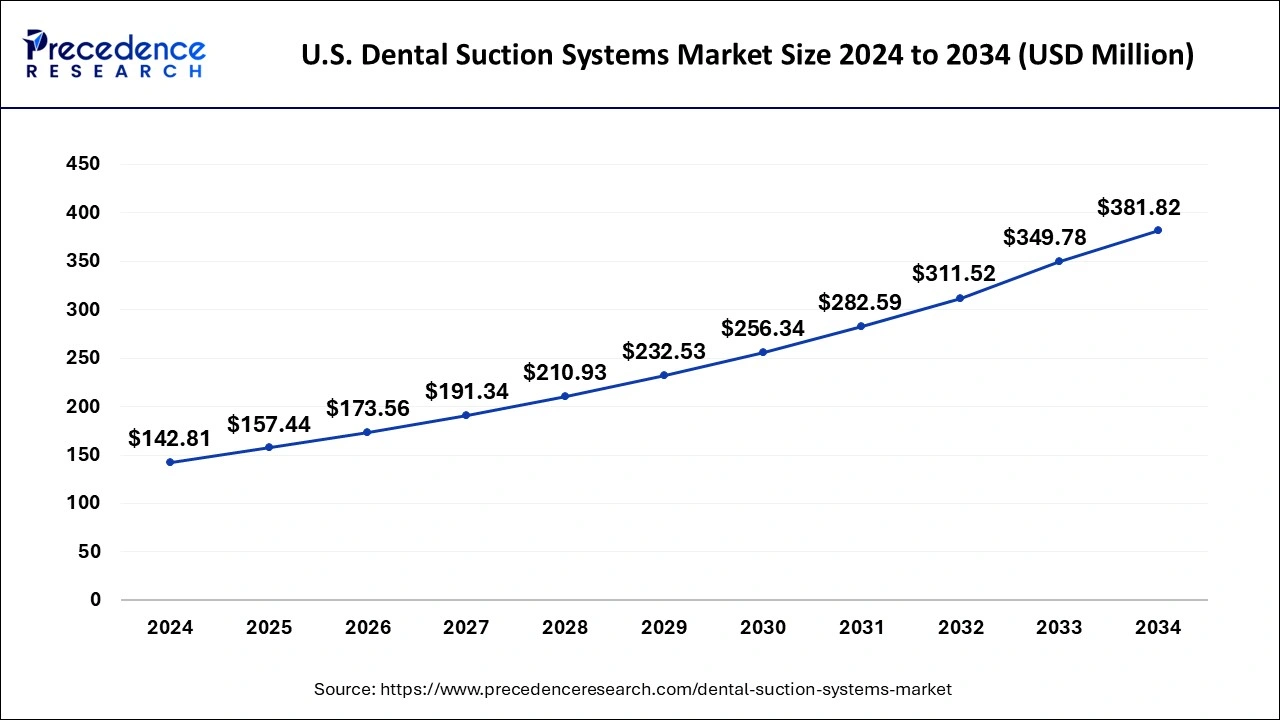

The U.S. dental suction systems market size was exhibited at USD 142.81 million in 2024 and is projected to be worth around USD 381.82 million by 2034, growing at a CAGR of 10.33% from 2025 to 2034.

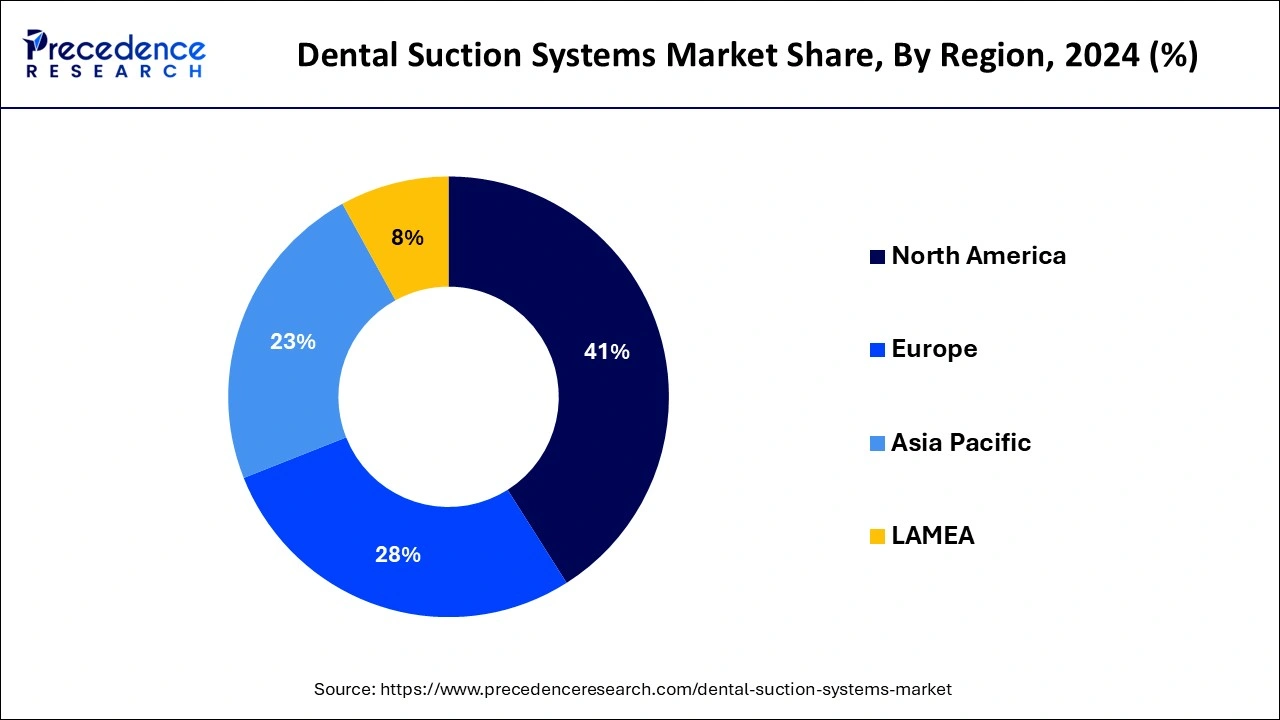

North America holds the largest share of the global dental suction systems market. In America, the market for dental suction systems has been steadily expanding. Dental suction systems are vital pieces of equipment at dental offices because they are used to extract blood, saliva, and other particles from patients' mouths while they are having dental work done. The market in North America is driven by a number of reasons, including the rising incidence of dental disorders, the need for cosmetic dentistry, improvements in dental equipment technology, and rising oral health awareness. Due to their affordability and ease of use, portable and compact dental suction devices have become more and more popular, particularly in mobile dentistry units and smaller dental clinics. These systems are adaptable and simple to use, which makes them appropriate for a variety of dental environments.

Asia Pacific is expected to be the fastest-growing dental suction systems market during the forecast period. Asia Pacific's population is becoming more conscious of the value of maintaining good oral hygiene, which is driving up demand for dental services and supplies, such as suction systems. Significant technological breakthroughs have been made in the dentistry business, including suction systems. For example, quieter and more effective suction systems have been developed, which appeal to both dental professionals and patients. A growing middle class with disposable income has been created by economic expansion and urbanization in nations like China and India. This has raised expenditures on dental treatments and equipment as well as other healthcare-related expenses. Several countries in the area have put plans into place to increase people's access to dental care and other healthcare services.

The growing elderly population, rising incidence of dental problems, growing awareness of oral hygiene, and technological improvements in dentistry have all contributed to the market's steady growth. Considerable technological progress has been made in the dental equipment market, including the creation of small and effective suction systems, the incorporation of automation and digitalization, and the launch of noiseless and portable suction units. The COVID-19 pandemic's effects on dental practices, the high upfront costs of sophisticated systems, the lack of access to dental care in underprivileged and rural areas, and other obstacles confront the dental suction systems market despite its promising future.

The dental suction systems market is anticipated to continue growing in the years to come due to a number of factors, including rising dental care costs, a rise in the use of cutting-edge dental technology, an increase in dental tourism, and the development of dental infrastructure in emerging nations. Considerable technological progress has been made in the dental suction systems market, including the creation of small and effective suction systems, the incorporation of automation and digitalization, and the launch of noiseless and portable suction units.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.09% |

| Market Size in 2025 | USD 480 Million |

| Market Size in 2024 | USD 435.41 Million |

| Market Size by 2034 | USD 1,138.25 Million |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased dental health awareness

It is true that increased awareness of dental health has prompted developments in a number of dental care areas, including the development of dental suction systems. Because these systems are so good at eliminating blood, saliva, and other detritus from the mouth cavity, they are essential in keeping the environment clean and productive during dental treatments. Dental suction systems with outstanding performance, dependability, and ergonomic design are in greater demand as awareness of the significance of infection control and patient safety grows. In order to provide the best possible infection control and patient comfort, manufacturers are adapting to this need by introducing cutting-edge features, including stronger suction, ergonomic handpieces, quieter operation, and better filtering systems.

Energy consumption

An important component of dental practice management and sustainability initiatives is the energy consumption of dental suction systems. Dental suction systems are essential parts of dental offices because they keep the dentist's workspace fresh and clean by sucking away blood, saliva, and debris from patients' mouths while they are having treatments done. Variable speed motors and automatic on/off features are common in modern suction systems; these features optimize energy consumption dependent on demand. Systems with higher efficiency levels typically use less energy overall. Energy usage is influenced by the dental clinic's size and the number of patients it treats each day. Greater suction system power may be needed in larger clinics with heavier patient loads, which could lead to higher energy consumption.

Growing dental tourism

Patients who travel abroad for dental treatment frequently do it in order to receive it for less money than they would back home. In the nations where dental tourism is popular, there is a growing need for dental care. Patients who travel for dental care may have high standards for the caliber of care they receive. In order to be competitive in the dental tourism industry, dental clinics must make sure that their equipment is up to date and that they provide high-quality treatments. In order to draw in patients from abroad, dentist offices are compelled by the dental tourism sector to keep up with the most recent developments in dental technology. Purchasing cutting-edge dental tools, including suction systems, that provide better functionality, dependability, and patient comfort is one way to do this.

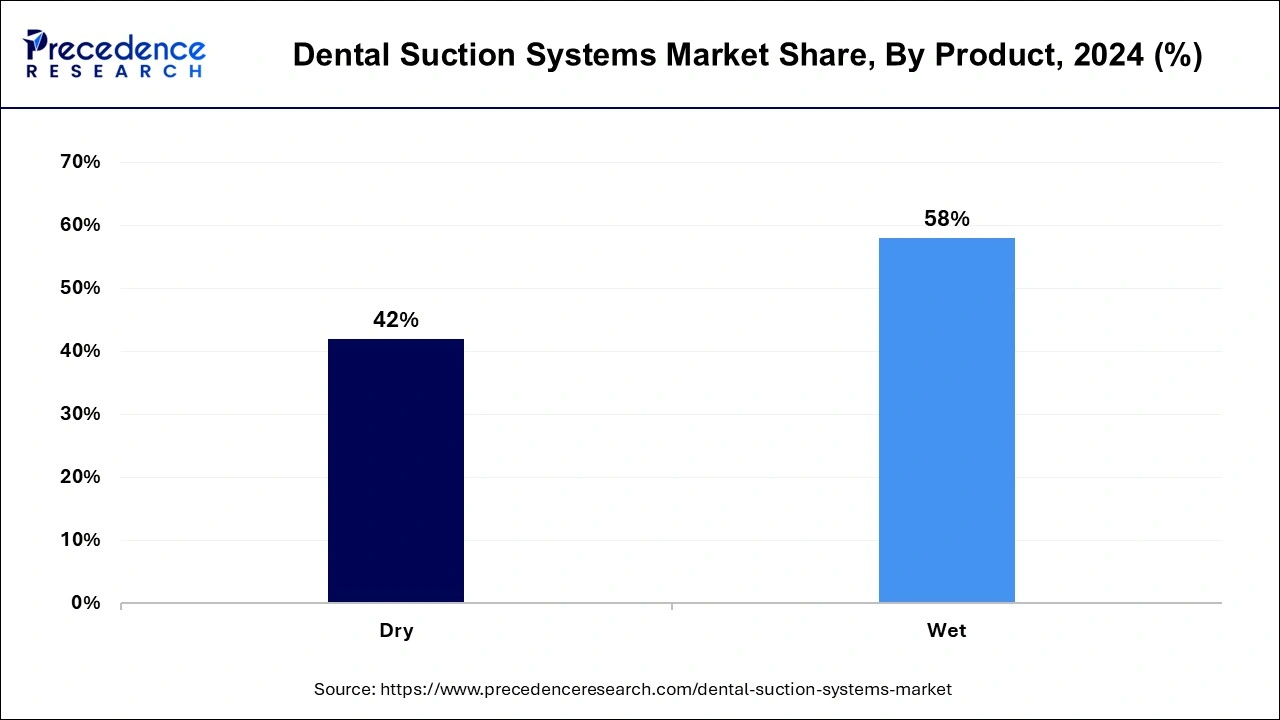

The wet suction segment holds the largest share of the dental suction systems market. A suction unit, hoses, and suction tips or nozzles are the standard components of wet suction systems. They work by creating suction through the flow of water or other liquids, which effectively removes dirt and fluids from the oral cavity. These devices are frequently utilized in dental clinics and offices to give the dentist a good field of vision and to guarantee the comfort of the patient throughout treatments. During dental operations, wet suction devices can effectively remove fluids such as blood, saliva, and other materials from the patient's mouth, improving visibility and control. By effectively eliminating impurities from the oral cavity, these systems contribute to the maintenance of a sanitary and clean atmosphere in the dental office.

The dry segment is expected to grow the fastest in the dental suction systems market during the forecast period. A suction system that does not require water could be referred to as a "dry product" in the dental suction systems market. These devices, which are frequently referred to as "dry vacuum systems," create suction without the need for water by using air compression or other techniques. They are frequently utilized in dental offices when water-based systems might not be appropriate or if there is a shortage of water. Dry vacuum systems have benefits such as lower maintenance needs and the removal of water-related problems like bacterial development and pollution. Additionally, because they don't require water usage or disposal, they are more environmentally friendly.

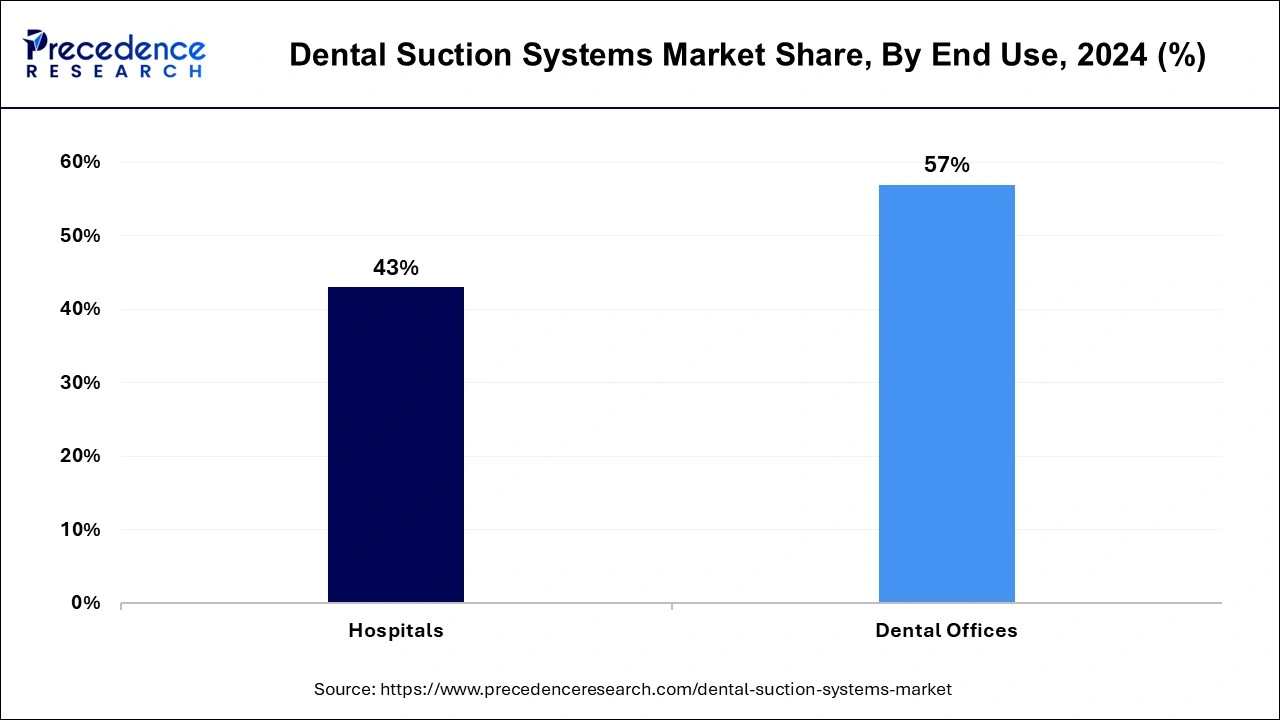

The dental offices segment dominated the dental suction systems market in 2024. Since dental offices are the main consumers of dental suction systems, they hold a significant market share in this industry. Dental suction systems, sometimes referred to as dental vacuum systems or dental suction units, are crucial pieces of equipment in dental offices that help keep the area dry and clean while performing a variety of dental operations. Dental offices create demand for dental suction systems by needing them to carry out a number of functions, including keeping the dentist's field of vision clear, removing saliva and debris during treatments, and ensuring patient comfort. Dental offices are adopting new dental suction technologies ahead of time. Dental offices invest in cutting-edge suction systems that provide better performance, efficiency, and infection control features as the dental industry develops.

The hospital segment is expected to grow rapidly in the dental suction systems market during the forecast period. Dental clinics and departments are common at hospitals, where a range of dental procedures are carried out. By eliminating blood, saliva, and debris from the oral cavity, dental suction systems help to ensure a clean and safe environment for these treatments, improving patient care and reducing the risk of infection. By offering effective suction and waste management systems to stop the spread of infections, dental suction systems assist hospitals in adhering to these laws. Advanced dental operations like maxillofacial surgeries, dental implants, and oral surgeries are often performed in hospitals. Hospitals offer emergency dental care for patients experiencing dental emergencies such as acute toothaches, face damage, or dental infections.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023