June 2025

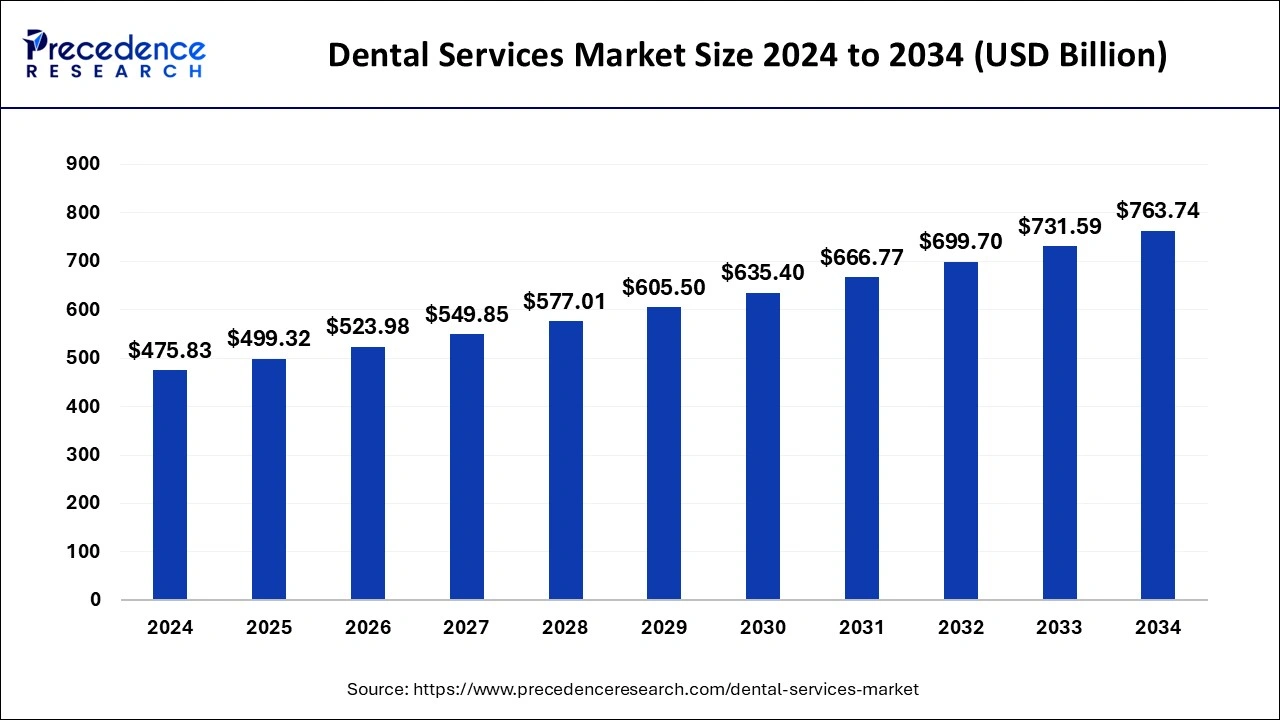

The global dental services market size accounted for USD 475.83 billion in 2024 and is expected to exceed around USD 763.74 billion by 2034, growing at a CAGR of 4.85% from 2025 to 2034.

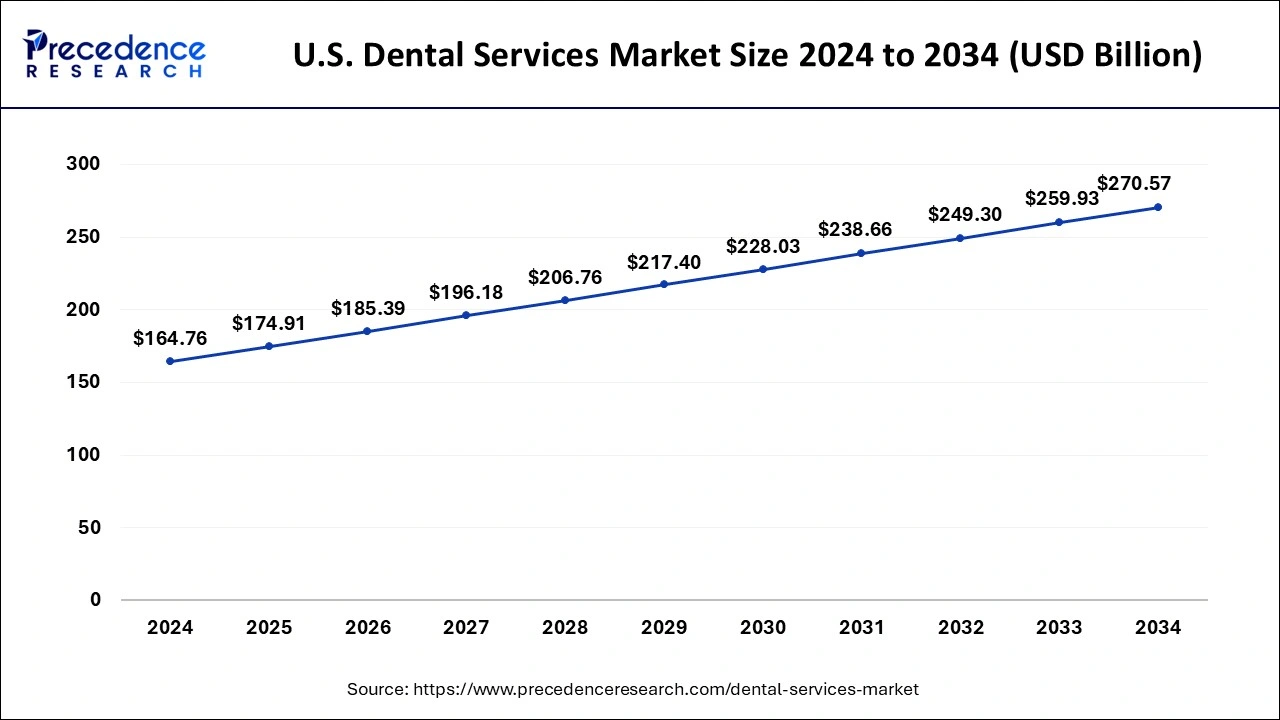

The U.S. dental services market size was exhibited at USD 164.76 billion in 2024 and is projected to be worth around USD 270.57 billion by 2034, growing at a CAGR of 5.09% from 2025 to 2034.

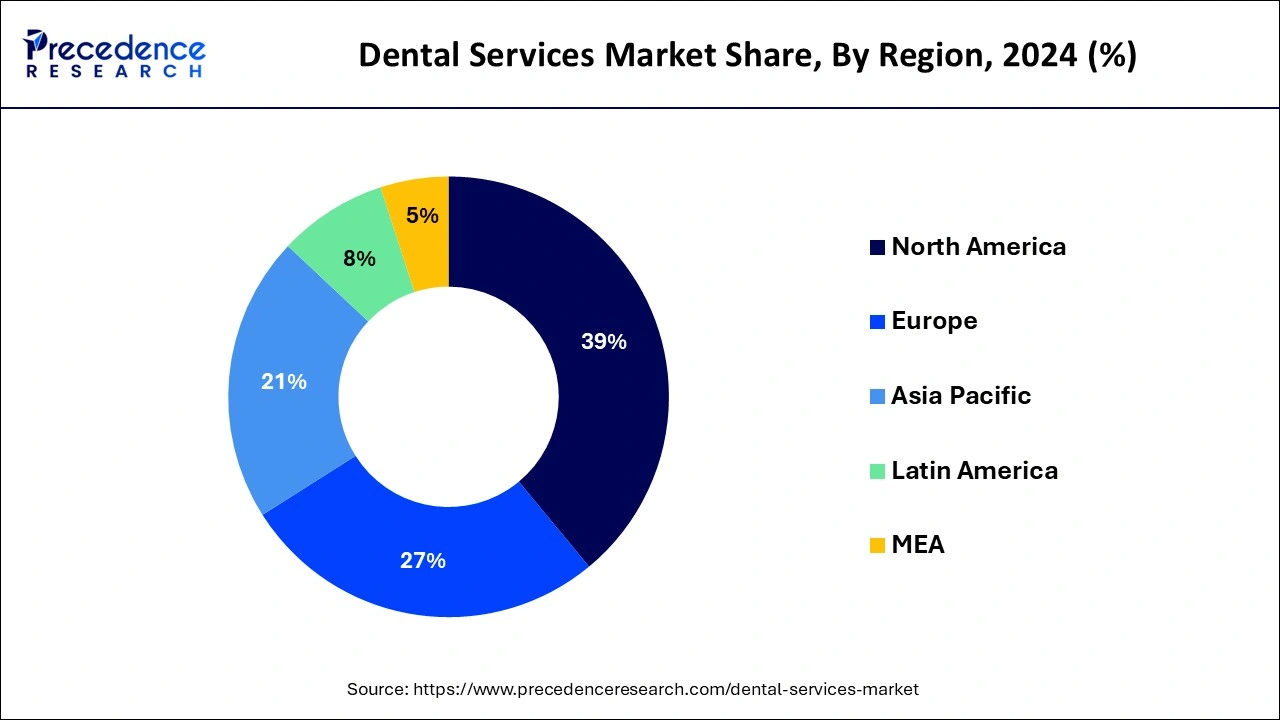

Based on the region, the North America dominated the global dental services market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. North America was followed by Asia Pacific and Europe. According to CDC, around 64.9% of the US adults had a dental visit in 2018 and around 85.9% of the children aged 2 to 17 years had a dental visit. The increased awareness regarding oral problems, high disposable income, increased cases of dental caries, and faster adoption of new technologies has significantly fostered the growth of the dental services market in North America. Moreover, developed healthcare infrastructure and the presence of numerous market players and dental support organizations have exponential contributions in the market growth.

On the other hand, Africa is estimated to be the most opportunistic market during the forecast period. The rising personal disposable income, growing oral health awareness among population, growing government expenditure on healthcare infrastructure development, and rising investments by the key market players in the region are providing lucrative growth opportunities to the players operating in the dental services market in Africa.

The growing prevalence of dental caries and other oral diseases among the global population is driving the demand for the dental services across the globe. According to the data published by the FDI World Dental Federation, in 2015, around 3.5 billion people were suffering from some kind of oral diseases across the globe. The most common oral health condition was the untreated decay of permanent teeth. The various other factors that drives the market includes the rising popularity of dental tourism, increasing demand for the cosmetic dentistry, growing dental implants, and technological advancements in dental services.

The growing awareness regarding oral health among the population, rising disposable income, and rising investments in developing healthcare infrastructure are the key factors responsible for the growth of the dental services market globally. The surging importance of dental support organizations is playing an important role in altering the delivery model of the dental services. The growth of various dental support organizations has significantly fostered the in-house dental services. Dental support organizations are centers that make contracts with the dental service providers and offers management services to provide non-clinical dental services to the consumers. According to the American Dental Association, around 16.3% of the dentists of US were partnered with dental support organizations in 2017. The introduction of invisible teeth braces or aligners have gained rapid traction among the consumers. Moreover, the growing concerns among the young population regarding their aesthetic appearances have encouraged the growth of the global dental services market.

| Report Highlights | Details |

| Market Size by 2025 | USD 499.32 billion |

| Market Size in 2034 | USD 763.74 billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.85% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segments Covered | Procedure Type, Service Type, and End User Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing Dental Awareness is driving the dental service market

Oral health tends to be neglected, even though approximately 3.5 billion individuals are currently dealing with oral diseases. Even though there are established methods for prevention, cavities persist as the most widespread chronic ailment among both adults and children, affecting an estimated 2.3 billion individuals. Periodontal disease is one of the most prevalent health issues worldwide, with severe gum diseases, potentially leading to tooth loss, impacting 10% of the global population. The level of public awareness and education about dental health and its importance has a significant impact on the demand for dental services. For instance, a nationwide campaign promoting the benefits of regular dental check-ups, proper oral hygiene practices, and the prevention of common dental issues like cavities and gum disease can lead to increased interest and utilization of dental services. Such campaigns include public service announcements, school programs, and community events focused on oral health. Campaigns such as National Smile Month by the Oral Health Foundation, Dental Care Awareness Month, World Health Day, and World Oral Health Day have resulted in an increased number of regular checkups and halitosis patients in 70% of the clinics belonging to the Dental Association A study published in the International Journal of Paediatric Dentistry found that the frequency of toothbrushing, use of dental services, and self-perceived need for dental treatment significantly decreased among adolescents during the COVID-19 pandemic but 70% of respondents visited the dentist more frequently compared to pre-Covid times due to the awareness campaigns.

The market for dental services is significantly restrained by uneven access to Care. Dental care is not sufficiently accessible in many areas, particularly in rural and underprivileged communities. This leads to differences in oral health outcomes, with certain populations receiving insufficient dental treatment due to a lack of dental facilities. Financial obstacles, geographic restrictions, and a lack of dental specialists in some places are all contributing factors to unequal access, which prevents people from getting timely and necessary dental care. For instance, nearly 80% of the Indian Population is dealing with Oral problems. There is an inadequate workforce. About 2.7 lakh dentists are responsible to cater 1.39 billion Indians. Which creates a huge gap in providing primary dental services. Moreover, the availability of dentists in rural areas in India is highly inconsistent. Owing to a lack of dental awareness and a shortage of government jobs, most dentists reside in urban India. This magnified the dental care problems of around 70% of the Indian Population. Lack of awareness, economic restrictions, and psychological and social barriers are the factors restraining the Indian Oral care facilities.

Teledensitry has gained considerable momentum leading to the growth of the dental services market. Teledensitry uses digital technology to deliver follow-up treatment and dental consultations remotely. The ability of teledentistry to increase accessibility, improve convenience, and allow for remote monitoring of oral health concerns is expected to drive growth. This possibility is expected to develop further due to the COVID-19 pandemic's acceleration of telemedicine adoption. Dental clinics take advantage of Teledentistry by investing in technology, advertising their services, making sure privacy laws are followed, providing flexible hours, and working with insurance companies to reach a larger patient base. Implementing Teledentistry promotes treatments that are advanced and patient-focused, addressing changing demands in the medical field.

How did the non-dentistry segment dominate the dental services market in 2024?

The non-cosmetic dentistry segment dominated the global dental services market with a remarkable revenue share in 2023 and is anticipated to retain its dominance throughout the forecast period. This is due to the rising prevalence of dental caries among the population. According to the FDI World Dental Federation, around 2.3 billion people were suffering from tooth decay of permanent teeth in 2015. Hence, it is the most common dental issue, and the non-cosmetic dentistry segment deals with the fixation of this issue. The rising cases increase the demand and drive the growth.

The cosmetic dentistry is estimated to be the most opportunistic segment during the forecast period. This is attributed to the growing aesthetic concerns among the young population. Cosmetic dentistry deals with various dental issues such as teeth whitening, bonding, contouring, and veneers.

Which segment of service type dominated the dental services market in 2024?

The oral surgery segment hit a remarkable revenue share in 2024 and is expected to retain its dominance throughout the forecast period. This is because most of the oral and dental problems, such as dental exams, crowns, fillings, and root canals, are taken care of by the general dentists. Also, easy accessibility of general dentists drives the growth of the market.

The orthodontics & prosthodontics are expected to be the most opportunistic segment owing to the technological advancements and development of affordable and latest technology such as digital photography, digital intra oral scanners, and computer-aided-design and computer-aided-manufacturing of dental products. These technological advancements are driving the growth of this segment.

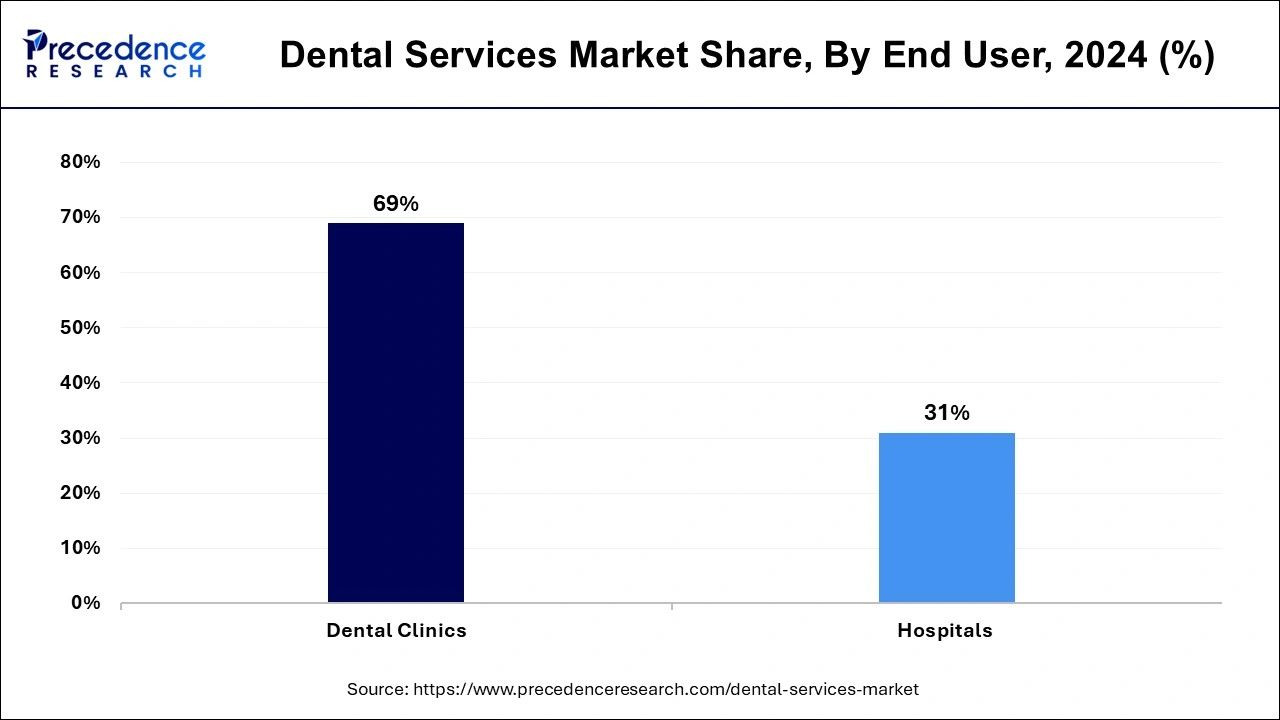

How did dental clinics' segment dominate the dental services market in 2024?

The dental clinics segment led the global dental services market with a remarkable revenue share in 2024 and is expected to retain its dominance throughout the forecast period. This is due to the specialized dental services provided by the dental clinics and the ease and convenience offered to the patients due to the easy accessibility of dental clinics

The hospitals segment is estimated to be the fastest-growing segment due to the growing investments by the government to develop sophisticated healthcare infrastructure.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved services. Moreover, they are also focusing on maintaining competitive pricing.

Recent developments and advancements in the dental services market such as introduction of invisible braces and tray system, laser dentistry techniques, advanced digital X-Ray technology, innovative tooth repair materials, and instant teeth whitening procedures will help the market growth in the forthcoming years.

By Procedure

By Service

By Gender

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2025

May 2025

October 2023

June 2025