January 2025

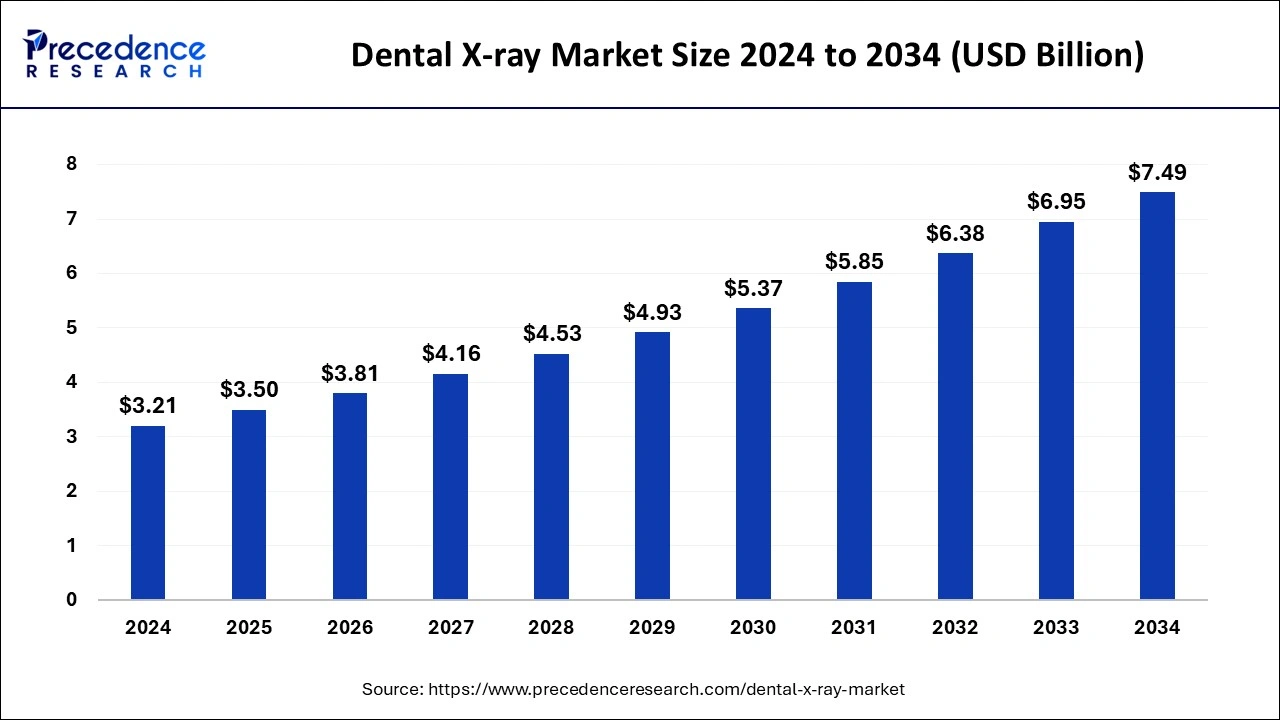

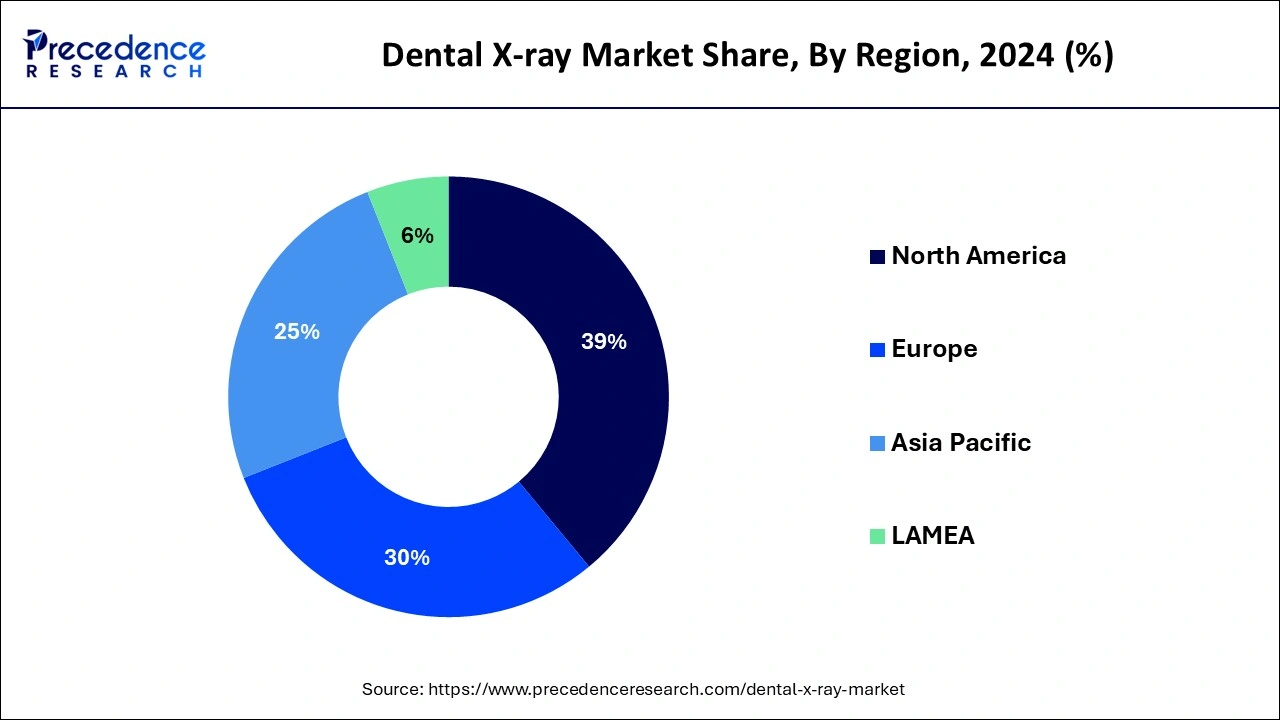

The global dental X-ray market size is calculated at USD 3.50 billion in 2025 and is forecasted to reach around USD 7.49 billion by 2034, accelerating at a CAGR of 8.84% from 2025 to 2034. The North America dental X-ray market size surpassed USD 1.25 billion in 2024 and is expanding at a CAGR of 8.85% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global dental X-ray market size was estimated at USD 3.21 billion in 2024 and is predicted to increase from USD 3.50 billion in 2025 to approximately USD 7.49 billion by 2034, expanding at a CAGR of 8.84% from 2025 to 2034.

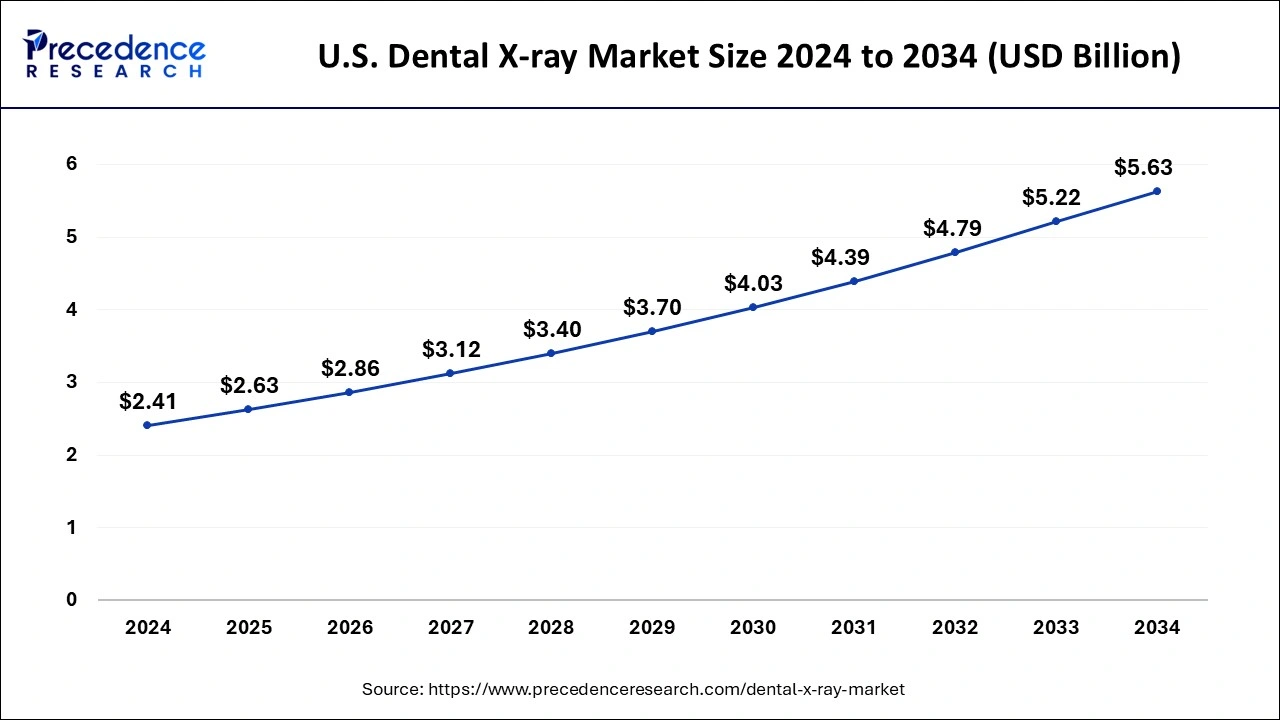

The U.S. dental X-ray market size was estimated at USD 2.41 billion in 2024 and is predicted to be worth around USD 5.63 billion by 2034, at a CAGR of 8.86% from 2025 to 2034.

North America had its largest Market share in 2024 in the dental X-ray market and observed to sustain the position throughout the predicted timeframe. In North America, there has been a noticeable change toward a higher emphasis and knowledge of oral health in the last several years. Increased awareness campaigns, educational activities, and the proactive efforts of healthcare professionals have resulted in a better understanding of the significance of routine dental checkups and the early detection of dental disorders. Due to this increased awareness, there is a greater need for dental X-ray services for preventive and diagnostic reasons.

Due to well-established healthcare reimbursement systems, dental X-ray techniques are becoming more widely used in North America. Dental imaging services are made more accessible and inexpensive for patients by insurance coverage and payment rules, which promote increased utilization rates among patients and healthcare providers.

Asia-Pacific is the fastest growing dental X-ray market during the forecast period. The region is seeing an increase in the prevalence of dental ailments such as cavities, gum disease, and oral cancer due to changing lifestyle patterns and expanding population. Due to the need for early detection and treatment planning, there is a greater need for diagnostic instruments such as dental X-rays. The public is now more conscious of the value of preventive dental care and oral health. Governments, healthcare organizations, and dental practitioners extensively promote oral hygiene habits and routine dental checkups. Due to greater knowledge, there is a greater need for dental X-rays for diagnostic and routine exams.

The dental X-ray market offers services and solutions associated with low-level radiation imaging used to detect oral problems. Dental infections can spread to the surrounding tissues from their source in the tooth or the structures supporting it. The infection comes from periodontal pockets, necrotic pulp, or pericoronitis when face structures are affected. Infections of the teeth have always been widespread and were among the leading causes of death several centuries ago. Even though they are usually preventable, oral diseases are a significant health burden in many nations and can cause pain, discomfort, disfigurement, and even death in some instances.

According to estimates from the WHO Global Oral Health Report 2022, oral illnesses afflict around 3.5 billion people globally, with middle-income nations accounting for three out of every four cases. 514 million children globally suffer from primary tooth caries, and an estimated 2 billion adults worldwide suffer from caries of permanent teeth.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.84% |

| Global Market Size in 2025 | USD 3.50 Billion |

| Global Market Size by 2034 | USD 7.49 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Voltage, By Class, By Material and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing emphasis on preventive dental care

Dental treatment now takes a proactive stance, emphasizing early identification and prevention rather than just addressing current problems. Dentists are increasingly in favor of routine examinations and screenings to spot oral issues early on. Dental X-rays are essential to this preventative paradigm because they allow dentists to identify problems before they worsen, such as cavities, gum disease, and oral cancer. Thereby, the rising emphasis on preventive dental care is observed to act as a driver for the dental X-ray market

Difficulties in obtaining high-quality images

During X-rays, even small patient movements can cause image blur, hiding essential features of the teeth and bone structures. This may lengthen the process, require repeats, and expose patients to more radiation. The resolution and size of the sensor might also affect the quality. Smaller sensors might not capture all relevant regions, while lower-resolution sensors might miss minute features. A good camera requires good technique and equipment expertise to produce high-quality photographs. Dental practitioners may make mistakes that lower the quality of their images due to inadequate training. Poor image quality might cause inaccurate diagnosis, which can cause treatment delays and possibly exacerbate dental issues.

Adoption of tele-dentistry

Access to dental care is made more accessible with the help of tele-dentistry, especially in isolated or rural locations where dental clinics may be few. Dental experts may diagnose oral health problems remotely, offer consultations, and even walk patients through self-care procedures using digital X-ray technology. By reaching a wider audience, dental treatment becomes more accessible overall, which promotes early intervention and better patient results. Dental experts may collaborate seamlessly thanks to tele-dentistry regardless of their geographical location.

Dentists may quickly communicate patient data with specialists for referrals or second opinions via secure digital platforms, including X-ray images. This real-time collaboration guarantees that patients receive knowledgeable and timely guidance from interdisciplinary teams, improving care quality.

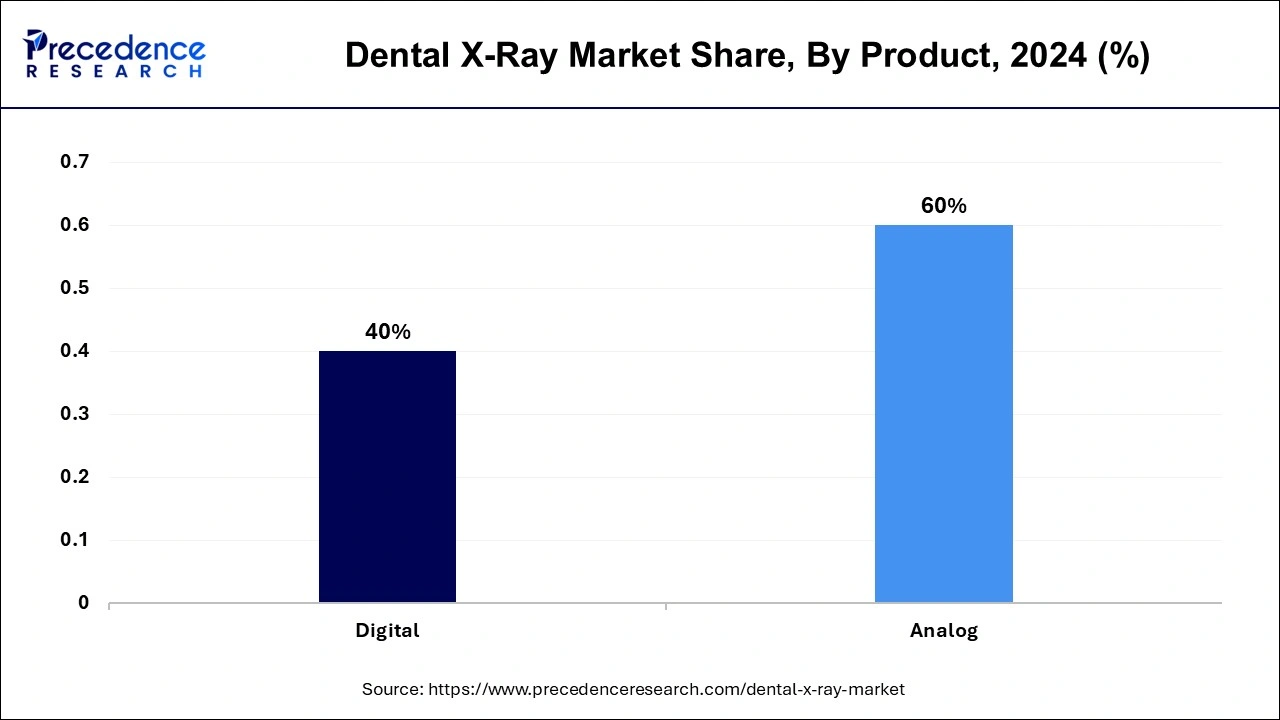

The analog segment dominated the dental X-ray market in 2024. For a long time, analog X-ray equipment has been the norm in the business. Radiologists and dentists were experienced in taking X-rays using film. The procedure, which entailed developing X-ray film in a darkroom after it had been exposed and placed into the patient's mouth, was one they were comfortable doing. For many practitioners, switching to digital systems seemed unnecessary or intimidating because of their expertise in analog systems. Early digital X-ray equipment has limits on software capabilities, resolution, and image quality. Digital sensors were less flexible and larger than X-ray film, making capturing some image kinds, like intraoral X-rays, difficult. Widespread acceptance was further hampered by the original digital systems' high cost and considerable training requirements.

The digital segment is observed to be the fastest growing in the dental X-ray market during the forecast period. Recent years have witnessed tremendous developments in digital dental X-ray technology, which has increased image quality, expanded diagnostic potential, and decreased radiation exposure for patients. Due to these developments, dental professionals who are looking for more precise and effective diagnostic instruments are finding digital X-ray systems to be more and more appealing. Film development and processing take a long time, but with digital technology, pictures can be taken and viewed virtually instantly. Due to this quick turnaround time, dental professionals can diagnose patients more quickly and effectively, which eventually improves patient happiness and care.

The intraoral segment dominated the dental X-ray market in 2024. The delicate features of teeth and surrounding oral structures are taken care of via intraoral X-rays. They give dentists access to high-resolution pictures that enable them to diagnose various dental conditions, including cavities, periodontal disorders, and root concerns. Their adaptability helps dentists take multiple photographs and perspectives, which helps with thorough diagnosis and treatment planning. Dental practices can benefit from optimized processes provided by intraoral X-ray equipment.

The time needed for diagnosis and treatment planning can be decreased using digital images, which can be instantaneously examined, altered, and shared with patients or specialists. Additionally, digital systems save dental practices money over time by eliminating the need for storage space and chemicals for film processing.

The extraoral segment is the fastest growing in the dental X-ray market during the forecast period. The past few decades have seen tremendous developments in extraoral dental X-ray imaging technology, which has improved diagnostic capabilities, raised patient comfort levels, and enhanced image quality. Cone-beam computed tomography (CBCT), for example, has completely changed extraoral imaging by offering exact and precise three-dimensional views of the oral and maxillofacial structures. Due to these improvements, extraoral X-ray devices are now essential for thorough dental diagnostics and treatment planning.

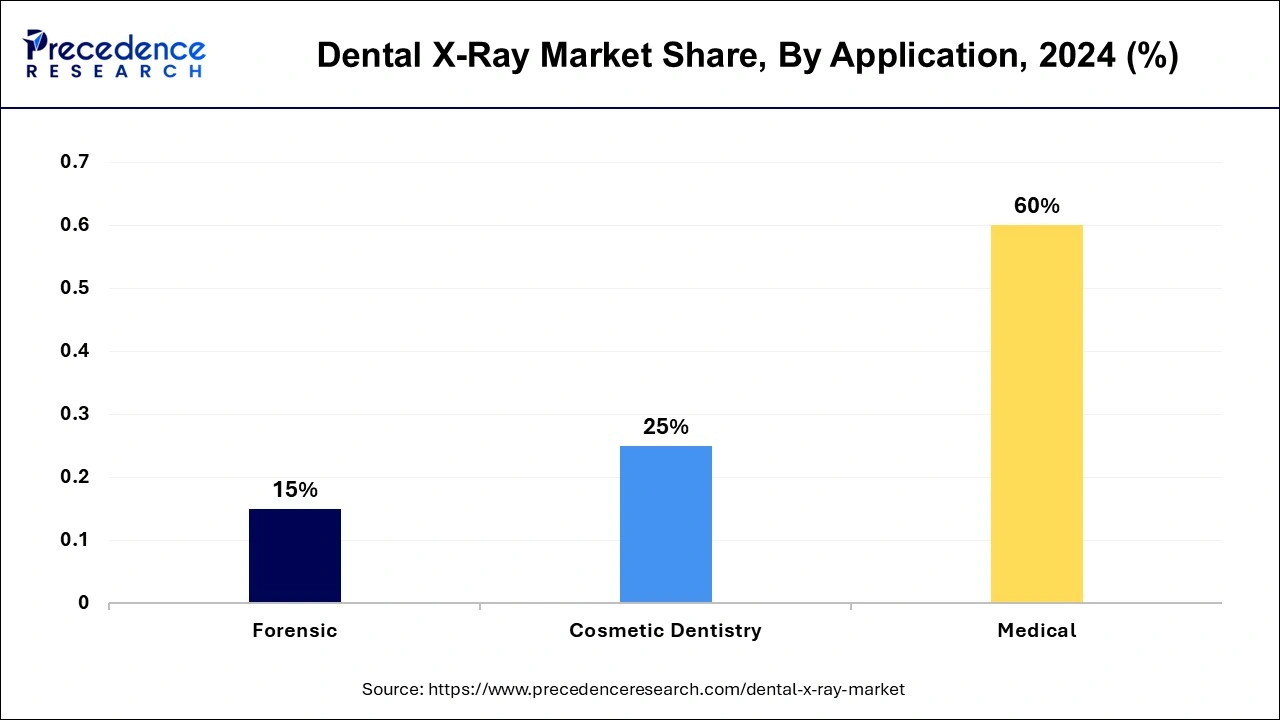

The medical segment dominated the dental X-ray market in 2024. Dental imaging solutions are being added to medical imaging firms' product portfolios in response to changing market demands and technological advancements. These businesses can effectively enter the dentistry market by utilizing their current knowledge of software development, imaging technology, and customer service to offer integrated solutions specifically designed to meet the requirements of dental practitioners.

The cosmetic dentistry camera segment shows a significant growth in the dental X-ray market during the forecast period. An increasing number of people are choosing cosmetic dentistry to improve their smiles as the value placed on appearance and aesthetics grows. Social media impact, the desire for self-improvement, and developments in dental technology that provide less invasive and more effective treatments are the driving forces behind this movement. Dentists can more effectively explain treatment options and possible results to patients using cosmetic dentistry cameras. By providing patients with digital representations of their suggested treatment plans and existing oral conditions, cosmetic operations are perceived more favorably by them.

The dental hospitals & clinics segment dominated the dental X-ray market in 2024. Dental hospitals and clinics are popular destinations for patients seeking dental care because of their stellar reputation for providing specialized and high-quality care. The high patient traffic results in the growing use of dental X-ray machines in these institutions. General practitioners and other healthcare providers frequently refer complex dental problems to dental hospitals and clinics. Their network of recommendations strengthens their position as leaders in the dentistry community by extending their reach and impact and securing their use of cutting-edge diagnostic instruments such as dental X-rays.

The dental diagnostic centers segment shows a significant growth in the dental X-ray market during the forecast period. In addition to standard X-rays, dental diagnostic clinics frequently provide cephalometric, panoramic, and three-dimensional CBCT scans. With these extensive diagnostic tools, dentists and other dental professionals may precisely diagnose various dental diseases, arrange intricate treatments like orthodontics and dental implants, and deliver individualized patient care. Dental diagnostic clinics encourage routine dental screenings and preventative measures to maintain oral health and avoid dental issues, with an increasing focus on preventive dental care and patient education. By providing thorough diagnostic services and preventative dental care programs, these clinics draw in more customers looking for proactive dental care solutions.

By Product

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023