September 2024

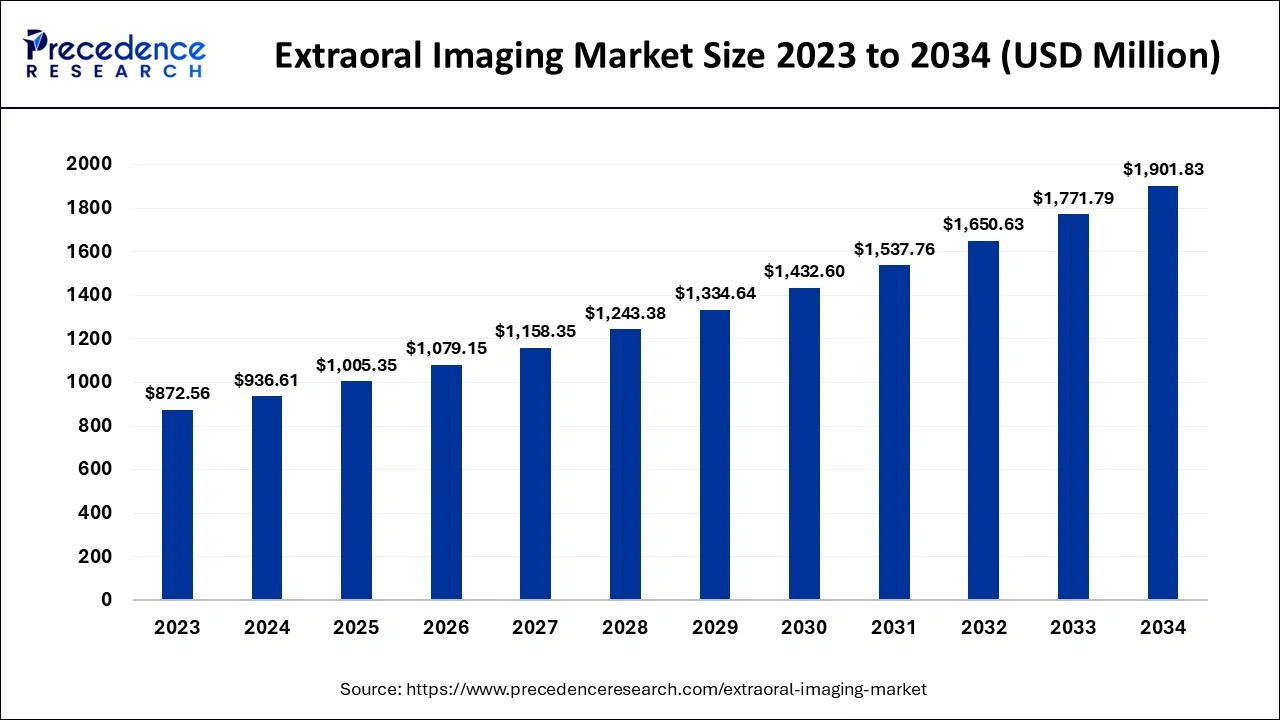

The global extraoral imaging market size is estimated at USD 936.61 million in 2024, grew to USD 1,005.35 million in 2025 and is predicted to hit around USD 1,901.83 million by 2034, expanding at a CAGR of 7.34% between 2024 and 2034. The North America extraoral imaging market size is calculated at USD 355.91 million in 2024 and is expected to grow at a CAGR of 7.47% during the forecast year.

The global extraoral imaging market size accounted for USD 936.61 million in 2024 and is expected to exceed around USD 1,901.83 million by 2034, growing at a CAGR of 7.34% from 2024 to 2034. Advancements in imaging technologies are the key factor driving the growth of the market. Also, the rising incidence of dental disorders coupled with the increasing need for reliable imaging platforms can fuel the extraoral imaging market growth shortly.

Artificial intelligence technology can improve the processes of diagnosis and treatment in dentistry. AI-based models can improve the efficiency, accuracy, and reliability of the whole dental imaging process. Furthermore, AI technology strengthens the functionality of overall dental imaging systems by enabling rapid detection of dental problems and providing clearer images. Also, AI-powered algorithms can offer services like prevention, diagnosis, and treatment of dental problems.

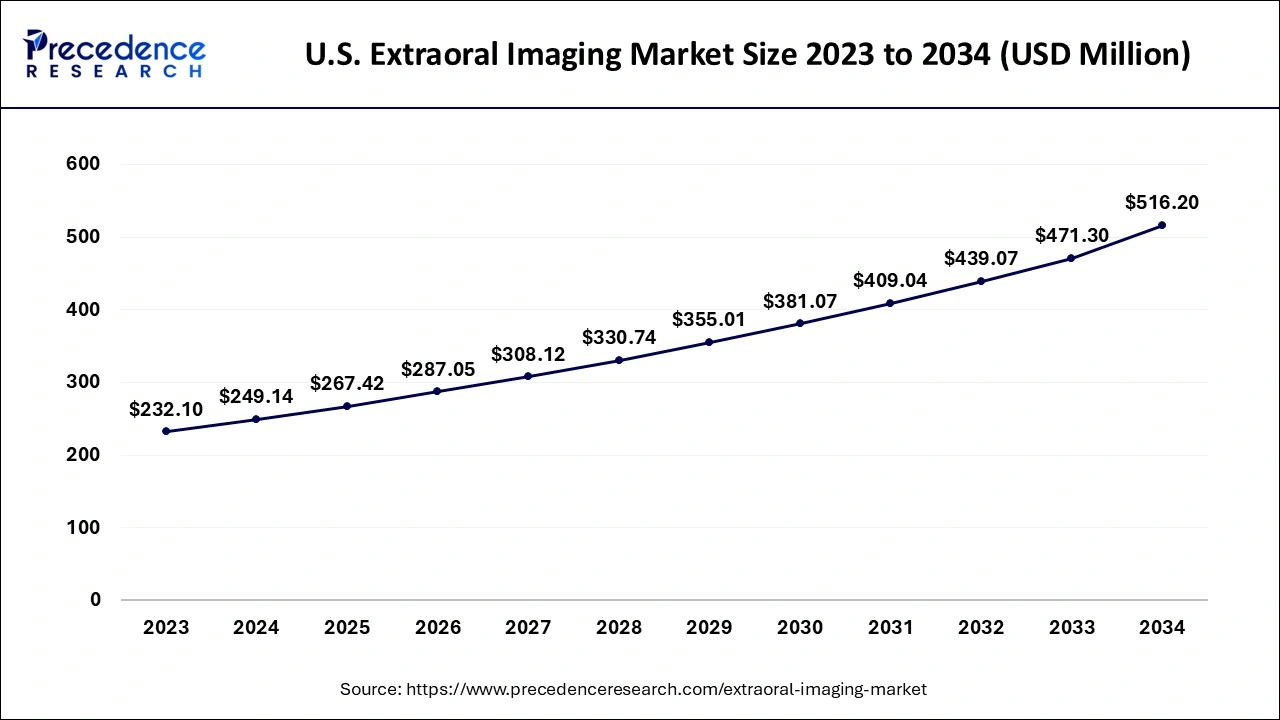

The U.S. extraoral imaging market size is exhibited at USD 249.14 million in 2024 and is projected to be worth around USD 516.20 million by 2034, growing at a CAGR of 7.54% from 2024 to 2034.

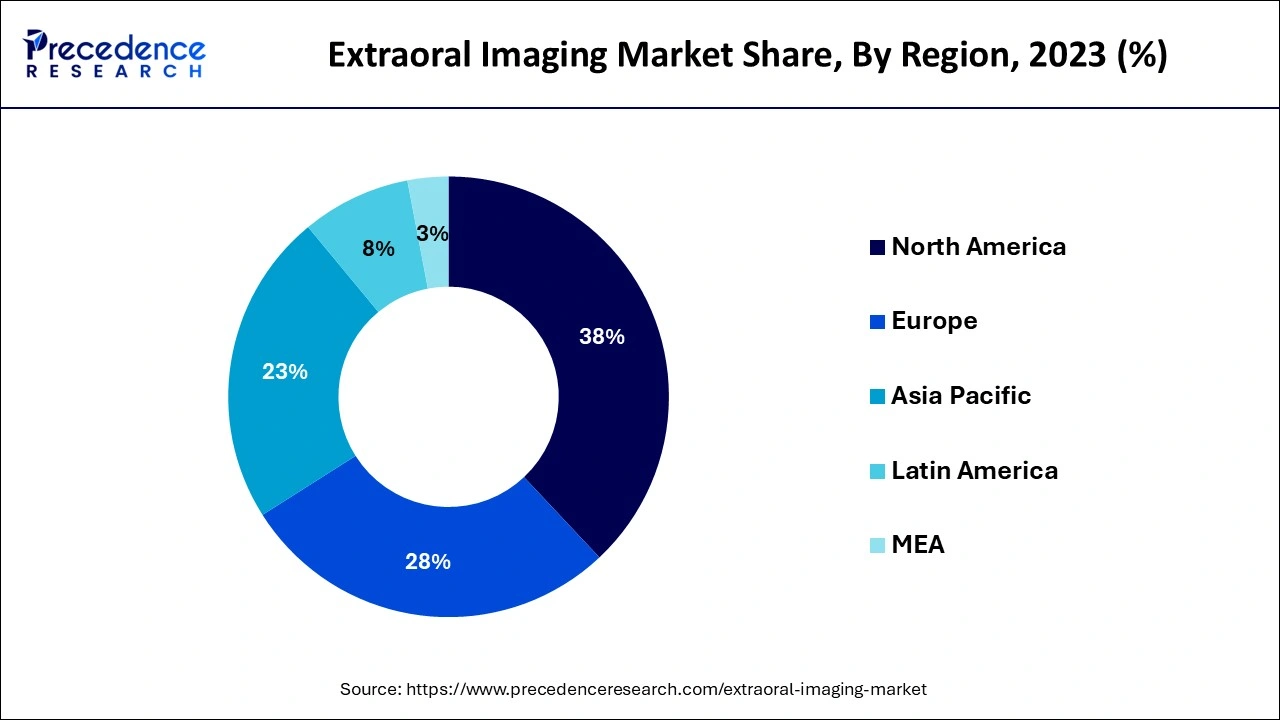

North America dominated the global extraoral imaging market in 2023. The dominance of the region can be attributed to the strong presence of developed healthcare infrastructure and high demand for cosmetic dentistry. Also, the high incidence of dental conditions coupled with the well-established dental care market fuels the need for innovative imaging systems such as extraoral devices. Moreover, ongoing innovations in AI and 3D imaging make North America a leader in the market.

Asia Pacific is expected to grow at the fastest rate in the extraoral imaging market over the projected period. The growth of the region can be linked to the increasing awareness of dental health and escalating dental tourism, especially in nations such as India and China. Furthermore, the region's growing middle class, along with the increasing elderly population, will contribute to this extraoral imaging market expansion soon.

It is the extraoral imaging market that manufactures and distributes imaging devices for maxillofacial and dental diagnostics and also uses methods to capture images from outside the mouth cavity. Extraoral imaging is advantageous for individuals who need oral surgical procedures, dental implants, or orthodontic treatment. It can also offer a detailed insight into craniofacial conditions and improve diagnostic precision and treatment outcomes.

| Report Coverage | Details |

| Market Size by 2034 | USD 1,901.83 Million |

| Market Size in 2024 | USD 936.61 Million |

| Market Size in 2025 | USD 1,005.35 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.34% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Rise in the incidence of dental problems in the population

Tooth decay is one of the most common chronic diseases, which is extensively spread all over the world. This is majorly due to unhealthy lifestyle changes such as tobacco intake, alcohol intake, and sugar intake in the majority of the population. In the extraoral imaging market, new product launches like ProX dental intraoral X-ray devices and innovations in dentistry.

Lack of awareness

The vast majority of the population is unaware of the probable dental conditions because they neglect oral health which sometimes leads to conditions like dental carries followed by tooth extraction. However, this can be tackled by spreading awareness about dental disorders among people in various countries coupled with increasing government funding.

Advancements in 3D imaging technique

Technological developments in extraoral imaging, such as AI-driven diagnostic tools, cone-beam computed tomography (CBCT), and 3D imaging, can significantly improve the precision of dental procedures, decrease the treatment time, and enhance patient outcomes, which makes it important for modern dental practices, boosting the extraoral imaging market growth exponentially. Furthermore, there is a substantial rise in demand for intraoral and extraoral diagnostic imaging systems that are effective in dental care.

The 3D CBCT system dominated the extraoral imaging market in 2023. The dominance of the segment can be attributed to the increasing use of this technique to evaluate the nerve pathways, bone structure and soft tissues of the mouth, jaw, neck, ears, and thorat.3D CBCT system also locates the infectious teeth and can used in surgical planning too. Additionally, CBCT images are more precise and distortion-free.

The panoramic system segment is expected to grow at the fastest rate in the extraoral imaging market over the forecast period. The growth of the segment can be linked to the diversity and extensive application of this system in dental diagnostics. Also, this equipment is required for dental implant treatment planning, dental examinations, and teeth evaluations. The panoramic system provides detailed views of facial and dental structures.

The implantology segment led the global extraoral imaging market in 2023. The dominance of the segment can be linked to the increasing cases of tooth decay, which further necessitates the need for dental implant procedures. These procedures need extraoral imaging equipment to offer a detailed 3D view of the jawbone, optimizing the accurate treatment and placement of dental implants. However, the increasing utilization of dental implants for tooth replacement is expected to drive segment growth soon.

The oral & maxillofacial surgery segment is anticipated to grow at the fastest rate in the extraoral imaging market over the forecast period. The growth of the segment can be driven by ongoing advancements in technology that improve diagnostic abilities for challenging dental conditions. Furthermore, this surgery emphasizes the diagnosis and treatment of the jaws, skull, mouth, and face-associated structures, making it a more preferred choice for diagnostic treatment.

The dental clinics segment dominated the global extraoral imaging market. The dominance of the segment can be credited to the presence of a large amount of specialty dentists using this practice. This dental clinic is the key place where all these practices are easily accessible. Also, the rising number of numerous dental disorders that necessitate minimal invasive treatment can impact segment growth positively.

The imaging centers segment is anticipated to grow at the fastest rate in the extraoral imaging market over the forecast period. The growth of the segment can be driven by the presence of expensive equipment, such as CBCT systems that offer enhanced diagnosis as compared to the other facilities, fuelling patients' access to these centers. In addition, this large patient pool can increase the adoption of imaging equipment in these centers.

By Product

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025