November 2024

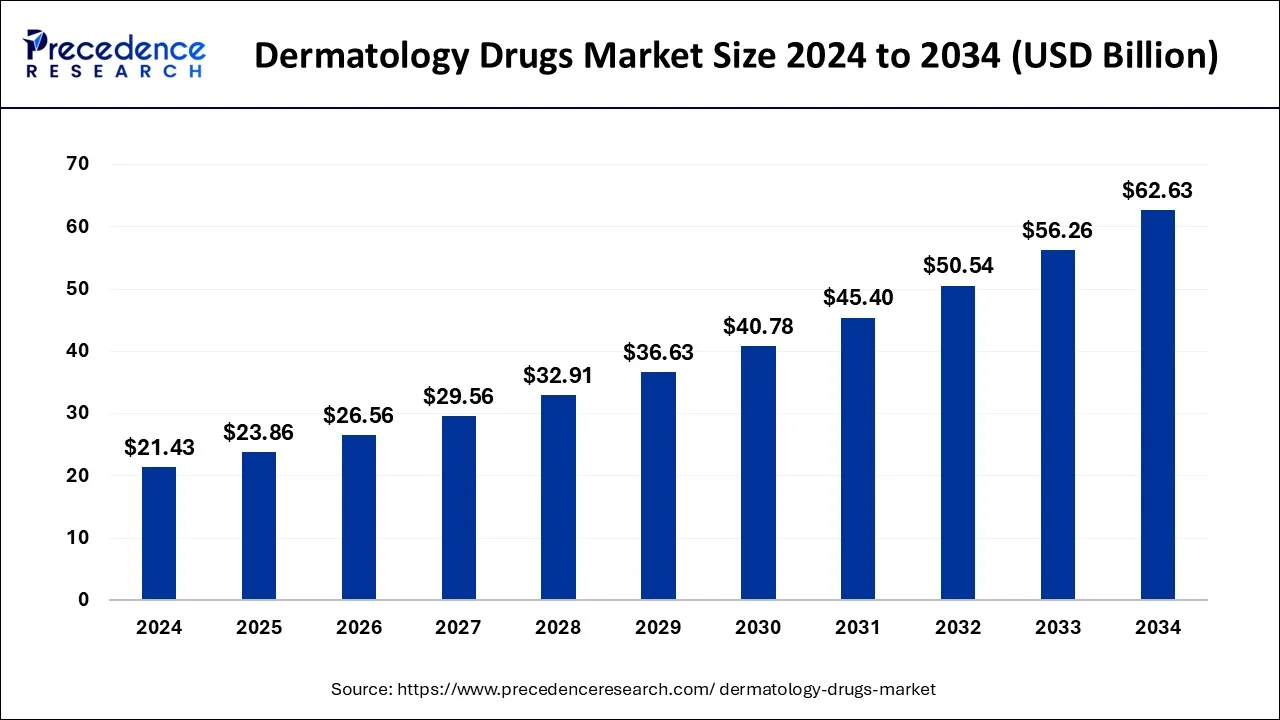

The global dermatology drugs market size accounted for USD 21.43 billion in 2024, grew to USD 23.86 billion in 2025 and is projected to surpass around USD 62.63 billion by 2034, representing a healthy CAGR of 11.32% between 2024 and 2034. The North America dermatology drugs market size is calculated at USD 8.57 billion in 2024 and is expected to grow at a fastest CAGR of 11.46% during the forecast year.

The global dermatology drugs market size reached USD 21.43 billion in 2024 and is anticipated to reach around USD 62.63 billion by 2034, expanding at a CAGR of 11.32% between 2025 and 2034. The market is growing due to the rise in skin conditions due to pollution, the demand for aesthetic dermatology procedures, the rise in disposable incomes, and the growing population. Dermatology is a field of medication that focuses on identifying, preventing, and treating conditions that affect the skin, including those that affect the hair as well as nails. Drugs used in dermatology are used to control and treat conditions affecting the skin, hair, nails, and genital membranes.

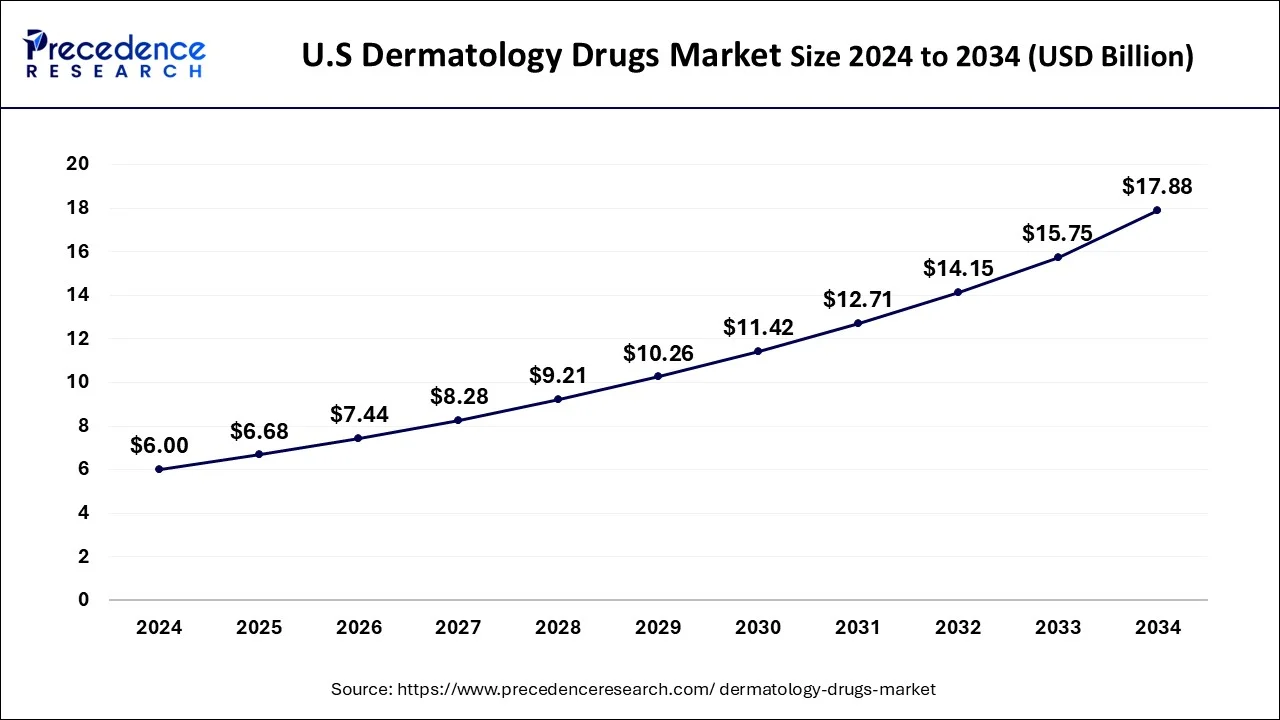

The U.S. dermatology drugs market size accounted for USD 6 billion in 2024 and is expected to be worth around USD 17.88 billion by 2034, poised to grow at a CAGR of 11.54% from 2025 to 2034.

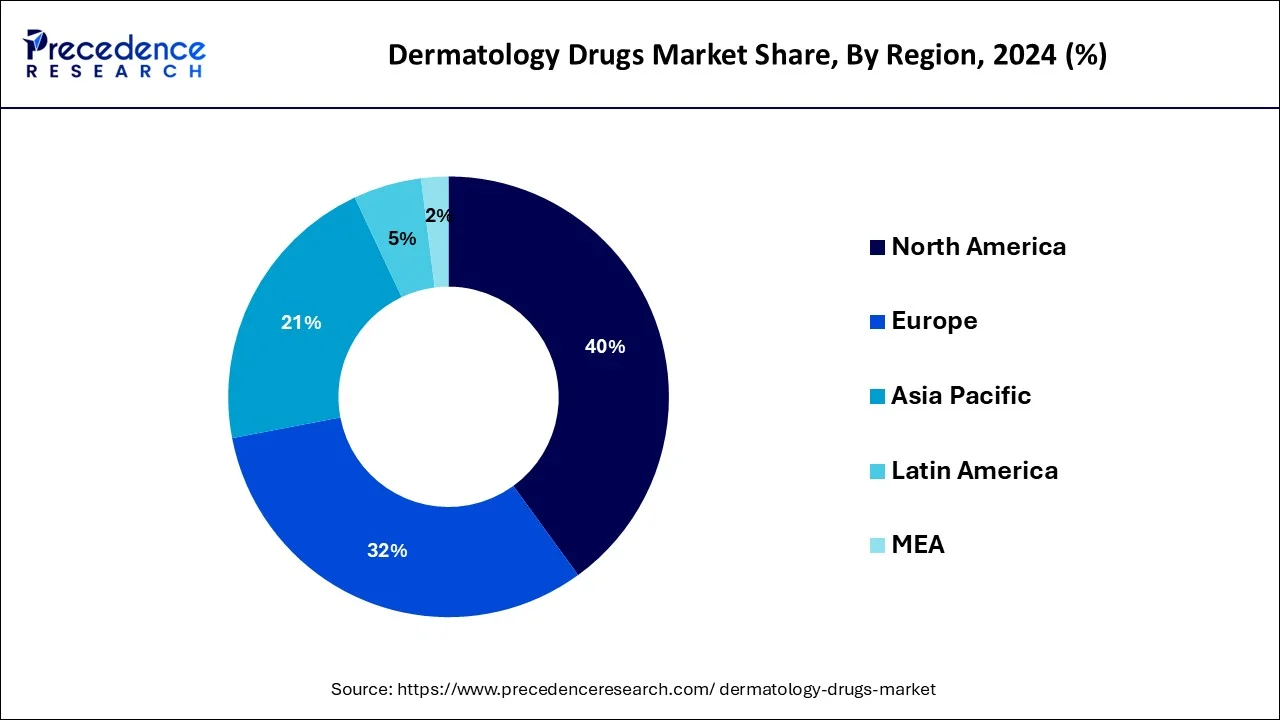

The North America region accounted for 40% of the revenue share in 2024. Due to the greater prevalence of skin conditions and diseases in the continent, North America accounted for the bulk of the market. According to statistics from statistica.com, in the US, those between the ages of 18 and 29 made the largest proportion of dermatologist visits, at 16.9%, followed by those between 50 and 64 at 15.73%, and those between 30 and 49 at 12.91%. Additionally, the introduction of new medications and the existence of significant industry-important players are fueling market expansion. The primary market growth contributors in the area are the USA, Canada, and Mexico. Because big businesses make significant investments in research and development for the creation of new pharmaceuticals, the European area ranks second on the market. The market is being driven by an increase in the prevalence of skin diseases among individuals and a decrease in the number of visits people are making for treatment. The fourth most prevalent sickness among people is a skin problem or disease, which has led to an increase in medicine demand throughout time. Due to the greater number of young patients, France, Germany, and Italy are the main contributors to the market growth in the area. Due to the relocation of important regional companies and growing awareness, the Middle East and Africa market is also exhibiting growth rates.

Because of the area's increased awareness of skin diseases and access to effective skin treatments, the Asia-Pacific region is anticipated to have the largest market growth. The market expansion has been encouraged by the availability of appropriate healthcare facilities. The annual Asia-Pacific Dermatology conference, which is held in several countries, is the main driver of market expansion in this area. where countries in the Asia-Pacific region congregate to talk about advancement, cooperation, concepts for better patient care, and medication development in the area. The three countries with the largest market shares in the area are China, Japan, and India.

The market for dermatological medications is expanding as a result of the rise in patients with dermatitis, fungal, and acne. According to data from the American Association of Dermatologists, acne affects almost 50 million individuals in the US alone. Skin and other associated issues can arise for a variety of causes, including improper body care, excessive perspiration, consuming hot foods, and wearing constricting clothing. As a result, the market is observing a rise in the sales of medications used for treatments. It has been demonstrated that increased public knowledge of skin and hair infections presents a potential opportunity for the industry. The sale of over-the-counter (OTC) medications, which are frequently used to treat hair loss and acne, has increased as a result of increased knowledge. Due to hormonal fluctuations, most young people and teenagers have skin-related problems such as skin irritability, acne, and excessive perspiration. The market is anticipated to continue expanding because of the increase in demand for dermatological medications that are regularly used as anti-inflammatory agents and cleansers topically. Other considerations include an increase in spending on R&D by industry leaders for the creation and clinical testing of new medications as a result of the rise in demand for innovative, efficient, and affordable medications. The rise in skin cancer cases and other illnesses is contributing to the expansion of the pharmaceutical industry. However, a number of adverse effects and inappropriate application of dermatological medications, together with governmental limitations and guidelines, will prevent the industry from developing to its full potential.

Artificial Intelligence (AI) is the new buzzword in the healthcare industry, especially in dermatology. While some mole-scanning mobile applications are popular, the overall effect of AI on dermatology is much lower than that in other visually oriented-specialties. Artificial intelligence, indeed, offers some applications in common diagnostic dermatology and cosmetic dermatology as well as basic research elation and practice optimization. AI has now become synonymous with machine learning (ML), which is the study of algorithms and statistical models that are used for improvement in computer performance on a specific problem. In this introduction to AI, there is an effort to clarify the ML methods as well as their applications, testing, evaluation, and deployment of machine learning models. It throws some myths away discusses challenges to the widespread adoption of AI and gives realistic advice.

| Report Coverage | Details |

| Market Size in 2024 | USD 21.43 Billion |

| Market Size by 2034 | USD 62.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.32% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Indication, By Distribution Channel, and By Administration Analysis |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The prevalence of dermatological disorders is rising

Launch of therapeutically effective drugs

Risk of side effects from improper use of products

Increasing elderly population

Increasing personal care spending is driving demand for dermatology drugs

With a revenue share of more than 36% in 2024, the psoriasis category led the market and is predicted to grow at the highest CAGR of 11.8% from 2024 to 2033. The immune system incorrectly attacks healthy skin cells, which results in psoriasis. Psoriasis is not a disease that spreads easily. Swollen fingers and toes, foot discomfort, lower back pain, nail alterations, and eye irritation are all symptoms of the illness. Stress, skin injuries, infections, certain medicines, and frequent drinking can all cause psoriasis. Although it affects people of all ages, psoriasis is more common in adults, which increases the need for dermatological drugs globally.

From 2024 to 2035, the alopecia market is anticipated to grow at the second-highest CAGR of 11.20%. Alopecia is a condition where hair follicles are attacked by the body's immune system, leading to hair loss. An autoimmune condition called alopecia causes hair to fall out. Due to hormonal imbalances, hair care products, scalp infections, and potential drug side effects, both men and women get alopecia. Additionally, the most typical reason for hair loss worldwide is inherited. People are cautious about hair loss and seek diagnosis at hospitals. Hair loss contributes to the market growth rate and necessitates long-term continuous treatments.

Due to a growth in patient visits and sales of prescription-only medications for the treatment of dermatological skin problems, the hospital pharmacy segment commands the greatest proportion of the worldwide dermatology drug market. This segment is expanding as a result of an increase in patient preference for local pharmacies and the accessibility of inexpensive OTC products. Due to the widespread use of online portals and websites like Amazon and Walmart, the online pharmacy market is anticipated to grow at a profitable CAGR over the course of the projected period.

In 2023, the parenteral administration market sector held a monopoly. The introduction of biologics for the treatment of dermatological disorders is responsible for the segment's dominance. Furthermore, it is anticipated that a growth in patient desire for tropical remedies would drive up sales of the items. Due to the US FDA's clearance of oral medicines, the oral category is predicted to have a substantial CAGR throughout the projection period.

The topical administration segment dominated the market with the largest share in 2024. It Is used a lot for the treatment of several diseases due to its value in the evasion of GI discomforts and all kinds of side effects. Skin is a significant protective organ, but one that is referred to really has the ability to hinder a topical dosage form’s access to its target site. A bioactive substance must penetrate the stratum corneum barrier to reach its site of action, and this can be influenced by the state of the skin barrier, the choice of delivery system used, and personalized disease detection and dosage planning. The current research into dosage forms certainly aims to improve topical application effectiveness but goes beyond topical application to improve transdermal absorption of the drug.

By Indication

By Distribution Channel

By Administration Analysis

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

November 2024

November 2024

August 2024