January 2025

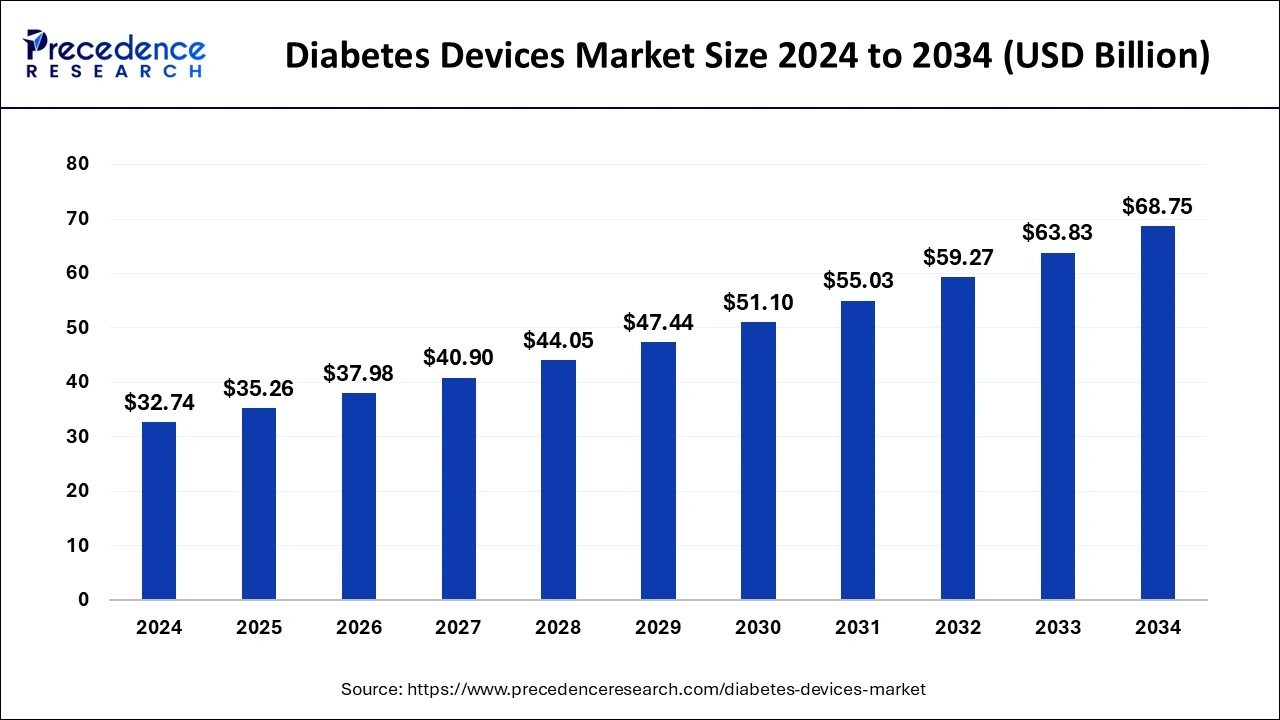

The global diabetes devices market size is calculated at USD 35.26 billion in 2025 and is projected to surpass around USD 68.75 billion by 2034, expanding at a CAGR of 7.7% from 2025 to 2034. The North America diabetes devices market size reached USD 13.75 billion in 2024 and is expanding at a CAGR of 7.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global diabetes devices market size accounted for USD 32.74 billion in 2024 and is expected to be worth around USD 68.75 billion by 2034, at a CAGR of 7.7% from 2025 to 2034.

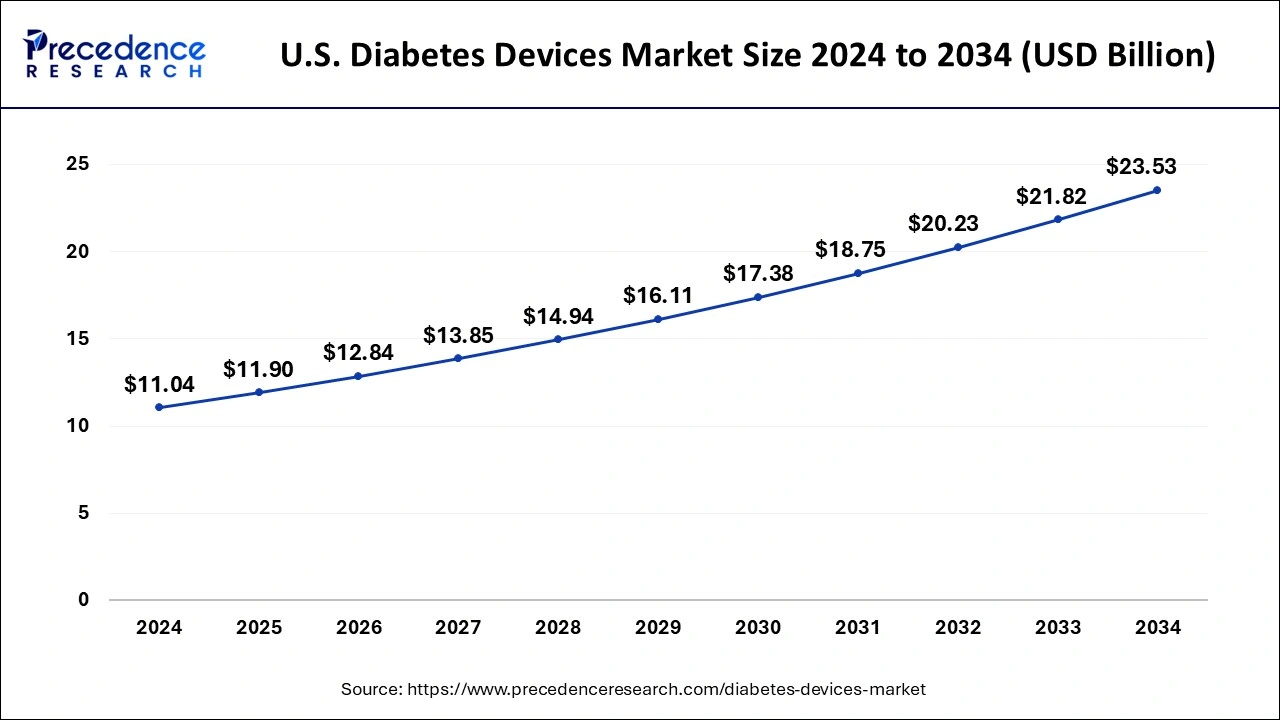

The U.S. diabetes devices market size was estimated at USD 11.04 billion in 2024 and is predicted to be worth around USD 23.53 billion by 2034, at a CAGR of 7.9% from 2025 to 2034.

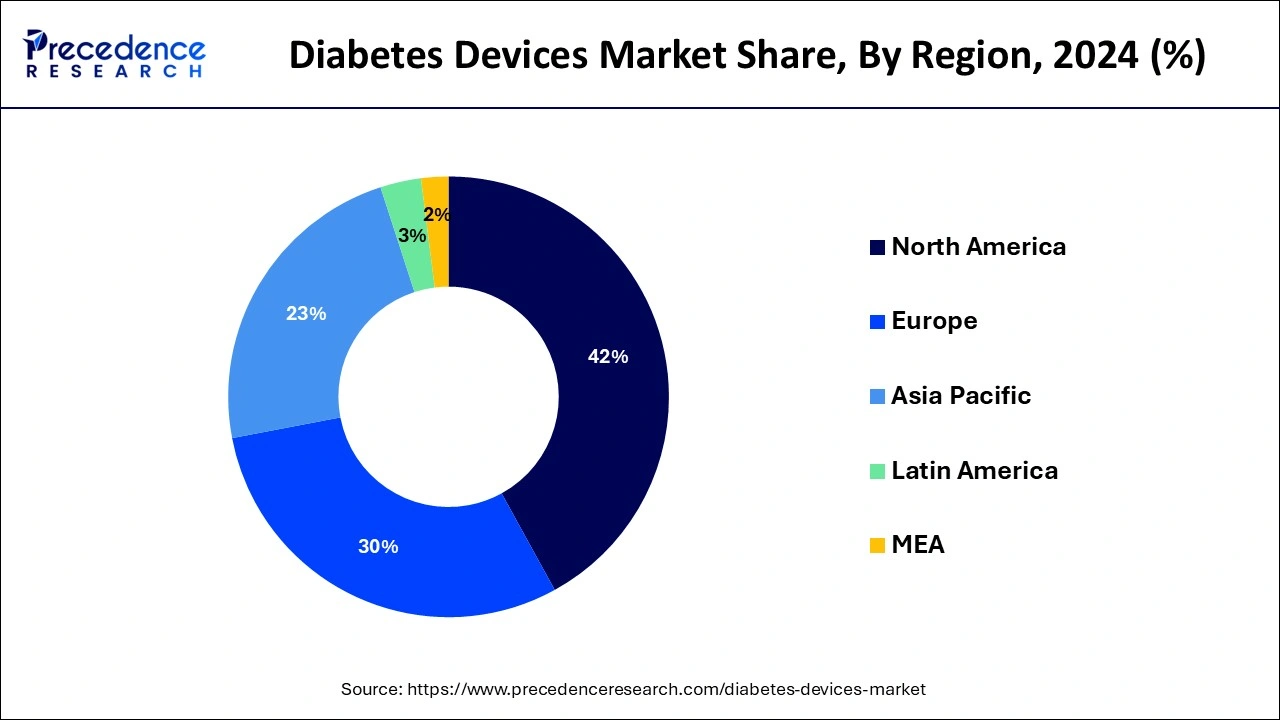

Based on the region, the North America accounted largest revenue share in 2024 and is expected to sustain its dominance during the forecast period. North America was followed by Europe. The higher personal disposable income and increased healthcare expenditure in North America has exponentially contributed to the growth of the diabetes devices market in the region. Growing cases of obesity and unhealthy food habits is fueling the prevalence of diabetes in US. The higher penetration of fast food chains in North America has significantly influenced the consumption of various unhealthy fast foods and soft drinks. This is a major cause of diabetes in US. Rising health consciousness among the population and demand for diabetes monitoring devices coupled with the easy availability of advanced diabetes devices is fostering the market growth in this region.

On the other hand, Asia Pacific is estimated to be the most opportunistic market. According to WHO, diabetes is rapidly increasing in low and middle-income countries. The huge and vast population of Asia Pacific provides the most lucrative growth opportunities to the vendors operating in the diabetes devices market. Therefore, rising prevalence of diabetes, rising disposable income, and increasing awareness regarding different types of diabetes devices is expected to drive the market in this region.

The growing prevalence of diabetes among the global population is the primary factor driving the global diabetes devices market. Furthermore, rising prevalence of obesity among the population, growing health consciousness, increasing awareness regarding diabetes, technological advancements in the diabetes monitoring devices, easy availability of diabetes devices, and rising personal disposable income are the key factors driving the demand for the diabetes devices across the globe. Obesity and unhealthy eating habits are the major reasons for the growing cases of diabetes. Moreover, growing geriatric population is another major factor leading to the growth of diabetes cases. According to the World Health Organization (WHO), around 422 million of the global population were suffering from diabetes. Diabetes is rising at a significant pace in the underdeveloped and developing nations. This is because of the low disposable income and less awareness regarding the availability of diabetes devices in the developing and under developed nations.

Around 1.5 million deaths were directly linked to diabetes in 2019, as per WHO. In 2012, around 2.2 million deaths were caused by high blood sugar levels. Diabetes causes kidney failure, blindness, stroke, and heart attacks. Therefore, rising awareness amongst the population regarding the various ill-effects of diabetes encourages them to acquire diabetes devices in order to keep a check on their blood glucose levels regularly and control diabetes. This is a major factor propelling the growth of the diabetes devices market across the globe.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.74 Billion |

| Market Size in 2025 | USD 35.26 Billion |

| Market Size by 2034 | USD 68.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.7% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Distribution Channel, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The insulin delivery devices segment led the market with a notable share in 2024 and will dominate over the forecast period. This is attributed to the increased adoption and convenience factor associated with the use of insulin pens and portable insulin pumps.

On the other hand, the blood glucose monitoring is estimated to fastest growing segment during the forecast period. The continuous glucose monitoring and self-monitoring blood glucose systems are the major drivers of this segment. The availability of continuous and self-monitoring devices is gaining rapid traction among the patients due to their ease of use.

The hospital pharmacy segment dominated the market with a notable revenue share in 2024. This is attributable to factors such as easy availability, growing popularity of private brands, and easy availability. For this, this segment is expected to sustain its significance during the forecast period.

On the other hand, the online pharmacy is projected to be the most opportunistic segment owing to the growing penetration of internet and telemedicine services. Moreover, one day delivery formats and discounted prices will positively impact the segment growth.

The hospital segment led the market with a notable revenue share in 2024. The growing number of hospitalization of diabetic patients is fueling the growth of this segment. Moreover, doctors’ advice helps the patient to acquire more reliable type of diabetes devices.

On the other hand, the home care is expected to grow rapidly due to the higher adoption and easy availability of self-monitoring devices and insulin pens and pumps.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improveddevices. Moreover, they are also focusing on maintaining competitive pricing.

In June 2020, Tandem Diabetes Care and Abbott agreed to work on the development of integrating continuous glucose monitoring system with insulin delivery system to offer more options to the consumers for diabetes management.

In March 2021, Roche launched Accu-Check Instant system that is connected to mySugar app via Bluetooth. This is a step towards providing personalized diabetes management services to the consumers.

These major developmental strategies focuses on creating new opportunities and drive the growth of the global diabetes devices market.

By Type

By Distribution Channel

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2025

November 2024

July 2024