May 2025

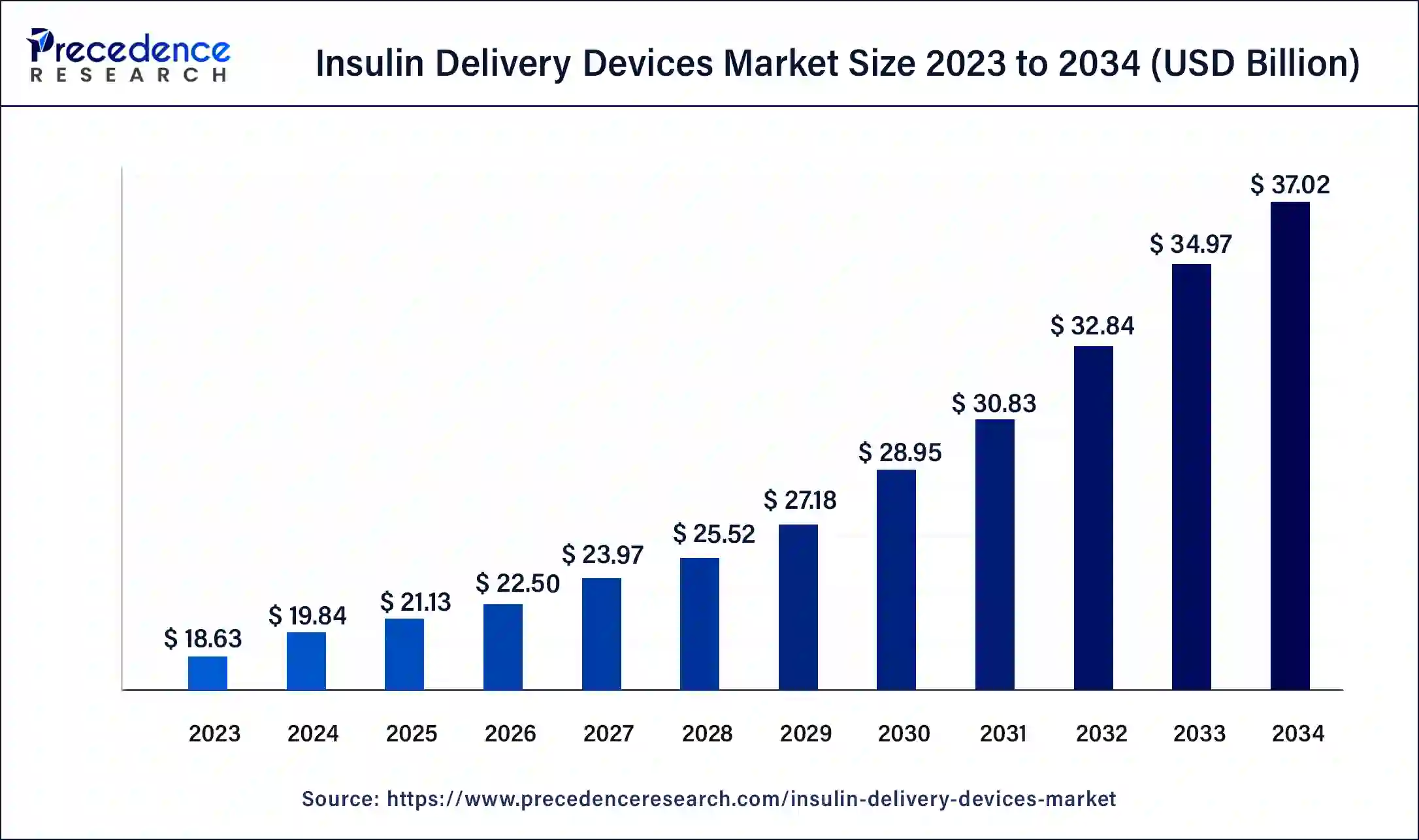

The global insulin delivery devices market size was USD 18.63 billion in 2023, estimated at USD 19.84 billion in 2024 and is anticipated to reach around USD 37.02 billion by 2034, expanding at a CAGR of 6.44% from 2024 to 2034.

The global insulin delivery devices market size accounted for USD 19.84 billion in 2024 and is predicted to reach around USD 37.02 billion by 2034, growing at a CAGR of 6.44% from 2024 to 2034.

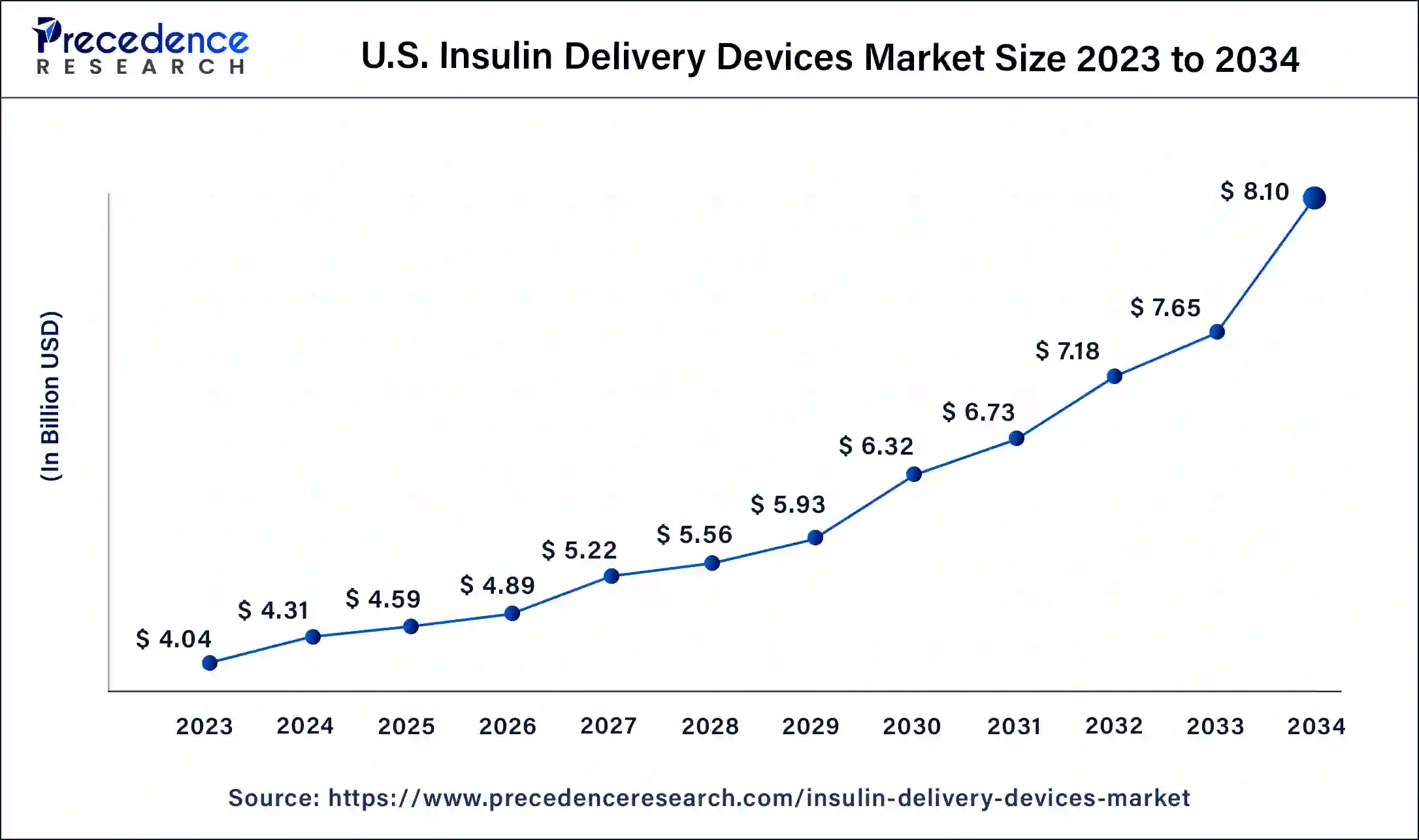

The U.S. insulin delivery devices market size was estimated at USD 4.04 billion in 2023 and is predicted to be worth around USD 8.10 billion by 2034, at a CAGR of 7% from 2024 to 2034.

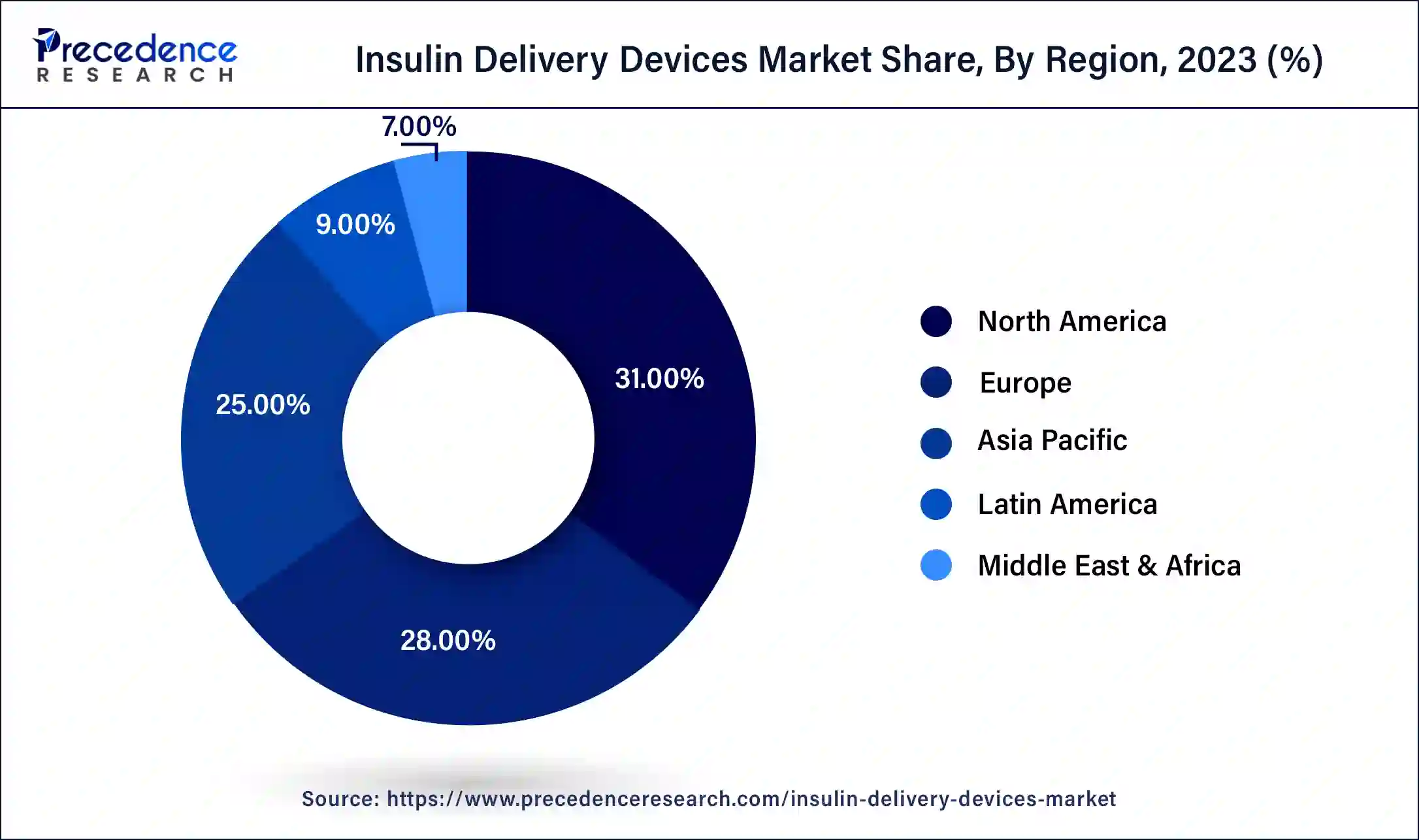

The North American region has dominated the market of insulin delivery devices in 2023 and has garnered a market share of 30.14%. An increasing diabetic population and availability of technologically advanced devices across the North American region is helping in the growth of the market. The increasing patient base of diabetes is expected to boost the growth of the market in this region.

The market for insulin delivery devices in the Asia Pacific region is also expected to grow fast during the forecast period. In many developing economies like India and China there shall be the highest growth other than increasing population based suffering from diabetes and the awareness about the treatments for the same. Another major factor contributing to the growth in the Asia Pacific region is the high end products that are available in the market in order to treat diabetes.

There are many ways in order to administer insulin to a patient. It is a hormone that helps in regulating the blood sugar levels of the diabetic patients. This hormone can be administered by the way of pens, pumps, jet sprays and syringes. The growing prevalence of diabetes is an important factor for the growth of the market. It also happens to be a major reason for surging mortality rate. It's about 1.5 million deaths due to diabetes in 2019 according to the report of the World Health Organization. The diabetic patients use the available insulin delivery devices in order to access the insulin dose which helps in regulating the hormone by maintaining the blood sugar of the patient. Administering insulin in the form of up tablet is also not possible as it gets degenerated by the digestive enzymes. Therefore there are a wide range of devices that are used in order to deliver the insulin at the correct location.

During the pandemic the patients with comorbidity contracted the disease earlier. About 40% of the hospitals has diabetic patients suffering with COVID-19. There were disruptions in the supply chain, shipping delays and shut down of various manufacturing units.

The increasing prevalence of diabetes which is mainly due to obesity, aging or unhealthy lifestyle is expected to help in the growth of the market. Obesity happens to be the major factor causing diabetes. The number of diabetic patients across the world is increasing mainly in the obese or overweight patients. The diabetes off lifted population in the nations is driving the market for the insulin delivery devices. There's an increased demand for these devices due to various innovations. As an increasing expenditure on diabetes care the market for the insulin delivery devices is expected to grow. Due to the favorable reimbursement policies another option of other facilitative initiatives are helping in the growth of the market. The progressive and the chronic nature of diabetes inflicts the use of insulin over a long period of time. The pandemic has also proven to be a great factor in the expansion of insulin delivery devices market. As the population afflicted with diabetes across the globe is increasing it is driving the market for the Insulin delivery devices.

| Report Coverage | Details |

| Market Size in 2023 | USD 18.63 Billion |

| Market Size in 2023 | USD 19.84 Billion |

| Market Size by 2034 | USD 37.02 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.44% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Application, By End User, and By Distribution Channels |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Horrifying and Unhealthy Lifestyle

The major factor contributing in the reduced degrees of actual work is the enlargement of the motorization and the urbanization. According the World Health Organization (WHO), approximately over the 60% of the global population is not satisfactorily energetic. WHO states that the active work is the livelihood component and subsequently, at every point in life, it procures any condition related to the health, inclusive of diabetes and cardiovascular disorders. The risk of diabetes type 2 arises when an individual’s weight starts increasing at an every stage of the age. Obesity affected diabetes is much more harmful than the one with an ordinary weight.

Horrifying routines of the food consumption and smoking are the unhealthy ways of livelihood. These habits increase the risk of diabetes type 2. Work culture primarily night shift culture is one the major reasons behind the risk factors of diabetes type 2. Smoking of cigarettes should also be avoided as it has more propensity of being diseased with diabetes type 2 than the non-smokers.

Evolution of Do It Yourself (DIY) Devices

The technologies related to diabetes have been revolutionizing at a very fast pace over the last decade in order to enhance the quality of life and to expand durability of subjects with diabetes. Many of these readily available devices were too costly to afford, in spite of having admirable advancements between them. Moreover, these devices were incorporated with several issues such as infusion set management, user friendliness, blockages of cannula, and Bluetooth connectivity. There is still a race to pursue appropriate and user friendly system going on. Developments in pumps, Continuous Glucose Monitors (CGMs), prognostics procedures are able to make shut loop system possible physiologically with more than 90% to 95 % Terminal Intervention Ration (TIR) and less time invested in glucose deficiency disorder. Do It Yourself-Artificial Pancreas System (DIY-APS) has shared a few of the promising witnesses. This Do It Yourself (DIY) evolution has induced all the producers of devices to unveil Angiotensin-Converting Enzyme (ACE) pumps and harmonious sensors. However, the main goal of these manufacturers is to create artificial pancreas which will be able to have 100% TIR and no time beneath range and should be afforded by everyone. This factor has the propensity to change the diabetic therapeutics, though this work demands dedication and time.

The beginning of systems with closed loop has become a breakthrough advancement in the treatment of diabetes. Despite this, compulsory procedures of regulations and clinical trials for the universalization of artificial pancreas systems (APS) are complicated and take a lot of time. As a result of this, patients suffering from diabetes and their care givers came together on the online platform with the hashtag “WEARENOTWAITING” to convey their understanding of the open sources software and hardware solutions. This hashtag was the emergence of DIY-APS move. This initiative was the grabbing moment for the IT specialists and enthusiasts who started working on building their own systems containing closed loop which is also known as looping. These devices are called DIY-APS. Open, Loop, and Android are its three different types. These projects related to devices were shared on the digital platforms like NightScout, Facebook, GitHub, and Twitter by the community of diabetic enthusiasts. Which in turn took these projects towards the confluence. Unlawful algorithms were made by FIY-APS for its usage to transmute CGM data as well as count doses of insulin, pumps of insulin, and communication devices approved by FDA. The algorithm used by these systems is not authorized, they are not approved by FDA, and not even regularized or commercialized. One such invention is done by Pete Schwamb for the usage of his own daughter Riley who was suffering from type 1 diabetes. The name of that evolution was “RileyLink”. This device is a translator that allows smooth communication in between iPhone and the insulin pump.

The insulin pen segment accounted for the largest market share 38% in 2023. The insulin pens segment shall have the highest market share as there's an increasing preference due to the various benefits that it offers. These insulin pens are available at affordable cost and they are technologically advanced among all the other devices. Many people across the globe prefer insulin pen as it is easy to use and it also limits the financial burden of the patient as it is pocket friendly.

In the future the development of smart pen is also expected to drive the market of the insulin pen. The increasing number of diabetic patients are using insulin pen due to the convenience in usage. Other products like the insulin pump or the hand syringes are also used to administer insulin. All of these delivery devices also share a good market growth during the forecast.

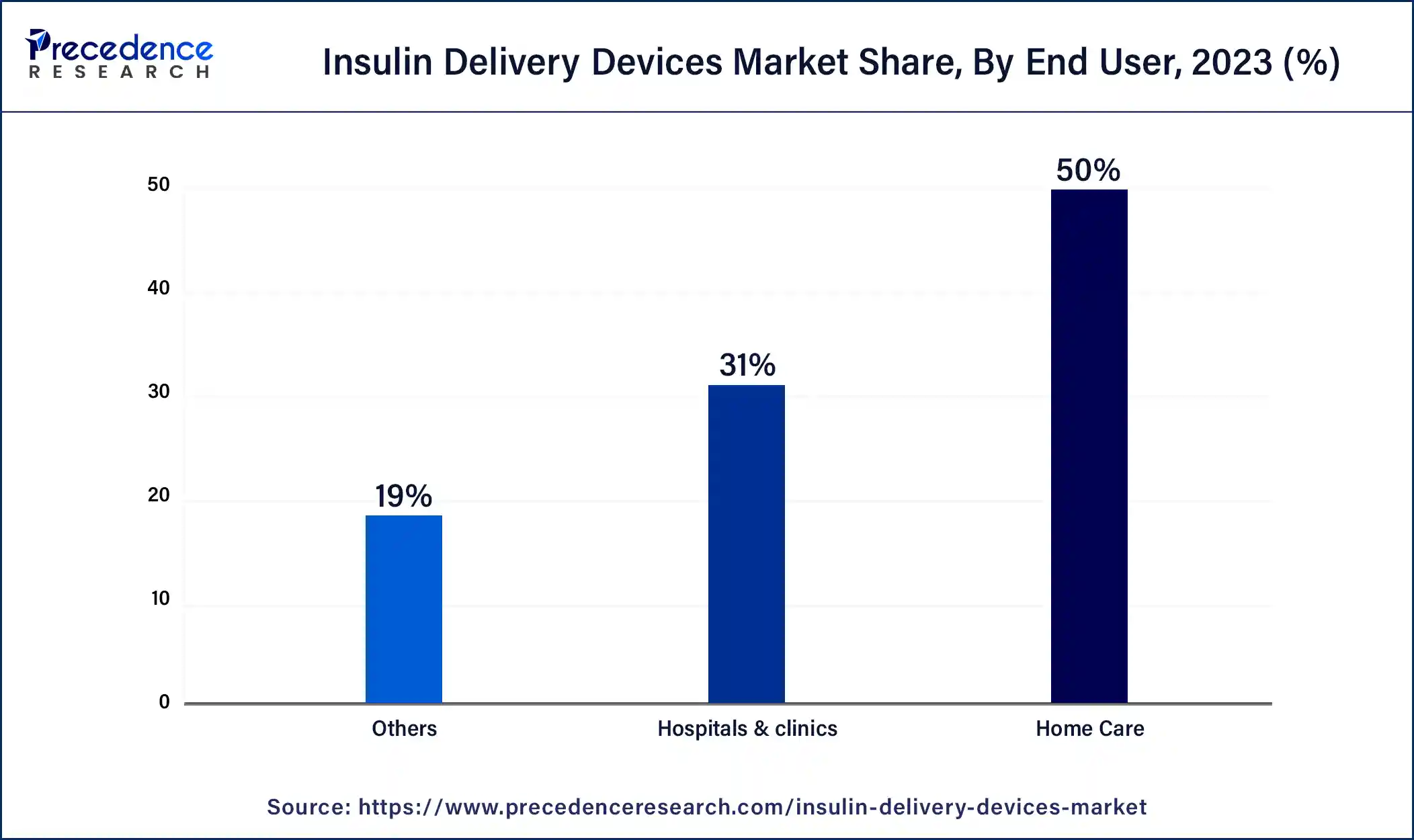

The home care segment accounted for a market share of 50% in 2023. As does an increasing adoption of the delivery devices by the diabetic patients in the home care settings the market is expected to grow well during the forecast period across all the nations. As diabetes is a chronic disease which keeps on growing with every passing year it poses a great health care expenditure. The increasing pressure to reduce these expenses helps in adopting the devices which are easy to use in the homecare settings.

Significant advancements in these devices and the availability helps in driving the market beaded does a higher option rate of the smart insulin pen in the home care settings. It has a supporting smartphone application and a reusable injector pen which is extremely efficient in managing the delivery of insulin. As there is an increased awareness amongst the patient regarding the insulin delivery devices for home use the market shall grow during the forecast period.

On the basis of the distribution channel, the incident delivery devices have maximum sales through the ecommerce segment. Due to advanced features provided by the ecommerce industry and as there is an increased use of the online services by the patients, this distribution segment is expected to grow well during the forecast. Ordering the devices online and getting it delivered to the house provides convenience. Apart from the E commerce segment the hospital pharmacies and the retail pharmacies segments are also expected to have a good crowd during the forecast period.

Positive Impact of the Pandemic for the expansion of Insulin Delivery Devices

The impact of COVID-19 pandemic was devastating for almost all the industries across the globe. However, the global insulin delivery devices market witnessed a positive impact of this pandemic. One of the major factors behind this affirmative impact was the growing population of diabetics and increasing obesity. The demand for protective equipment involving insulin delivery devices like insulin pumps, pens, syringes, among others suddenly got a boost due to the outbreak situation of this pandemic. This pandemic created a major threat among populace which is also the factor for the increasing demand of protective equipment, thus directing towards the growth of revenue trajectory of this market. In the expansion of insulin delivery devices, COVID-19 pandemic plays a very considerable role in the year 2020. In addition, prominent market players operating in this market have taken an advantage of this positive impact to streamline their revenues and expand their footprints in various parts of the globe.

Segments covered in the report

By Type

By Application

By End User

By Distribution Channels

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

December 2024

May 2025

August 2024