List of Contents

Diabetic Retinopathy Market Size and Forecast 2025 to 2034

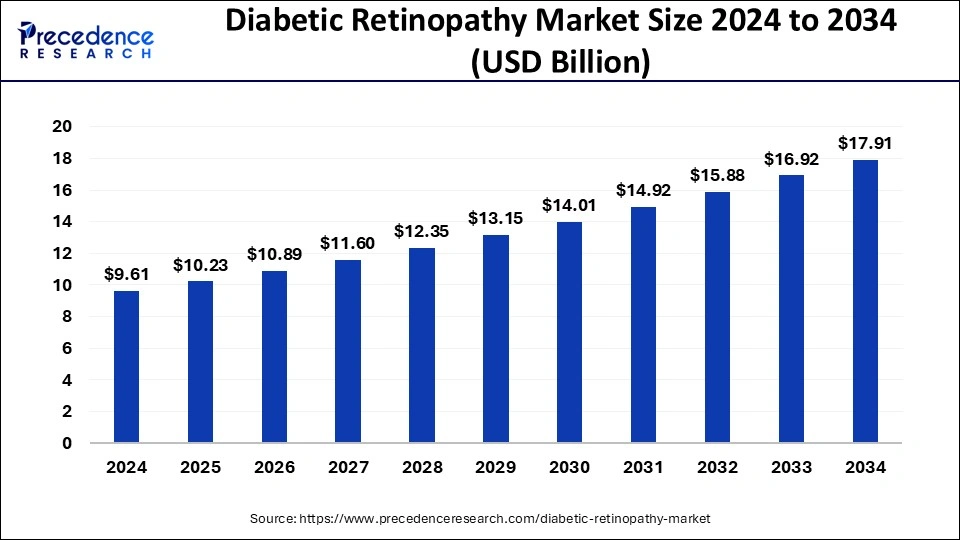

The global diabetic retinopathy market size was calculated at USD 9.61 billion in 2024 and is predicted to increase from USD 10.23 billion in 2025 to approximately USD 17.91 billion by 2034, expanding at a CAGR of 6.42%. The growing cases of diabetic patients due to the unhealthy lifestyle and the aging population are contributing to the growth of the diabetic retinopathy market.

Diabetic Retinopathy MarketKey Takeaways

- The global diabetic retinopathy market was valued at USD 9.61 billion in 2024.

- It is projected to reach USD 17.91 billion by 2034.

- The diabetic retinopathy market is expected to grow at a CAGR of 6.42% from 2025 to 2034.

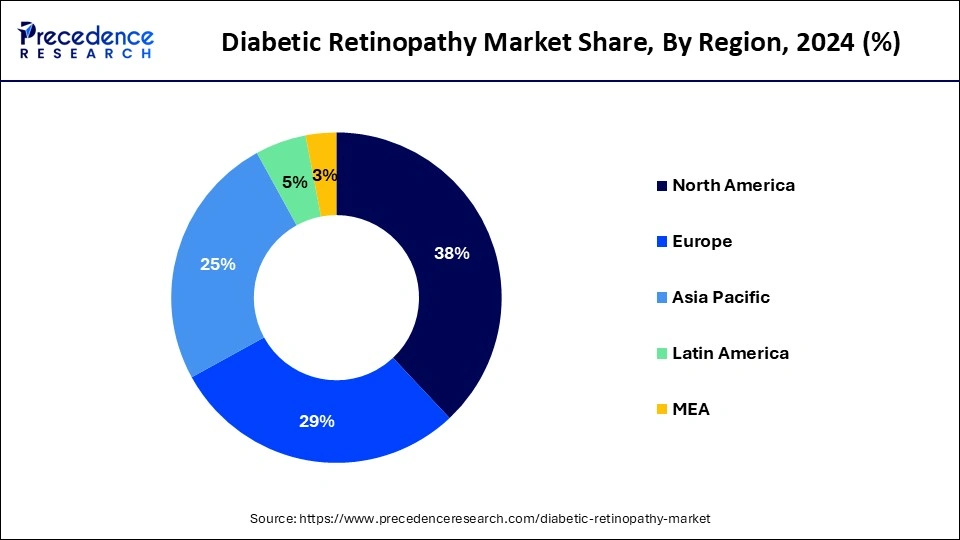

- North America led the market with the largest market share of 38% in 2024.

- Asia Pacific is expected to witness significant growth in the market during the forecast period.

- By type, the proliferative diabetic retinopathy segment dominated the market with the highest market growth in 2024.

- By type, the non-proliferative diabetic retinopathy segment is expected to grow at a significant rate in the market during the forecast period.

- By age group, the 40-49 age group segment projected the highest share in the market in 2024.

- By age group, the 65-74 age group segment is expected to grow notably in the market during the anticipated period.

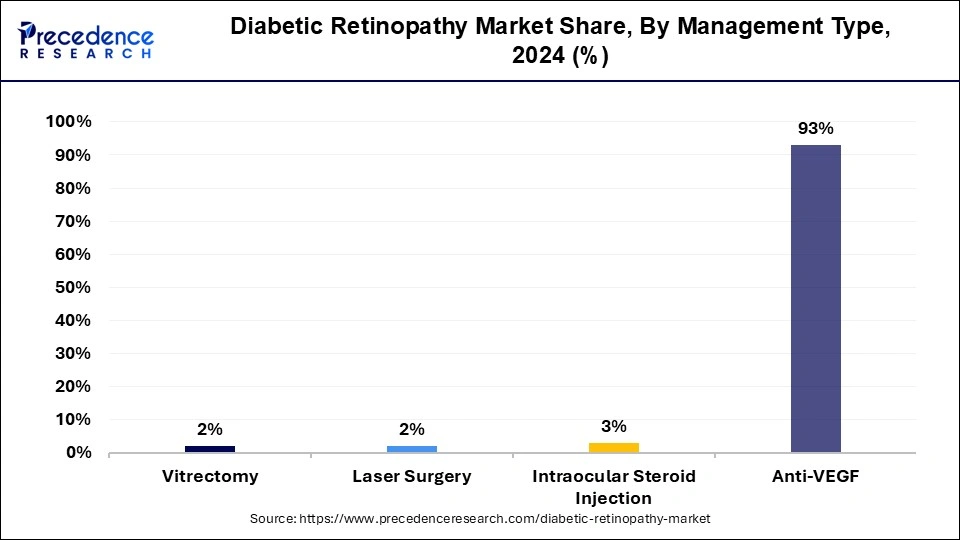

- By management, the Anti-VEGF segment dominated the market in 2024.

- By management, the vitrectomy segment is expected to witness substantial growth in the market during the forecast period.

- By distribution channel, the hospitals and pharmacies segment dominated the market in 2024.

- By distribution channel, the ambulatory surgical centers segment is observed to grow at a significant rate during the forecast period.

U.S.Diabetic Retinopathy Market Size and Growth 2025 to 2034

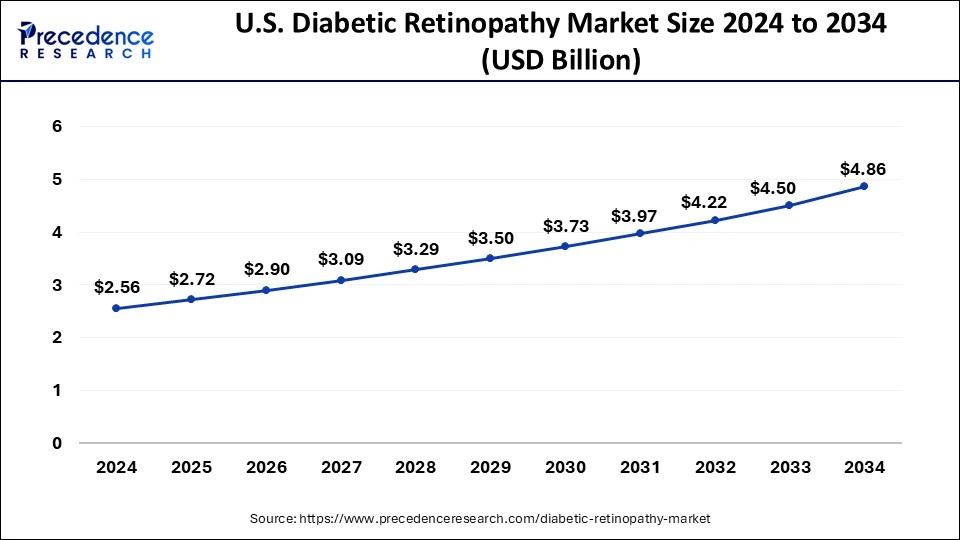

The U.S. diabetic retinopathy market size was exhibited at USD 2.56 billion in 2024 and is projected to be worth around USD 4.86 billion by 2034, growing at a CAGR of 6.62%.

North America dominated the market with the largest market share of 38% in 2024. The growth of the market in the region is increasing due to the higher technological adoption and the well-developed healthcare infrastructure that drives the growth of the market. The increasing tendencies in spending on healthcare due to the increased disposable income and the awareness about the health in the population accelerated the growth of the market. Additionally, the rising diabetic cases in the population due to the unhealthy and sedentary lifestyle that boosts the chances of getting the diabetic condition and higher level of diabetic condition in the individual may develop the risk of diabetic retinopathy that boost the growth of the market across the region.

- Nearly 37 million American with diabetes, it is approximately 26.4% (9.6 million) people are having retinopathy (DR) and 5% (1.8 million) people are having the cases of vision-threating.

Asia Pacific is expected to witness the fastest rate of growth in the diabetic retinopathy market during the forecast period. The growth of the market in the region is owing to the increasing healthcare development and technological innovations in the medical industry. The region has the larger number of aged people with diabetic conditions that drives the higher cases of the diabetic retinopathy conditions and drives the demand for the market. Additionally, the increasing investments in the manufacturing of the advance ophthalmic devices in the countries like China, Japan, and India is further contributed in the growth of the market in the region.

Market Overview

An eye consequence of diabetes is called diabetic retinopathy. It is brought on by injury to the blood vessels in the retina, the light-sensitive tissue located at the back of the eye. People with type 1 or type 2 diabetes have the potential to acquire the disease. This ocular problem is more likely to occur in those with elevated diabetes and poorly regulated blood sugar. Damage to the blood vessels in the retina is the cause of diabetic retinopathy or DR.

In most cases, this results in blurred vision and visual loss. The increasing prevalence of the geriatric population has a higher number of diabetic cases having a higher chance of getting infected with diabetic retinopathy which accelerates the growth of the diabetic retinopathy market.

Diabetic Retinopathy Market Growth Factors

- The rising geriatric population and the related factors are causing higher diabetes patients which will turn on diseases like diabetic retinopathy are driving the growth of the diabetic retinopathy market.

- The increasing prevalence of diabetes in the population due to the changing lifestyle habits, genetics, and growing age is leading to an increased number of diabetic patients which causes problems related to eyesight and drives the demand for the surgical procedure for the treatment that accelerates the growth of the market.

- The increasing government support for awareness about chronic diseases like diabetes and the rising campaign for awareness of eye-related diseases drive the growth of the market.

- The technological advancements in ophthalmic devices and diagnostic instruments for the treatment are further propelling the growth of the market.

- The increasing investments by the private and public sectors for the advancements in healthcare equipment for the ease of surgical procedures with higher accuracy foster the growth of the diabetic retinopathy market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.42% |

| Market Size in 2025 | USD 10.23 Billion |

| Market Size by 2034 | USD 17.91 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Age Group, Management, and Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing cases of diabetes

The increasing population around the world and the rise in the geriatric population are likely to cause diabetes due to the aging factor and other reasons. Diabetic retinopathy is caused by the higher level of sugar in the blood which results in the blockage of tiny blood vessels that provide blood to the retinas, due to the blockage cuts off the blood supply. Due to these, the eye attempts to grow the new blood vessels, but these types of blood vessels cannot develop properly and lead to leakage, which might cause spots or dark strings floating on the vision, fluctuating vision, blurred vision, and sometimes vision loss. The increasing chance of diabetic retinopathy in the geriatric population due to the higher level of diabetes leads to the increasing demand in the diabetic retinopathy market.

Restraint

High cost

The escalating cost of diabetic retinopathy treatment contributes to the overall healthcare spending burden, both for individuals and healthcare payers, including government healthcare programs, private insurers, and employers. High healthcare expenditures associated with diabetic retinopathy management may strain healthcare budgets and limit investment in preventive measures and early intervention strategies.

The cost of diabetic retinopathy treatment, including frequent eye examinations, laser therapy, intraocular injections, and surgical interventions, can place a substantial financial burden on patients, particularly those without adequate insurance coverage or financial resources. High out-of-pocket expenses may deter patients from seeking timely and appropriate care, leading to delayed diagnosis and progression of the disease. Thereby, the cost factor acts as a major restraint for the diabetic retinopathy market.

Opportunity

Rising investments

The increasing investments by the leading market players in the development of technologies in ophthalmic devices promises a lucrative opportunity for the diabetic retinopathy market. Technological adoption such as emergence of artificial intelligence in diabetic retinopathy devices for efficiency in the treatment drives the growth of the market. Further technological adoption such as optical coherence tomography used in the diagnosis allows the provision of cross-sectional images with superior quality that allows doctors to make better decisions. Thus, all these advancements in diabetic retinopathy devices are driving the growth of the market.

Type Insights

The proliferative diabetic retinopathy segment dominated the diabetic retinopathy market with the largest share in 2024. The growth of the segment is owing to its severity in the diabetic eye disease that higher need for the surgical procedure. Proliferative diabetic retinopathy is a more severe form of diabetic retinopathy that can develop from diabetic retinopathy. This kind results in the formation of new, aberrant blood vessels in the retina as injured blood vessels close off. The translucent, jelly-like material called vitreous humor fills the center of the eye, but these new blood vessels are brittle and can burst. The accumulation may harm the optic nerve, which transmits images from your eye to your brain, leading to glaucoma.

The non-proliferative diabetic retinopathy segment is expected to grow in the diabetic retinopathy market during the forecast period. The blood vessel walls in the retina deteriorate in non-proliferative diabetic retinopathy (NPDR). The walls of the smaller vessels have tiny bulges that occasionally leak blood and/or fluid into the retina. It is also possible for larger retinal vessels to start dilating and changing in diameter. As more blood vessels close, NPDR could increase from mild to severe that could cause irreversible eyesight loss.

Age group Insights

The 40-49 age group segment projected the largest share in the diabetic retinopathy market in 2024. The growth of the segment is attributed due to these age group is having a higher prevalence of getting diabetes. Mostly this age group is considered as the most working age group which carries the sedentary lifestyle, irregular eating and sleeping habits. Along with this, the increasing adoption of unhealthy diet increases the chances of diabetic complications for this age group. Thereby, the segment is observed to keep growing in the upcoming years.

The 65-74 age group segment is expected to grow in the diabetic retinopathy market during the anticipated period. These age group is considered as geriatric population that has the largest set of diabetic patients. The increased level of sugar in the blood for this cateogry of patients is more likely to boost the chances of retinopathy while promoting the segment's growth.

Management Type Insights

The anti-VEGF segment dominated the diabetic retinopathy market share of 93% in 2024. The increasing prevalence of the treatment of eye disease is driving the growth of the segment in the market. Anti-vascular endothelial growth factor (VEGF) therapy for the eyes is one of the greatest medical advancements. Millions of people worldwide have had their sight preserved due to the quick and extensive adoption of this novel treatment into clinical practice for the treatment of age-related macular degeneration. It is commonly expected that ocular anti-VEGF medication will become more frequently used to treat forms of diabetic retinopathy which are a threat to vision loss.

The vitrectomy segment is expected to witness substantial growth in the market during the forecast period. Vitreoretinal surgery includes in the vitrectomy procedure. This phrase describes a variety of surgical techniques used to treat issues with the retina, macula, and vitreous fluid of the eye. The vitreous humor, a gel-like fluid found in the eye, must be removed and replaced in these type of surgery. This helps in the removal of any blood and scar tissue that might be present as a result of advanced diabetic retinopathy treatment.

Distribution Channel Insights

The hospitals and pharmacies segment dominated the diabetic retinopathy market in 2024. The growth of the segment is attributed to the increasing prevalence of surgical procedures in the hospitals. The increasing availability of skilled professionals for the treatment. Additionally, the hospitals are covered by the government and public healthcare sector though they can afford the latest technological advanced devices for the treatment of the diseases and get proper treatment and care by the trained professionals. The rising adoption of the hospital segment for the efficient treatment of the diseases that drives the growth of the segment.

The ambulatory surgical centers segment is expected to grow in the market during the forecast period. The growth of the segment is increasing due to the larger number of ophthalmic surgical procedures performed on an outpatients basis due to the lower cost compared to the inpatient. Thus, these factor is highly contributing to the higher demand for the segment.

Recent Developments

- In February 2024, the King's George Medical University (KGMU) is launching the latest technology for the treatment of diabetic retinopathy. The University is allocated Rs 2 Crores from the government and the development of revolutionary machines and services for the treatment of eye conditions.

Diabetic Retinopathy Market Companies

- Bayer AG

- ABBVIE INC.

- Novartis AG

- Oxurion NV

- Sirnaomics

- Alimera Sciences

- Ampio Pharmaceuticals Inc.

- BCNPeptides

- Kowa Company Ltd.

- Genentech, Inc.

Segments Covered in the Report

By Type

- Proliferative Diabetic Retinopathy

- Non-Proliferative Diabetic Retinopathy

By Age Group

- 40-49

- 65-74

- 50-64

By Management Type

- Vitrectomy

- Anti-VEGF

- Intracular Steroid Injection

- Laser Surgery

By Distribution Channel

- Hospitals and Pharmacies

- Ambulatory Surgical Centers (ASCs)

- Eye Clinics

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client