March 2024

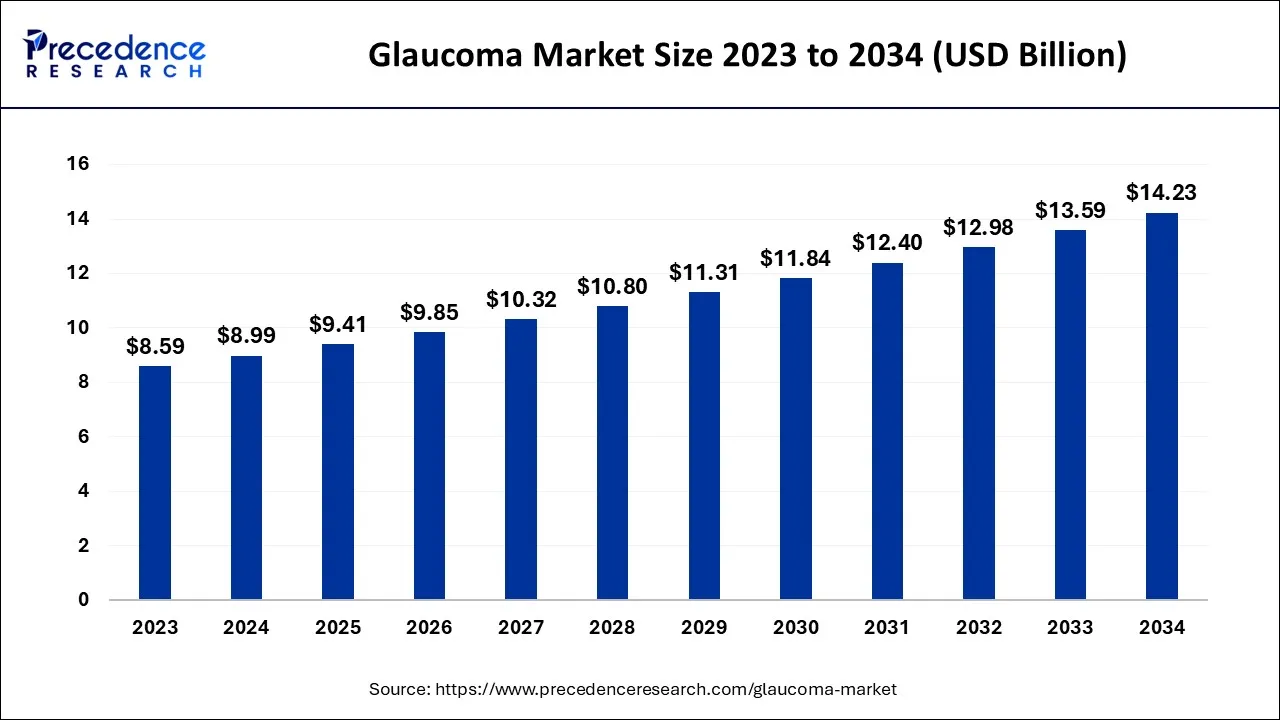

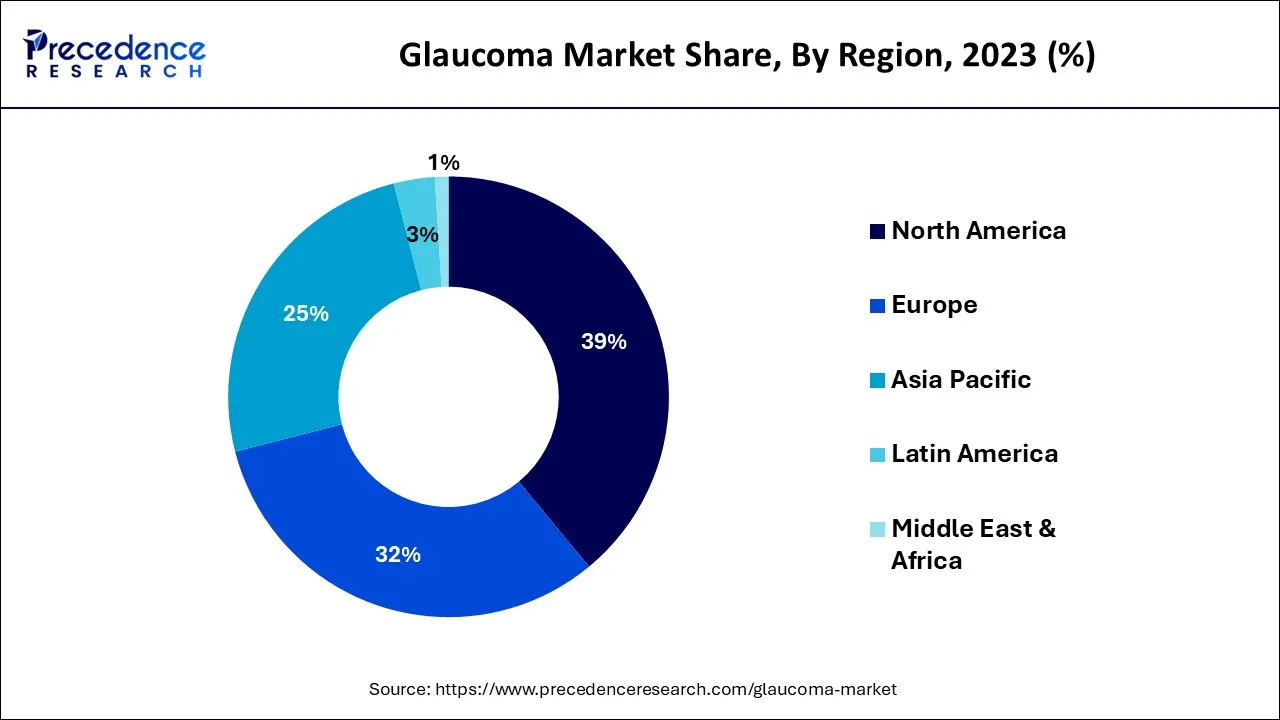

The global glaucoma market size accounted for USD 8.99 billion in 2024, grew to USD 9.41 billion in 2025 and is expected to be worth around USD 14.23 billion by 2034, registering a CAGR of 4.7% between 2024 and 2034. The North America glaucoma market size is calculated at USD 3.51 billion in 2024 and is estimated to grow at a CAGR of 4.83% during the forecast period.

The global glaucoma market size is calculated at USD 8.99 billion in 2024 and is projected to surpass around USD 9.80 billion by 2034, growing at a CAGR of 4.7% from 2024 to 2034.

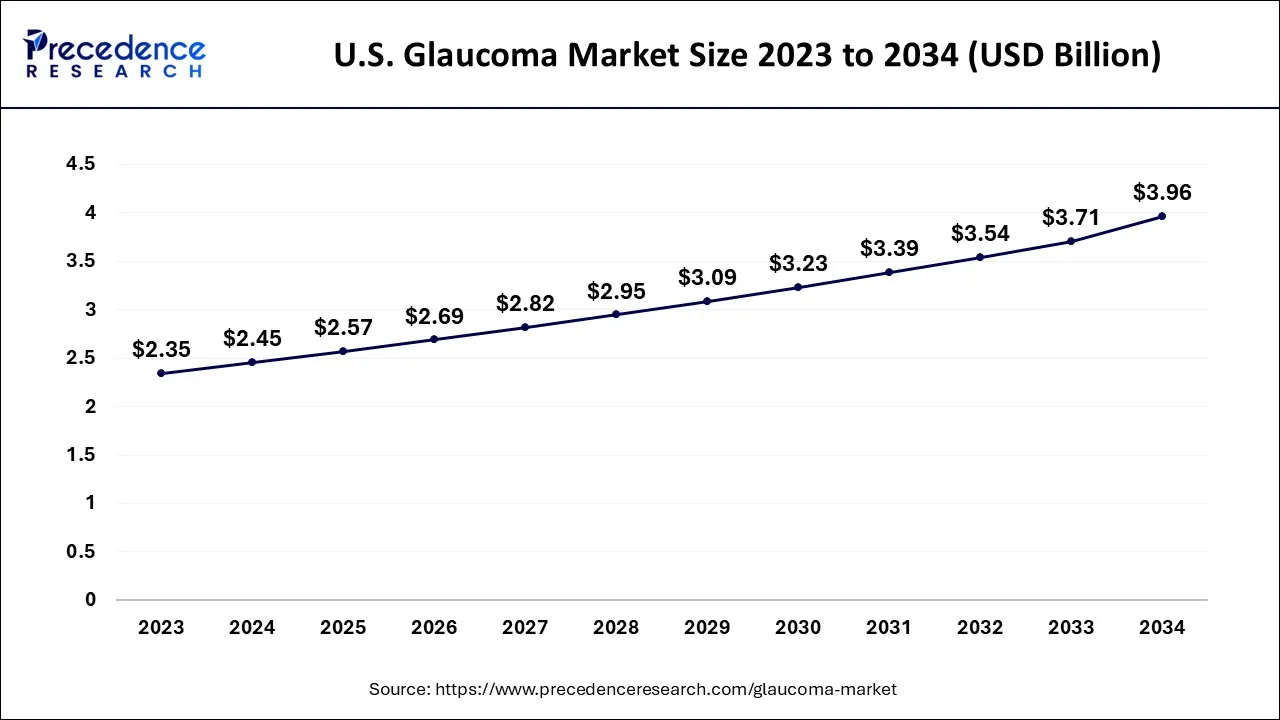

The U.S. glaucoma market size is exhibited at USD 2.45 billion in 2024 and is projected to be worth around USD 3.96 billion by 2034, growing at a CAGR of 4.91% from 2024 to 2034.

One of the main factors contributing to North America's dominance in this sector is its practical treatment framework and sophisticated hospital diagnosis infrastructure. Since the problem worsens gradually, efficient diagnostic instruments allow for early identification. The increasing number of FDA approvals and medicine launches for the treatment in the area is supporting the increase. More than 3 million Americans have glaucoma, and open-angle glaucoma is the most prevalent type, according to research from the Bright Focus Foundation.

In September 2020, the two glaucoma medications introduced by Micro Labs USA were dorzolamide 2% and dorzolamide-timolol. Micro Labs USA intends to launch new ophthalmic solutions that are now undergoing FDA evaluation and development to satisfy the rising demand.

Additionally, Allergan Plc announced in July 2019 that the US Food and Drug Administration (FDA) had accepted the New Drug Application (NDA) for Bimatoprost Sustained Release. The first sustained, reversible implant for treating people with primary open-angle glaucoma or ocular hypertension would be called bimatoprost SR. The excellent reimbursement situation in Europe is predicted to be perfect, which will encourage people to use glaucoma therapies. Glaucoma treatments are currently among the approved, subsidized therapeutic commodities that UK residents can access through the National Health Service (NHS).

On the other hand, due to the region's aging population, which is exceptionally high in countries like China and Japan, Asia-Pacific is predicted to grow faster in the market. Public spending is lower in Asia, and most medical operations are fee-for-service. The largest markets are Japan and South Korea, but China will grow at the highest rate due to rising healthcare costs and accelerated economic expansion. Additionally, the availability of potent generics, particularly in countries like India, will cause the number of anti-glaucoma medications to increase. However, compared to the growing regions of Asia and the Pacific, Japan will have the most significant development in the surgical industry. Additionally, the number of anti-glaucoma medications will rise due to the availability of solid generics, particularly in nations like India. However, Japan will experience the most significant growth in the surgical business when compared to other developing Asia-Pacific nations.

One of the most prevalent ocular conditions seen in secondary and primary care settings, glaucoma is the third most common cause of blindness in the general population. Glaucoma is a condition that damages the optic nerve of your eye and gets worse over time. It frequently has to do with an increase in pressure inside your eye. The optic nerve that transmits images to your brain may get damaged due to increased intraocular pressure in your eye. Glaucoma can, within a few years, result in total blindness or irreversible vision loss if the disease develops. The glaucoma market is the demand for medications and therapies used to treat glaucoma. Over the past ten years, glaucoma drugs have become more widely accessible, while laser trabeculoplasty has become more popular, leading to a decline in invasive incisional surgery. The rising prevalence of glaucoma, rising activities to raise awareness of glaucoma, and technical breakthroughs in the field of ophthalmology are the main drivers of the growth of the glaucoma treatment market. The second most common cause of blindness in the world is glaucoma.

In 2019, statistics from the WHO indicated more than 60 million glaucoma patients worldwide.

The rising prevalence of glaucoma, rising attempts to raise awareness of glaucoma, and technical breakthroughs in the field of ophthalmology are the key drivers of the growth of the glaucoma treatment market. The second most common cause of blindness in the world is glaucoma. In most cases, increased intraocular tension is to blame. The main therapeutic objective is to reduce intraocular pressure, and this is done by either increasing or decreasing aqueous fluid output.

Therefore, the market is anticipated to expand rapidly throughout the forecast period due to increased glaucoma occurrences.

| Report Coverage | Details |

| Market Size in 2024 | USD 8.99 Billion |

| Market Size by 2034 | USD 14.23 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.7% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Disease Type, By Drug Class, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The demand for efficient prescription eye drops for glaucoma is driving its treatment

Manufacturers and industry participants in the glaucoma treatment market aim to create newer drug combinations and prescription eye drops to control glaucoma at an early stage. Numerous biomedical and pharmaceutical businesses invest in product development to reduce the pressure on healthcare facilities. Beta-blockers, carbonic anhydrase inhibitors, alpha-agonists, cholinergics, prostaglandin analogs (PGAs), beta-blockers, carbonic anhydrase inhibitors, carbonic anhydrase inhibitors, and some combination therapies are some of the drugs used to treat glaucoma. By promoting fluid evacuation from the patient's eye, these medications aid in lowering intraocular pressure. However, instances of drug recalls by essential industry players need to be improved for the global glaucoma treatment market to expand. Failure to meet regulatory requirements and observable contaminants in various medicine combinations are the leading causes of these product recalls. When regulatory requirements are not met, patients, medical professionals, and the public become anxious and skeptical.

In the upcoming years, the market for glaucoma treatment may expand thanks to alternative methods that don't require much medicine and provide long-lasting comfort. Laser therapy, selective laser trabeculoplasty, and minimally invasive glaucoma operations, sometimes known as MIGs, are a few alternative treatments for glaucoma. Both methods lower intraocular pressure by causing the patient's eye to produce more fluid.

Side effects associated with the drugs

For the treatment of glaucoma, there are many medications available. Several possible adverse effects of glaucoma drugs include Analogs of prostaglandins

Prostaglandin analogs: PGAs raise uveoscleral outflow, which lowers IOP. Hypertrichosis, conjunctival hyperemia, irreversible iris darkening, darkening of the periorbital skin, prostaglandin-associated periorbitopathy (PAP), cystoid macular edema (CME), and non-granulomatous anterior uveitis are a few potential side effects of these medications. Following the start of PGA, hypertrichosis frequently develops between 6 and 12 months later. Trichiasis needing epilation has also been documented. The eye and periorbital skin often get darker due to PGA-induced melanogenesis. Ptosis, deepening of the lid sulcus, enophthalmos, dermatochalasis, and loss of periorbital fat are some of the involutional changes to the eyelids that make up PAP. However, those familiar with bimatoprost (> 93.3%) may recognize the syndrome.

Alpha-2 adrenergic agonists: By reducing the output of aqueous humor, alpha-2 agonists reduce IOP. A popular selective alpha-2 adrenergic agonist is brimonidine. Six to nine months after starting the medication, brimonidine can result in acute follicular conjunctivitis in 5% to 9% of individuals. After 15 months, a delayed follicular reaction has been documented. Another alpha-2 adrenergic agonist, apraclonidine, has a greater incidence (30–48%). Alpha-2 adrenergic agonists frequently cause dry mouth, which is a side effect that can be related to a systemic action. The lipophilic nature of this drug class and its capacity to pass the blood-brain barrier may make children and older adults more susceptible to central nervous system side effects, including lethargy, apnea, hypotension, and bradycardia.

Beta blockers' adverse effects include weariness, low blood pressure, and a slowed heartbeat. People with a history of asthma or other respiratory diseases may experience shortness of breath when using beta-blockers. Beta-blockers can also alter cardiac activity by lowering the amount of blood the heart pumps, which may reduce the pulse rate and slow the heart's reaction time during exercise. Depression and decreased libido are uncommon side effects.

Carbonic Anhydrase Inhibitors: Mental fuzziness, memory problems, depression, kidney stones, frequent urination, and carbonic anhydrase inhibitors can also result in burning or a loss of strength in the hands and feet and an upset stomach. These drugs come in pill form, and the eye drops might cause stinging, burning, and other uncomfortable eye effects.

Pipeline treatment

The main driver of the market expansion during the projection period will be the numerous pipeline medicines for the currently developed condition. One of the most recent innovations is a brand-new drug for glaucoma treatment created by the University Of Minnesota College Of Pharmacy's Department of Medicinal Chemistry and Institute for Therapeutics Discovery & Development (ITDD). Netarsudil mesylate, ripasudil hydrochloride hydrate, latanoprost, PH-011, PH-012, netarsudil mesylate, latanoprost, (bimatoprost + timolol), and (latanoprost + netarsudil) are some of the top glaucoma medications under development. In most cases, prostaglandin analogs are the first line of treatment.

NCX 470 (Nicox SA): NCX 470, a PGA made from a nitric oxide-donating substance, has demonstrated promise in clinical trials. In decreasing IOP and treating glaucoma and ocular hypertension, the solution outperformed bimatoprost in prior animal research.

In the Phase II studies, latanoprost was administered at a concentration of 0.005%, while topical NCX 470 was supplied at 0.065%. According to the manufacturer, NCX 470 effectively reduced patients' IOP levels by up to 1.4 mmHg more than latanoprost at all-time points during the 28-day trial.

Cromakalim prodrug 1 (CKLP1) is an ATP-sensitive potassium channel opener being studied by researchers from the United States and the United Kingdom. It is one of two potential medications that use a new mechanism of action involving the reduction of episcleral venous pressure (EVP).

Omidenepag isopropyl (Omdi, Santen) is a medication available in Japan and other Asian countries since 2018; however, the FDA has not yet approved it. Omdi is a selective EP2 prostanoid receptor agonist that is not prostaglandin-based. Its safety and effectiveness have been demonstrated in numerous research. One of these studies indicated that Japanese patients with open-angle glaucoma or ocular hypertension experienced sustained IOP reductions for 52 weeks when Omdi 0.002% was treated alone or concurrently with timolol 0.5%.

The diseases type in the disease-type sector, the open angle led the market, which is anticipated to continue throughout the expected time frame. The condition's high prevalence explains why this is distinct from other types of glaucoma. Primary open-angle glaucoma (OAG) is the most prevalent kind of glaucoma. If the eye usually functions, fluid exits the anterior chamber through the gap between the cornea and iris and disappears from view. When OAG is present, the liquid slowly leaks out and accumulates, increasing the pressure inside the eye and potentially leading to a gradual loss of eyesight. The market for open-angle glaucoma care and therapies is growing due to the aging population's growth and the frequency of chronic eye diseases. Open-angle glaucoma may not manifest symptoms in the early stages and often advances slowly. Blind patches generally appear as the disease progresses since peripheral vision is typically the first to be compromised.

On the other hand, acute angle-closure glaucoma (ACG), also known as angle-closure or narrow-angle glaucoma is less common and happens when the iris blocks the angle. If ignored, ACG can quickly result in visual loss. The "angle" between your iris and cornea "closes" as they get closer to one another. Your canals are entirely blocked by acute angle closure glaucoma. Like a piece of paper slipping over a sink drain, it prevents fluid from flowing through it.

The drug class, segmental demand will increase as prostaglandin analogs, which have several benefits, including effectiveness with a single daily dose, are used more frequently to treat the condition. The category is also anticipated to grow significantly due to the increased demand for prostaglandin medications used in combination therapy. The prostaglandin analog industry retained the most significant market share for the drugs because they successfully decrease intraocular pressure and have fewer adverse effects than other therapies. The prostaglandins section also includes subsections for latanoprost, bimatoprost, travoprost, and other substances. Combination medicines are a further emerging option for treating complex and rapidly progressing glaucoma in some rare instances. The expanded study of prostaglandin analogs has altered how glaucoma patients use this pharmaceutical class.

In some rare cases, combination medications are another growing therapy for treating challenging, rapidly developing glaucoma.

The distribution channel Hospital pharmacies are anticipated to hold the largest market share throughout the projected period. The large selection of products for diverse treatment modalities is to blame for the massive growth. Patients' preference for hospital pharmacies when purchasing prescription drugs aids revenue growth. It will also strengthen market estimates by offering insurance coverage and payment guidelines for pharmaceutical purchases conducted in hospital settings. The retail pharmacy segment is anticipated to experience the most significant increase. The growing preference for treatments in outpatient settings among older people is expected to fuel the growth of the retail pharmacy category.

Segment Covered in the Report

By Disease Type

By Drug Class

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

September 2024

April 2025