August 2024

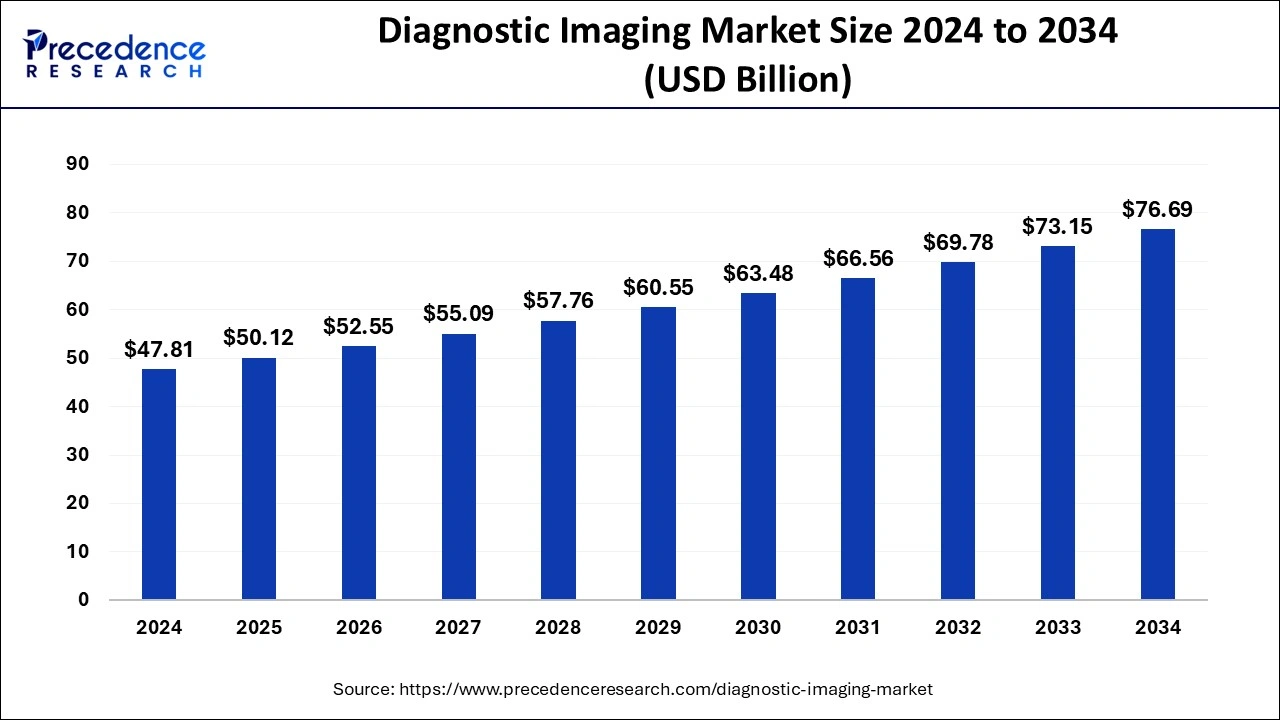

The global diagnostic imaging market size was estimated at USD 47.81 billion in 2024 and is anticipated to reach around USD 76.69 billion by 2034, expanding at a CAGR of 4.84% from 2025 to 2034. The rising awareness of early disease detection is expected to boost the market growth.

AI-driven diagnostic imaging has opened up new possibilities and is transforming diagnostic imaging in the healthcare industry by assisting healthcare practitioners and doctors to provide more accurate, quick, and efficient diagnoses. AI can enhance the accuracy and efficiency of interpreting medical images such as MRIs, X-rays, and CT scans. By leveraging AI, diagnostic imaging technology allows healthcare professionals to identify abnormalities and detect diseases with higher precision and speed. AI-powered diagnostic tools can speed up the interpretation of complex images and improve efficiency, resulting in the early detection of chronic diseases. Moreover, AI can enhance the accuracy of diagnosis and treatment efficiency, improving overall patient care.

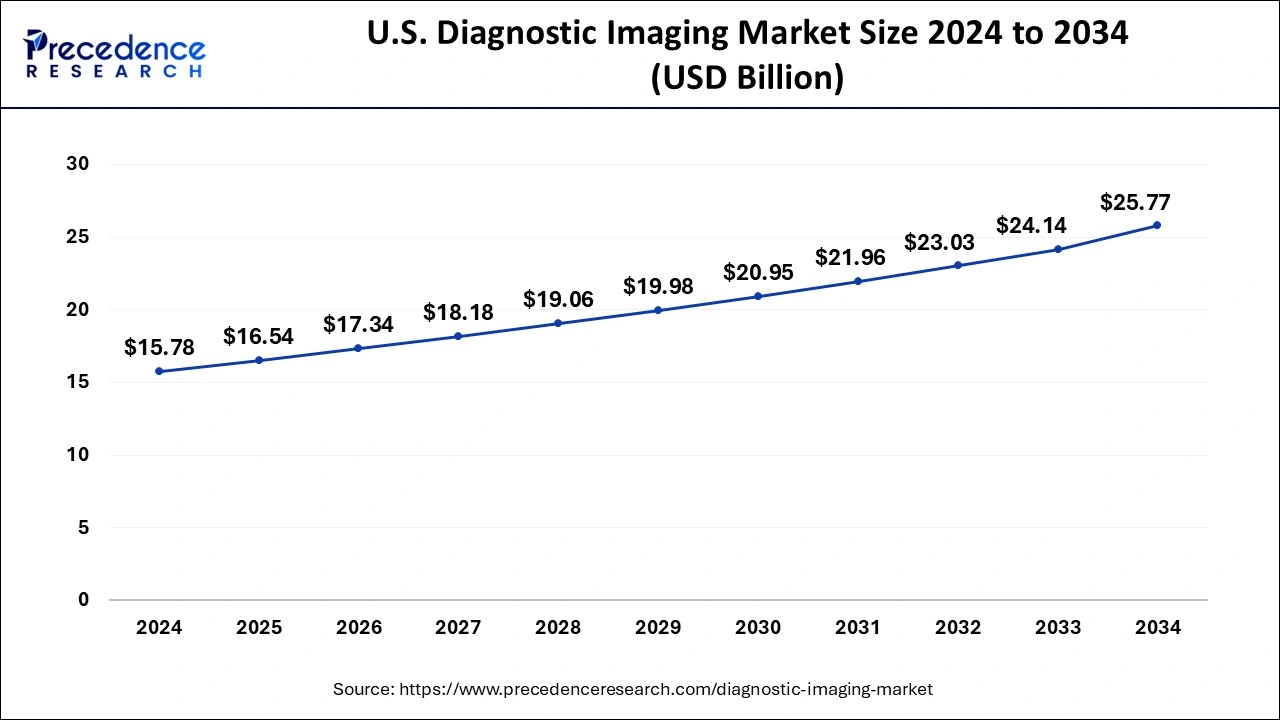

The U.S. diagnostic imaging market size was evaluated at USD 15.78 billion in 2024 and is predicted to be worth around USD 25.77 billion by 2034, rising at a CAGR of 5.02% from 2025 to 2034.

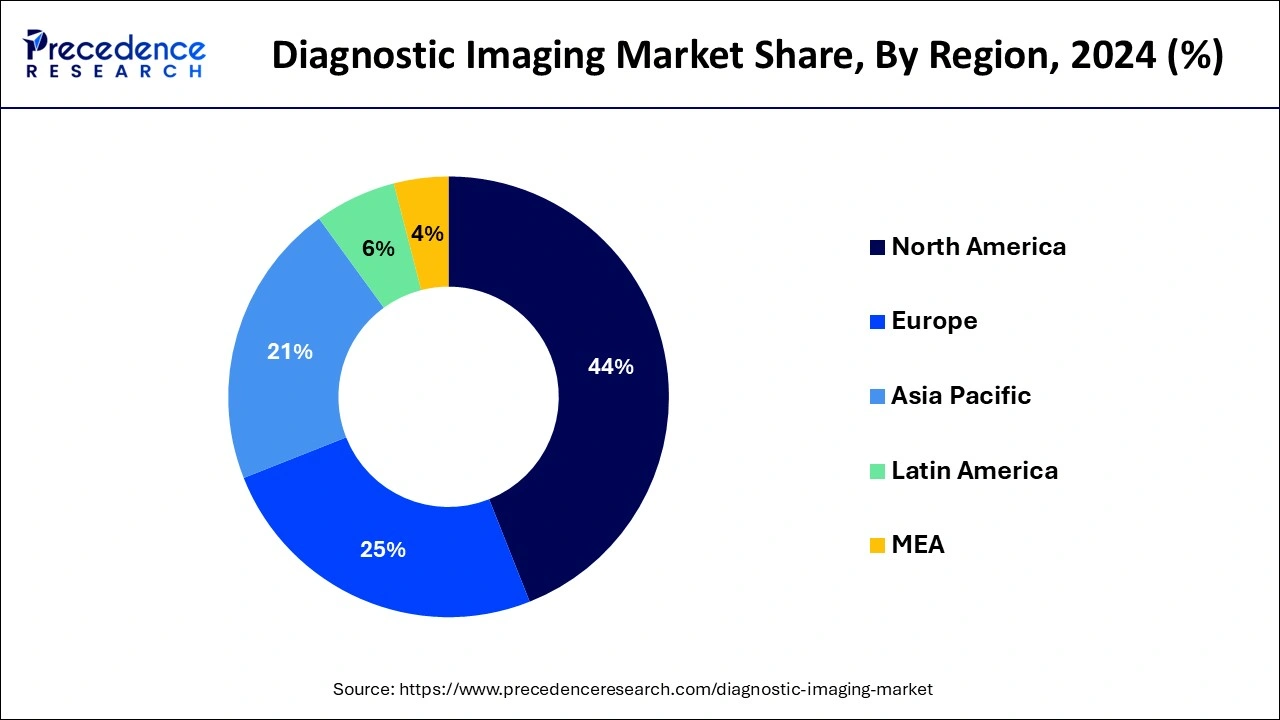

North America accounted for over 44% of the market share in 2024. The increased adoption rate of the advanced technologies in the healthcare industry and the increased demand among the population for the advanced diagnostic imaging solutions has significantly boosted the growth of the North America market.

The increasing prevalence of chronic diseases and the availability of advanced diagnostic imaging solutions bolstered the growth of the market in the region.

Asia Pacific is estimated to be the most opportunistic segment during the forecast period. Asia Pacific is characterized by the increasing penetration of private hospitals and diagnostic centers. The rising awareness among the population regarding the availability of the advanced diagnostic imaging devices is expected to drive the market growth during the forecast period.

The surge in healthcare expenditures for the development of sophisticated healthcare devices further boost the growth of the market during the forecast period. Moreover, several developing and developed nations across the region are investing in advanced imaging technologies to enhance care.

| Report Coverage | Details |

| Market Size in 2024 | USD 47.81 Billion |

| Market Size in 2025 | USD 50.12 Billion |

| Market Size by 2034 | USD 76.69 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 4.84% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, Region |

Increasing Burden of Chronic Diseases

With the increasing burden of chronic diseases worldwide, there is a significant increase in the adoption of diagnostic imaging solutions. Diagnostic imaging is important for detecting and treating numerous health conditions, such as neurological disorders and cardiovascular diseases. The prevalence of chronic diseases such as cancer, CVDs, and diabetes is on the rise across the globe. According to the International Diabetes Federation, around 700 million people will have diabetes around the globe by 2045. Moreover, global cancer cases are estimated to grow by 47% from 2020 to 2040, highlighting the need for advanced imaging technologies. In addition, the demand for diagnostic imaging is exponentially rising owing to the growing geriatric population, as old age people are more prone to various chronic diseases. The surge in awareness regarding the availability of advanced diagnostic devices is expected to contribute to the significant growth potential of the diagnostic imaging market.

High Cost

High cost associated with advanced diagnostic imaging equipment discourage small healthcare organizations from adopting them, thereby hampering the growth of the market. Moreover, the lack of skilled radiologists, especially in underdeveloped countries, limits the usage of advanced imaging technologies.

Technological Advancements

Rising technological advancements in imaging technologies create immense opportunities in the market. Advanced imaging technologies play a vital role in the accurate and rapid diagnosis of diseases. Thus, market players are continuously launching new products to cater to consumers’ varying needs. For instance, in April 2024, Q Bio Inc., an innovator in medical imaging technology, announced the launch of Tensor Field Mapping (TFM), a new technology for Magnetic Resonance Imaging (MRI) that provided detailed insights into the human body that previously unimaginable. Furthermore, rising government investments in developing sophisticated healthcare infrastructure contribute to market expansion.

The ultrasound segment accounted for the biggest market share of 34% in 2024. This can be attributed to the increased adoption of the ultrasound equipment in the healthcare sector owing to its low cost and enhanced features such as instant and accurate ultrasound results, safety, improved radiation-free imaging, and non-invasiveness. It is one of the most popular and extensively used diagnostic imaging devices all over the globe, which led the growth of this segment as a dominating segment.

On the other hand, the computed tomography (CT) is estimated to be the most opportunistic segment during the forecast period. The CT segment witnessed a strong growth in 2022 owing to the increased adoption of the CT for diagnosis of the COVID-19 patients. The high-precision CT scanners and its integration with the technology like artificial intelligence is anticipated to further drive the growth of this segment.

The oncology segment dominated the global diagnostic imaging market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is simply attributed to the increased prevalence of cancer among the population. Lungs cancer is the most prominent type of cancer and accounts for the maximum number of cancer deaths across the globe. According to the International Agency for Research on Cancer, breast cancer has surpassed lungs cancer as the most diagnosed type of cancer. Therefore, the increased demand for the oncology diagnostic imaging has fostered the growth of this segment.

On the other hand, orthopedics is estimated to be the fastest-growing segment during the forecast period. The rising geriatric population and rising road accident cases is boosting the demand for the orthopedics segment. Moreover, the access to the technologically advanced devices for the diagnostics is fueling the market growth.

Based on the end user, the hospitals segment accounted largest revenue share of over 45% in 2024. The wide spread penetration of the public and private hospitals across the globe is the major factor behind the growth of this segment. Moreover, rising investments in the development of smart and technologically advanced hospitals equipped with advanced diagnostic imaging equipment will further drive the segment’s growth.

On the other hand, ambulatory imaging centers are estimated to be the most opportunistic segment. This is due to the rising investments in increasing the penetration of the ambulatory services in the rural areas to provide advanced care in the underdeveloped region is a major factor that propels the growth of this segment. The penetration of the ambulatory services is rising in the Southeast Asian countries.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like new product launches with latest and innovative features fosters market growth and offers lucrative growth opportunities to the market players.

By Product Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

June 2025

February 2025