April 2024

Digestive Health Products Market Size, Share and Growth Analysis (By Ingredients: Probiotics, Prebiotics, and Food Enzymes; By Distribution Channel: Supermarkets & Hypermarkets, Pharmacy Stores, E-commerce, and Others; By Product) - Global Industry Analysis, Trends, Regional Outlook, and Forecast 2024 - 2033

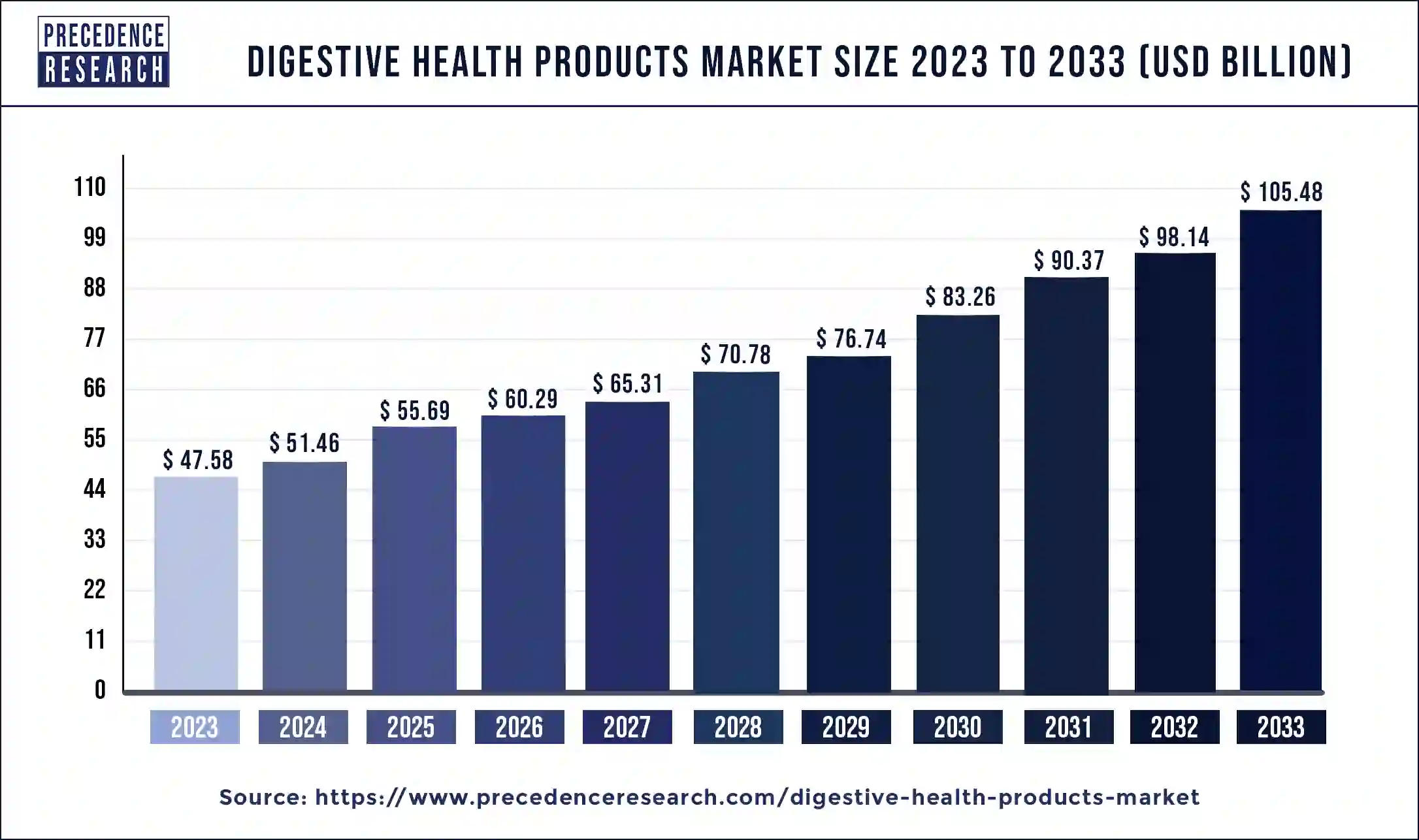

The global digestive health products market size was valued at USD 47.58 billion in 2023 and it is expected to hit around USD 105.48 billion by 2033 with a registered CAGR of 8% from 2024 to 2033.

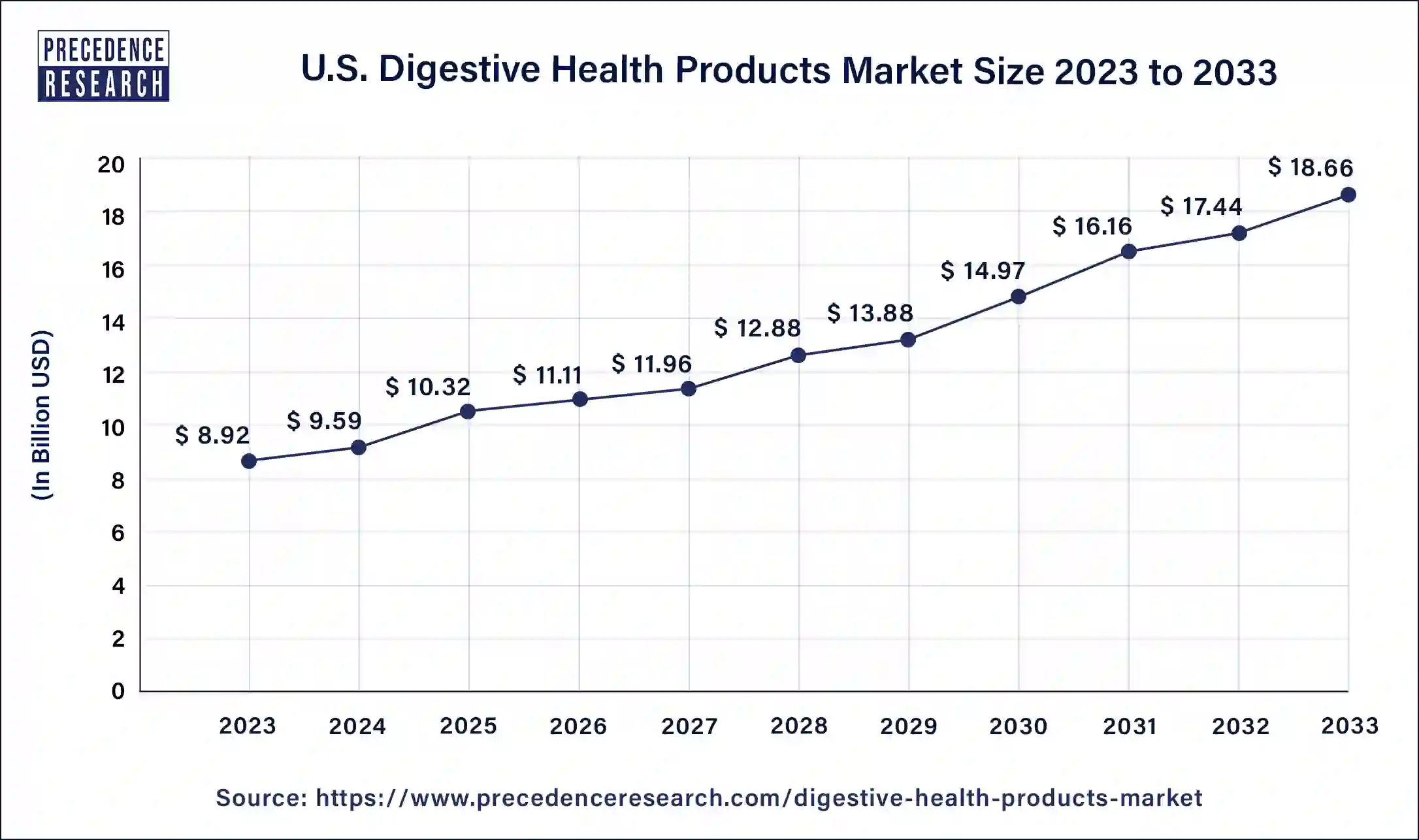

The U.S. digestive health products market size was valued at USD 8.92 billion in 2023 and is expected to reach USD 18.66 billion by 2033, growing at a CAGR of 8% from 2024 to 2033.

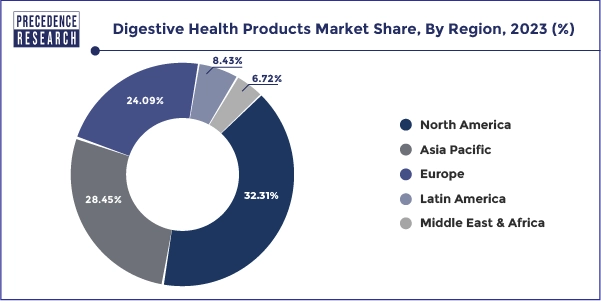

North America dominated the digestive health products market and accounted for the largest revenue share of 32.31% in 2023. The presence of a substantial number of digestive health product producers and increased consumer awareness regarding the availability of various digestive health products has significantly contributed in the growth of the North America market. Moreover, technological advancements, product innovations, and quick door step delivery of products have fueled the growth of the North America digestive health products market in the recent years.

Asia Pacific is anticipated to be the fastest growing market for the digestive health products in the upcoming years. The growing penetration of different health products by the producers in the large economies such as China, Japan, and India is fueling the market growth across the Asia Pacific region. Moreover, the huge consumer base, rising disposable income, rapid urbanization, and growing number of working population is perfectly augmenting the market growth in the region.

The growing prevalence of malabsorption, obesity, and reduction of food intake due to changing lifestyle of the consumers is augmenting the growth of the digestive health products market. Digestive health products are intended to boost the human immunity system by improving the functions of the digestive system. The presence of various enzymes such as lipase, amylases, and lactase in the digestive health products helps to maintain the stomach acid levels and improves digestion of nutrients. Rising demand for nutritional supplements and nutritional food additives is one of the key factors propelling the growth of the digestive health products market.

Changing lifestyle of the consumer, rising number of working population, busy and hectic schedule of consumers, growing geriatric population, rising disposable income, and increased consumer expenditure on healthcare products is significantly contributing to the growth of the digestive health products market. Furthermore, growing consumer awareness regarding probiotics and associated benefits coupled with rising healthcare costs is driving the demand for the digestive health products among the population.

| Report Highlights | Details |

| Growth Rate From 2024 to 2033 | CAGR of 8% |

| Market Size in 2023 | USD 47.58 Billion |

| Market Size by 2033 | USD 105.48 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Ingredients, Product, Distribution Channel |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

| Companies Mentioned | Cargill, Inc., Arla Foods, Inc., Danone A.S., PepsiCo, Inc., Yakult Honsha Co., Nestle SA, AST Enzymes, Beroni Group, Danisco AS, Chr. Hansen Holding |

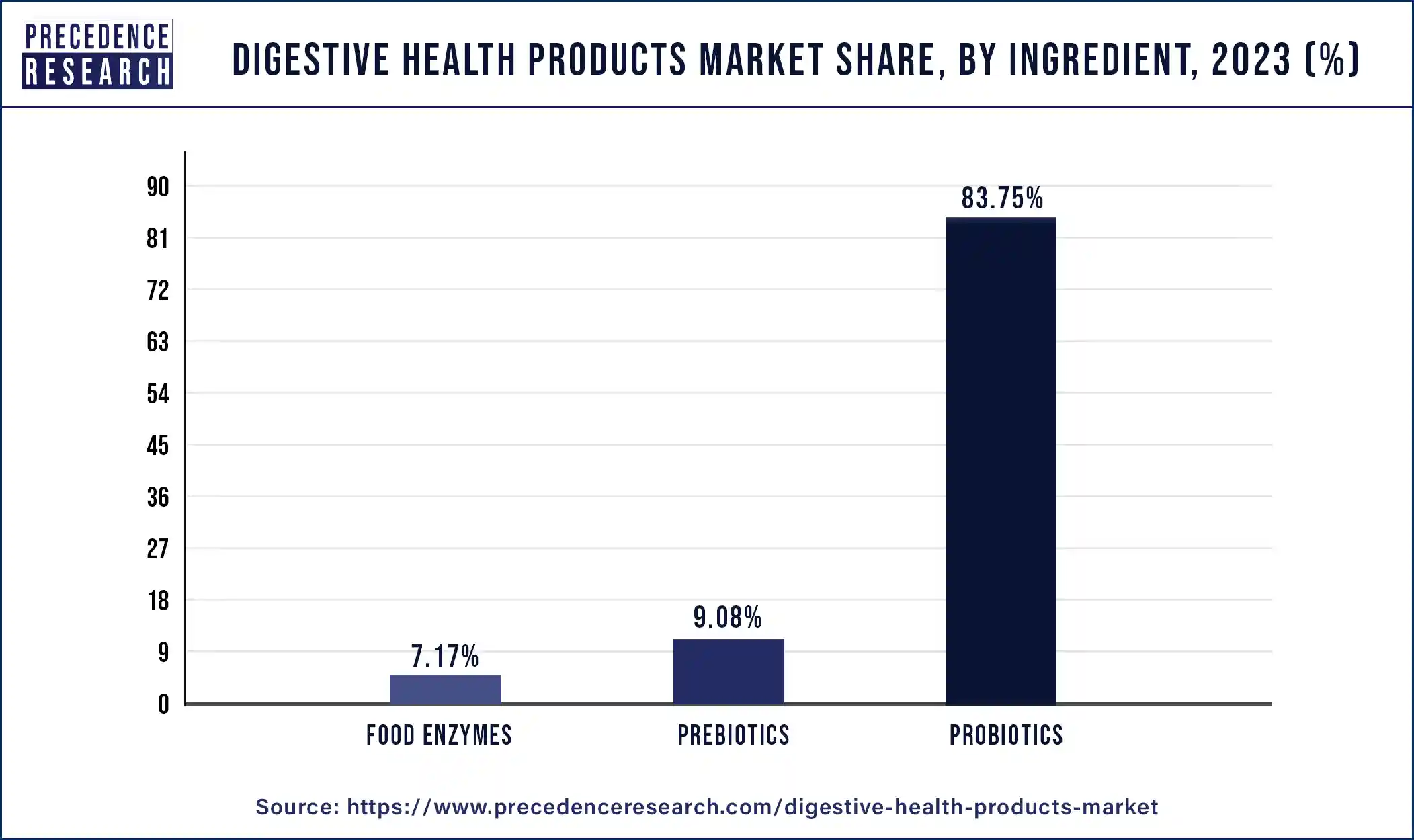

By Ingredients, in 2023, Probiotics dominated the market with around 83.75% share in terms of revenue of the total market. This is attributed to the increased awareness regarding the health benefits of probiotics such as prevention of irritable bowel syndrome (IBS), treatment and prevention of diarrhea, prevention of allergies and inflammation, and improvement of immunity system. Moreover, the growing demand for probiotics among the food companies is driving the growth of this segment.

Product Insights

Digestive Health Products Market, By Product, 2020-2023 (USD Million)

| Product | 2020 | 2021 | 2022 | 2023 |

| Dairy Products | 24,600.00 | 26,686.72 | 28,764.01 | 31,031.71 |

| Cereals | 3,900.00 | 4,256.26 | 4,615.14 | 5,008.93 |

| Non-Alcoholic Beverages | 3,000.00 | 3,283.83 | 3,571.36 | 3,887.66 |

| Others | 6,000.00 | 6,535.70 | 7,072.98 | 7,661.10 |

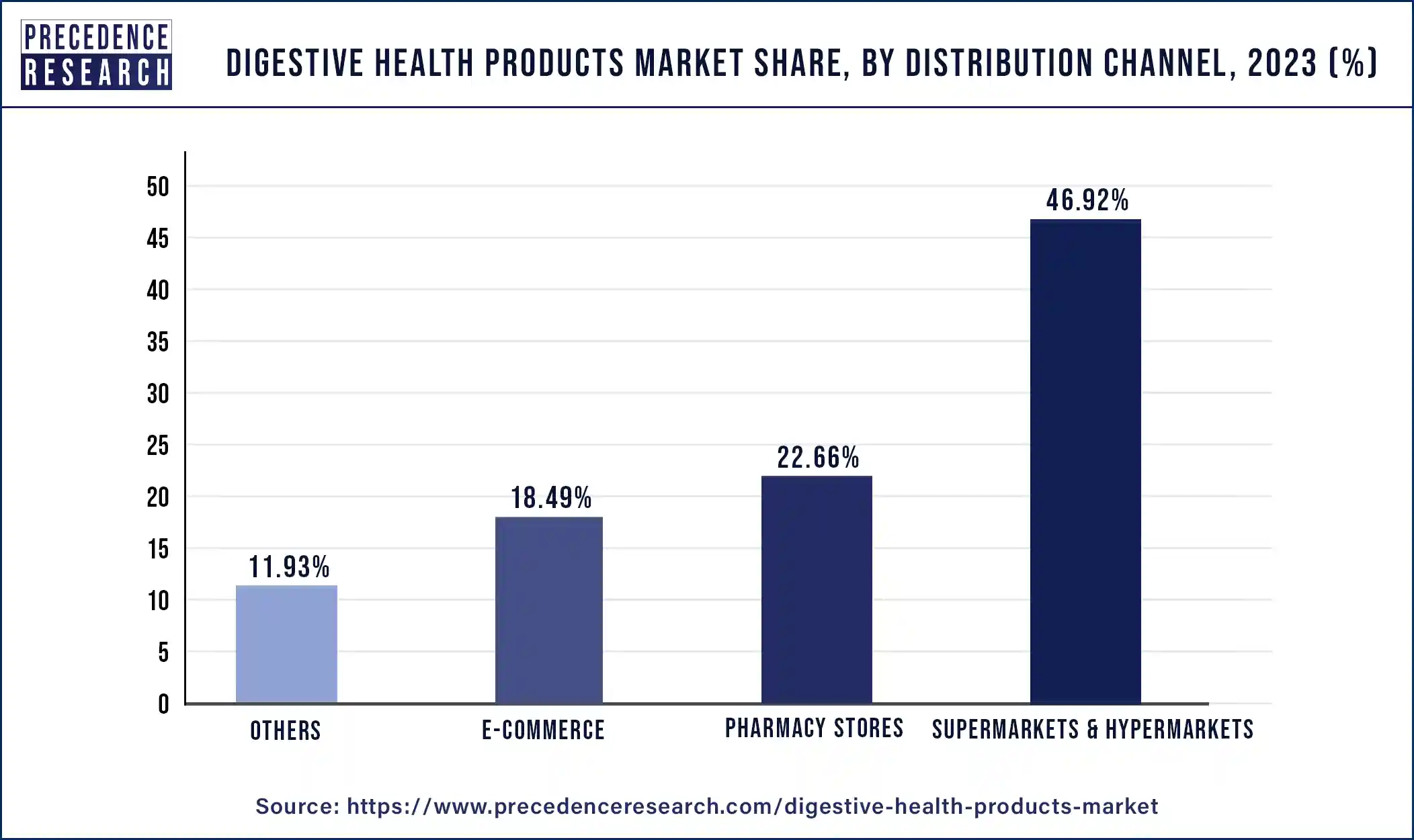

The supermarkets and hypermarkets segment dominated the digestive health products market in 2023. Supermarkets and hypermarkets utilize in-store promotions, displays, and end-of-aisle placements to highlight digestive health products and stimulate impulse purchases. Eye-catching displays and promotional signage attract consumer attention and encourage shoppers to explore and purchase digestive health products while browsing the aisles. Supermarkets are trusted retail outlets that consumers frequent regularly for their grocery needs. This trust and familiarity extend to the purchase of digestive health products, as consumers perceive supermarkets as reliable sources of high-quality products and trusted brands.

The e-commerce segment is expected to grow at a notable rate during the forecast period. E-commerce platforms provide unparalleled convenience and accessibility, allowing consumers to browse, purchase, and receive digestive health products from the comfort of their homes. This eliminates the need to visit physical stores, saving time and effort for busy individuals. Many e-commerce platforms offer subscription and auto-replenishment services for digestive health products, allowing consumers to schedule regular deliveries based on their usage frequency. This ensures continuity of product supply and encourages long-term customer loyalty.

Digestive Health Products Market, By Distribution Channel, 2020-2023 (USD Million)

| Distribution Channel | 2020 | 2021 | 2022 | 2023 |

| Supermarkets & Hypermarkets | 40,213.25 | 43,475.87 | 46,939.75 | 50,777.95 |

| Pharmacy Stores | 19,717.46 | 21,210.93 | 22,786.72 | 24,527.08 |

| E-commerce | 15,566.42 | 16,930.04 | 18,388.26 | 20,010.84 |

| Others | 10,982.97 | 11,600.00 | 12,228.00 | 12,907.08 |

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several number companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers.

The prevalence of gut concerned problems among the population led the vendors to invest in the research & development activities. The development of innovative digestive health products by the top players will have a positive impact on the market in the forthcoming years. Beroni Group, in November 2020, launched a new digestive health product called Beilemei, in China. This product aims at balancing the intestinal flora.

Segments Covered in the Report

By Ingredients

By Product

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2024

January 2025

March 2023

February 2024