October 2024

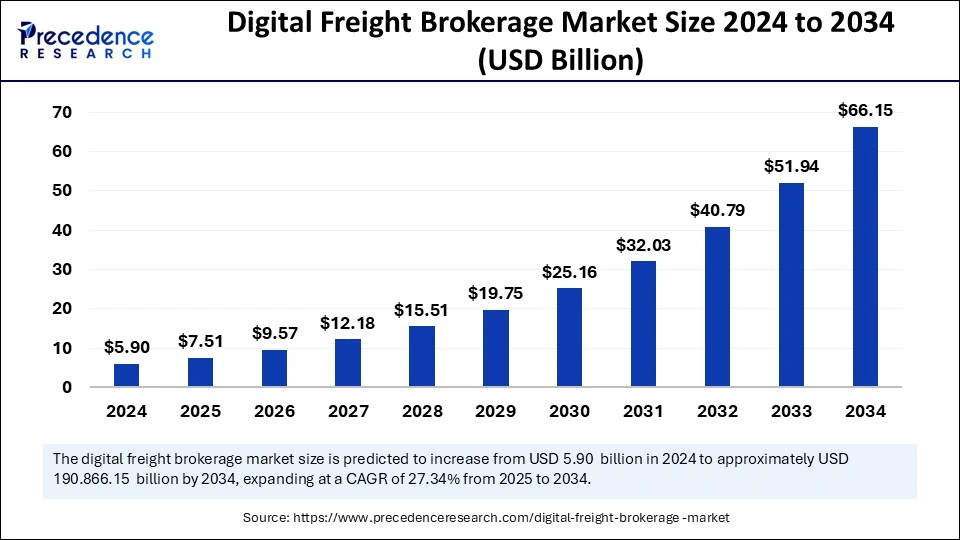

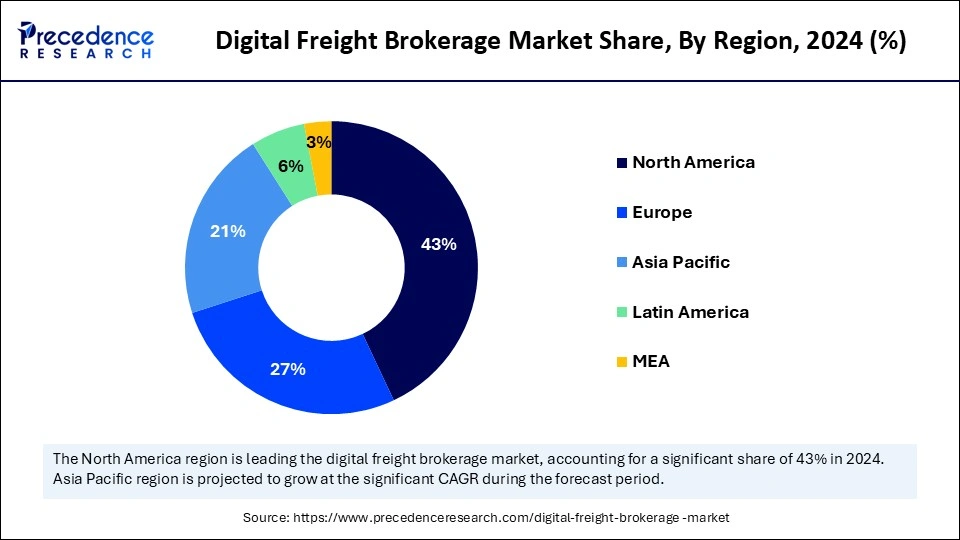

The global digital freight brokerage market size is accounted at USD 7.51 billion in 2025 and is forecasted to hit around USD 66.15 billion by 2034, representing a CAGR of 27.34% from 2025 to 2034. The North America market size was estimated at USD 2.54 billion in 2024 and is expanding at a CAGR of 27.48% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital freight brokerage market size was calculated at USD 5.9 billion in 2024 and is predicted to increase from USD 7.51 billion in 2025 to approximately USD 66.15 billion by 2034, expanding at a CAGR of 27.34% from 2025 to 2034. The market growth is attributed to the rising need for real-time logistics visibility, automated freight solutions, and streamlined supply chain operations.

Artificial Intelligence platforms help shippers automate their load-matching operations. AI systems analyze current and past data to predict customer needs and prevent supply chain complexities. AI helps shippers with suitable carriers considering factors like capacity and shipment type. It also helps in analyzing real-time weather conditions and traffic data and suggests the most efficient routes, reducing delivery times. Moreover, AI technology helps brokers create flexible pricing systems, which enable them to make rate adjustments to facilitate market variations and industry competition.

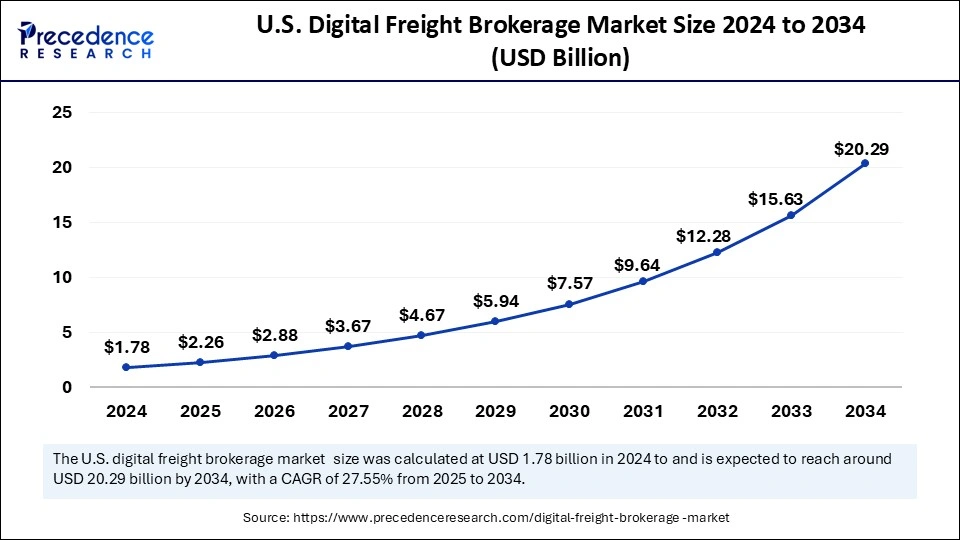

The U.S. digital freight brokerage market size was exhibited at USD 1.78 billion in 2024 and is projected to be worth around USD 20.29 billion by 2034, growing at a CAGR of 27.55% from 2025 to 2034.

North America led the digital freight brokerage market by capturing the largest share in 2024 and is likely to sustain its position in the coming years. This is mainly due to its advanced transportation infrastructure and heightened need to track real-time freight movements. The U.S. emerged as a leading player in the market. There is a high adoption of digital platforms among shippers. The rise in cross-border shipment activities further supports regional market growth. The United States Department of Transportation expanded Freight Logistics Optimization Works (FLOW) in 2024. This initiative is critical to the Biden-Harris Administration’s work to strengthen supply chains. Furthermore, the Canadian government programs aimed at improving logistics operations boost the adoption of digital solutions, thus driving market growth.

Asia Pacific is anticipated to grow at the fastest rate during the forecast period, owing to international business growth with increased spending on logistics technology. The adoption of digital freight platforms by nations such as China, India, Malaysia, and other Southeast Asian countries is growing rapidly. According to the Indian Ministry of Commerce and Industry, a substantial increase in e-commerce freight transport occurred in 2024, which received support from National Logistics Policy (NLP) initiatives targeting lower logistics expenses and complete freight system digitization. Under the Ministry of Transport, Chinese authorities adopted “smart logistics” policies by implementing national digital solutions for goods supply chain optimization for distant and regional freight distribution networks. Furthermore, the freight ecosystem of Asia Pacific receives significant digital transformation from rising demands for urgent, time-sensitive, and temperature-sensitive deliveries within city centers.

Europe is expected to witness notable growth during the forecast period. This is mainly due to its strong focus on sustainability, borderless logistics systems, and rapid supply chain digitization. The European Commission significantly advanced its Sustainable and Smart Mobility Strategy in 2024 to enhance logistics network connections between all European states. Furthermore, combining digital infrastructure with regulatory support with sustainability initiatives is expected to boost the market in this region in the coming years. The rising trade activities further contribute to regional market growth.

The digital freight brokerage market is growing rapidly because of the rapid expansion of the e-commerce industry and the increasing demand for more efficient logistics solutions among businesses. The Internet of Things (IoT) enables businesses to achieve supply chain transparency through applications that show real-time updates about shipment locations and statuses. The adoption of digital freight solutions has increased in the last few years as companies are continuously seeking to improve their supply chains and lower human errors. In June 2024, NFI announced its acquisition of Transfix's freight brokerage operations, highlighting a trend toward advanced integrated logistics solutions within the industry. Furthermore, the growing emphasis on sustainability and reducing carbon emissions in transportation are compelling companies to implement digital freight management systems.

| Report Coverage | Details |

| Market Size by 2034 | USD 66.15 Billion |

| Market Size in 2025 | USD 7.51 Billion |

| Market Size in 2024 | USD 5.9 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 27.34% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Transportation Mode, Service Type, Costumer Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing E-commerce Activities Across Urban and Regional Corridors

The growing e-commerce activities across urban and regional corridors drive the growth of the digital freight brokerage market. According to the Shopify report, worldwide e-commerce sales in 2024 exceeded USD 6.09 trillion after showing a year-on-year growth of 8.4%. As e-commerce activities increase, so does the need for fast, flexible, and effective freight solutions to deliver products within time. Logistic providers are now increasingly preferring digital brokerage systems for scaling capacity. Furthermore, the expansion of distribution networks that heavily depend on digital freight technology solutions drives the growth of the market.

Increasing Adoption of Digital Platforms by Shippers and Carriers

The increasing adoption of digital platforms by shippers and carriers is another driver facilitating the market expansion. Shippers and carriers are adopting digital platforms as a standard operational practice. These platforms reduce human involvement while achieving better operational precision. Digital platforms enhance trust between parties through fast response times as they replace manual communication methods with digital methods. French shipping and logistics company CMA CGM joined forces with Google's AI division in July 2024. Under this partnership, CMA CGM aims to integrate artificial intelligence solutions in its supply chain operations to reduce delivery times and optimize routes and overall efficiency.

Data Privacy and Cybersecurity Concerns

Concerns about data privacy and cybersecurity are expected to hinder the growth of the digital freight brokerage market. Logistics organizations deal with sensitive business information, including customer information, financial documentation, and live shipping position updates. Data security concerns that include breaches, unauthorized access, and ransomware attacks cause small and mid-size operators to remain cautious. These security measures are insufficient, making organizations doubtful about the integrity of their digital systems, thus hampering the market.

Surging Investments in Logistics Technology

Rising investments in logistics technology are expected to create immense opportunities for key players operating in the market. Digital brokerage startups acquired venture capital investment and funds from major logistics companies. The US-based autonomous truck company Outrider raised USD 62 million from Series D funding to increase its self-driving truck offerings for distribution yards in October 2024. The company upgraded each platform through these investments and expanded its geographical market while developing new customer service methods.

The road freight segment dominated the digital freight brokerage market with the largest share in 2024. This is mainly due to the rise in the need for last-mile deliveries. Road freight provides adaptability during operations with wide service routes and specialized last-mile delivery capabilities. The ability of road transportation to support quick mobile-based load booking and tracking compels small and midsize carriers to adopt digital platforms at a faster pace.

The air freight segment is expected to grow at the fastest rate during the forecast period, owing to the increasing need for fast delivery services. The global air cargo demand rose by 11.9% in February 2024 compared to the previous year, as per the International Air Transport Association (IATA) data. With the increasing global trade, the demand for air freight is rising, contributing to segmental growth.

The Full-truckload (FTL) brokerage segment held a considerable share of the digital freight brokerage market in 2024. This is mainly due to the heightened demand for large-scale shipment deliveries across extensive routes. Inbound Logistics' 2024 Trucking Perspectives revealed that full truckload services are available through 83% of trucking companies, highlighting their notable role in the market. Additionally, the increase in border trade across the U.S., Canada, and Mexico increased the demand for FTL brokerage services.

The refrigerated freight (temp-controlled) segment is anticipated to expand at a significant CAGR over the studied years, owing to the growing transportation of perishable products and pharmaceuticals. The rising preference for fresh organic food among consumers generated more need for refrigerated freight for better supply chain quality. The globalized supply chain operations require strong temperature-controlled logistics systems to keep products safe during extended transport durations. Furthermore, the implementation of technology solutions by freight brokers for the route planning process and maximum load consolidations fuel the segment growth.

The business-to-business (B2B) segment dominated the digital freight brokerage market in 2024, as manufacturers, together with suppliers or retailers, needed efficient logistics solutions. Companies require cost-efficient, flexible modes of transportation across their complex supply chains. Thus, they turned to freight brokers to discover various carriers and establish optimal routes for the timely delivery of shipments. Additionally, the increased need for real-time tracking systems to improve operational capabilities and better monitor activities bolstered the segmental growth.

The business-to-consumer (B2C) segment is projected to expand rapidly in the coming years. This is mainly due to the expansion of the e-commerce sector and the changing consumer shopping preferences. Consumers are increasingly seeking fast delivery services. The rising popularity of online shopping has intensified delivery requirements. The demand for digital solutions increases as e-commerce organizations team up with freight brokers to handle their logistics operations. Furthermore, the growing need to enhance freight operational transparency and efficiency contributes to segmental growth.

The retail & e-commerce segment dominated the digital freight brokerage market with the largest share in 2024. This is mainly due to the increased popularity of online shopping, boosting the need for effective logistics solutions. According to the IBEF report, the e-commerce sector in India experienced significant growth and achieved a GMV of USD 60 billion in FY23, marking a 22% increase from the previous year. The rise in volumes of deliveries further boosted the demand for faster transportation services to fulfill consumer requirements in retail business, thus fueling the segment.

The healthcare & pharmaceutical segment is expected to grow at a significant rate during the projection period. The growth of the segment can be attributed to the increasing need for secure and fast delivery services for medical products. The COVID-19 pandemic highlighted the need for efficient logistics systems for vaccines and medical supplies. Digital freight brokers provide safe and quick delivery services. Furthermore, the rising demand for temperature-sensitive pharmaceutical products drives segmental growth.

By Transportation Mode

By Service Type

By Customer Type

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

April 2025

May 2024