April 2025

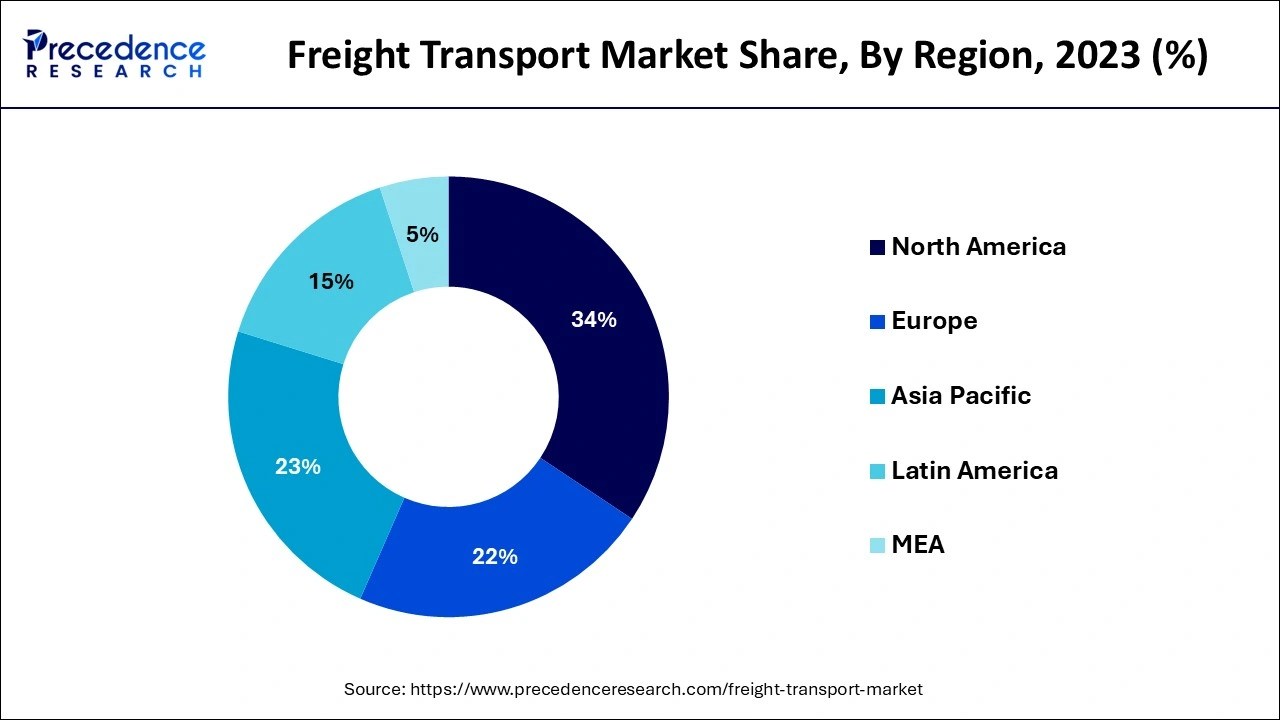

The global freight transport market size is evaluated at USD 34.53 billion in 2024, grew to USD 38.43 billion in 2025 and is projected to hit around USD 100.81 billion by 2034. The market is expanding at a CAGR of 11.31% between 2024 and 2034. The North America freight transport market size is calculated at USD 11.74 billion in 2024 and is estimated to grow at a solid CAGR of 11.45% during the forecast period.

The global freight transport market size accounted for USD 34.53 billion in 2024 and is predicted to reach around USD 100.81 billion by 2034, representing a CAGR of 11.31% from 2024 to 2034. The increasing demand for the retail industry and international trade across countries are boosting the market's growth.

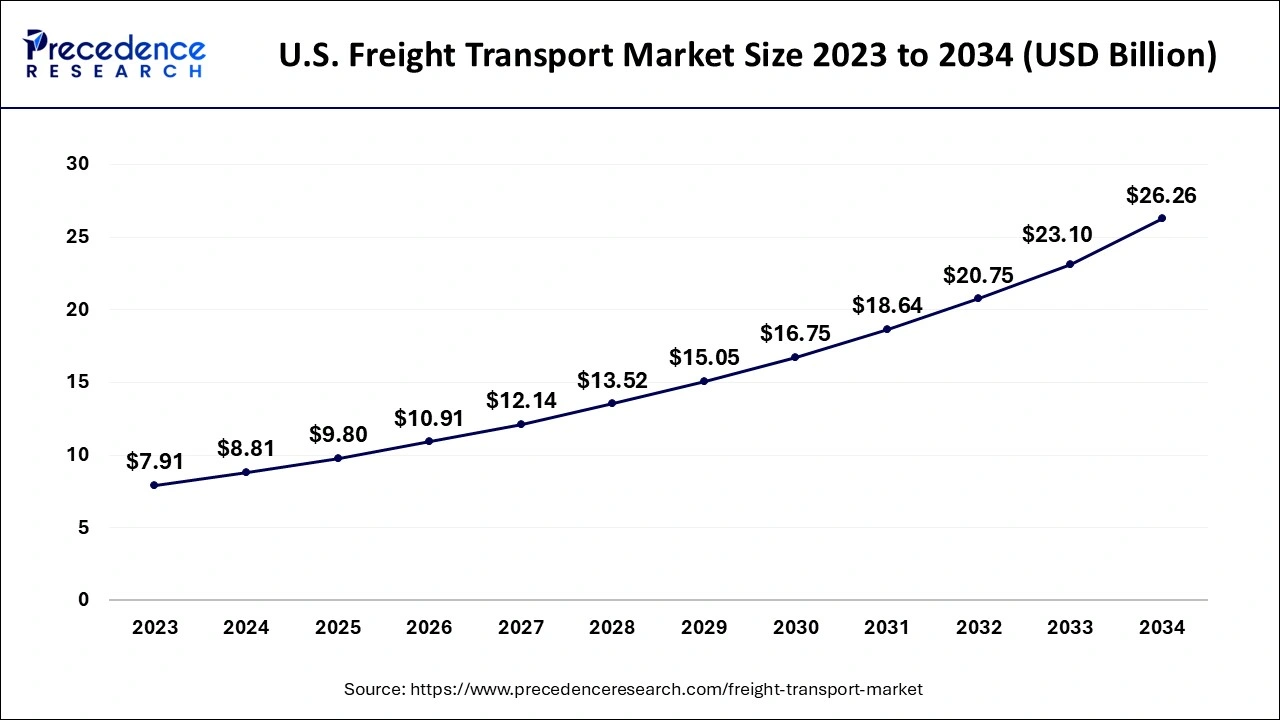

The U.S. freight transport market size is evaluated at USD 8.81 billion in 2024 and is projected to be worth around USD 26.26 billion by 2034, growing at a CAGR of 11.52% from 2024 to 2034.

North America dominated the freight transport market in 2023. The region has a well-developed industrial infrastructure, and the presence of the major manufacturing units of several products is accelerating the demand for freight transport for goods. Regional countries like the United States and Canada are experiencing a higher demand for various industrial goods, and the presence of the leading freight transporting leaders, e-commerce players, and logistics centers is driving the growth of the market. Additionally, the acceptance of technologies and advancements in transportation and logistics further boost the growth of the freight transport market in the region.

Asia Pacific is expected to grow at a significant CAGR during the forecast period. The growth of the market is owing to the rising population, rising economies, and industrial infrastructure, which are driving the demand for efficient freight transport for logistics and goods. The rapid development in the manufacturing industries in regional countries like China, India, and Japan and the international import and export facilities worldwide by the countries are driving the expansion of the freight transport market across the region.

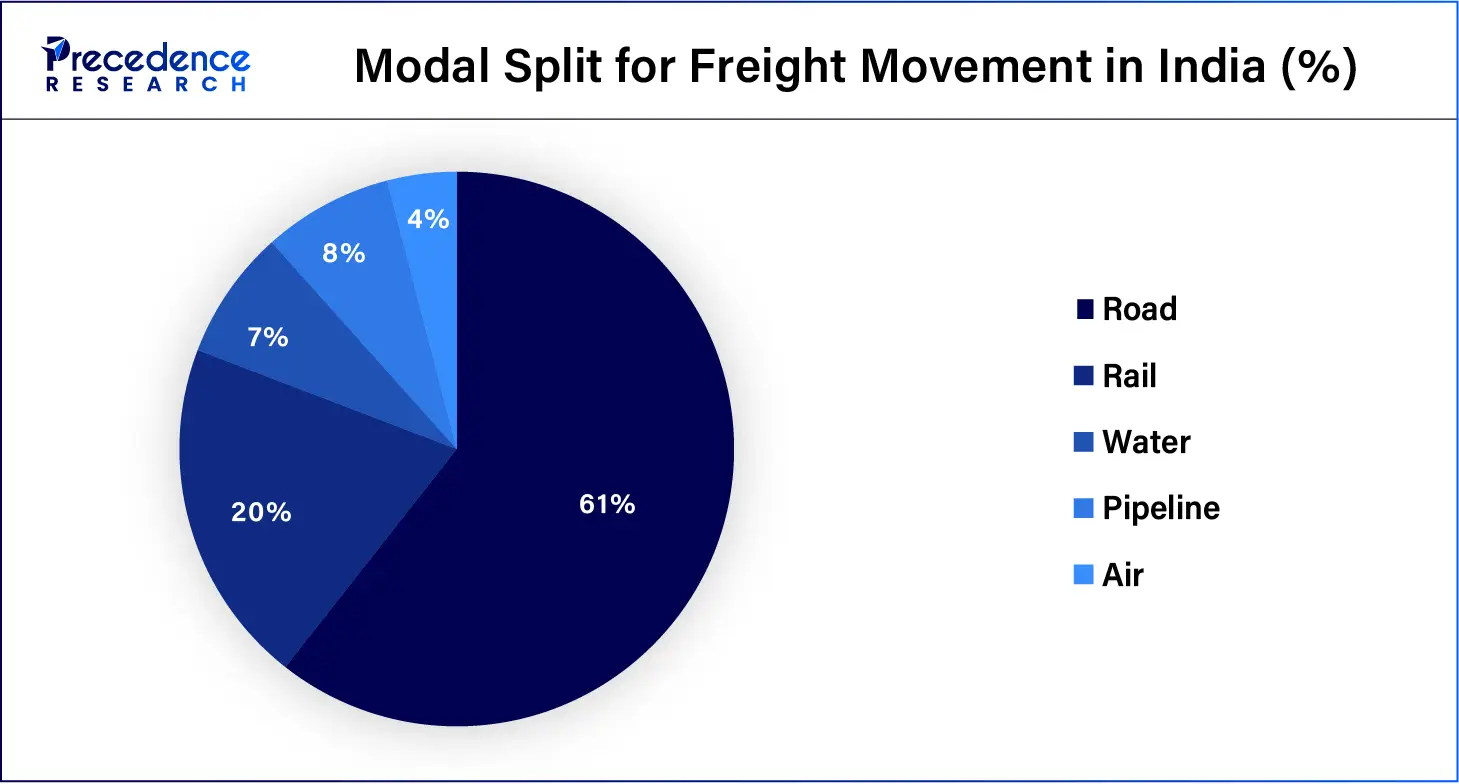

The Indian Logistics industry consists of over 10,000 types of products with a market size of INR 11 Lakh Crore. With the rising demand for goods, the movement of goods is expected to increase to 15.6 trillion tonnes in 2050. In India, about 71% of freight is transported by road and 17.5% by the railways.

Freight transport is the transportation of goods or logistics from one place to another. Some common freight includes commodities, commercial goods, and merchandise in bulk. The freight transport is one of the major part of the global economic expansion. The freight transport further includes the scheduling, storing, products, equipment, and personnel. Freight transport can be done by several means, including road, rail, maritime, and airways. The quantity of the inventory, weight, and size of the goods, as well as high-value goods, need security. These are some of the factors that should be considered when planning for freight transportation. Maritime transportation is one of the leading modes of global trade, covering about 90% of the trading goods.

The rise in the sustainability of the freight transport market

How Can AI Impact the Freight Transport Market?

The optimization of artificial intelligence in freight transport enhances the operations and efficiency in the transportation industry. AI in transportation and logistics influences the supply chain and distribution process through the real-time monitoring and tracking of the inventory in warehouses to optimize the demand for the inventory and help minimize the wastage in transportation costs. There are several benefits associated with AI integration in transportation and logistics, such as smart warehousing systems, demand-driven optimizing traffic management, on-time in full (OTIF) deliveries, and strategic asset utilization.

| Report Coverage | Details |

| Market Size by 2034 | USD 100.81 Billion |

| Market Size in 2024 | USD 34.53 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Offering, Mode of Transport, Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The demand for the transportation industry

The increasing demand for the transportation and supply chain industry due to the rising retail and e-commerce industry is contributing to the expansion of the market. Freight transport is offering several benefits, including greater accessibility, efficiency, flexibility, cost-effectiveness, enhanced reliability, and minimization of environmental impacts. Additionally, the rising industrialization across the countries is driving the demand for the logistics, supply chain, and transportation industry, contributing to the growth of the freight transport market.

Environmental impacts

The rising freight transport is driving the number of heavy-weight and high-emitting vehicles on the road or any other mode of transportation that negatively impacts the environment by the higher pollution is restraining the growth of the freight transport market.

Advancements in freight transport

The evaluation in the logistics and logistics industry with the significant advancements in technologies such as blockchain, IoT, automation, and robotics that help in enhancing the operational transparency, efficiency, sustainability, and resilience in the freight transport industry. Automation in freight transport streamlines warehouse operations, lowering costs and reducing errors.

The service segment dominated the freight transport market in 2023. The service segment is further divided into business services, managed services, and system integration. The rising demand for freight management and logistics supply from one place to another is driving the demand for the freight transport market by the residential and commercial applications. Freight transport allows businesses to manage and supply their goods efficiently and affordably. The freight transport services can help transport logistics for all sizes in the required time.

The solution segment expects the fastest growth in the market during the predicted period. There is an increasing demand for freight transport by several end-use industries for efficient logistics and shipment of goods. The rising industrialization and the increase in international import-export facilities are contributing to the expansion of the freight transport solution. There are several leading players who are heavily contributing to freight transport and helping several industries bring down their cargo requirements with reduced costs and better effectiveness.

The roadways segment led the freight transport market in 2023. The rising adoption of roadway freight transport by the number of end-use industries is due to the lower cost of transporting as compared to other transporting mediums. The roadways take a shorter route to transport the goods and take much less time to transport. Roadways freight transport is known as the best choice for door-to-door transport services. Roadway freight transportation offers various benefits, including accessibility and flexibility, cost-effectiveness, increased speed and efficiency in delivering the goods; it provides easy tracking services, helps in transporting freight in remote areas, simplifies logistics, and lowers packaging costs with advanced packaging, minimizes the risk of damaging the goods and one of the major benefits like it supports the eCommerce growth in the country.

The airways segment will gain a significant freight transport market share over the studied period of 2023 to 2034. The rising economic growth in developing countries is driving the rapid development of airports and air cargo. Airways transportation aims to deliver goods rapidly, and the rising international trade between countries is driving the growth of the segment. There are several benefits associated with air freight, such as a faster shipping process, most reliable arrival and departure times, lower insurance premier, higher security, lower risk of thefts and damage, lower demand for warehousing, less packaging requirement, and the live tracking of cargos.

The retail and e-commerce segment dominated the freight transport market in 2023. The rising population and the increasing disposable income in the population are driving the demand for the retail industry. The rising living standards and the spending culture on daily living are driving the demand for industries such as consumer goods, technologies, electronics, food and beverages, and others, which drive the retail industry and demand for efficient transportation services or medium to provide the goods in the areas of demand. Additionally, the rise of the e-commerce industry is due to the rising inclination of the population towards online shopping. Freight transport is one of the most important parts of the e-commerce industry, and it helps manage and transport goods from the delivery facilities to the consumer's doorstep.

The pharmaceutical segment is predicted to witness significant growth in the freight transport market over the forecast period. The pharmaceutical transportation is one of the most important parts of the logistics centers. Pharmaceutical transportation is a separate type of cargo from others; it has temperature control containers that help maintain the effectiveness of the drugs. The rising demand for pharmaceutical products in the countries and the increasing cases of international import and export of medicines are driving the demand for freight transport by the pharmaceutical industry.

Segments Covered in the Report

By Offering

By Mode of Transport

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

October 2024

May 2024