September 2024

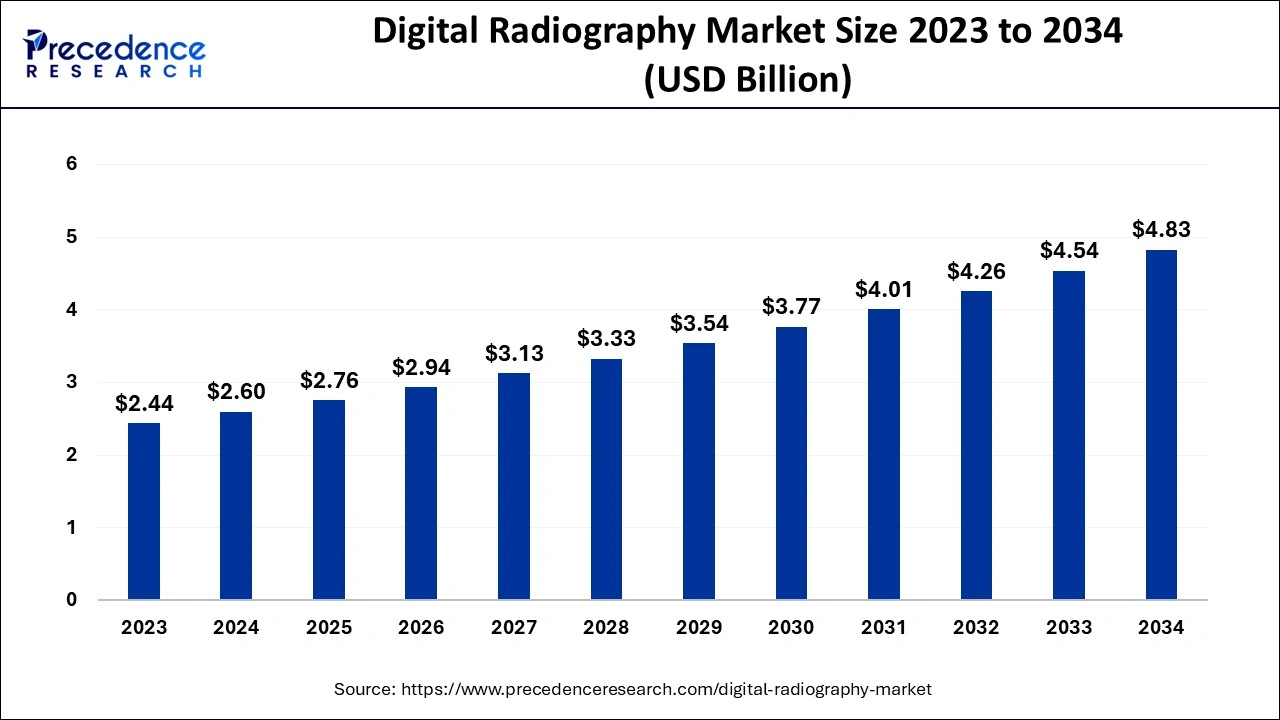

The global digital radiography market size accounted for USD 2.60 billion in 2024, grew to USD 2.76 billion in 2025 and is predicted to surpass around USD 4.83 billion by 2034, representing a healthy CAGR of 6.40% between 2024 and 2034. The North America digital radiography market size is calculated at USD 1.09 billion in 2024 and is expected to grow at a fastest CAGR of 6.55% during the forecast year.

The global digital radiography market size is estimated at USD 2.60 billion in 2024 and is anticipated to reach around USD 4.83 billion by 2034, expanding at a CAGR of 6.40% from 2024 to 2034.

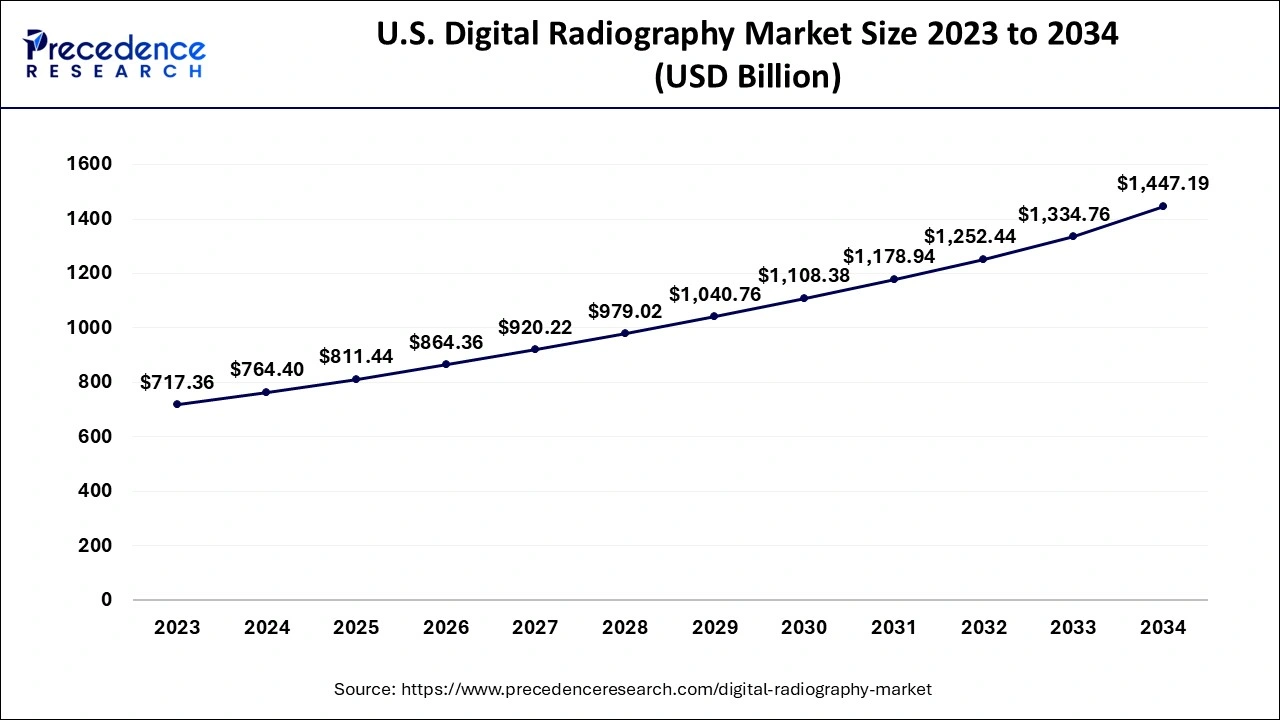

The U.S. digital radiography market size is evaluated at USD 764.40 million in 2024 and is predicted to be worth around USD 1447.19 million by 2034, rising at a CAGR of 6.57% from 2024 to 2034.

Why has North America region dominated the digital radiography market?

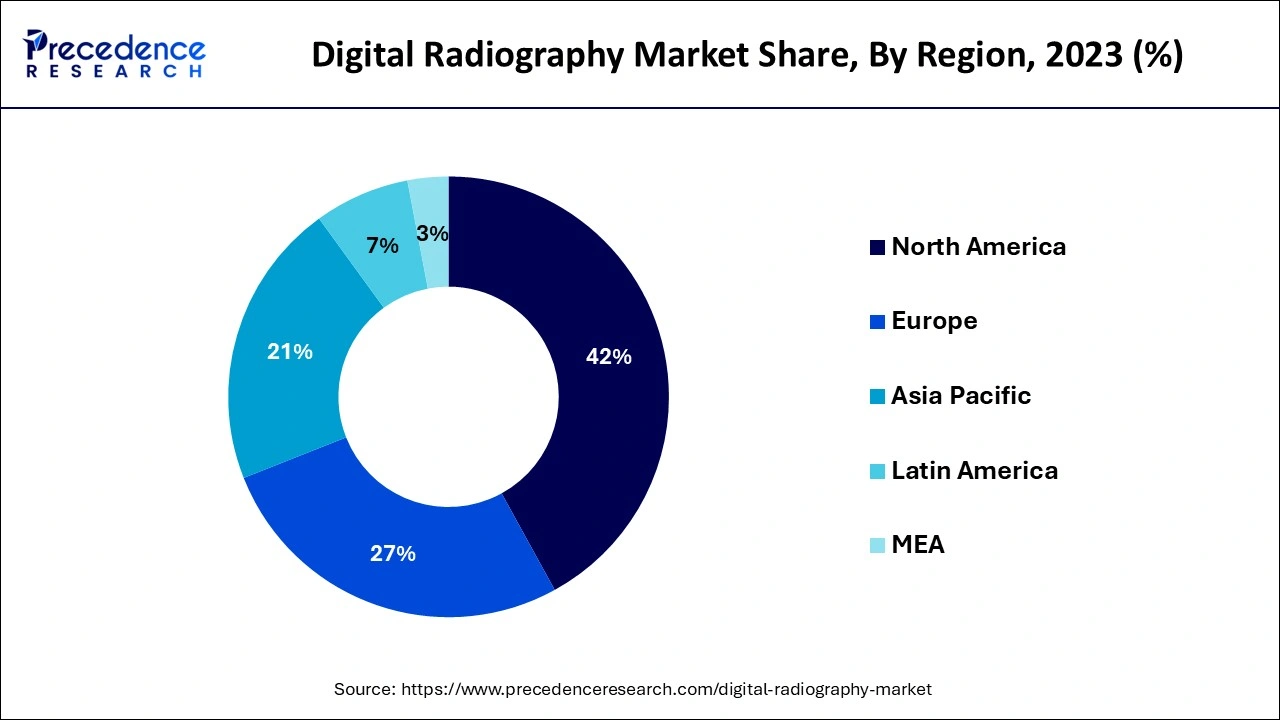

North America dominated the digital radiography market in 2023. The U.S. dominated the digital radiography market in North America region. One of the key factors driving the growth of North America digital radiography market is the growing prevalence of chronic disorders. According to the GLOBOCON 2020 data, there were 2,281,658 new cancer cases identified in the U.S. in 2020, with 612,390 fatalities.

According to the Arthritis Foundation Fact Sheet for 2019, the number of people in the U.S. with doctor-detected arthritis is expected to reach 78.4 million by 2040, accounting for 25.9% of all adults in the country. In addition, according to Arthritis Foundation data updated in October 2021, 1.5 million people in the U.S. suffer from rheumatoid arthritis, which strikes women between the ages of 30 and 60.

In addition, the existence of major market players as well as growing adoption of key strategies by market players are also contributing towards the digital radiography market in North America region. Canon Medical System USA, Inc., for example, introduced the OMNERA 500A Digital Radiography System in December 2020, which includes cutting-edge intelligent auto-positioning capability to increase workflow.

Why Asia-Pacific region is growing faster in the digital radiography market?

Asia-Pacific is expected to develop at the fastest rate during the forecast period. China, India, and Japan dominate the digital radiography market in Asia-Pacific region. The growing cases of target diseases, as well as favorable government measures, are driving the digital radiography market in Asia Pacific. These aspects contribute to the growth of the digital radiography systems market in this region, as well as attracting foreign investment and partnerships. Low hospital budgets, expensive equipment costs, and a lack of government investment in some countries, on the other hand, are constraining the market's growth in Asia Pacific.

The growth of global digital radiography market is being driven by the growing number of cancer and dental disorder diseases. According to the American Heart Association's, cardiovascular disease is the leading cause of death in the U.S., accounting for 874,613 deaths in 2019. On average, someone died of a stroke every 3 minutes 30 seconds and someone died of a myocardial infarction every 40 seconds in 2019. In addition, technological developments and adoption of new and innovative technologies are driving the growth of global digital radiography market.

Digital X-ray systems, mammography systems, fluoroscopy systems, mobile C-arms, mobile X-ray systems, and robotic X-ray systems are all available from market participants. To improve and retain its market position, it relies on inorganic and organic growth tactics, such as new product launches, collaborations, and agreements. In the previous three years, they've released a number of items in the digital X-ray industry and are always working on new product development. The company has a large regional footprint and is continually pursuing strategic deals and alliances to help the industry flourish.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.60 Billion |

| Market Size by 2034 | USD 4.83 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Technology, Method, End User, and Geography |

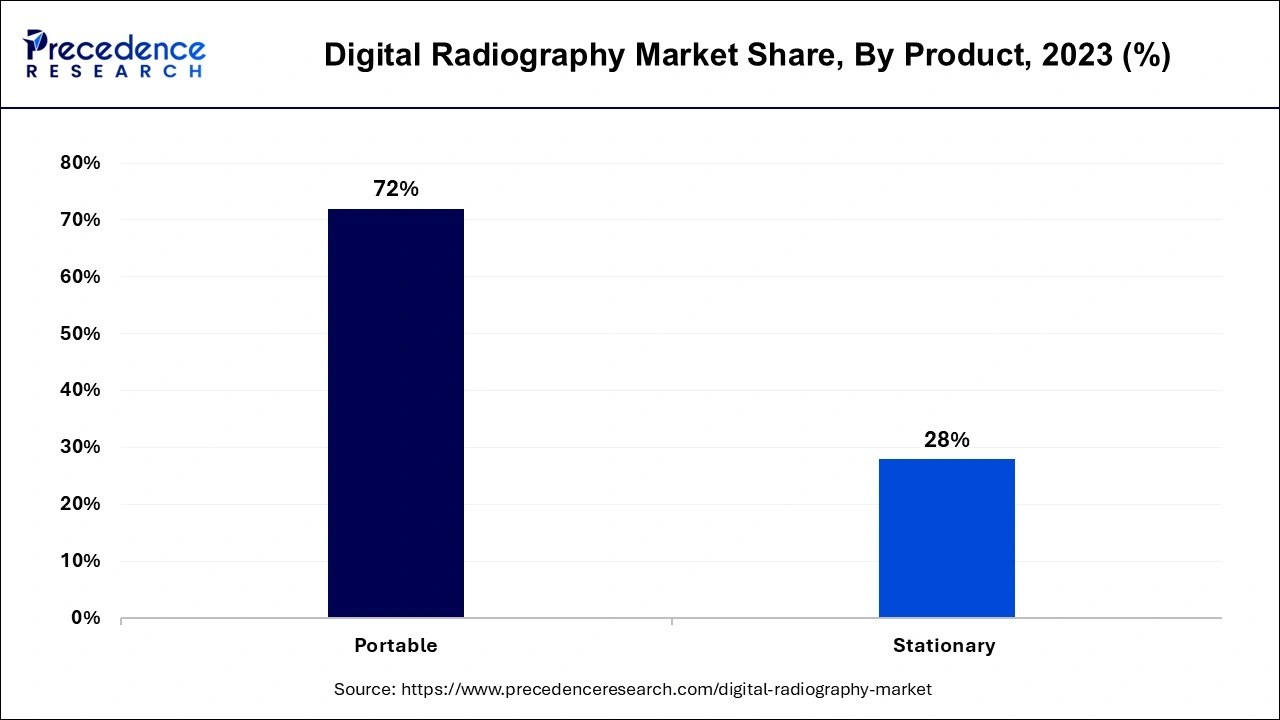

The portable system segment dominated the digital radiography market in 2023. Factors like the growing quantity of diagnostic imaging due to the ageing population and the widespread deployment of portable radiology systems throughout diagnostic centers. In addition, an increase in ailments such as vascular, dental, and cancer, particularly breast disorders and others, is propelling the portable digital radiography segment forward. The government's support for numerous radiology research programs is also propelling the sector forward.

The stationary system segment is the fastest growing segment of the market in 2023. The rise in the prevalence of chronic diseases and cancer is driving the expansion of the stationary digital radiography system market. Many patients, particularly in developing nations, have imaging tests every year. Furthermore, future population expansion will increase demand for digital radiological detectors, boosting the segment's growth. One of the significant digital radiography market trends is that older persons acquire age-related diseases, necessitating the usage of a variety of radiographic tests.

The direct digital radiography segment dominated the market in 2023. Direct digital radiography is a type of x-ray examination that produces a digital radiologic image on a supercomputer very quickly. This technique captures information during object examination using x-ray subtle plates, which are then transferred to a processor without the obligation of the middle cassette. A detector sensor alters the incident x-ray radiation to an equal electric control, which is then translated to a digital image.

The computed digital radiography segment is the fastest growing segment in 2023. When imaging plates are subjected to X-rays or gamma rays, the energy of the incoming radiation is recorded in a specific phosphor layer in computed digital radiography. The latent picture from the plate is then read out using a scanner, which stimulates it with a very precisely focused laser beam. The plate produces blue light with an intensity proportionate to the quantity of radiation acknowledged during the contact when triggered.

The dental radiology segment dominated the digital radiography market in 2023. Digital radiography is used in dental radiology on a large scale. Instead of film, digital imaging uses a hard sensor, such as a connected or wireless hard sensor, or phosphor plate sensors, known as a receptor. Pixels are grouped in a matrix of rows and columns in digital images.

The cardiovascular imaging segment is the fastest growing segment in 2023. One of the primary factors projected to boost the segment is rising demand for technologically advanced breast cancer screening systems. The Medical Imaging Modernization Act of 2015, which was enacted to stimulate technical breakthroughs, led in a boom in demand for digital radiography systems.

By Product

By Application

By Technology

By Method

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

January 2025

January 2025