March 2025

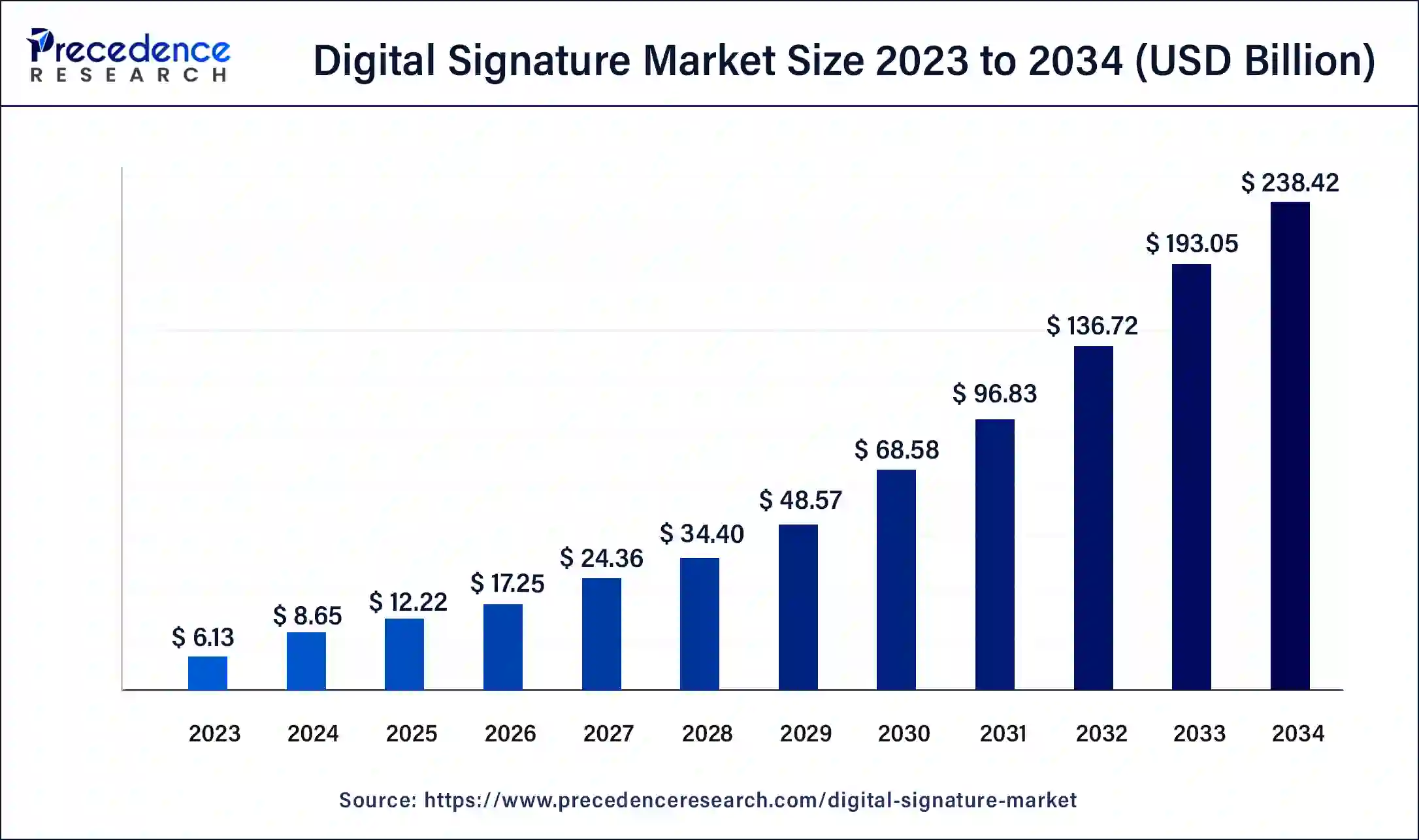

The global digital signature market size was USD 6.13 billion in 2023, calculated at USD 8.65 billion in 2024 and is projected to surpass around USD 238.42 billion by 2034, expanding at a CAGR of 39.3% from 2024 to 2034.

The global digital signature market size accounted for USD 8.65 billion in 2024 and is expected to be worth around USD 238.42 billion by 2034, at a CAGR of 39.3% from 2024 to 2034. The North America digital signature market size reached USD 2.82 billion in 2023. The increasing demand for electronic documents, government regulations and increasing use of mobile devices and the growing need for secure and legally binding electronic signatures is the factor that propelled the market demand.

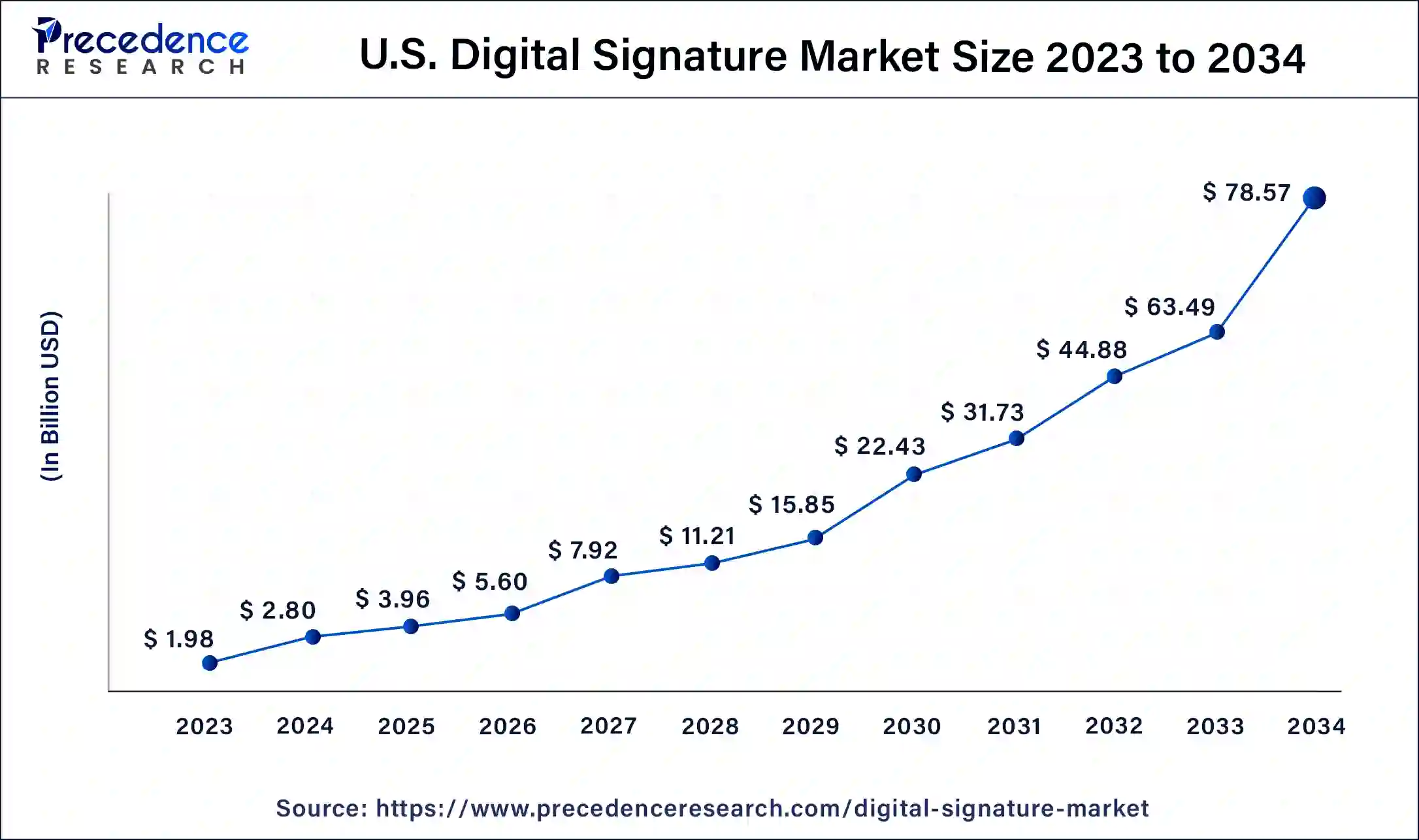

The U.S. digital signature market size was estimated at USD 1.98 billion in 2023 and is predicted to be worth around USD 78.57 billion by 2034, at a CAGR of 39.6% from 2024 to 2034.

On the basis of geography, North America dominates the market, driven by the factors such as increasing adoption of digital technologies, the need for secure and efficient document management, and the presence of major players in the region, including Adobe Inc., DocuSign Inc., OneSpan Inc., and HelloSign Inc. These companies offer a range of digital signature solutions that are secure, efficient, and compliant with industry regulations. The North American digital signature market is expected to grow due to the increasing adoption of digital technologies, government initiatives to promote e-government services, and the need for secure and compliant document management in various industries.

The Europe market will reach at a CAGR of 34.5% between 2024-2034. Europe is a significant market for Digital signatures, with Germany, the United Kingdom, and France being the major contributors to the market's growth. The growth in this market is driven by the increasing adoption of electronic document management solutions and the region's favorable regulatory environment. For instance, eIDAS (Electronic Identification, Authentication and Trust Services) regulation provides a common legal framework for electronic signatures. It promotes their use in cross-border transactions, facilitating the adoption of digital signatures in various industries. The increasing demand for secure and efficient document management solutions in industries such as finance, healthcare, and the government is also driving the growth of the digital signature market in Europe.

The region in Asia-Pacific is anticipated to have the greatest CAGR. This growth is due to the increasing adoption of digital signatures across industries such as BFSI, healthcare, government, and retail. Digital signatures provide a secure and convenient way of signing documents and conducting transactions online, which is especially important in remote work and virtual meetings. The growing need for regulatory compliance and the rise of e-commerce in the region also drive the market. Governments in countries such as India, China, and Japan have implemented regulations mandating digital signatures in certain industries, further boosting the market growth.

Market Overview

The digital signature market refers to the industry that provides electronic signature solutions for signing and authenticating electronic documents. Digital signatures are based on cryptographic techniques that safeguard the integrity and authenticity of the signed document. The market for digital signatures is growing rapidly due to the increasing demand for secure and legally binding electronic transactions in various industries, such as banking and financial services, healthcare, government, and education.

The technology offers many benefits, including convenience, security, and cost-effectiveness. Digital signatures can be signed from anywhere, anytime, using various devices such as smartphones, tablets, and laptops, eliminating the need for physical signatures. They also offer high security as the cryptographic techniques used to create the digital signature ensure that the text, paper, and document has not been tampered with.

Furthermore, The global digital signature market is anticipated to grow considerably in the coming years due to the increasing adoption of digital transformation technologies and the growing need for secure electronic transactions. Additionally, with the increasing use of electronic documents, there is a rising need for secure legally and secure binding electronic signatures. Digital signatures provide ensure the authenticity & integrity and a high level of security of the signed document.

The adoption of digital transformation technologies, such as mobile devices, cloud computing, and the internet of things (IoT), is driving the growth of the digital signature market. These technologies have made it easier for businesses to implement digital signature solutions and sign documents from anywhere, at any time. Moreover, the solutions are cost-effective compared to traditional signature methods, such as printing, mailing, and storing physical documents. This makes them a popular choice for businesses looking to reduce costs and improve efficiency.

However, a lack of awareness and security concerns are anticipated to impede market growth. Digital signatures are designed to provide a high level of security, but there are still concerns about the security of electronic signatures. Cybersecurity threats, such as data breaches and hacking, can compromise the integrity of electronic documents and undermine trust in digital signature solutions.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have accelerated the adoption of digital transformation technologies, including digital signature solutions, as more people have been working remotely and relying on electronic communication and transactions. With more people working from home, there has been an increased demand for digital signature solutions that enable remote signing and authentication of documents. Digital signature solutions have provided a convenient and secure way for businesses to continue operating and conducting transactions without needing physical signatures.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.13 Billion |

| Market Size in 2024 | USD 8.65 Billion |

| Market Size by 2034 | USD 238.42 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 39.3% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Deployment Model, By Organization Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for secure and legally binding electronic transactions to brighten the market prospect

A digital signature is a mathematical technique that is enabled to integrity and verify the authenticity of an electronic document or message. It is based on public-key cryptography, which uses a pair of keys, one private and one public, to encrypt and decrypt messages. The private key is used to sign a message, while the public key is used to verify the signature. With the increasing digitization of business processes and the growing use of electronic documents, there is a growing need for secure and legally binding electronic transactions.

Digital signatures provide a way to ensure the authenticity, integrity, and non-repudiation of electronic documents and transactions. It is legally binding in many countries and is recognized as a valid means of authentication and authorization. They are commonly used in e-commerce, online banking, government transactions, and other electronic business processes.

The digital signature market is anticipated to grow rapidly in the coming years, driven by the increasing adoption of digital technologies and the growing demand for secure and legally binding electronic transactions. The market includes a range of digital signature solutions, including software and hardware-based solutions, cloud-based services, and mobile-based solutions. Thus, the growing demand for secure and legally binding electronic transactions will drive the demand for the digital signature market.

Increasing adoption of digital transformation technologies

The digital transformation of business processes involves the integration of such as cloud computing, digital technologies, mobile applications, the Internet of Things (IoT), and artificial intelligence into existing business processes to streamline operations, enhance productivity, and create new revenue streams. Digital signatures are a crucial component of the digital transformation process because they enable businesses to sign and authenticate electronic documents, contracts, and agreements in a secure and legally binding manner.

Such as blockchain technology and smart contracts are being used to create secure and tamper-proof digital signatures that are virtually impossible to forge. These technologies are particularly relevant in industries where trust is crucial, such as finance and healthcare. For instance, the healthcare industry uses blockchain technology and smart contracts to create tamper-proof digital signatures for medical records, prescriptions, and other sensitive data.

Furthermore, cloud-based digital signature solutions are becoming more popular as businesses shift to cloud-based technologies. These solutions offer scalability, cost-effectiveness, and accessibility from anywhere with an internet connection. For instance, Adobe Sign, a cloud-based digital signature solution, reported a 40% year-over-year increase in revenue for Q4 2020, citing increased demand for cloud-based solutions. Therefore, adopting digital transformation technologies drives demand for digital signature solutions, making it a rapidly growing market. Digital signatures are a crucial component of the digital transformation process, enabling businesses to sign and authenticate electronic documents, contracts, and agreements in a secure and legally binding manner.

Lack of standardization is causing hindrances to the market

Digital signatures are electronic signatures that use encryption techniques to authenticate the signer's identity and the signed document's integrity. They offer a secure and efficient way to sign and transmit electronic documents, but a lack of standardization hinders their widespread adoption. Multiple digital signature formats exist, and different countries have different legal frameworks for recognizing and regulating digital signatures. This fragmentation makes it difficult for organizations to adopt digital signatures, as they must navigate a complex landscape of different standards and regulations.

Another challenge is the lack of interoperability between different digital signature solutions. This means that a document signed with one solution may not be verifiable by another, creating compatibility concerns that can be problematic to resolve. The lack of standardization and interoperability in the digital signature market can limit demand for digital signature solutions, as potential users may be hesitant to adopt a solution that others may not recognize or accept. To overcome these challenges, there is a need for greater collaboration and standardization efforts among digital signature solution providers and regulatory bodies. This would help to build trust in digital signatures and encourage wider adoption of this important technology.

These are the following factor which is likely to create opportunity over the forecast period.

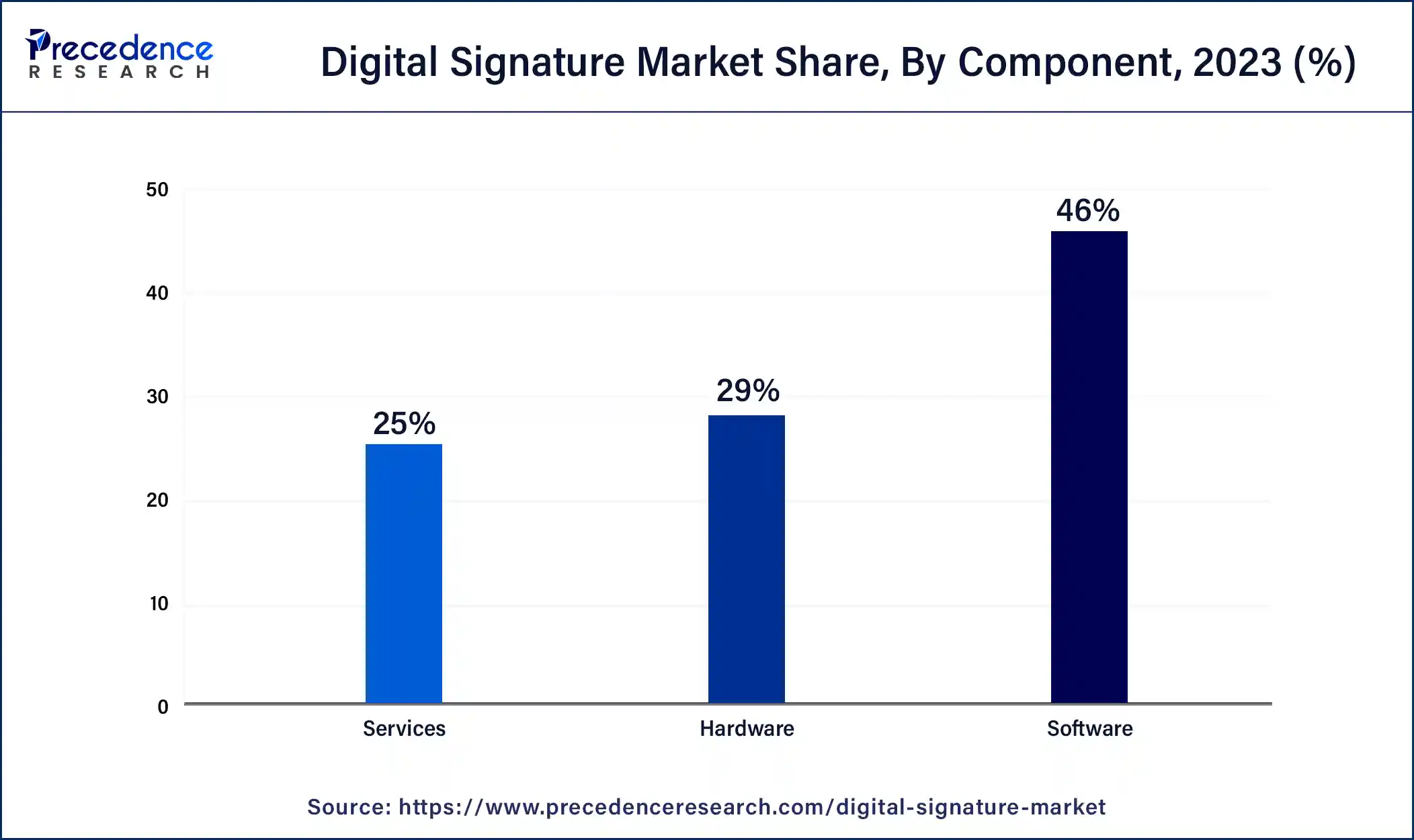

On the basis of components, the digital signature market is divided into software, services, and hardware, with the software accounting for most of the market because it can be integrated with other systems, such as document management systems, CRM, and ERP systems, allowing for streamlined document workflows and enhanced productivity.

This integration is particularly important for businesses that deal with a large volume of documents and require a secure and efficient way to sign and authenticate these documents. Also, the growing adoption of cloud-based digital signature solutions is one of the primary reasons for the software segment's dominance. Cloud-based solutions offer numerous advantages, such as ease of use, scalability, and affordability, making them an attractive option for businesses of all sizes.

On the basis of the deployment model, the digital signature market is divided into the cloud, and on-premises, with the cloud accounting for most of the market. This is because cloud-based deployment offers scalability, accessibility, and cost-effectiveness. It allows businesses to scale their digital signature solution up or down based on their needs without investing in additional infrastructure. Additionally, cloud-based solutions can be accessed from anywhere at any time, making them ideal for remote workers and distributed teams. Cloud-based digital signature solutions may have a subscription-based pricing model, which can be more cost-effective for businesses than purchasing and maintaining an on-premise solution.

On the basis of the industry vertical, the digital signature market is divided into IT & telecommunication, healthcare & life science, government, education, BFSI, human resources, real estate, and others, with the BFSI accounting for most of the market. This is due to the sensitive nature of financial transactions and the need for secure and compliant documentation. Digital signatures provide a secure and efficient way for banks, financial institutions, and insurance companies to authenticate and authorize transactions and agreements.

Segments Covered in the Report

By Component

By Deployment Model

By Organization Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024