March 2025

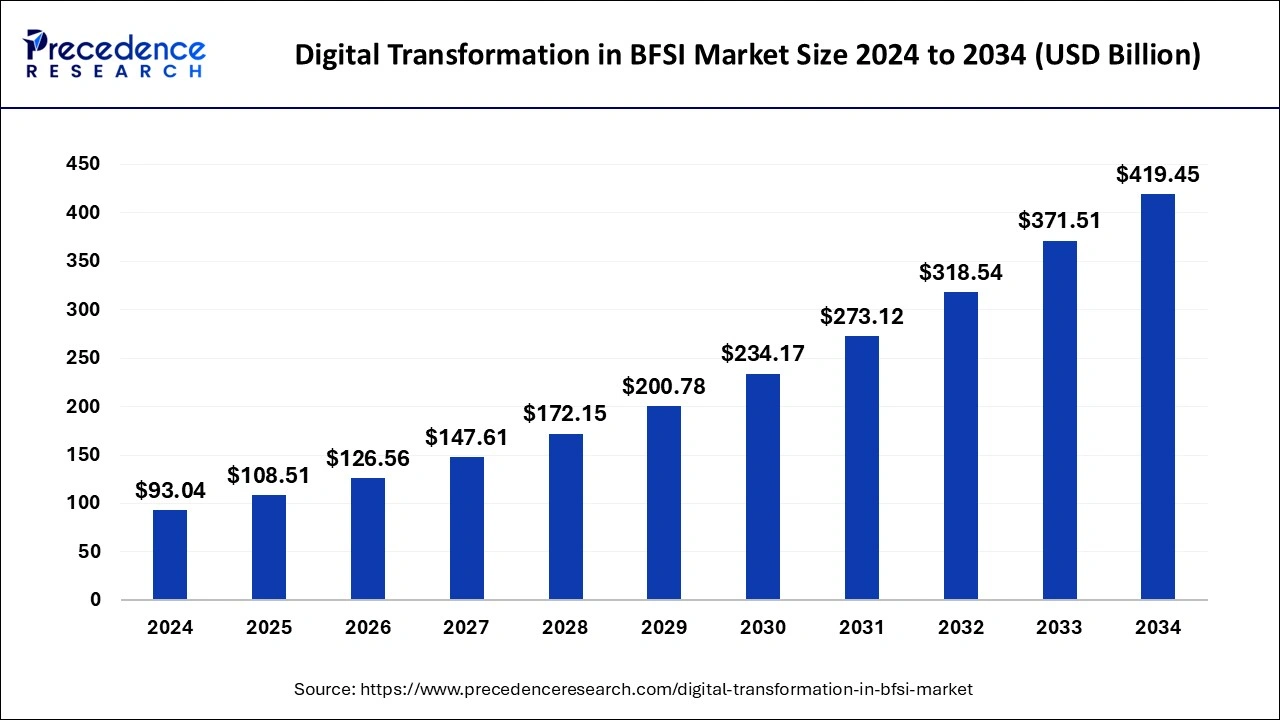

The global digital transformation in BFSI market size is calculated at USD 108.51 billion in 2025 and is forecasted to reach around USD 419.45 billion by 2034, accelerating at a CAGR of 16.25% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global digital transformation in BFSI market size was estimated at USD 93.04 billion in 2024 and is predicted to increase from USD 108.51 billion in 2025 to approximately USD 419.45 billion by 2034, expanding at a CAGR of 16.25% from 2025 to 2034. The increasing customer expectations and modernization in services are driving the growth of the market.

Digital transformation is also considered as modernization across several industries. Digital transformation is reshaping the operational efficiency in the banking and financial industry. Digital transformation means the integration of modern technologies like artificial intelligence, automation, IOT, and other technologies all across the banking and financial services. The integration of technologies in banking services enhances operational efficiency, innovations in services, and customized financial solutions. The increasing demand for online transactions, inquiries, and advisory services is driving the demand for digital transformation to cater to the rising expectations of customers. Digital transformation in the BFSI industry helps stay ahead of the competition and aims to set a new industry standard for new market entrants. It enhances the customer experience, operational efficiency, innovative product offerings, risk management, and others that collectively drive the growth of the digital transformation in BFSI market.

| Report Coverage | Details |

| Market Size in 2025 | USD 108.51 Billion |

| Market Size by 2034 | USD 419.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.25% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise, Technology, End-User and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand for technological solutions in banking institutions

The increasing global population and the rising consumer base in banking and financial institutions are generating a large industry database. The rising digitization in the industries and the rising customer expectation from their banks with the rapid advancements in technologies are driving the demand for digitization or digital transformation in the industry. The integration of personalization in services and digitization in banking and financial institutions are driving customer retention and enhancing the experience of their banks. The integration of technologies in the making sector is driving operational efficiency, security, innovations, and consumer-centricity. The adoption of modern technologies like artificial intelligence, cloud computing, machine learning, blockchain, and data analytics helps transform banking operations by automating tasks, enhancing employee productivity, and reducing the cost of operations. Thus, all the benefits associated with the technological solutions are driving the growth of the digital transformation in BFSI market.

Security concern

The rising cases of cybercrimes and security concerns in organizations are limiting the expansion of the market. The number of cybersecurity cases is increasing due to data breaches, financial threats, and identity theft, which are restricting the growth of the digital transformation in BFSI market.

Artificial intelligence and machine learning in BFSI industry

Artificial intelligence is one of the prominent parts of the digital transformation. The adoption of AI in each end-use industry improves efficiency and productivity with less manpower and cost. The introduction of machine learning and artificial intelligence in the banking sector, like in services and apps, helps in increasing customer-centric services. AI helps to make informed future decisions by analyzing historical data, automating repetitive tasks, and saving man hours. The intelligent algorithms of artificial intelligence help in detecting fraudulent transactions and information in the system. Artificial intelligence is used in a wide range of applications in the banking industry, such as it used to enhance customer experience, cybersecurity and fraud detection, chatbots, risk management, loan and credit decisions, regularity compliance, tracking market trends, predictive analytics, data collection and analytics, and process automation. Thus, all the technologies are playing a significant role in the growth opportunity in the digital transformation in BFSI market.

The solution segment dominated the digital transformation in BFSI market, with the largest market share in 2024. The increasing adoption of digitization platforms or technological solutions in banking and financial institutions to increase operational efficiency and end-to-end applications in the banking industry is driving the market's growth. There are different digital solutions in the BSFI market, including analytics, blockchain, artificial intelligence, cloud computing, APIs, mobile banking, regulatory compliance, and enhancing customer experience. Digitalization has improved overall performance, accuracy, efficiency, and productivity in the BSFI sector, and digitalization will continue to improve the solutions provided with advancements in technology.

The on-premise dominated the market in 2024. The increasing adoption of on-premise digital transformation in banking and financial institutions, which helps the organization manage the data, cyber security, and other operations, is driving the adoption of the on-premise segment in the digital transformation in BFSI market.

On the other hand, the cloud segment is expected to grow at the fastest CAGR during the forecast period. Cloud-based software and solutions are more cost-efficient and are leveraged by more efficient automated processes. Cloud solutions help BSFI firms scale resources, including features, lines, and agents, based on demand. It also helps in expansion on a global level.

The large enterprise segment dominated and had the largest digital transformation in BFSI market share in 2024. The growth of the segment is attributed to the rising demand for digital transformation in large enterprises due to the larger consumer bases and the increasing customer demand for digitization in the industry for enhancing consumer experience and improving operations productivity, which is driving the demand for digital transformation in BFSI. The higher availability of capital for technological implementation and the rising investment in technologies by large enterprises are boosting the growth of the segment.

The artificial intelligence segment dominated the market with the largest revenue in 2024. AI plays an important role in the development of the BFSI industry, which heavily depends upon the problem-solving and decision-making process. The integration of AI in banking and financial institutions helps the industry to become more efficient, customer-centric, and secure and prevents fraudulent transactions and information. AI in banking helps in the detection of fraud and prevention, customer relationship management, anti-money laundering, data analytics, and prediction according to historical data. AI chatbots and virtual assistants are significant advancements in banking and financial institutions, which are highly contributing to solving customers' queries and enhancing the personalization and customer experience.

The banks segment dominated the digital transformation in BFSI market in 2024. The growth of the segment is attributed to the rising demand for digitalization in the banking sector by the customer to increase operational efficiency and customer experience. The major banking institutions are heavily investing in the implementation of technologies in their end-to-end operations to increase customer retention and stay ahead of the competition that is driving the demand for digital transformation in the BFSI market. The increasing number of banking and financial institutions due to the rising population and increasing consumer base drive the demand for technologically advanced banking and financial institutions that drive the growth of the segment.

North America led the digital transformation in BFSI market with the largest market share in 2024. The growth of the market is attributed to the rising adoption of technologies in each end-use industry. The region is the early adopter of the technologies, and the population in the region is more tech-savvy, which is highly contributing to the growth of digital transformation in the BFSI market. The growing population in the region and higher availability of economically developed countries, like the United States and Canada, are boosting digital transformation across various industries and banking and financial institutions. The rising customer expectations of the population from their banking institutions and the rising investment in research and development activities in technologies like AI, machine learning, cloud computing, and others are collectively driving the growth of digital transformation in the BFSI market in the region.

Asia Pacific is expected to witness the fastest growth during the forecast period. The growth of the market in the region is owing to the rising population and the increasing consumer base in the BFSI sector and the rising young age population that is more likely to be prone to the technologies and the expectation for online banking solutions are boosting the demand for the digital transformation in the industry. The rising economic development in the regional countries is further accelerating the growth of digital transformation in the region's digital transformation in BFSI market.

By Component

By Deployment

By Enterprise

By Technology

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

January 2025

August 2024