January 2025

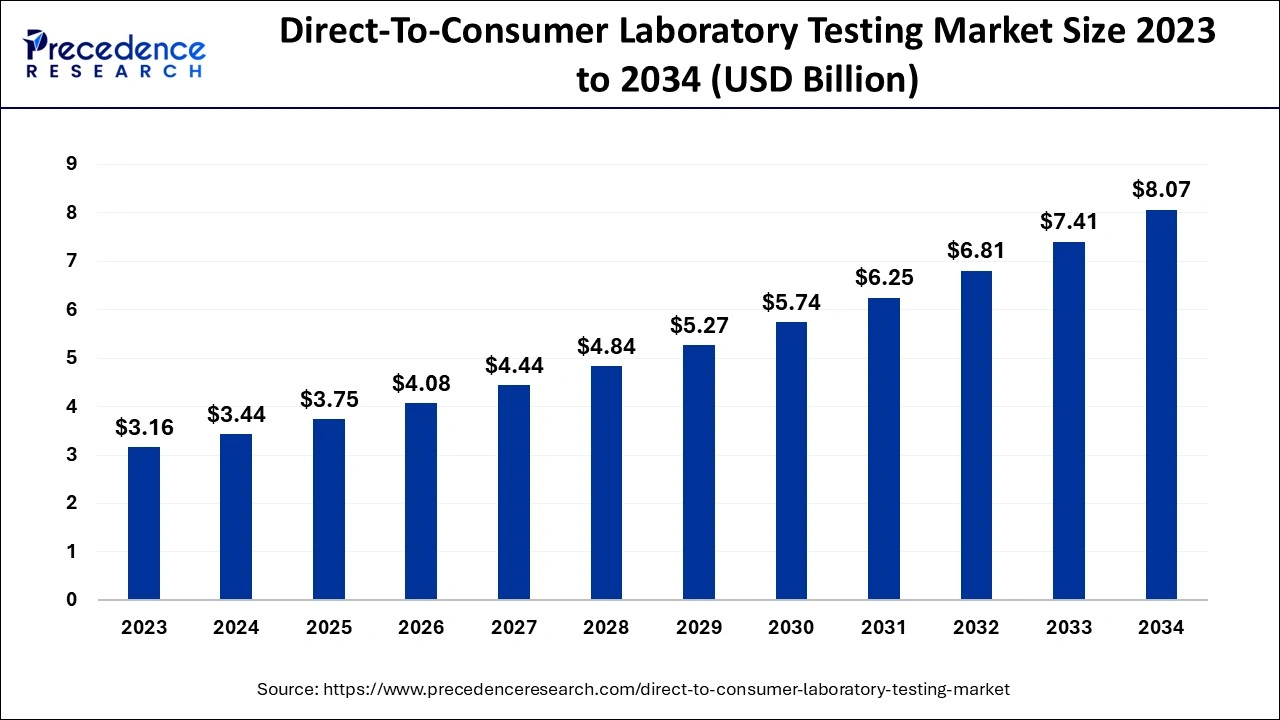

The global direct-to-consumer laboratory testing market size accounted for USD 3.44 billion in 2024, grew to USD 3.75 billion in 2025 and is predicted to surpass around USD 8.07 billion by 2034, representing a healthy CAGR of 8.90% between 2024 and 2034. The North America direct-to-consumer laboratory testing market size is calculated at USD 1.62 billion in 2024 and is expected to grow at a fastest CAGR of 8.96% during the forecast year.

The global direct-to-consumer laboratory testing market size is accounted for USD 3.44 billion in 2024 and is anticipated to reach around USD 8.07 billion by 2034, growing at a CAGR of 8.90% from 2024 to 2034.

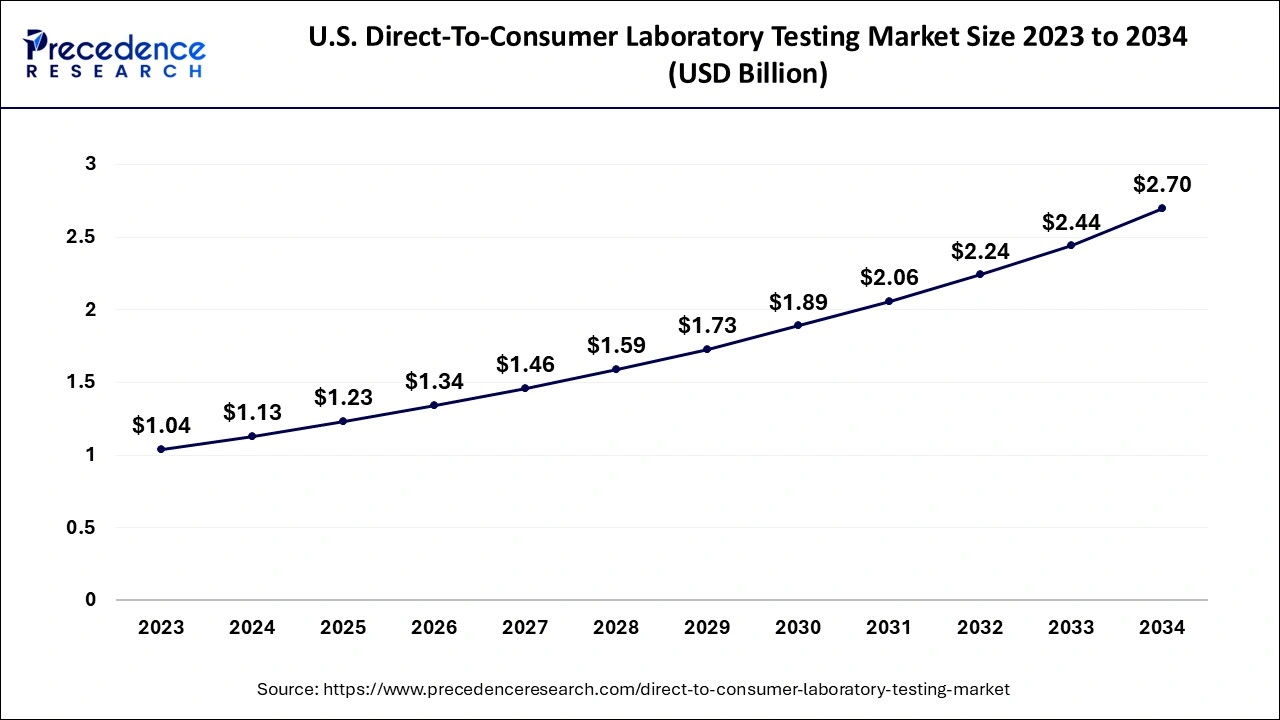

The U.S. direct-to-consumer laboratory testing market size is evaluated at USD 1.13 billion in 2024 and is predicted to be worth around USD 2.70 billion by 2034, rising at a CAGR of 9.06% from 2024 to 2034.

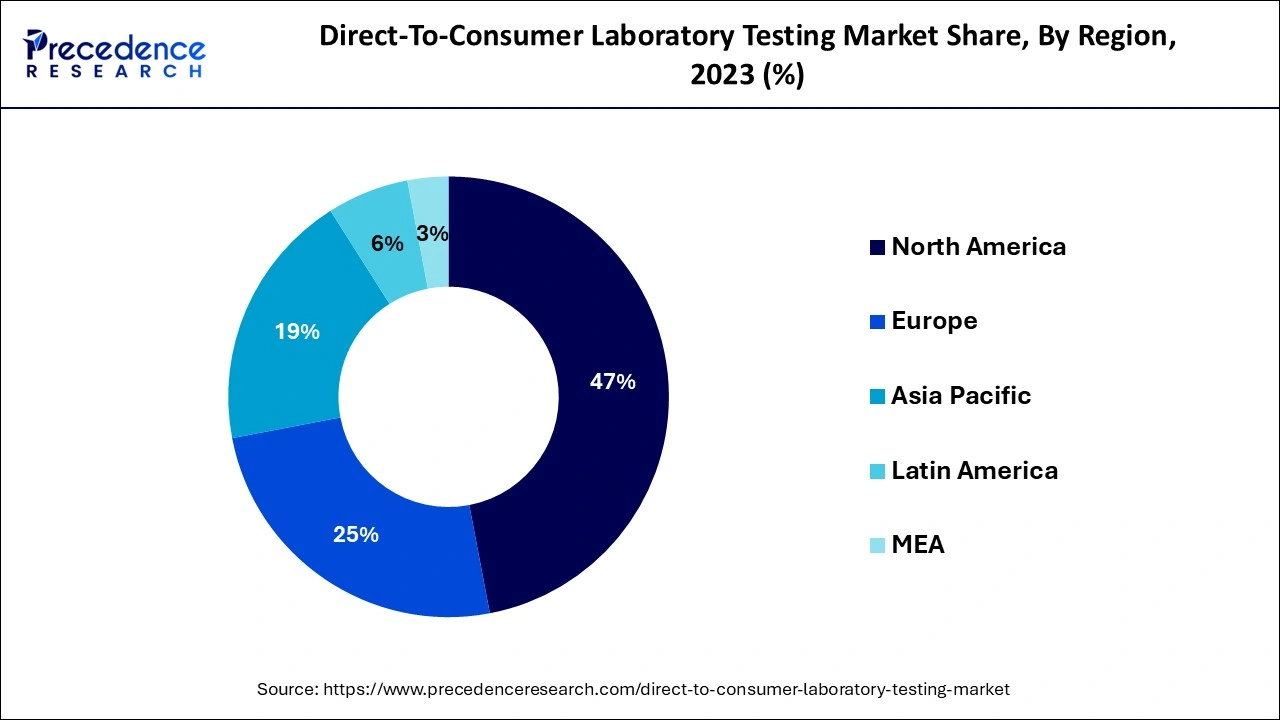

During the projection period, North America is anticipated to have a significant market share with direct-to-consumer tests performed worldwide. Due to the significance of early detection for improved treatment results as well as a greater standard of consumer knowledge about illnesses, North America ruled the global DTC testing industry.

The need for direct-to-consumer lab testing with earlier detection is expected to increase in North America during the projected timeframe due to the increase in the incidence of several lifestyle-related and infectious disorders, including obesity, cancer, diabetes, and STDs.

In the foreseeable future, it is projected that the European market would grow rapidly. The industry is expected to be driven by rising consumer consciousness and improving lifestyles. Because of increasing expendable cash and more health care understanding, the Asia Pacific region was anticipated to have considerable growth during the projection period.

Asia Pacific's direct-to-consumer diagnostic test industry is anticipated to grow quickly in the next years. This is attributable to increased education programs and advancements made by federal agencies to support biological testing in nations all over Asia.

Individuals can request laboratory studies immediately from such a laboratory via direct-to-consumer (DTC) diagnostics, also referred to as immediate access diagnostics, without necessarily involving the health professional. Such tests' outcomes can be used to track an established health condition, spot problems with medical disorders that weren't previously identified, or gather information on a patient's traits. laboratory to improve people's involvement in directing their health, direct-to-consumer testing is just a crucial component of continued attempts, and it is essential that perhaps the test findings are precise and easy to comprehend. In this procedure, laboratory specialists are essential.

The direct-to-consumer laboratory testing market is being driven by the alluring advantages of DTC screening. Consumers should weigh the advantages they experience with the dangers they may encounter, such as privacy issues, the chance of getting conflicting health data, details that might arouse unanticipated feelings, misinterpretation, and over-testing. DTC tests are advertised for several purposes. Cheek saliva or spit, swabs, urine, hairs, blood stains, or blood are typical sample forms. As new knowledge about just the significance of the findings becomes available shortly the near future, DTC test firms upgrade their clients' knowledge. Customers who want to keep up to date on developments in science about their well-being and propensity for the condition may find this to be appealing. Consumers can purchase tests efficiently using direct-to-consumer lab tests, which eliminates the need for them to coordinate with their healthcare professionals.

The healthcare sector is changing its emphasis from one that is physician-focused to one that is consumer-focused. DTC laboratory testing is therefore another of the mid-1900s health industry dreamt implementations. The concept of being examined without being to endure a drawn-out in-clinic procedure is becoming more and more appealing to customers, which is driving the largest international regular laboratory industry. By observing the patient's current physical condition, the lab tests are used to discover previously undiscovered medical diseases. Access to information regarding aspects of one's health is also helpful.

The development of DTC laboratory testing is crucial for raising consumer and personalized participation in patient monitoring. To deliver accurate test results with complete comprehension, laboratory personnel must update their technology promptly. Due to the increased rate of aging populations and the rising number of chronic diseases, the worldwide direct-to-consumer testing market is predicted to grow significantly.

The need for direct-to-consumer testing was increasing towards the earlier treatment of various diseases, which is boosting the development of a direct-to-consumer testing marketplace. These factors, as well as the growing incidence of major diseases, have resulted in a rise in healthcare spending. The industry is also driven by technological advancements, the conclusion of individual genomic studies, and the demands of the business. Additionally, market participants provide a range of customized testing options. Although genetic studies represent the majority of such tests, new microbial testing and medical lab testing will spur market expansion. The Accountability and Health Insurance Portability statute does not apply to direct-to-consumer testing or businesses, and an absence of oversight and procedures to safeguard consumer testing results may limit market expansion. Additionally, privacy and data security issues limit the industry's ability to expand.

| Report Coverage | Details |

| Market Size in 2024 | USD 3.44 Billion |

| Market Size by 2034 | USD 8.07 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.90% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Test Type, and By Sample Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing customer demand for transparency in test performance drives industry growth

Consumer availability to DTC testing and marketing is a key factor in the industry's expansion

Controlled laboratory tests for DTC

Give people useful data regarding their health condition in a relevant and practical manner

Healthcare delivery method changes

The market is dominated by regular medical lab testing. Regular testing is essential to help doctors diagnose diseases, validate medical conditions, and provide preventative medicine. These examinations are frequently completed quickly and on a routine basis. Since it assists in discovering the genetic cause of persistent illnesses such as cancer, Healthcare Genetic Lab Tests were anticipated to experience considerable growth in the coming years. These encompass inherited screening and transmitter testing, which are frequently done for DTC genetic analysis.

Further divisions of the medical risk evaluation diagnostics market include STDs, cancer, and others. In 2022, the market was led by the genetic screening niche. The number of people using DTC testing kits for health and wellness has rapidly expanded. The market for DNA testing kits is expected to rise as more people become interested in learning about your forebears & personal history, particularly in industrialized nations worldwide.

The market is expected to be dominated by the saliva sector. The domination of the market can be due to the rise in DTC screening businesses that provide saliva-based testing kits. The advantages of samples taken in DTC testing are responsible for this company's substantial market share. The collecting of saliva samples is an easy, dependable, and non-invasive process that is also practical for sample processing and transportation to testing facilities.

By Product

By Test Type

By Sample Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

January 2025