February 2025

The global directed energy weapons market size is calculated at USD 12.35 billion in 2025 and is forecasted to reach around USD 27.95 billion by 2034, accelerating at a CAGR of 9.50% from 2025 to 2034. The North America market size surpassed USD 4.17 billion in 2024 and is expanding at a CAGR of 9.65% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

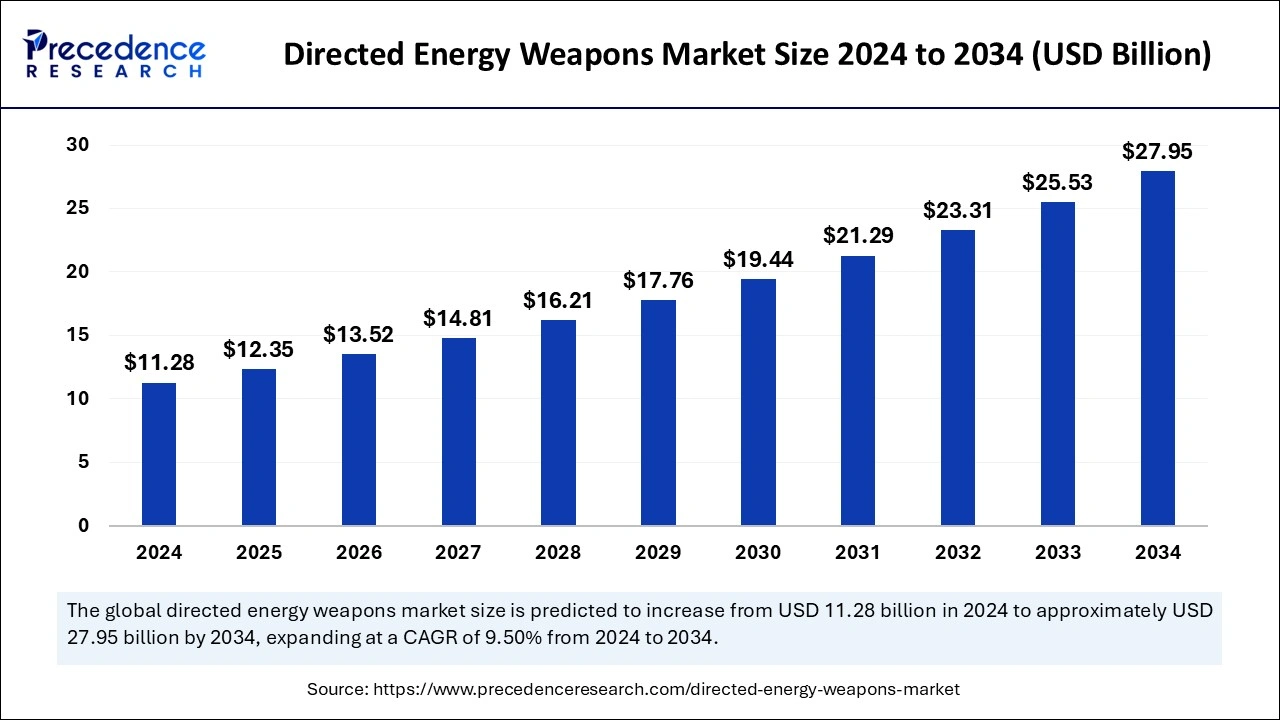

The global directed energy weapons market size accounted for USD 11.28 billion in 2024 and is expected to exceed around USD 27.95 billion by 2034, growing at a CAGR of 9.50% from 2025 to 2034. The increasing international dispute over borders and the deployment of efficient anti-missile technology into the defense system are collectively boosting the growth of the directed energy weapons market.

The deployment of Artificial Intelligence into the defense industry is driving the revolution in defense equipment and technologies with improved precision and accuracy. Combining AI with the directed energy weapons market helps improve the speed of operations. AI provides an extensive weather database that offers the operator meta-analysis and helps them to make an informed decision on the battlefield and increases the probability of defeating the target.

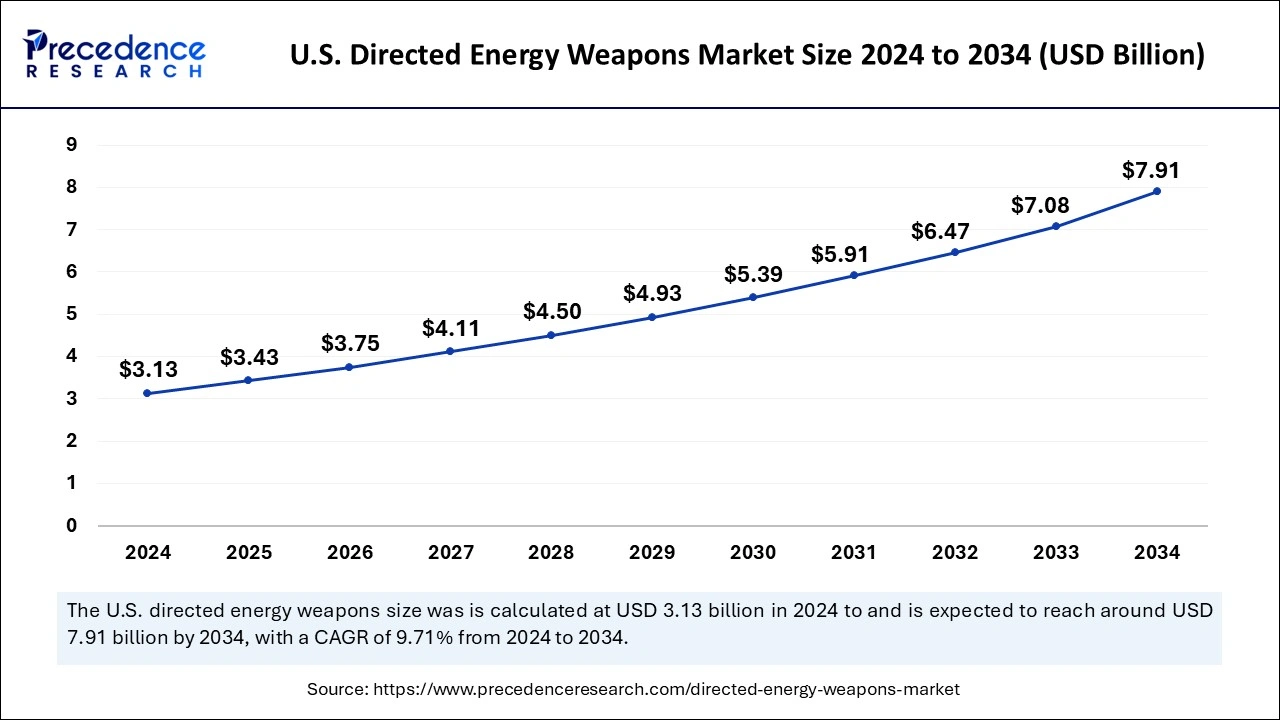

The U.S. directed energy weapons market size was exhibited at USD 3.13 billion in 2024 and is projected to be worth around USD 7.91 billion by 2034, growing at a CAGR of 9.71% from 2025 to 2034.

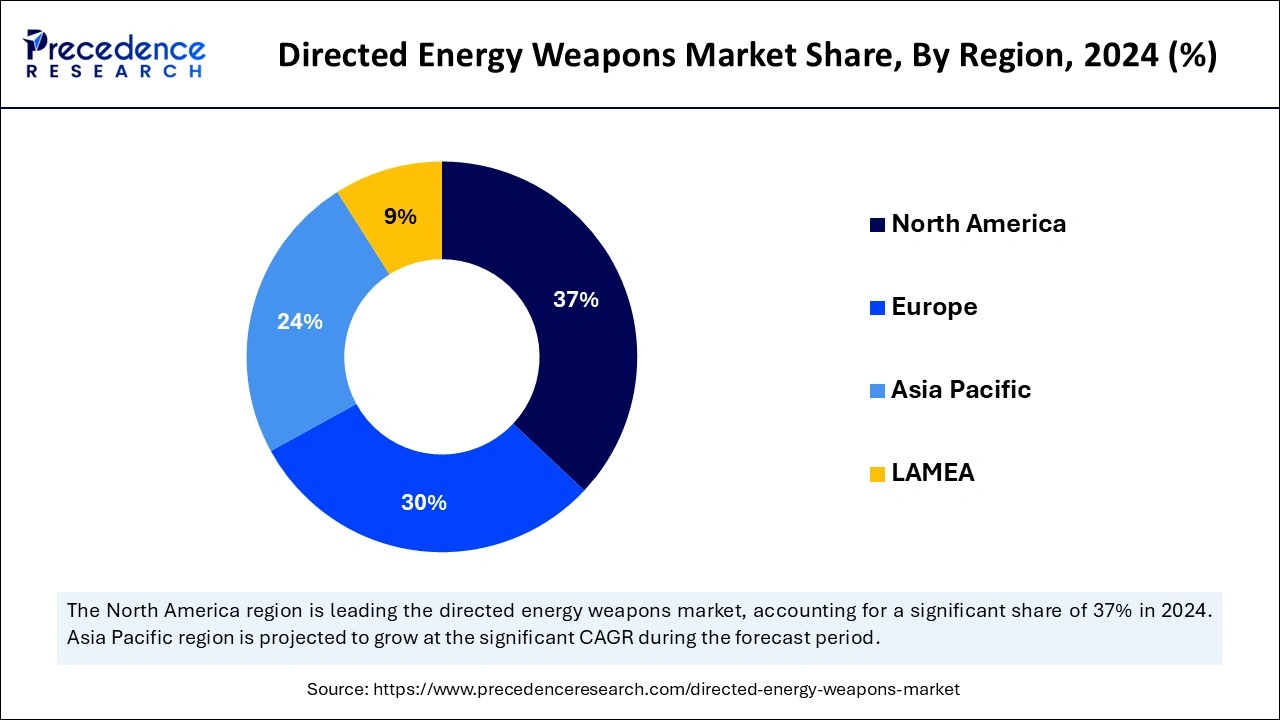

North America dominated the directed energy weapons market in 2024. The growth of the market is attributed to the rising acceptance of advanced technologies and government investment in the strengthening of the defense system by leading countries like the United States and Canada, which is driving the growth of the market. The increasing defense industry and the availability of the leading weapon manufacturing units in the regional countries are accelerating the growth of the directed energy weapons market in the region.

Asia Pacific is expecting substantial growth in the directed energy weapons market during the predicted period. The growth of the market is owing to the availability of highly populated countries like India, and China which also have one of the strongest and largest defense forces that boost the demand for directed energy weapons. The increasing dispute in the regional countries causes the increased demand for robust military equipment, weapons, and others that drive the growth of the directed energy weapons market across the region.

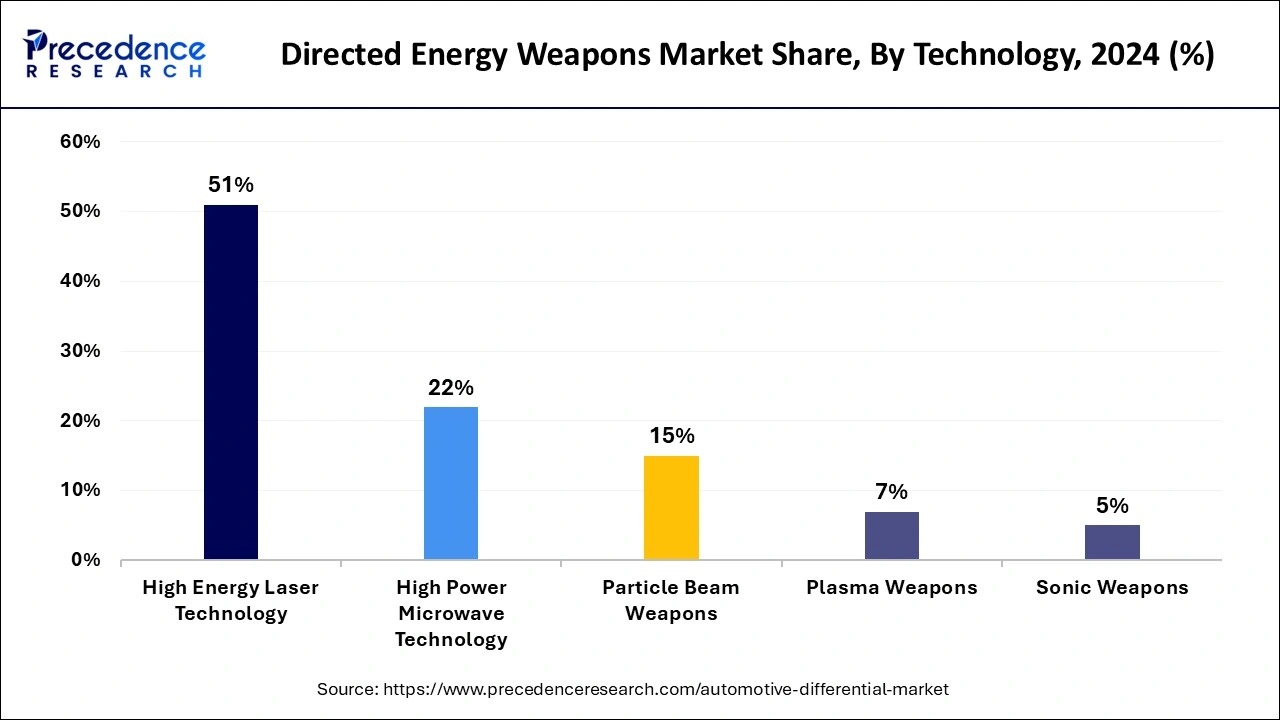

The directed energy weapons that are using electromagnetic technology to destroy or degrade the targets. Direct energy weapons are effective defense equipment or technology that is used by different defense platforms, including air, land, and sea. The directed energy weapons market technology has the capability of degrading or destroying the target over long distances with enhanced accuracy and precision. It has inclusive technologies such as high energy lasers, high power microwaves, millimeter waves, particle beams, and space that help in offering the directed energy weapons improved accuracy and precision.

| Report Coverage | Details |

| Market Size by 2024 | USD 11.28 Billion |

| Market Size in 2025 | USD 12.35 Billion |

| Market Size in 2034 | USD 27.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Lethality, Platform, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Advantages related to the directed energy weapons

The increasing demand for strengthening the defense mechanism of the country causes the increased demand for advanced technologies and equipment that help elevate the defense system, boosting the growth of the directed energy weapons market. The directed energy weapons have several benefits, including their lower cost of operations, logistical efficiency, rapid response time, increased precision and stealth, and ability to counter the lower drones and rockets.

High cost of development

The increased cost of development and deployment of technology and limitations over environmental factors are collectively restraining the growth of the directed energy weapons market.

Advancements in directed energy weapons

The integration of the latest advancements in the directed energy weapons market, such as solid-state output, offers scalability and compact size to the weapon. The integration of beam control and fiber optics enables the improvement of the target accuracy, enhances engagement over longer distances, maintains atmospheric turbulence, and improves performance. Additionally, there is an ongoing investment in research and development activities for the further expansion of technology and the launch of products.

The high-energy laser technology segment dominated the directed energy weapons market in 2024. The increasing demand for high-precision defense technology from different countries to strengthen their military and defense mechanisms is driving the demand for the segment. The high-energy laser is an advanced technology that has several benefits compared to the traditional type of laser system. This system has the ability to engage the target with enhanced accuracy, speed, and virtually unlimited magazines. The high-energy laser uses light particles and photons to accomplish defense or military missions. It offers the detection of threats, positive visual identification to defeat a wide range of threats, and tracking during maneuvers, including rockets, unmanned aerial systems, mortars, and artillery.

The high-power microwave technology segment expects the fastest growth in the directed energy weapons market during the forecast period. The increasing demand for high-power microwave technology weapons is due to their compatibility with any type of atmospheric conditions. It can impact the target in wide areas. The high-power microwave offers deep magazines, speed of light attack, and modest electrical power from the host platform. Leading countries like the United States Navy use directed energy high-power microwave technology to strengthen their defense mechanism.

The lethal segment led the directed energy weapons market in 2024. The increasing demand for lethal directed energy weapons by a number of industries to strengthen their defense industry with high precision targets, speed of light target detection, and greater destroying capabilities are driving the growth of the lethal segment.

The non-lethal segment will witness the fastest growth in the directed energy weapons market during the predicted period. The rising demand for non-lethal directed weapons to strengthen homeland security is driving the demand for the segment. The rising criminal activities in countries, the government intervention in developing the internal defense system in the countries, and the ongoing investment in the research and development activities for the further development and launch of the product are driving the growth of the non-lethal segment.

The land-based segment dominated the directed energy weapons market in 2024. There is an increasing demand for directed energy weapons in the military or land-based army to improve their defense system, which enhances defense equipment and weapons. The ongoing investment and the higher budget allotment by the regional government to strengthen the military are contributing to the growth of the segment.

The airborne-based segment accounted for the fastest growth in the directed energy weapons market during the predicted period. The increasing adoption of directed energy weapons by the Air Force and other airborne defense systems is driving the demand for the segment. The rising investment in the airforce and aerospace defense system is enhancing the demand for the segment.

The defense segment dominated the directed energy weapons market in 2024. The increasing demand for technologically advanced defense equipment and weapons by the various regional countries for improving their security system and increasing international disputes over the period between the countries are causing the higher demand for robust defense mechanisms of the countries that further contributes to the higher demand for directed energy weapons in the defense applications.

The homeland security segment expects notable growth in the directed energy weapons market during the forecast period. The rising number of internal disputes in the countries and the crime rate are driving the demand for directed energy weapons. Furthermore, there are various countries that are highly investing in the development of internal security and defense, which is also driving the demand for the market in homeland security applications.

By Technology

By Lethality

By Platform

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

January 2025