November 2024

Homeland Security Market (By Types: Aviation Security, Maritime Security, Border Security, Critical Infrastructure Security, Cyber Security, CBRN Security, Mass Transit Security, Others; By Technology: Recognition and Surveillance Systems, AI-based Solutions, Security Platforms, Others; By End-use: Public Sector, Private Sector) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

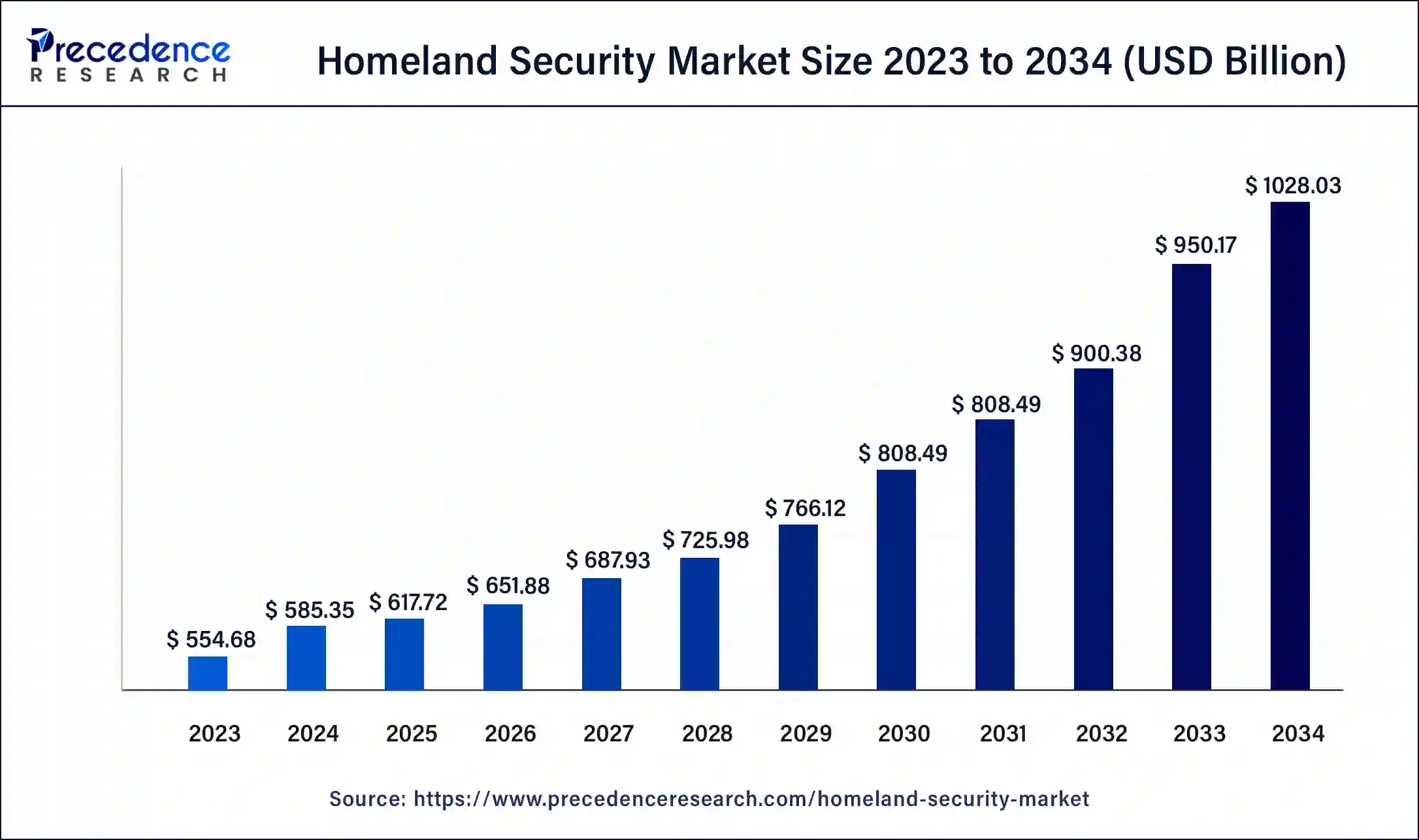

The global homeland security market size was USD 554.68 billion in 2023, calculated at USD 585.35 billion in 2024 and is expected to reach around USD 1028.03 billion by 2034, expanding at a CAGR of 5.8% from 2024 to 2034. The homeland security market size reached USD 199.68 billion in 2023.

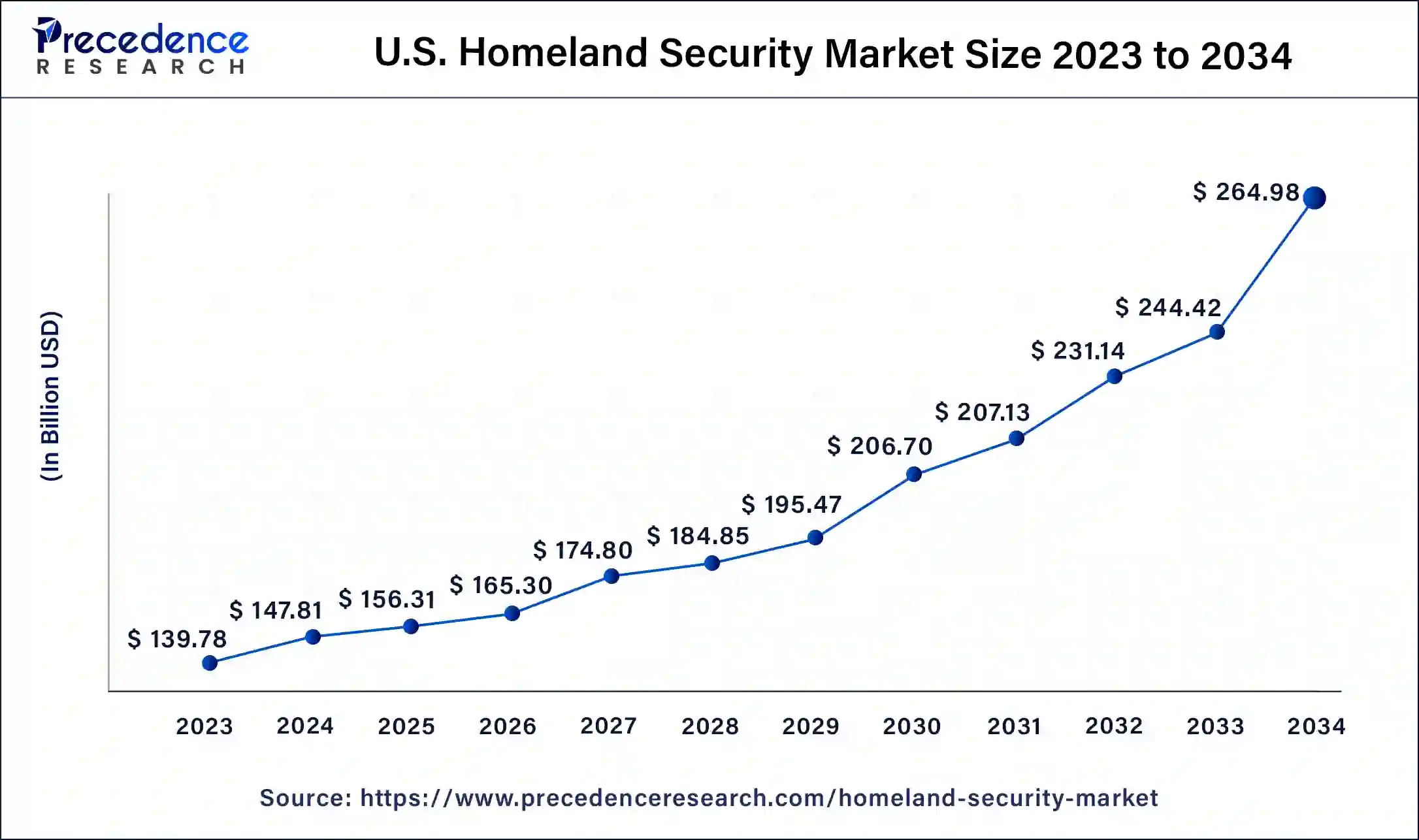

The U.S. homeland security market size was estimated at USD 139.78 billion in 2023 and is predicted to be worth around USD 264.98 billion by 2034 at a CAGR of 6.01% from 2024 to 2034.

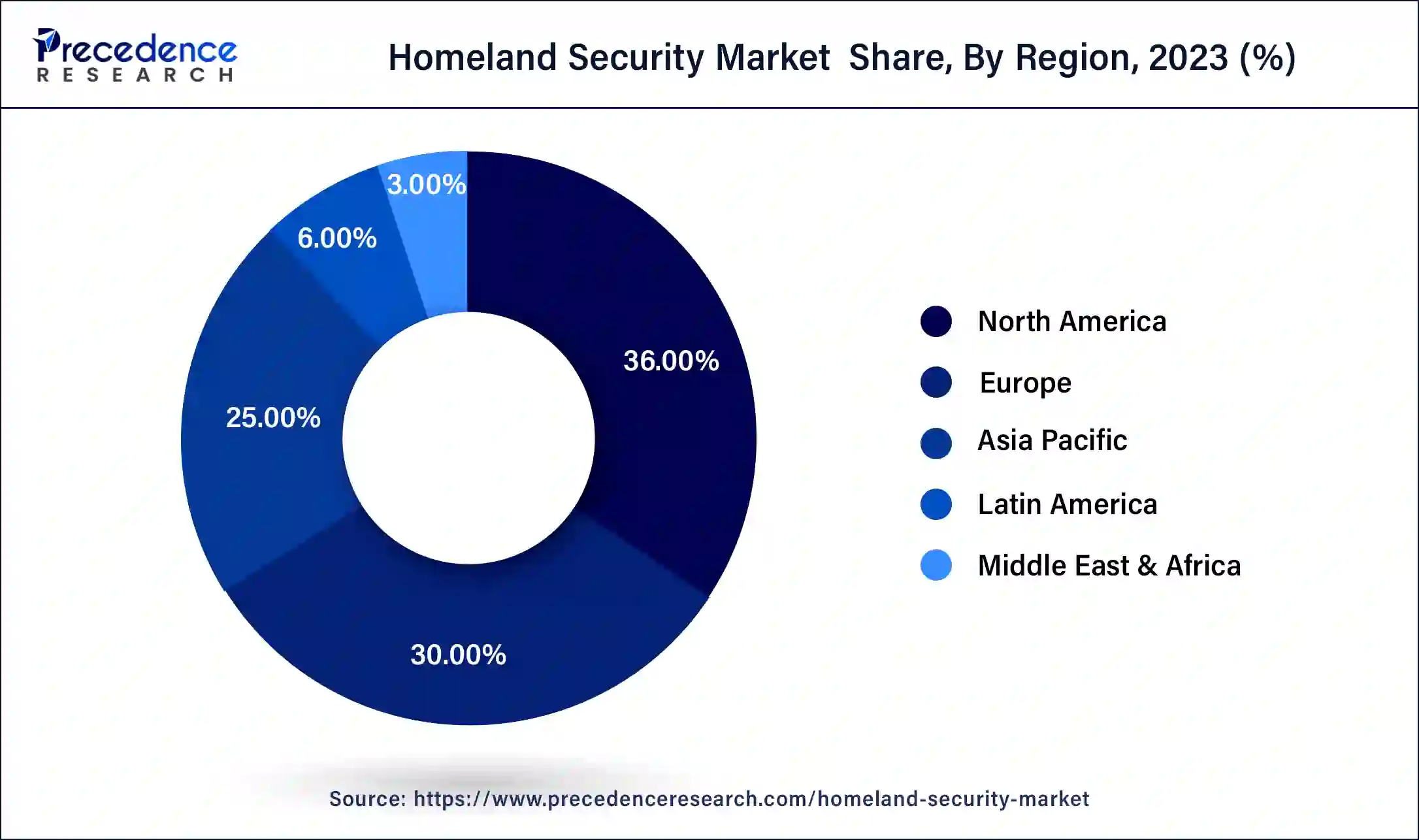

North America led the market with the biggest market share of 36% in 2023., with the United States taking significant strides in fortifying its defenses against evolving threats. The U.S. Navy's historical engagement in homeland security and defense missions has been marked by episodic responses, often shifting focus towards forward operational concepts.

The establishment of the U.S. Department of Homeland Security and USNORTHCOM reflects a growing recognition of the need for a more sustained and focused commitment to safeguarding the nation's security. However, there remains considerable scope for enhancing maritime aspects of homeland security and defense, requiring collaborative efforts between senior leadership in both Canada and the United States.

Future steps should prioritize practical and cost-effective measures aimed at improving continental security against terrorism. By fostering joint initiatives and leveraging regional partnerships, North America can bolster its resilience against emerging threats and ensure the safety and security of its citizens.

Recent achievements within the Department of Homeland Security, such as reducing public burden by over 21 million hours through streamlined administrative processes, demonstrate the region's commitment to enhancing efficiency and effectiveness in homeland security operations. These efforts contribute to a more robust and resilient security framework, positioning North America as a leader in safeguarding its borders and citizens.

The Department of Homeland Security (DHS) is a crucial institution tasked with safeguarding the nation from multifaceted threats, necessitating the dedication of over 260,000 employees across diverse roles. Ranging from aviation and border security to emergency response and cybersecurity analysis, DHS operates at the forefront of defense. Central to its mission is preemptive counterterrorism measures, where DHS employs sophisticated strategies to outpace potential threats.

Additionally, DHS assumes responsibility for disaster preparedness and response, with agencies like the Federal Emergency Management Agency (FEMA), the U.S. Coast Guard, and Customs and Border Protection playing integral roles. Through coordinated efforts, DHS ensures that communities nationwide are equipped to confront and mitigate various emergencies.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 1028.03 Billion |

| Global Market Size in 2023 | USD 554.68 Billion |

| Global Market Size in 2024 | USD 585.35 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.8% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Types, Technology, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Enhanced national cybersecurity

The Department of Homeland Security (DHS) is poised to catalyze growth in the homeland security market through its commitment to fortifying national cybersecurity. With increasing reliance on the Internet for daily conveniences, critical services, and economic prosperity, the demand for robust cybersecurity measures has never been higher. DHS aims to address this need by bolstering cybersecurity risk management across government networks and critical infrastructure, curtailing illicit cyber activity, and enhancing responses to cyber incidents.

Through a unified departmental approach, strong leadership, and strategic partnerships with federal and nonfederal entities, DHS is paving the way for a more secure and resilient cyber ecosystem. By leveraging its broad resources and capabilities across the homeland security enterprise, DHS is positioned to drive innovation and effectively manage national cybersecurity risks, thereby fueling growth in the homeland security market.

Comprehensive public safety education

Homeland security programs are instrumental in propelling growth within the homeland security market by offering students a comprehensive public safety education. Through a carefully crafted curriculum, students are equipped with the necessary skills and knowledge to pursue careers in firefighting, emergency medical response, fire protection, emergency health services, and emergency management. The curriculum encompasses a wide range of topics, including fire science focusing on prevention, firefighting, rescue techniques, and hazardous materials management, as well as emergency medical services covering first responder techniques, EMT training, and dispatch operations. This focused education not only prepares students for diverse roles within the public safety sector but also contributes to the expansion of the homeland security market by supplying skilled professionals to address evolving security challenges.

Budgetary constraints

The homeland security market faces limitations due to the current budget environment, presenting challenges to programs and initiatives within the Department of Homeland Security (DHS). Competing funding demands from ongoing capital investment endeavors like the proposed border wall and ongoing recapitalization efforts, alongside staffing requirements for cybersecurity, border security, and immigration enforcement, create competition for limited funds both across the government and within DHS. These budgetary constraints pose significant restraints on the growth potential of the homeland security market, impeding the ability to invest in innovative solutions and expand critical capabilities to address emerging threats effectively.

Vulnerabilities in digital infrastructure

The rapid advancement of the digital revolution, while offering numerous benefits such as global connectivity and market efficiency, also introduces significant risks to cybersecurity. With more components of the global supply chain connected to the internet, the potential for malicious attacks or disruptions escalates. Moreover, the fast-paced nature of technological development often outpaces traditional government oversight, making it challenging to establish comprehensive security standards.

The COVID-19 pandemic further underscored the vulnerabilities inherent in a globally connected supply chain, prompting heightened awareness of cybersecurity risks. As the Department of Homeland Security (DHS) shifts its focus towards securing the nation's digital infrastructure, efforts to address these vulnerabilities may impose constraints on the growth of the homeland security market, as resources are redirected to mitigate cyber threats and enhance resilience against cyberattacks.

Leveraging advanced technologies

Recent advancements in technology, including artificial intelligence (AI) and machine learning, present significant opportunities for the homeland security market. Deployments by the Department of Homeland Security (DHS), such as face-recognition technology, fifth-generation network technology, counter-unmanned aircraft systems, and chemical and biological detection systems, offer a range of potential benefits.

Despite associated risks, developments such as the DHS Artificial Intelligence (AI) Task Force, digital transformation initiatives leveraging cloud and data analytics, advancements in tactical communications and edge computing, and innovative procurement techniques to support DHS mission outcomes create fertile ground for market growth. These developments not only enhance the effectiveness and efficiency of homeland security operations but also spur demand for innovative solutions and services, driving opportunities for growth and advancement in the homeland security market.

Trends in cybersecurity and resilience

The next decade is expected to witness significant opportunities in the homeland security market, driven by two prominent trends. Firstly, the expansion of cybersecurity capabilities emerges as a pivotal focus area. With cyber threats evolving in sophistication and complexity, there's a heightened emphasis on bolstering cybersecurity within homeland security and emergency management domains. This trend propels the demand for innovative solutions and services tailored to combat emerging cyber threats, thereby creating opportunities for market growth. Secondly, there's a notable shift towards prioritizing resilience and adaptation in the face of evolving risks.

There's a growing inclination toward adopting a robust approach centered on building resilience and fostering adaptation. This paradigm shift opens doors for market players to offer solutions that enhance organizational resilience and facilitate adaptive strategies, driving growth opportunities within the homeland security market.

The critical infrastructure security segment is emerging as the dominant focus area within the homeland security market. Critical infrastructure encompasses vital systems such as highways, bridges, railways, utilities, and buildings, which are essential for maintaining daily life operations. Transportation, commerce, clean water, and electricity all rely on these interconnected networks.

To address the security challenges associated with critical infrastructure, there's a need for appropriate information-sharing mechanisms without risking antitrust liability. The establishment of a new legal regime enables the Department of Homeland Security (DHS) to provide assurances to private-sector owners and operators regarding the protection of sensitive or proprietary information shared with the government. These assurances serve as incentives for the private sector to collaborate and share vital information about infrastructure vulnerabilities, enhancing overall security.

Furthermore, DHS's Science and Technology Directorate (S&T) is actively involved in the development and testing of innovative concepts aimed at providing better protection against various threats, including flooding, explosive blasts, solar storms, and other natural or man-made disasters. By improving infrastructure resilience and reducing the risk of disruptions to daily commerce, these initiatives contribute significantly to enhancing national security and safeguarding critical infrastructure networks.

The AI-based solutions segment held the largest share of the homeland security market in 2023. AI-driven analytics empower security personnel with predictive insights and anomaly detection capabilities. By leveraging machine learning algorithms, these solutions can identify patterns and trends indicative of suspicious behavior, even in the absence of explicit threat indicators. This proactive approach allows security agencies to anticipate and mitigate threats before they escalate, enhancing overall preparedness and response effectiveness. Additionally, AI-driven decision support systems provide commanders with actionable intelligence and situational awareness, facilitating informed decision-making in dynamic and high-pressure environments.

The public sector held the largest share of the market in 2023. Governments around the world have the primary responsibility for protecting their citizens and national interests from a wide range of threats, including terrorism, cyberattacks, natural disasters, and pandemics. As such, they allocate significant resources to homeland security efforts, including the procurement of advanced technologies and services. Governments typically have larger budgets compared to private entities, allowing them to invest substantial funds into homeland security initiatives. These budgets are allocated to various departments and agencies tasked with protecting borders, critical infrastructure, transportation systems, and public safety.

Segments Covered in the Report

By Types

By Technology

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

July 2024

August 2024