April 2025

The global disposable lead wires market size is calculated at USD 1.27 billion in 2025 and is forecasted to reach around USD 2.26 billion by 2034, accelerating at a CAGR of 6.62% from 2025 to 2034. The North America disposable lead wires market size surpassed USD 490 billion in 2024 and is expanding at a CAGR of 6.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global disposable lead wires market size was estimated at USD 1.19 billion in 2024 and is predicted to increase from USD 1.27 billion in 2025 to approximately USD 2.26 billion by 2034, expanding at a CAGR of 6.62% from 2025 to 2034. The rising developments in ECG systems across the world are driving the growth of the disposable lead wires market.

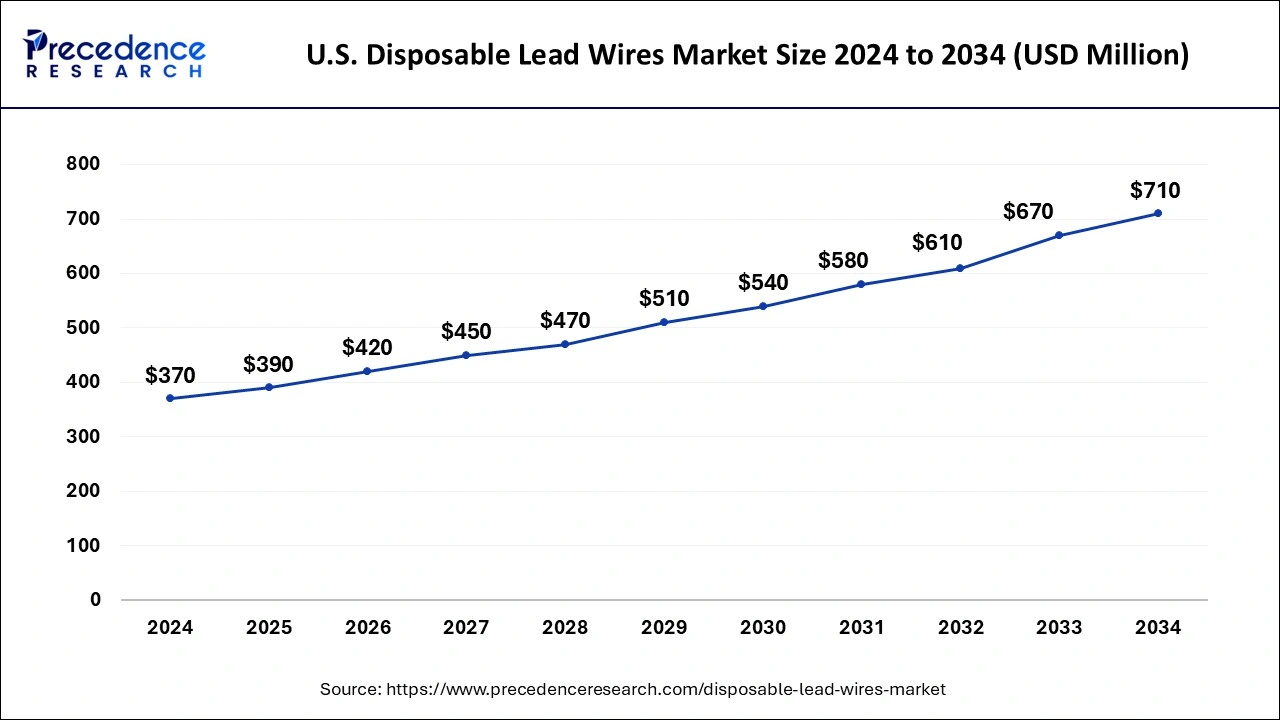

The U.S. disposable lead wires market size was valued at USD 370 million in 2024 and is predicted to surpass around USD 710 million by 2034, at a CAGR of 6.73% from 2025 to 2034.

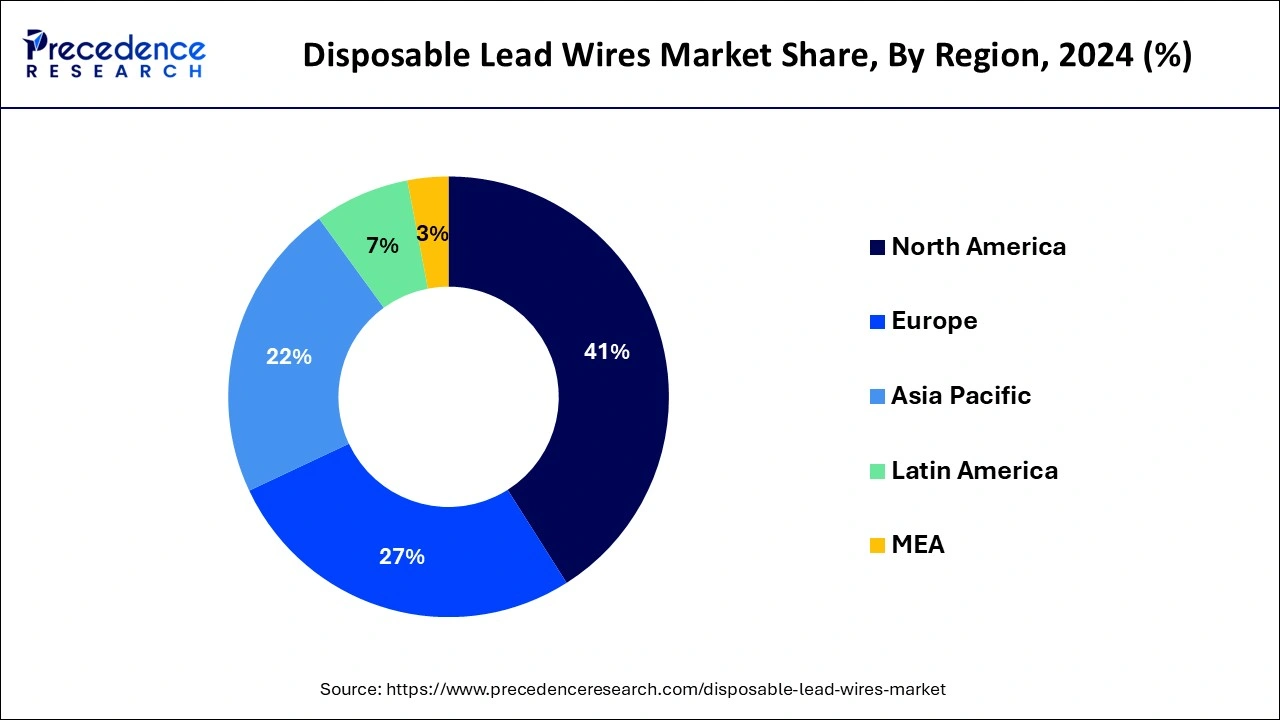

North America held the largest market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by the rising technological developments in the healthcare industry. Also, the increasing prevalence of cardiovascular diseases (CVDs) has increased the demand for ECG systems, which in turn increases the demand for disposable lead wires, thereby driving the market growth. According to a study conducted by the American Heart Association in January 2023, CVD was the leading cause of death in the U.S.. Moreover, the announcement of new government investments for developing healthcare sectors in countries such as Canada, Mexico, and the U.S. also boosted the growth of the disposable lead wires market.

Asia Pacific is the fastest-growing region during the forecast period. The growth of this region is mainly driven by the scientific advancements in the healthcare sector in countries such as India, Israel, China, Japan, and some others. Also, the rising interest from the public and private sectors for development & research related to the manufacturing of disposable lead wires has also boosted the market growth. Additionally, the rising cases of cardiovascular disease (CVD) deaths across Asia increases the demand for ECG machines, which in turn increases the demand for disposable lead wires, thereby driving the market growth. Moreover, rising government investment in countries such as India and Japan to develop the healthcare sector has boosted disposable lead wires market growth.

The disposable lead wires market has grown gradually with the developments in the healthcare instruments industry. The disposable lead wires are mainly used in ECG systems due to several benefits such as low maintenance, superior sterility, high signal quality, reliability, and durability. These wires are also used in hospitals as these wires help to maintain safety and retards infectious organisms to harm patients. It also provides high-quality signals for proper diagnosis of the human heart. These wires are embedded in several ECG systems, including 3 lead systems, 5 lead systems, 6 lead systems, and others. It mainly finds applications in several end-use segments that include clinics, long-term facilities, hospitals, and ambulatory & home care.

| Report Coverage | Details |

| Market Size in 2025 | USD 1.27 Billion |

| Market Size by 2034 | USD 2.26 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Materials, Machine Type, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising cases of heart disease across the world

There are several types of heart diseases across the world that mainly include coronary artery disease, Heart failure, congenital heart disease, valve disease, arrhythmia, myocarditis, heart attack, angina, atherosclerosis, cardiomyopathy, aortic disease, tachycardia, stenosis, peripheral arterial disease, Rheumatic heart disease, and some others. The above-mentioned diseases require early detection to get cured, which increases the demand for ECG systems, which in turn increases the demand for disposable lead wires, thereby driving the disposable lead wires market growth. Also, the rise in the number of cardiovascular deaths has increased significantly, which increases the demand for superior ECG systems, which in turn increases the demand for disposable lead wires, thereby driving the market growth.

High cost of disposable lead wires

The manufacturing cost of disposable lead wires is very high due to the rising prices of raw materials along with the increasing wage rate of workers who are engaged in the industry. In order to maximize profits, disposable lead wire companies have to increase the price of the final product. Thus, the increased cost of disposable lead wires is expected to restrain the growth of the disposable lead wires market during the forecast period.

AI-enabled ECG systems to shape the disposable lead wires industry

There have been several developments in the disposable lead wires industry in recent times. This industry grows parallel with the growth of the ECG industry as disposable lead wires are only used in connection with ECG systems. There is ongoing research and several technological advancements in the ECG industry that include the integration of modern technologies such as AI, blockchain, machine learning, and others in ECG systems to get accurate results.

The TPE segment held the largest share of the disposable lead wires market in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this segment is driven by the rising application of TPE-based disposable lead wires in electrocardiograph (ECG) systems due to several advantages such as compatibility, stability, high-cost efficiency, and high insulation properties, thereby driving the growth of disposable lead wires. Also, rising advancements in chemical sciences related to the production of high-grade Thermoplastic Elastomer (TPE) drive the growth of the disposable lead wires market.

The TPU segment is expected to grow at a significant rate during the forecast period. The growth of this segment can be attributed to technological advancements in the chemical sector. Also, the growing application of TPUs in the production of lead wires due to various benefits, including biocompatibility, biostability, low-temperature elasticity, abrasion resistance, and others, has driven the growth of the disposable lead wires market. In addition, rising technological developments related to injection molding and blow molding techniques that are important for the production of superior quality Thermoplastic polyurethane (TPUs) drive the growth of the disposable lead wires market.

The others segment held the largest market share in 2024 and is expected to continue its dominance during the forecast period. The other segment includes several machines, such as 6, 12, 15, and 18 lead machines. These machines are highly suitable for identifying several conditions, such as rhythm and conduction abnormalities in patients, the cause of arrhythmia, syncope or palpitations, accurate diagnosis of STEMI, areas of myocardial damage, and some others. Thus, the growth of other segments is expected to drive the growth of the disposable lead wires market.

The 5-lead machine segment is expected to grow at a significant rate during the forecast period. The growth of this segment is mainly driven by the rising adoption of these machines in hospitals and other healthcare settings. Also, 5-lead ECG machines are mainly used for detecting Perioperative Myocardial Infarction (MI) in Non-Cardiac Surgery Patients, which increases the demand for disposable lead wires, thereby driving the market growth.

The hospitals segment dominated the disposable lead wires market in 2024 and is expected to continue its dominance during the forecast period. The growth of this segment is generally driven by the rise in number of surgeries in public hospitals across the world. According to a report by the Australian Institute of Health and Welfare, around 735,000 patients were admitted for surgery in public hospitals in Australia in 2022-2023, which rose by 18% as compared to 2021-22. With the rise in the number of surgeries, the demand for ECG systems increases, which in turn increases the demand for disposable lead wires, thereby driving the market growth. Also, rising cases of road accidents across the world that need early detection for emergency treatment increase the demand for ECG systems in hospitals, thereby driving the growth of the market. Moreover, cardiology specialty hospitals across the world increase the demand for ECG systems, which in turn increases the demand for disposable lead wires, thereby driving disposable lead wires market growth. Some of the famous cardiology hospitals include Mayo Clinic-Rocheste, Herzzentrum Leipzig, The Johns Hopkins Hospital, Deutsches Herzzentrum der Charité, and others.

The clinics segment is growing with a significant CAGR during the forecast period. The growth of this segment is generally driven by the growing demand for remote patient monitoring services among people across the world. Also, the availability of quality doctors in clinics allows people to visit clinics regularly when suffering from mild or serious heart diseases. Thus, regular heart checkups in clinics increase the demand for ECG systems, which increases the demand for disposable lead wires, thereby driving the growth of the disposable lead wires market.

By Materials

By Machine Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

January 2025