January 2025

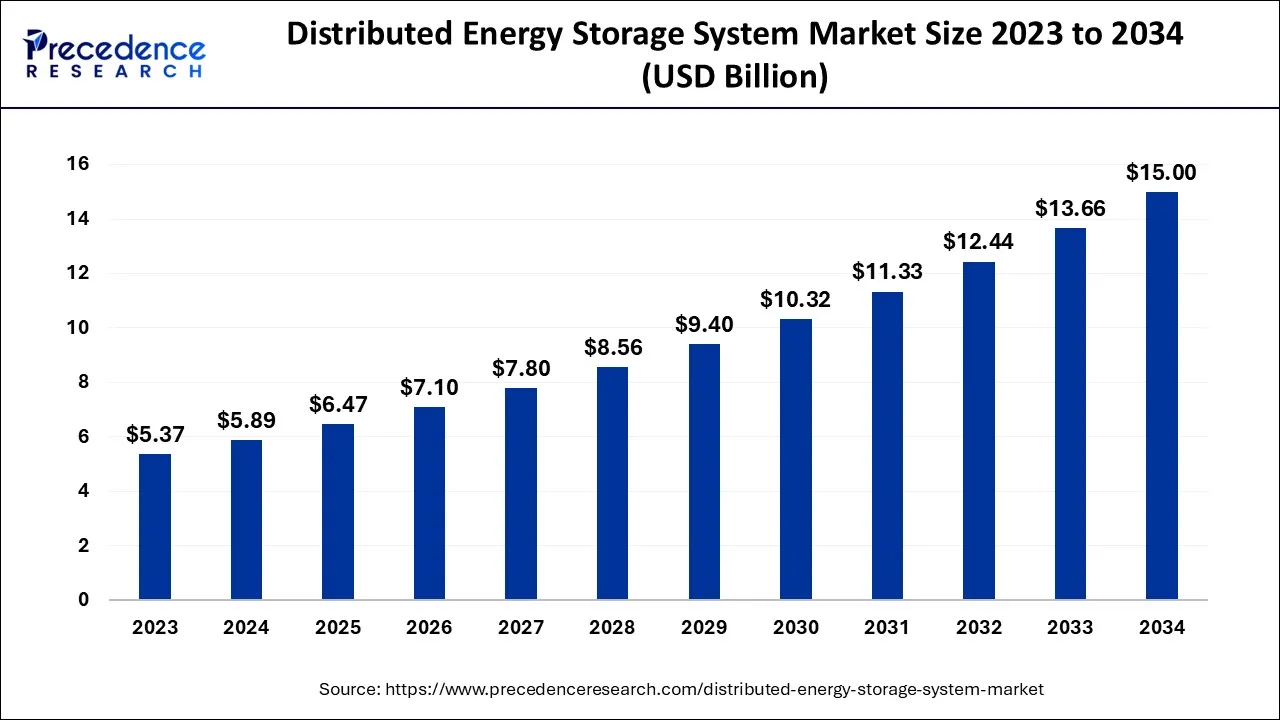

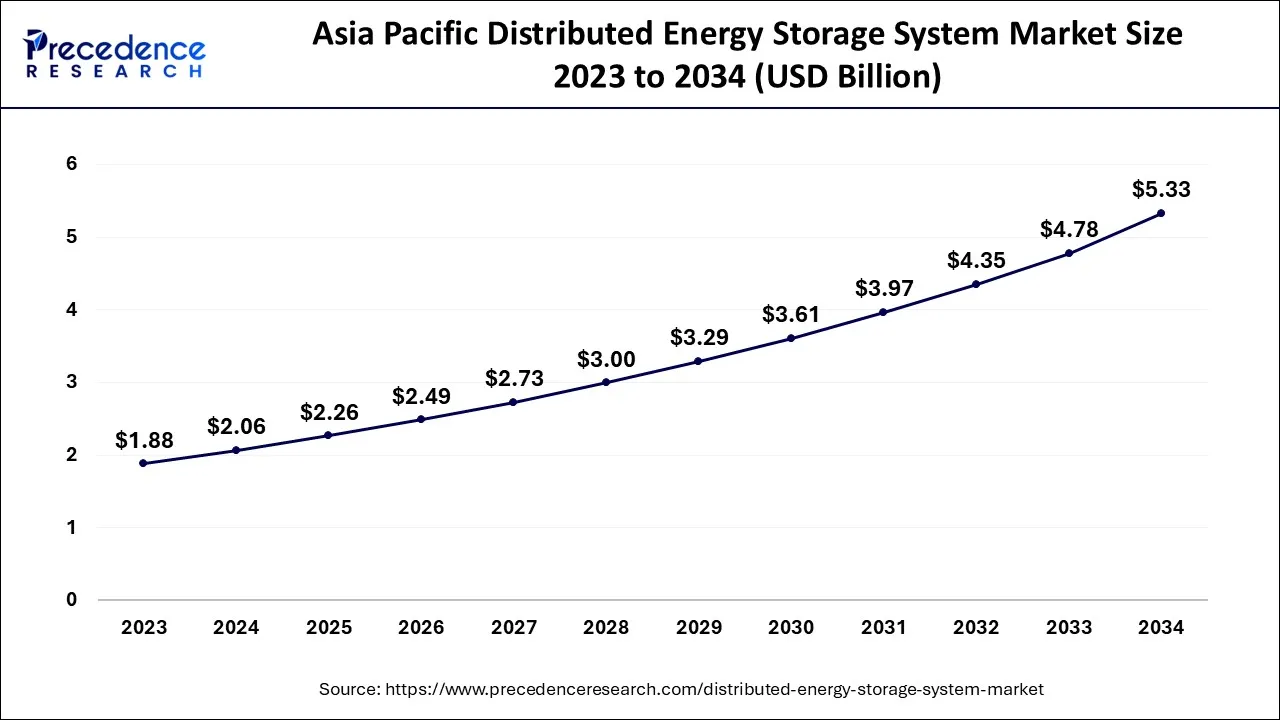

The global distributed energy storage system market size accounted for USD 5.89 billion in 2024, grew to USD 6.47 billion in 2025 and is expected to be worth around USD 15.00 billion by 2034, registering a CAGR of 9.8% between 2024 and 2034. The Asia Pacific distributed energy storage system market size is calculated at USD 2.06 billion in 2024 and is estimated to grow at a CAGR of 9.95% during the forecast period.

The global distributed energy storage system market size is calculated at USD 5.89 billion in 2024 and is projected to surpass around USD 15.00 billion by 2034, growing at a CAGR of 9.8% from 2024 to 2034.

The Asia Pacific distributed energy storage system market size is exhibited at USD 2.06 billion in 2024 and is projected to be worth around USD 5.33 billion by 2034, growing at a CAGR of 9.95% from 2024 to 2034.

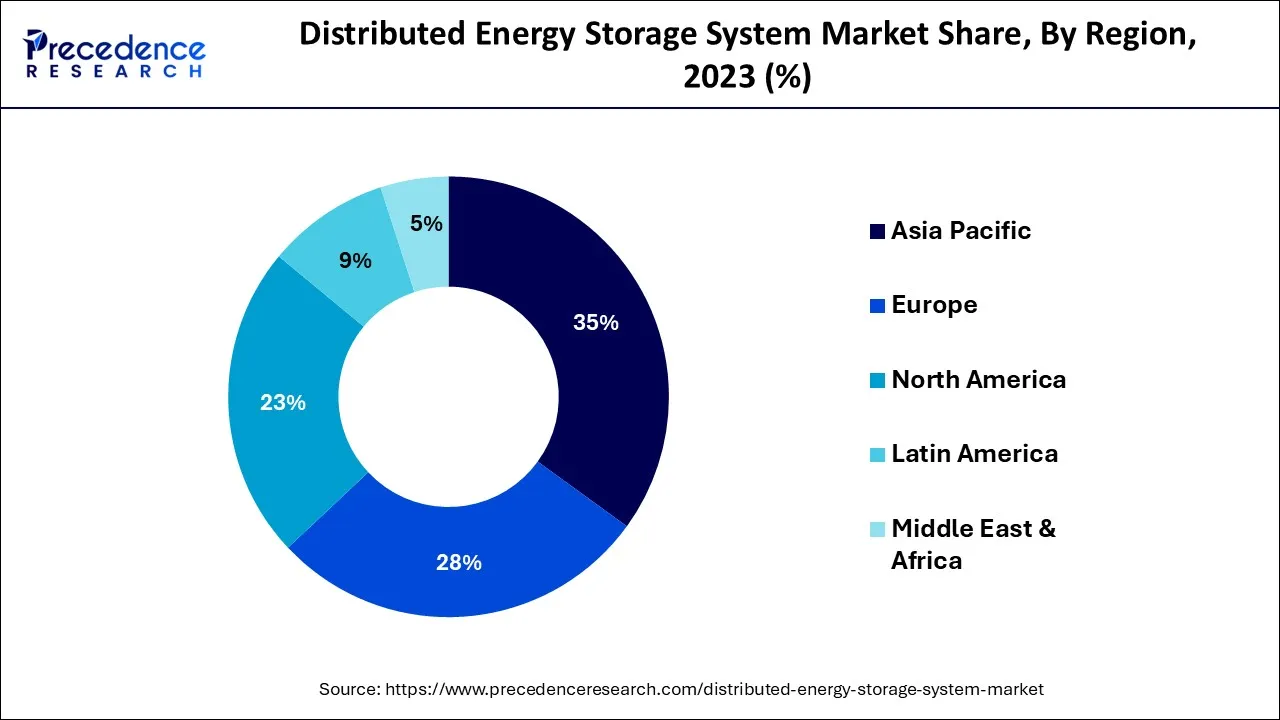

Asia-Pacific dominated the distributed energy storage market in 2023 and is expected to grow at a CAGR of around 10.42% during the forecast period, owing to rising electricity demand and investment in renewable energy projects, as well as an increase in purchasing power. According to an IEA report, India energy outlook 2021, the Indian residential sector will see an increase in electricity consumption, from around 1000 kWh per household in 2019 to 1500 kWh in 2030, due to an increase in the country's disposable income.

Such increases in electricity demand have a positive impact on the rate of adoption of distributed energy storage systems. Similarly, in July 2020, Neyveli Lignite Corporation (NLC) India Limited announced that the electricity department of Andaman and Nicobar had confirmed the commissioning of a 20MW solar power project integrated with an 8MWh BESS. Such projects involving renewable energy sources and energy storage systems are boosting growth. Aside from that, urbanization, industrialization, and the growing need for electrification in remote areas are driving the growth of this market in this region.

Furthermore, increasing environmental awareness among the general public contributes significantly to the growth of this market. According to an international energy agency (IEA) report published in January 2020, solar PV capacity in India alone could reach 800 GW by 2040, reducing power-related CO2 emissions and air pollution. This type of advancement will accelerate the deployment of distributed energy storage systems. As a result, the aforementioned factors are set to create massive growth opportunities for the APAC distributed energy storage system market.

Market Overview

By reducing variability, distributed energy storage systems allow for the smooth integration of renewable energy sources into the main grid. Furthermore, distributed energy storage systems aid in the storage of excess renewable energy for use during peak demand. As a result, increased renewable energy adoption and rising demand for clean power are expected to be major drivers of the distributed energy storage system market.

During peak hours, distributed energy storage systems support and reduce stress on grid infrastructure by providing backup power, voltage support, frequency support, power quality, and peak shaving. This allows power companies to meet the increased demand for electricity with relative ease at any time. As a result, an increase in power demand is expected to be a key driver of the distributed energy storage system market.

There are the following factors which are expected to boost the distributed energy storage system market growth:-

| Report Coverage | Details |

| Market Size in 2024 | USD 5.89 Billion |

| Market Size by 2034 | USD 15.00 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.8% |

| Largest Market | Asia-Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising renewable energy usage and investment

One of the major factors driving the growth of the distributed energy storage market is increased investment in renewable energy. Nowadays, most countries rely on and invest heavily in renewable energy sources to generate electricity, creating a high demand for distributed energy storage technology, which aids in the storage of excess energy generated by renewable sources for use during peak demand.

ACEN announced its investment plan for the development of wind, solar, and battery energy storage system (BESS) projects in April 2021, in order to expand its renewable energy portfolio. Similarly, ACEN has already invested in BESS through its renewable energy laboratory in Bataan, Mariveles, where various technologies in solar and battery energy storage systems will be tested. As a result of these investments in renewable energy and its high usage rate, the adoption rate of distributed energy storage systems will accelerate during the forecast period.

Grid storage systems are becoming popular

The rising demand for grid storage systems for storing energy generated from various sources is driving the growth of the distributed energy storage market. Weather changes, wind fluctuations, and other factors cause variations in energy generation, resulting in an increasing demand for grid storage systems to store energy. The distributed energy storage system assists the grid in storing excess generated electricity, which can then be used when there is a power outage.

The use of these storage systems improves reliability and flexibility in the distribution, transmission, and generation of electricity. As a result, the aforementioned factors drive the adoption of these distributed energy storage systems, fueling market growth during the forecast period 2024-2034. Broad Reach Power announced in June 2020 that it plans to build 15 utility-scale battery storage plant sites in Texas near Houston and Odessa by the end of 2020, with each site capable of storing and distributing up to 10MW of power. Such developments will fuel the market's expansion.

Technological advancements

The integration of advanced technologies, synergetic digital communication, and smart control strategies in existing power grids has resulted in a new phenomenon in the power sector known as smart grids. The development of smart grids has altered how power is generated, distributed, and consumed. It has improved grid utilization, reliability, and security for both customers and power companies. Smart grids are now viewed as energy infrastructure solutions for smart cities of the future.

A distributed energy storage system aids in the balancing of power generation and demand across a grid, thereby supporting and playing an important role in the implementation and operation of smart grids. Furthermore, distributed energy storage systems enable the integration of distributed energy generation systems into the main grid, increasing grid resilience and reliability. As a result, the emergence of the smart grid is anticipated to provide lucrative opportunities for the global distributed energy storage system market.

Expensive capital investment and thermal runaway

Despite the fact that the distributed energy storage market is rapidly expanding, the thermal runaway issue of batteries is impeding its expansion. Thermal runaway is a significant risk for Li-ion batteries, posing a significant challenge to the battery energy storage system market. Internal cell defects, mechanical failures or damage, or excess voltage are the primary causes of thermal runaway, which results in high temperatures, gas buildup, and potentially explosive rupture of the battery cell, resulting in fire or explosion.

Thermal runaway can spread from one cell to the next if not disconnected, causing additional damage. This challenge is expected to stymie the growth of the distributed energy storage system markets during the forecast period. Aside from that, this market necessitates a substantial capital investment in order to manufacture such a system. As a result, the aforementioned factor will impede this market's growth during the forecast period.

Expensive setup and battery costs

The initial cost of distributed energy storage systems is high, and the ongoing maintenance costs are even higher. Rising costs of several critical minerals used in battery production, supply chain disruptions caused by Russia's war with Ukraine, and COVID-19 lockdowns in some parts of China are all impeding the growth of the battery energy storage system market. Prices for lithium, a key mineral in automobile batteries, were roughly seven times higher in May 2022 than they were at the start of 2021.

Russia produces 20% of the world's nickel for use in batteries, owing to which the Russian invasion of Ukraine has increased market pressure. The increased use of lithium, as well as the brisk growth of the electric vehicle industry, are factors driving up lithium prices. The high initial investment and high cost of batteries may have a negative impact on the growth of the distributed energy storage system market.

Rising demand for EV

Consumer preference has shifted away from traditional vehicles and towards electric vehicles as living standards have risen. The majority of EVs have massive batteries that can store far more energy than is required for a typical commute. These vehicles will have more than enough energy to power a typical household in addition to commuting.

Installing a bidirectional charging infrastructure will allow it to be used at home, where EVs can be charged when there is an electrical supply and used to power home appliances when there isn't. Once connected, the infrastructure can use the EV's battery bank to store excess energy from the grid or, if necessary, extract and return it to the grid to balance out variations. As a result, demand for distributed battery energy storage systems is expected to surge during the forecast period. Many policies have been released by governments in various countries, including the United States and Europe, to help EV manufacturing.

In 2021, global electric vehicle sales more than doubled to 6.6 million units, accounting for 10% of total car sales worldwide. At the end of 2021, there were approximately 16.5 million electric vehicles on the road. As a result, demand for distributed energy storage systems is expected to skyrocket in the coming years.

On the basis of technology, the distributed energy storage market is segmented into thermal storage technology, mechanical technology, and electrochemical technology. During the forecast period, the thermal storage technology segment is expected to grow at a significant CAGR of around 9.2%. Thermal energy storage systems have several advantages over other segments, including lower costs and being a clean energy storage technology, making it more environmentally friendly than others.

This technology is ideal as a storage method for both large-scale and small-scale hot water and heating applications because it makes use of every stage of thermal transformation. Aside from that, thermal energy storage systems have lower maintenance costs than other segments, resulting in high demand for thermal energy storage systems.

Aside from that, it is more efficient during peak periods of electricity demand, which drives investment in this technology. Seramic Materials, a Masdar City-based start-up, developed ReThink Seramic - Flora, a unique patented solution to recycle industrial solid waste into a high-temperature thermal energy storage (TES) product, a circular economy solution that both reduces waste and promotes renewable energy development, in September 2021. Such advancements will hasten the adoption of thermal energy storage software, propelling the market's growth during the forecast period.

On the basis of application, distributed energy storage market is segmented into renewable energy storage, grid storage, transportation, and others. According to the distributed energy storage market report, the distributed energy storage market size for transportation is expected to grow at a CAGR of 9.65% during the forecast period, owing to the rising adoption of electric vehicles. According to the International Energy Agency's Global EV Outlook 2020 report, 2.1 million electric vehicles were sold globally in 2019.

Such expansion benefits the distributed energy storage market. The growing investment in environmentally friendly e-vehicles, as well as the government's initiative to promote the adoption of EVs in order to improve the environment by reducing pollution levels caused by vehicles, is increasing demand for batteries, particularly lithium-ion batteries, which have a high energy density, a high EE, a high storage capacity, a longer life cycle, low maintenance, and cost-effectiveness. This, in turn, has a positive impact on the demand for distributed energy storage technology for transportation, driving the market's growth over the forecast period.

Segments Covered in the Report

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

January 2025

January 2025