August 2024

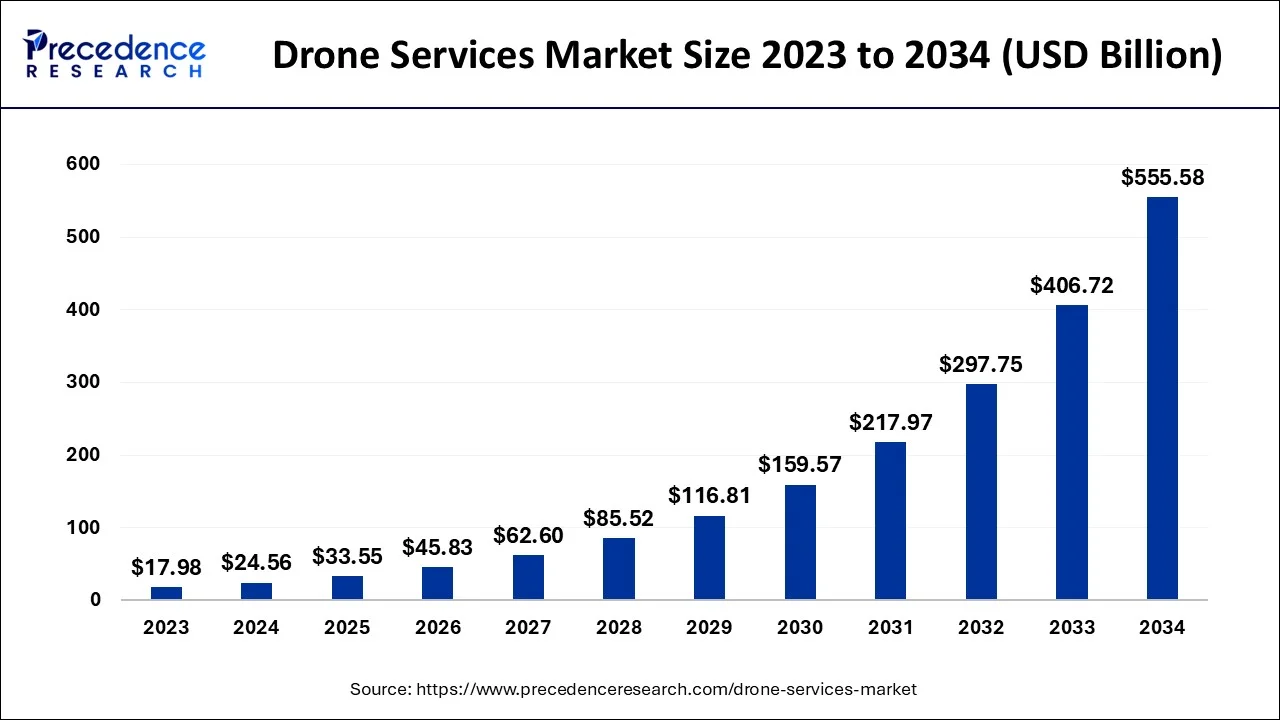

The global drone services market size accounted for USD 24.56 billion in 2024, grew to USD 33.55 billion in 2025 and is predicted to surpass around USD 555.58 billion by 2034, representing a healthy CAGR of 36.60% between 2024 and 2034. The North America drone services market size is calculated at USD 8.84 billion in 2024 and is expected to grow at a fastest CAGR of 36.78% during the forecast year.

The global drone services market size is estimated at USD 24.56 billion in 2024 and is anticipated to reach around USD 555.58 billion by 2034, expanding at a CAGR of 36.60% from 2024 to 2034.

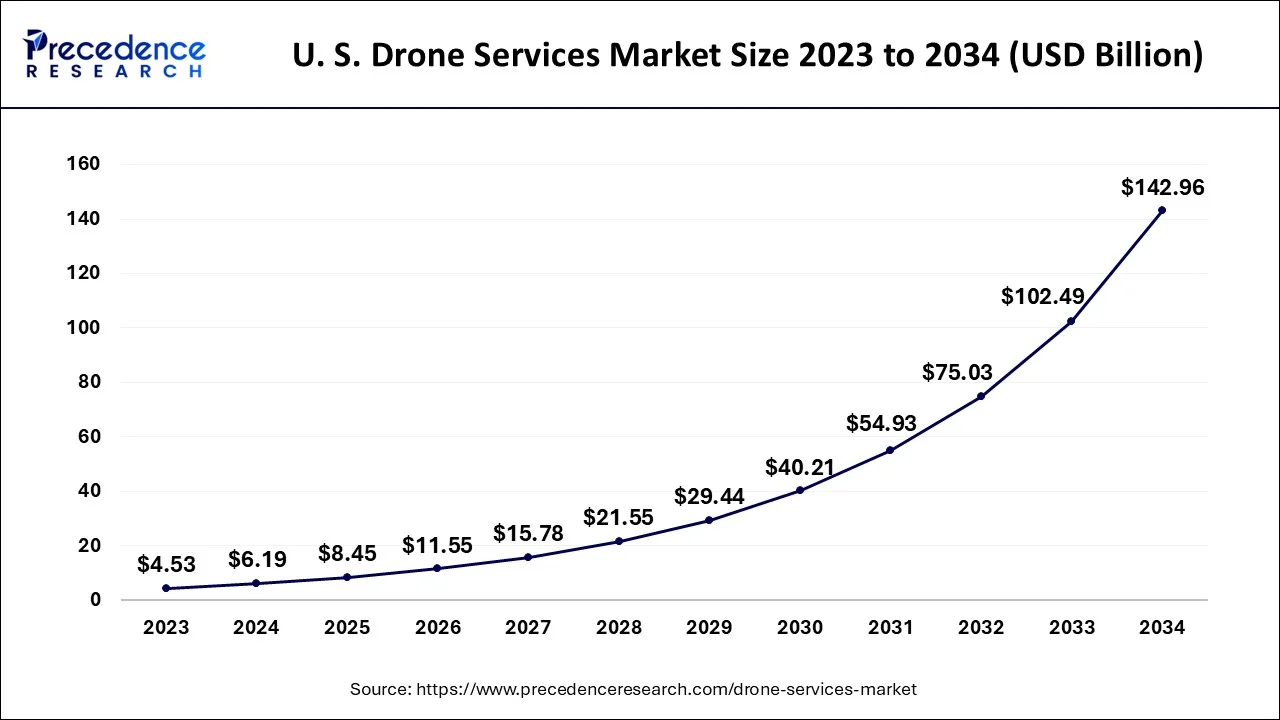

The U.S. drone services market size is estimated at USD 6.19 billion in 2024 and is expected to be worth around USD 202.79 billion by 2034, rising at a CAGR of 36.78% from 2024 to 2034.

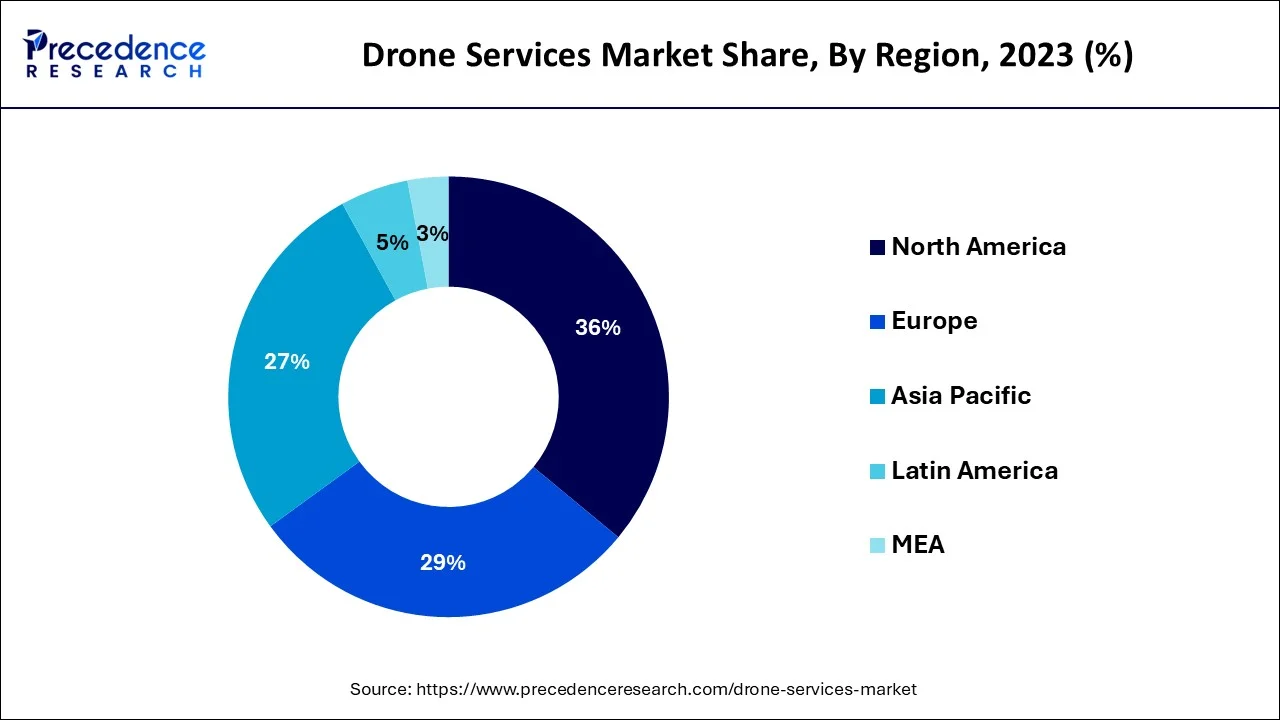

North America held the highest share of the global drone services market in terms of value. This is due to major service providers' presence and early adoption of high-end drone technologies. Furthermore, the region's market is driven by increased demand for aerial photography in the real estate and construction sectors. The US is a significant market for drone services in North America, accounting for a large share of the region's market.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. Large drone service providers exist in APAC countries such as China and Japan. Limited regulation on commercial drone use and price drop drive market demand. Furthermore, the rise is attributed to increased government and OEM investments in drone services propelling the market.

For instance, the drone industry in India is still in its early stage, with a total revenue of USD 600 million. Still, on April 22, 2022, the Indian government announced a USD 1,200 million incentive for developing the drone service industry and creating 100,000 job opportunities in the coming years.

The rising demand for industry-specific solutions and the increasing demand for time-efficient delivery are driving the growth of the drone service market. For instance, Aerologix, a drone tech company based in Sydney, raised USD 4.2 million in May 2022 to increase the company's staff headcount and R&D capabilities. Along with this, the growing initiative from governments and regulatory bodies to develop drones propels the market forward. For instance, according to the civil aviation ministry, India's drone market will grow from about Rs 80 crore to between Rs 12,000 crore and Rs 15,000 crore by 2026.

| Report Coverage | Details |

| Market Size in 2024 | USD 24.56 Billion |

| Market Size by 2034 | USD 555.58 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 36.60% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Service, By Application and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for applications in building information modeling (bim) supported by aerial photography and 3d scanning

Due to the widespread availability of low-cost drones, photography has become well-known for applications requiring high-resolution cameras. Aerial photography offers new perspectives on innovative city projects, large township projects, and multi-story building projects. Mini drones are also becoming popular for wedding photography and videography.

Furthermore, the real estate and infrastructure industries also see increased demand for drones. For instance, Skydio introduced Skydio 3D Scan, an optional software suite for its self-flying drones that enables them to produce incredibly detailed designs.

Increased adoption of drone services in agriculture to drive market growth

Drones are used for various commercial purposes, including agriculture, transportation, mapping, aerial photography, and videography. Drones increase productivity and improve farming methods. The growing demand for precision farming propels the agricultural industry and expands the drone services market. Precision farming has the potential to increase crop productivity.

Drone OEMs focus on research to develop thermal cameras, multispectral sensors, and LiDar to improve drone effectiveness. Drones with sensors fly at a predetermined altitude to collect analytical data. Additionally, several government initiatives are also expected to increase market growth. For instance, the government of India recently offered a 100% subsidy, or 10 lakhs, to Farm Machinery Training and Testing Institutes, ICAR Institutes, Krishi Vigyan Kendras, and State Agriculture Universities on January 23, 2022, to encourage the use of drones for agricultural purposes and reduce the labor burden on farmers.

Inadequate risk management and insurance coverage for aerial delivery drones

Due to a lack of insurance coverage, service providers & manufacturers of aerial delivery drones face the risk of losing parcels delivered by delivery drones. For airborne delivery drones to be used properly, service providers and manufacturers must work closely with regulatory bodies.In several countries, drone users must have insurance coverage to cover liabilities in the event of an accident.

Current drone insurance focuses on the risk of personal injury & property damage caused by the drone. Before operations begin, a contract must be signed between the delivery drone service providers and the customers using those services.

COVID-19 Impact:

The Covid-19 pandemic had a positive effect on the global drone service industry. The pandemic's impact caused significant disruption in the logistics and transportation systems. The ability of drones to deliver goods and services in remote locations without human intervention has invented a new opportunity in the transportation industry.

For instance, Amazon, the world's largest online retailer, launched the Air Program in July 2022. In this program, Amazon used drones as automated flying machines to deliver packages to customers. Drones have been used by police departments as well as governments all over the world to conduct remote policing and enforce social distancing.

Based on the service, the drone service market is segmented into drone platform service, drone MRO service, and drone training & stimulation services. The drone platform services segment generates 41% of the revenue share in 2023.

Due to MRO's costs, productivity, and safety implications, most businesses digitize the MRO process to optimize inventory levels, streamline procurement, improve supply chain relationships, and remain at the forefront of equipment failures.

Drone platform services are expected to grow at the fastest rate during the forecast period due to the high adaptability of data collection in various commercial domains. Drones provide commercial and residential sectors with services such as photography, construction site supervision, assessment, ortho mosaic, aerial survey, data capture and analysis, drone modeling, and others. However, drone service is widely used in major sectors such as defense, energy and power, homeland security, and others.

Based on the end user, the drone service market is segmented into agriculture, infrastructure, oil & gas, and logistics. In 2023, the agriculture segment dominated the market. Farmers can benefit from drones for crop spraying, monitoring, and field surveillance. This can give farmers real-time images of their crops for various purposes such as pest control, disease outbreak monitoring, and water usage efficiency.

Moreover, drone analytics can also interpret data such as soil moisture, temperature, wind speed, and precipitation. These drones are also used for planting seeds as well as for pollination.

On the other hand, the logistics segment is expected to be the fastest growing in 2023 due to increased demand for fast packaging delivery systems in the healthcare industry. A drone can automatically read Quick Response (QR) codes, which aids in the identification of shipping containers, delivery boxes, and other items.

Drones are also equipped with radio frequency identification (RFID) scanners, which assist in locating and identifying items that are not visible from the ground. Additionally, operators use electronic devices such as mobile phones, tablets, and computers to view images captured by drone services and even operate drones using these electronic devices to reach the desired location.

Based on the application, the drone service market is segmented into aerial photography, product delivery, surveillance & inspection, and data acquisition & analytics. The aerial photography segment dominates the market due to the increased use of drones for aerial photography and videography at specific events.

Furthermore, the availability of low-cost drones with exceptional qualities such as high-definition cameras, low weight and size, and portability features causes professional photographers and videographers, media entertainment, and filmmakers to adopt drones, propelling the market growth. Drones can obtain information about a target without making physical contact with it, which increases the demand for drones in remote sensing applications, which leads the market.

The surveillance and inspection market is expanding at the fastest pace. This segment is critical as drones are primarily used as a specialized tool that allows surveyors and mappers to collect necessary data and measurements for terrain mapping, site planning, and other applications, thereby saving manpower, money, and time.

The escalating conflict between Russia and Ukraine benefits the growth of the drone services market. Drones are used in both countries for border surveillance and inspection to track enemy movements. This factor promotes the expansion of local drone-based businesses in the European region.

By Service

By Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

January 2025

August 2024