November 2024

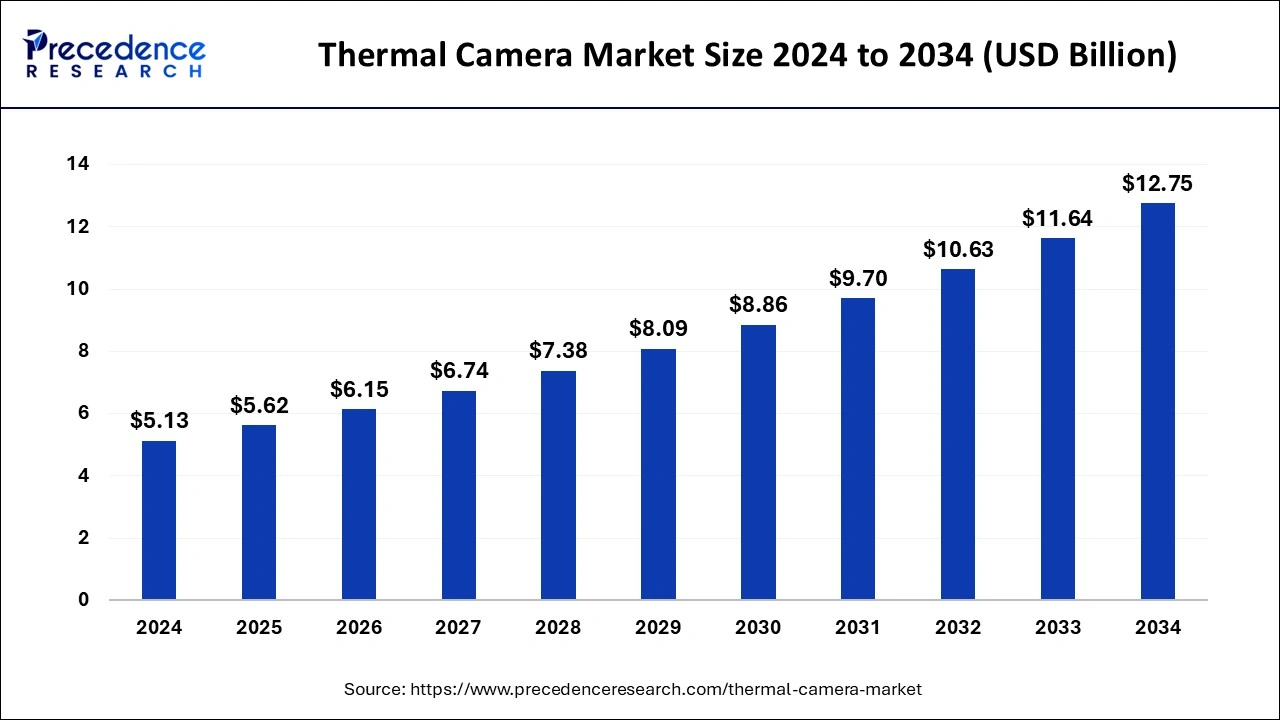

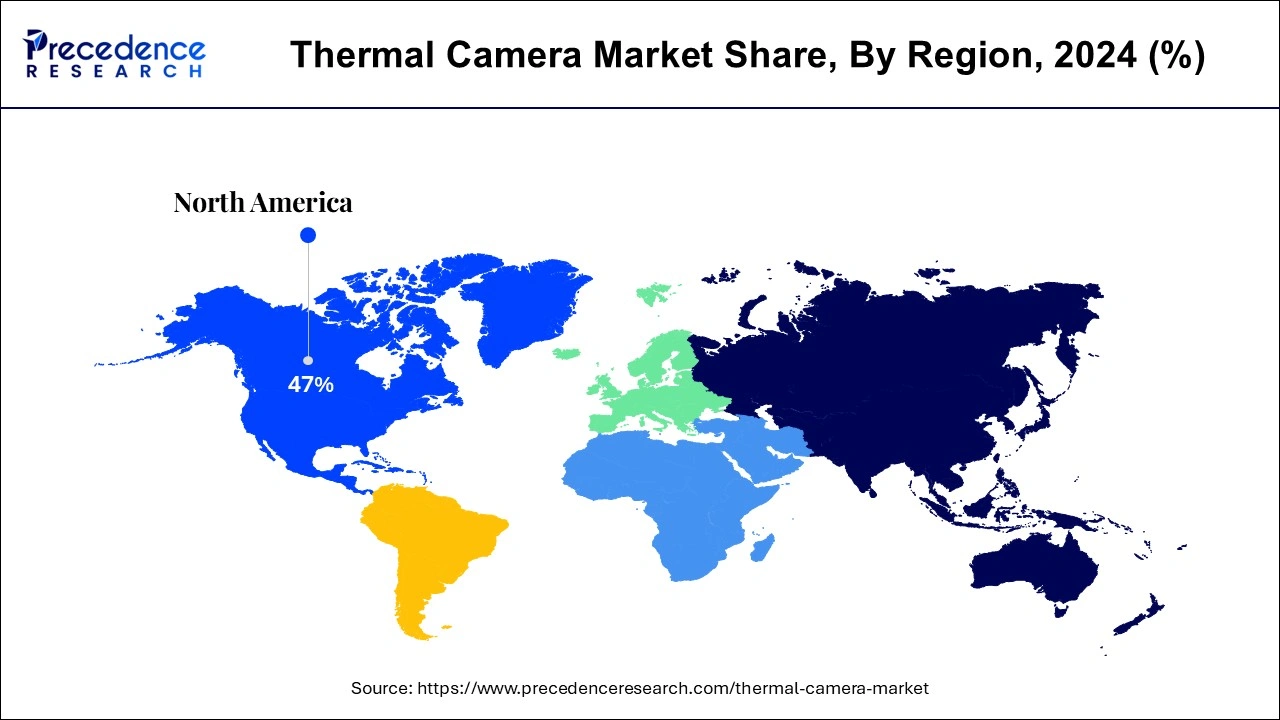

The global thermal camera market size is calculated at USD 5.62 billion in 2025 and is forecasted to reach around USD 12.75 billion by 2034, accelerating at a CAGR of 9.53% from 2025 to 2034. The North America thermal camera market size surpassed USD 2.41 billion in 2024 and is expanding at a CAGR of 9.66% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global thermal camera market size was estimated at USD 5.13 billion in 2024 and is anticipated to reach around USD 12.75 billion by 2034, expanding at a CAGR of 9.53% from 2025 to 2034. Similar to a regular camera, which creates photos using visible light, a thermal imaging camera aids in the production of photographs utilizing infrared radiation. Numerous industries, including autonomous cars, skin temperature monitoring, firefighting, military and defense, infrastructure, and structures, employ thermal imaging extensively.

AI is revolutionizing the thermal camera market by focusing on digital interpretation of visual data as images and videos. With the integration of deep learning algorithms as convolutional neural networks, the models have become highly efficient and able to extract the most relevant features for each task on their own. The AI algorithms also help to save time along with, help to find relevant information, pattern that can be ignored by human detection. On account of this, many developers have been creating AI solutions that are fed with thermal images. Some of these applications are for material recognition, human detection, automatic guidance for firefighters, fever detection and carpal tunnel syndrome diagnosis.

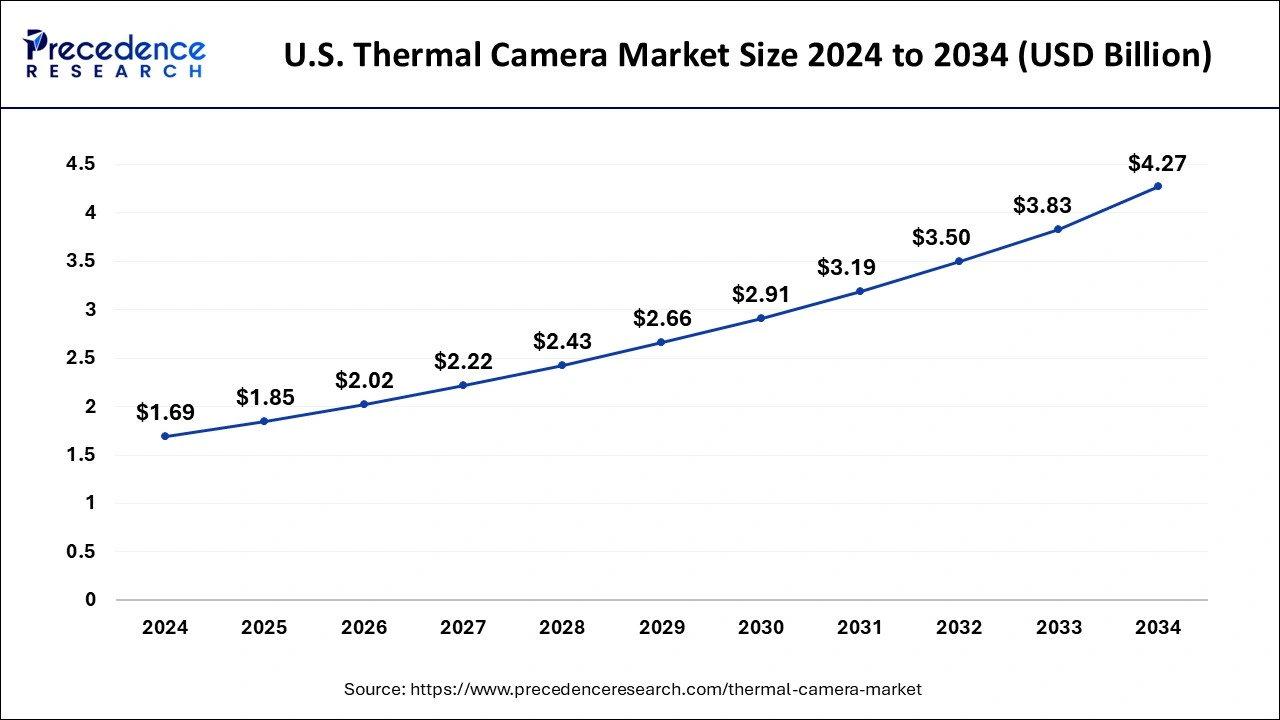

The U.S. thermal camera market size was evaluated at USD 1.69 billion in 2024 and is predicted to be worth around USD 4.27 billion by 2034, rising at a CAGR of 9.71% from 2025 to 2034.

North America is anticipated to lead this market share due to the rising need for thermal imaging technology in the manufacturing as well as commercial sectors. Additionally, the military and defense sector's booming need for these cameras for the purpose of security and surveillance applications is anticipated to have a beneficial influence on the market's expansion in North America. IoT and improved thermal imaging solutions are being implemented more slowly than initially anticipated, with semiconductor businesses stepping in to assist advance other new imaging technologies. The technical potential of thermal technology, including its capacity to collect and analyze enormous amounts of industrial data, is the focus of developers and business leaders in the region. This data may be used to manage industrial safety and compliance while enhancing protection, monetary returns, and convenience.

The second-largest market share belongs to Europe. This region's market is expected to grow as defense & monitoring need rises. The demand in this area has also been greatly influenced by the progressive fall of thermal cameras in addition to the inexpensive availability of thermal sensors. Additionally, nations like France, the United Kingdom, and Italy are increasing their military spending, making up a significant portion of the market. Due to the escalating border conflicts between nations like India and China, the Asia-Pacific market is predicted to have exceptional growth. Countries are being forced by these wars to increase their military spending and provide their armed forces with cutting-edge monitoring equipment like thermal cameras.

| Report Coverage | Details |

| Market Size in 2025 | USD 5.62 Billion |

| Market Size by 2034 | USD 12.75 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.53% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Largest Market | North America |

| Segments Covered | By Product, By Technology, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Because of its wider range of uses, including thermal imaging, medical imaging, predictive maintenance, and other areas, the portable thermal camera market is anticipated to develop at the greatest rate over the projected period. The demand for these cameras has also increased as a result of the growing need for these devices to detect body temperature and also for other healthcare-related applications. Mount thermal camera devices are essential in smoke detection & protection, early fire warning, and surveillance applications, in addition to being utilized to boost manufacturing productivity or optimize quality assurance.

The market's largest share will be accounted for by the cooled thermal camera segment. During the forecast period, thermal imaging systems with cooled detectors are anticipated to see rapid acceptance, primarily because of their quick capture rate as well as the broad thermal isolation band. Additionally, because they use shorter infrared wavelengths for sensing, cooled cameras typically have larger magnification capabilities. Since cooled cameras have higher resistance qualities, they can be used with lenses that have more optical elements or thicker components without lowering the signal-to-noise ratio.

The military and defense segment has held the largest market share in 2024. The industry segment with the highest CAGR will be healthcare as well as life sciences. Thermal cameras are being used by many researchers as well as healthcare organizations all over the world to monitor and capture variations in body temperature for diagnostic reasons. Researchers get information on metabolic and circulatory functioning through the analysis of thermal pictures taken by cameras in order to spot abnormal physical changes.

These tools are also used to look at a wide range of illnesses where the skin's temperature may reveal inflammation or injury to the tissues, or if blood flow is altered due to a clinical deformity. Also most clinicians today use thermal imaging equipment to identify a wide range of medical issues, including circulatory abnormalities, arthritis, recurring strain injuries, and body aches.

By Product

By Technology

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

April 2023

April 2025

January 2025