September 2024

The global dry construction market size accounted for USD 92.14 billion in 2024, grew to USD 96.67 billion in 2025 and is predicted to surpass around USD 148.95 billion by 2034, representing a healthy CAGR of 4.92% between 2024 and 2034.

The global dry construction market size is estimated at USD 92.14 billion in 2024 and is anticipated to reach around USD 148.95 billion by 2034, expanding at a CAGR of 4.92% from 2024 to 2034. The dry construction market growth is attributed to increasing urbanization and the rising demand for sustainable construction practices and environmentally friendly dry construction methods.

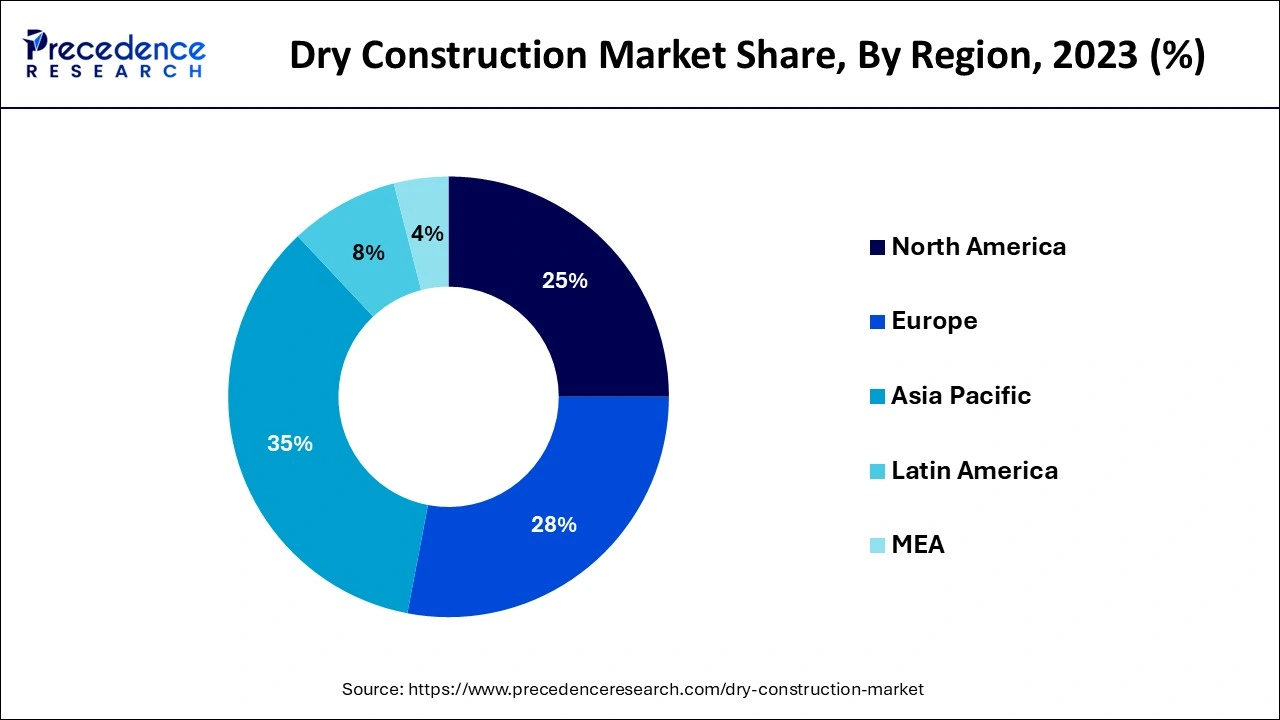

The Asia Pacific dry construction market size accounted for USD 32.25 billion in 2024 and is expected to be worth around USD 52.88 billion by 2034, growing at a CAGR of 5.05% from 2024 to 2034.

Asia Pacific is anticipated to grow at the fastest rate in the dry construction market during the forecast period, owing to the planned infrastructural development and growth in the area's construction industry. The overwhelming majority of people reside in developing countries, with millions aspiring to shift to urban areas. Developing nations, including China and India, are expanding as urban populations. Furthermore, there is a growing trend within the government bodies within the region to support sustainable buildings to control environmental effects, which, in turn, adds a positive aspect to dry construction products.

North America is projected to host the fastest-growing dry construction market in the coming years due to the rising housing needs and higher investment in structures and systems. Furthermore, the growth of cities and the focus on the environment while constructing buildings are anticipated to facilitate the dry construction market in this region.

Strong demands for environment-friendly construction solutions facilitate the dry construction market's growth, as most of the used techniques are environmentally friendly and incorporate efficient resource use. Dry construction mainly involves the use of prefabricated constructions and modular constructions since they make the construction faster and less destructive than wet constructions. Additionally, the U.S. EPA underlines that disclosure and use of sustainable materials and processes reduce greenhouse gases and energy use. Increasing urban development is increasing across the globe, and especially in the developing world, the desire to have structures constructed quickly for efficient occupancy puts dry construction technologies into practice. Furthermore, the high architects employ dry construction techniques in new and renovation projects.

Impact of Artificial Intelligence on the Dry Construction Market

In the dry construction market, artificial intelligence (AI) is making it possible to automate almost every process. Automated analysis of resources and time takes place to ensure construction companies make appropriate decisions that eliminate resource wastage and unnecessary expenditure. AI, as applied in machine learning, gathers sets of data about previous projects, and contractors learn what problems might ensue and prepare for them in advance. Moreover, AI also helps improve safety in the construction workplace, as it does risk analysis and anticipates dangerous situations, thus improving the safety profile of the construction setting.

| Report Coverage | Details |

| Market Size by 2034 | USD 148.95 Billion |

| Market Size in 2024 | USD 92.14 Billion |

| Market Size in 2025 | USD 96.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.92% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Material, System, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for sustainable construction solutions

Increasing demand for sustainable building practices is anticipated to drive the dry construction market in the coming years. Higher demands for green construction in the next decade are expected to foster highly effective dry construction solutions as they allow for decreased usage of water. There is also a strong correlation between sustainable goals and adopting dry construction techniques, which rely on prefabricated environmentally friendly materials and significantly eliminate the water intensity of conventional methods. Moreover, by raising energy efficiency standards for buildings, countries such as Germany and the Netherlands regulate sustainable construction activities.

High initial costs

High initial investment costs are expected to impede the widespread adoption of dry construction techniques, thus further hindering the dry construction market. The long-term benefits of occasional dry construction include lower labor costs and shorter construction times. Yet, the initial costs remain high, mainly due to the specific materials and equipment needed. This financial constraint is why small contractors’ developers or companies in regions with high costs do not adopt these techniques.

Rising investment in modular and prefabricated construction

Rising investments in modular and prefabricated construction are anticipated to create immense opportunities for the players competing in the dry construction market. Consumers are adopting dry construction elements, including gypsum boards, steel frames, and fiber cement panels, for their lower cost, minimal waste, and easier assembly. This trend conforms to Universal's efforts towards sustainable construction and efficient construction time. Additionally, there is an increasing demand for modular building systems used in North America and Europe.

The supporting framework segment held a dominant presence in the dry construction market in 2023 due to its important function of providing support to structures and improving the efficiency of the load-carrying system. Products, such as steel frames and trusses, are used in different applications for their strength. The rising trend for lightweight and lasting materials in the building and construction industries facilitates the segment. Furthermore, the accompanying frameworks have higher load support and lighter construction duration and cost, consequently making them popular among the construction, which further boosts the segment.

The boarding segment is expected to grow at the fastest rate in the dry construction market during the forecast period of 2024 to 2034, owing to the increasing demand for boarding materials to utilize in interior walls, ceilings, and exterior facades. Specifically, gypsum boards are expected to witness remarkable market demand given the material’s fireproofing capability and installation. Global construction activity itself is anticipated to surge and further contribute to the high use of boarding materials. The general change in the trend towards building green complements the manufacture of eco-friendly boarding materials, creating demand from builders. Additionally, the increase in the effectiveness and sturdiness of boarding material makes them more appealing among developers and contractors.

The plasterboard segment accounted for a considerable share of the dry construction market in 2023 due to its effectiveness in the housing sector and also in the business world. Plasterboard, which is commonly referred to as drywall or gypsum board, has smooth finishes for interior walls and ceilings; hence, it is widely used by builders. Furthermore, the increased government support for green buildings drives demand for sustainable plasterboard products, which consequently use recycled materials and have low emissions of volatile organic compounds.

The metal segment is anticipated to grow with the highest CAGR in the dry construction market during the studied years, owing to their strength, durability, and recyclability. Metal framing systems, especially steel ones, provide numerous benefits in terms of load-bearing capacity and protection against moisture and other pests. The growth of new high-rise and commercial building structures is also likely to create further demand for metal components because of the ability to span and carry more than conventional building forms. Further, with increased consciousness of sustainability in the construction business, manufacturers are likely to adopt metal framing, which is made out of recycled content.

The wall segment led the global dry construction market in 2023 due to its importance as a tool for understanding and categorizing interior environments. Nonload-bearing and load-bearing walls are useful structures that enhance space management while providing insulation, soundproofing, and aesthetic value. People continue to move into urban areas, and more projects are being developed; hence, residential and commercial buildings are necessitating the need for effective wall solutions. Furthermore, with the growing focus on sustainability, the market expects a high demand for recycled composites, along with low-VOC coatings for walls.

The ceiling segment is projected to expand rapidly in the dry construction market in the coming years, owing to the architects and builders shifting towards the creation of flexible and aesthetically stimulating spaces. Such ceiling systems improve the levels of acoustic insulation and allow access to other building utilities, and thus are ideal for business establishments, including offices and educational facilities. Moreover, the increasing demand for efficient ceiling systems in terms of noise control measures further fuels the segment.

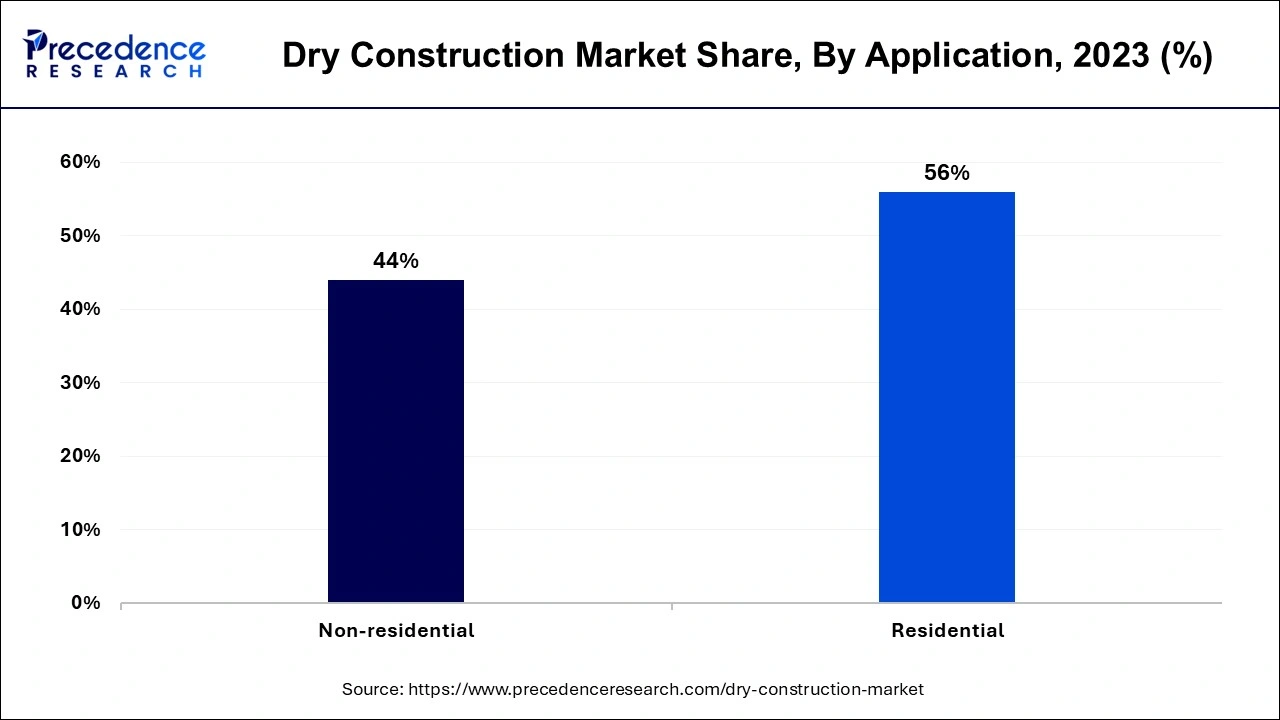

The residential segment dominated the global dry construction market in 2023 due to the great need for cheap apartments and fast urbanization. Higher population density has favored the need for quick housing and construction solutions, which has led to developers applying dry construction methods. Furthermore, owners of houses also want energy conservation and green materials, which further boosts the demand for dry construction materials.

The non-residential segment is projected to grow at the fastest rate in the dry construction market in the future years, owing to the higher spending on the construction of commercial structures and public premises. This segment includes offices, schools, health care premises, and retail, which are moving towards efficient and speedier construction processes. Additionally, the general movement towards the transformation of new promotes the usage of dry construction solutions due to their fluid adaptability to fast renovation processes.

September 28, 2022 – Saint-Goblin

CEO - Patrick Maier

Announcement: Saint-Gobain has announced a strategic partnership with Megasol, a leading European manufacturer in Building Integrated Photovoltaics (BIPV). As part of this collaboration, Saint-Gobain has taken a minority stake in Megasol's business unit, which focuses on developing and producing building-integrated photovoltaics at its facility in Deitingen, Switzerland. The CEO of Saint-Gobain Switzerland stated, “Thanks to the aesthetic design of Megasol’s products, its fully customized and, at the same time, industrialized production, we are extending the scope of our applications, allowing significant growth for Saint-Gobain’s total facade solutions.”

Segments Covered in the Report

By Type

By Material

By System

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

February 2025

November 2024