May 2025

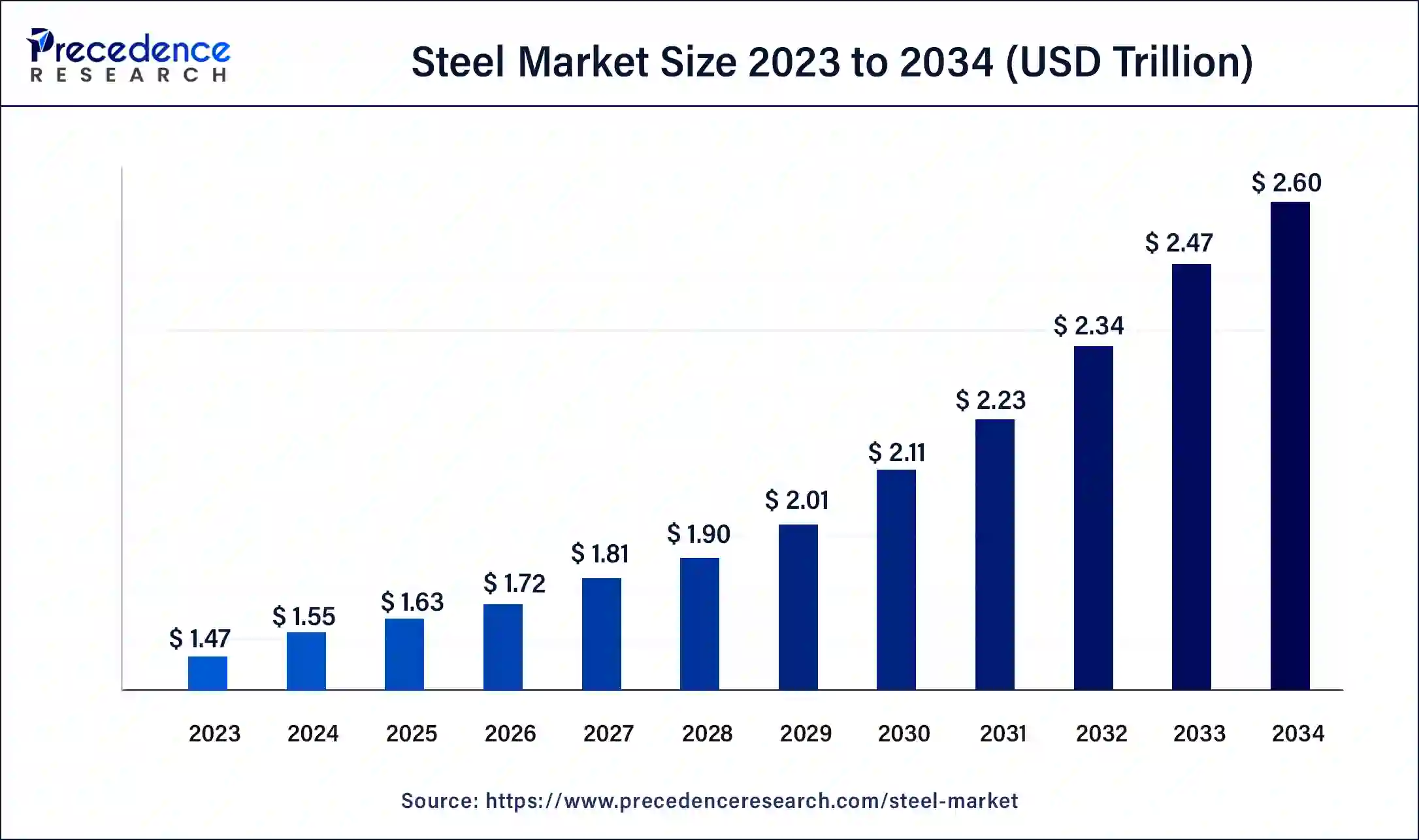

The global steel market size was USD 1.47 trillion in 2023, calculated at USD 1.55 trillion in 2024 and is expected to be worth around USD 2.60 trillion by 2034. The market is slated to expand at 5.32% CAGR from 2024 to 2034.

The global steel market size is projected to be worth around USD 2.60 trillion by 2034 from USD 1.55 trillion in 2024, at a CAGR of 5.32% from 2024 to 2034. The rising use of steel from the various end-use industries such as automotive, healthcare, construction and buildings, manufacturing, and others due to its higher mechanical strength, durability, anti-termite, and corrosion resistance drives the growth of the steel market.

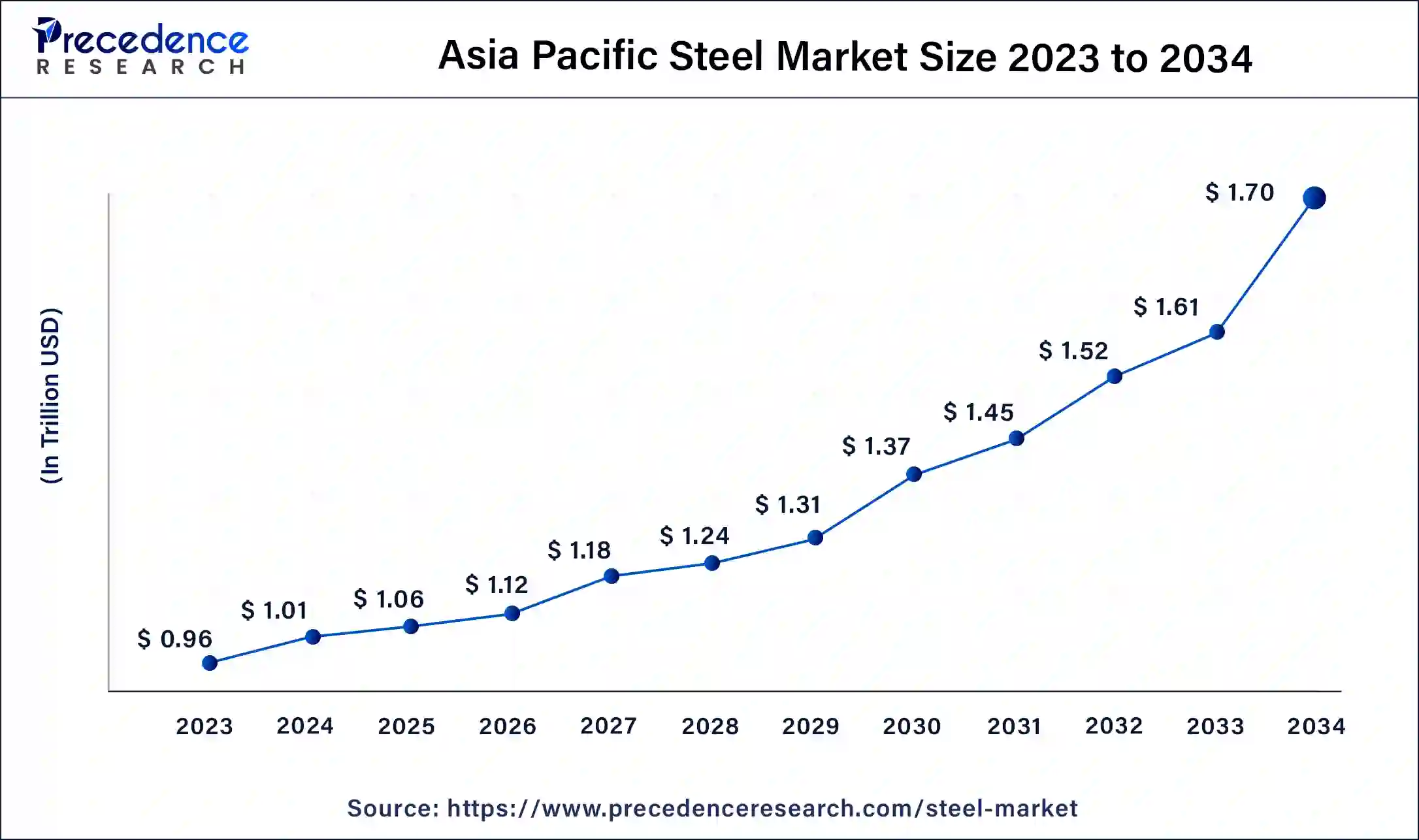

The Asia Pacific steel market size was exhibited at USD 0.96 trillion in 2023 and is projected to be worth around USD 1.70 trillion by 2034, poised to grow at a CAGR of 5.33% from 2024 to 2034.

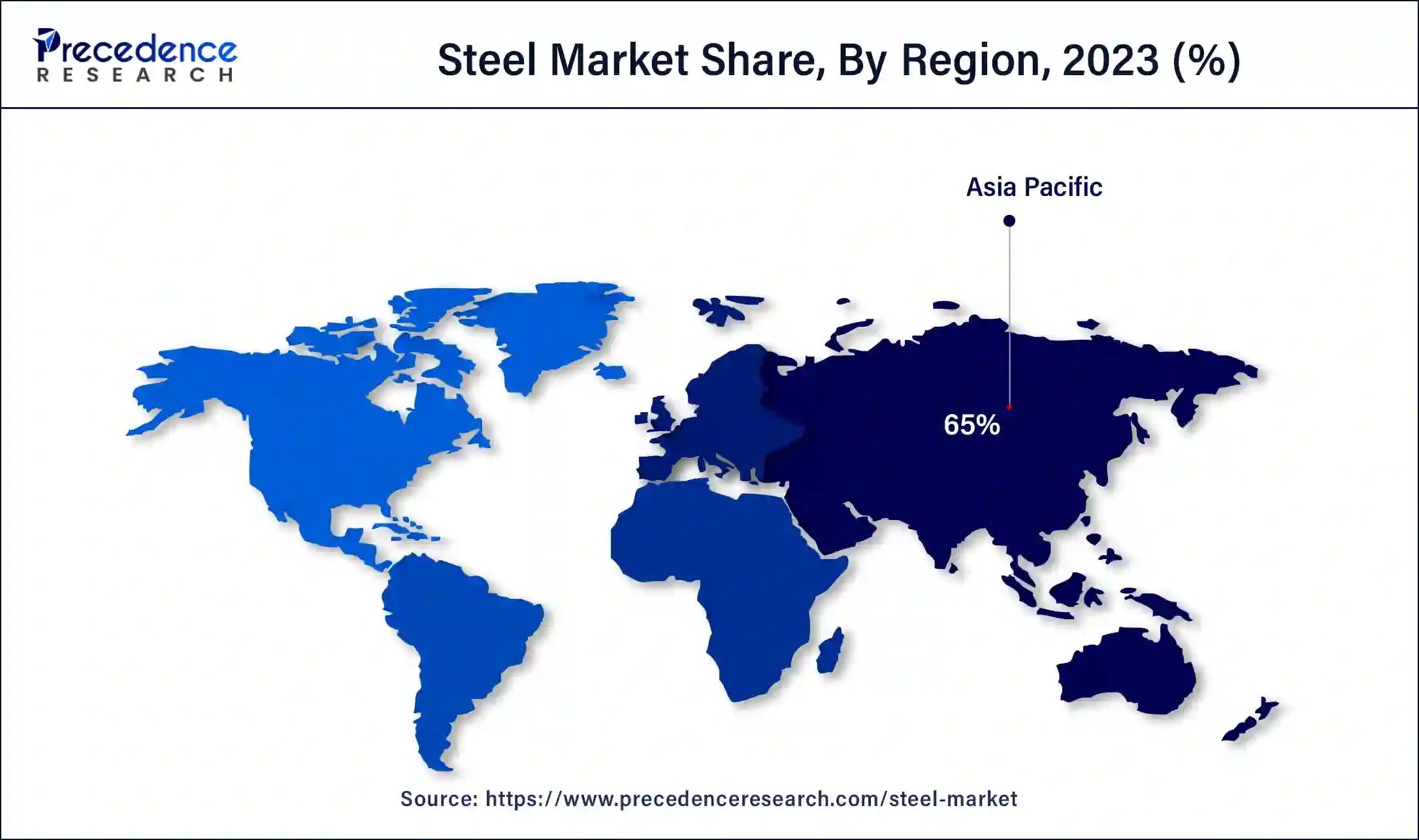

Asia Pacific dominated the steel market in 2023. The growth of the market is attributed to the rising manufacturing and the population's expansion of steel material for household, industrial, and commercial use. The rising adoption of steel material products into the construction and building industry and other infrastructural development due to its durability and high mechanical strength and countries like China and India have a higher consumer base for steel material.

North America is expected to have accountable growth during the forecast period. The growth of the steel market is owing to the rising infrastructural development and the continuous investment in the development of real estate and construction activities. Additionally, the region plays a significant role in the manufacturing sector, and the higher availability of the major industrial leaders in countries like the U.S. and Canada is driving the growth of the steel market across the region.

Steel is basically the composition or the alloy of carbon and iron with different amounts of components with specific properties. Steel is one of the modern materials that play a revolutionary role in the various end-use industries. The alloy component allows the material to be used in different varieties of products. The properties of the steel, such as high tensile, machinability, compressive strength, and corrosion proof, make it an ideal material for structural applications. Steel is highly used in industries such as construction and buildings, automotive, residential and commercial applications, and others. The steel industry has evolved over time and has opened up for eco-friendly steel that can be recyclable and reused. Steel is considered the most versatile material or component that can be used in residential kitchenware and industrial machinery, which leads to the growth of the steel market.

The steel industry and its production have evolved over time; traditionally, the manufacturing of steel involves three basic steps: the preparation of raw materials, ironmaking, and steelmaking. With the advancement in technology, different methods have evolved in the steel industry, i.e., the ORC Technology, the Hybrit Process, the Jet Process, and Molten Oxide electrolysis.

How Can AI Impact the Steel Industry?

The integration of artificial intelligence (AI) in the steel industry is one of the revolutionary processes in the steel market. Manufacturers are highly investing in AI and other technological advancements to increase production capacity with enhanced efficiency and lower production costs. There are significant benefits of AI associated with steel manufacturing, such as reducing raw material costs and improving quality by analyzing defects in the early stages before they become severe problems. It helps in managing and understanding assets, including production equipment, inventory, and logistics. It streamlines the production process and minimizes waste. It helps to improve the customer experience with better customer service and understanding their preferences and requirements.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.60 Trillion |

| Market Size in 2023 | USD 1.47 Trillion |

| Market Size in 2024 | USD 1.55 Trillion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The increased demand for steel in the healthcare industry

The evaluation of the healthcare and pharmaceutical industry drives the adaptation of advanced equipment and machinery for enhancing patient outcomes. Steel plays a significant role in the healthcare industry due to the higher use of steel material for the manufacturing of surgical equipment and other healthcare machinery. The steel is used in various healthcare applications such as surgical equipment such as surgical blades, scissors, forceps, and clamps. Medical devices like orthopedic implants, pacemakers, catheters, and prosthetics.

Machinery, hospital furniture, medical needles, syringes, and cannulas. The properties of stainless steel, such as corrosion resistance, fire and heat resistance, ease in sanitization, and durability, are unfavorable for germs. Hygiene and safety are the leading considerations of the healthcare industry, and the above-mentioned properties make it an ideal material for use in healthcare and pharmaceutical applications.

High cost

The relative increase in cost associated with manufacturing, raw material production, transportation, and logistics due to its large size and heavy material, as well as increased taxes and duties, collectively make steel production higher in cost and limit the growth of the steel market.

Advancements in the use of steel in different industries

The steel industry is revolutionizing global industrial equipment and machinery with higher durability and strength. The steel industry is experiencing numerous trends, such as technological advancements, such as digitization and automation. Sustainable practices, diversion in more eco-friendly production, and recyclability. Worldwide market shifts and demand fluctuation are due to the number of end-use industries such as construction, automotive, manufacturing, and others.

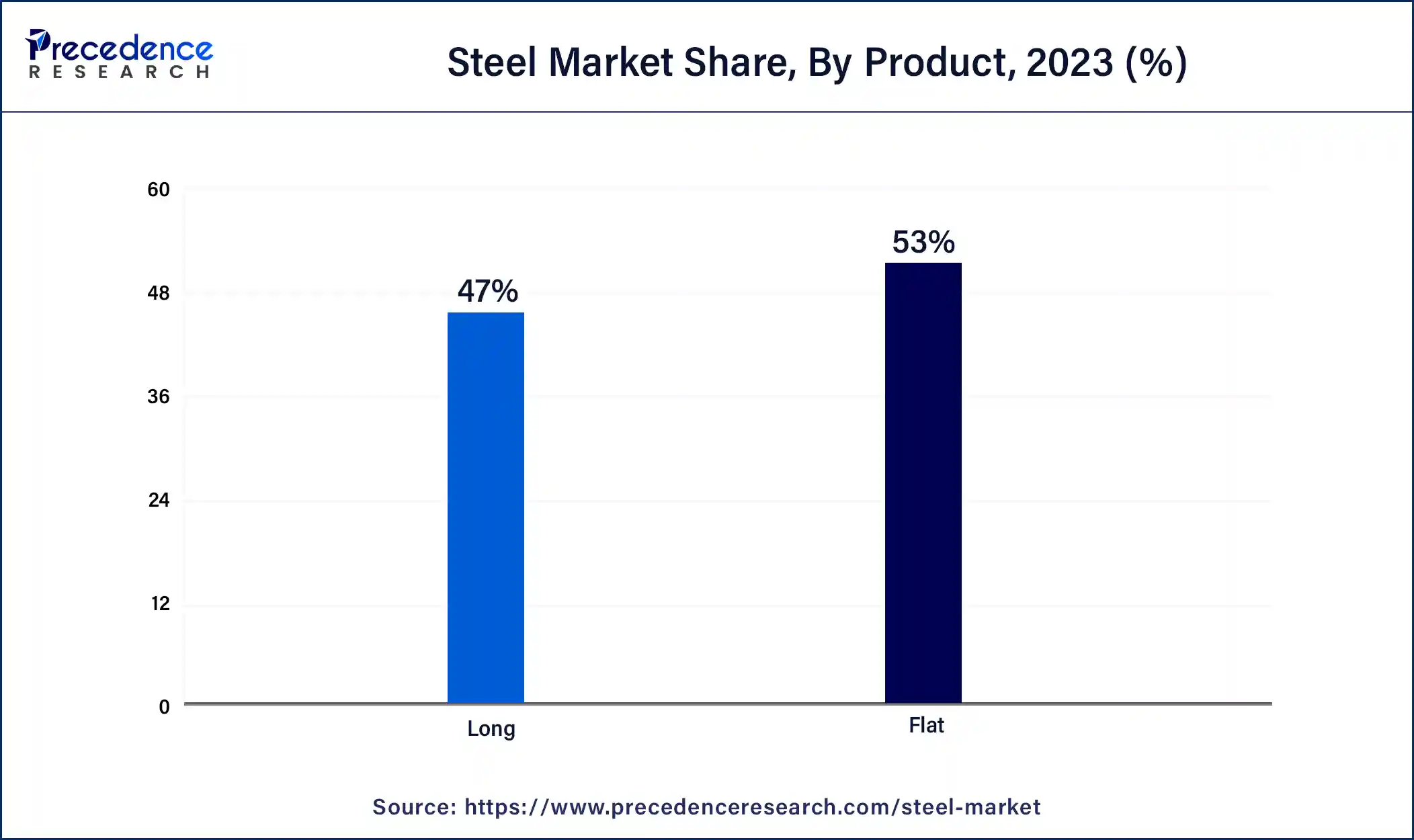

The flat steel segment dominate the steel market in 2023. The growth of the segment is attributed to the rising demand for flat steel from various end-users such as construction and buildings, manufacturing, automotive, and others. As per its name, flat steel is a rectangular-shaped flat steel plate with square edges. The flat has high capabilities in terms of properties, such as being incredibly versatile, cost-effective, and recyclable, which makes it more environmentally friendly and highly adopted by a number of industries.

These types of flat steel bars are most prevalently used in home appliances such as freezers, fridges, extractor hoods, microwaves, washing machines, and all these types of electronic home appliances. Steel is a safer and more reliable, long-lasting material for electronic appliances. Flat steel is also used as the infrastructure structure material for the energy industry; though it is used in infrastructure for the refineries to the pressure valve, it plays a significant role in the energy industry.

The building and construction segment dominated the steel market in 2023. The increasing use of steel in the construction and building industry as the raw material provides support and durability to the construction and buildings. Traditionally, steel was mainly used in skyscrapers, but with technological advancements, it has also been used in small buildings and homes. The recyclability of the steel material makes them the ideal choice for the building and construction industry. Steel is more strong and more durable than the traditionally used materials in the buildings, such as bricks and wood; they provide more stability, durability, and strong structure. These are easy to install and are flexible materials that can handle external pressure, thunderstorms, and termites.

The automotive and aerospace segment is projected to show significant growth in the steel market during the forecast period. Steel plays an important role in automotive manufacturing; it can be used in several parts of the vehicle, such as braking pads, exhaust, and body. Steel in the automotive industry has a number of beneficial properties, such as high corrosion resistance, machinability, strength range, and thermal resistance. There are some types of steel used in the automotive industry, including stainless steel, advanced high-strength steel, high-carbon steel, low-carbonized steel, and galvanized steel.

Segments Covered in the Report

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

May 2025

January 2025