April 2025

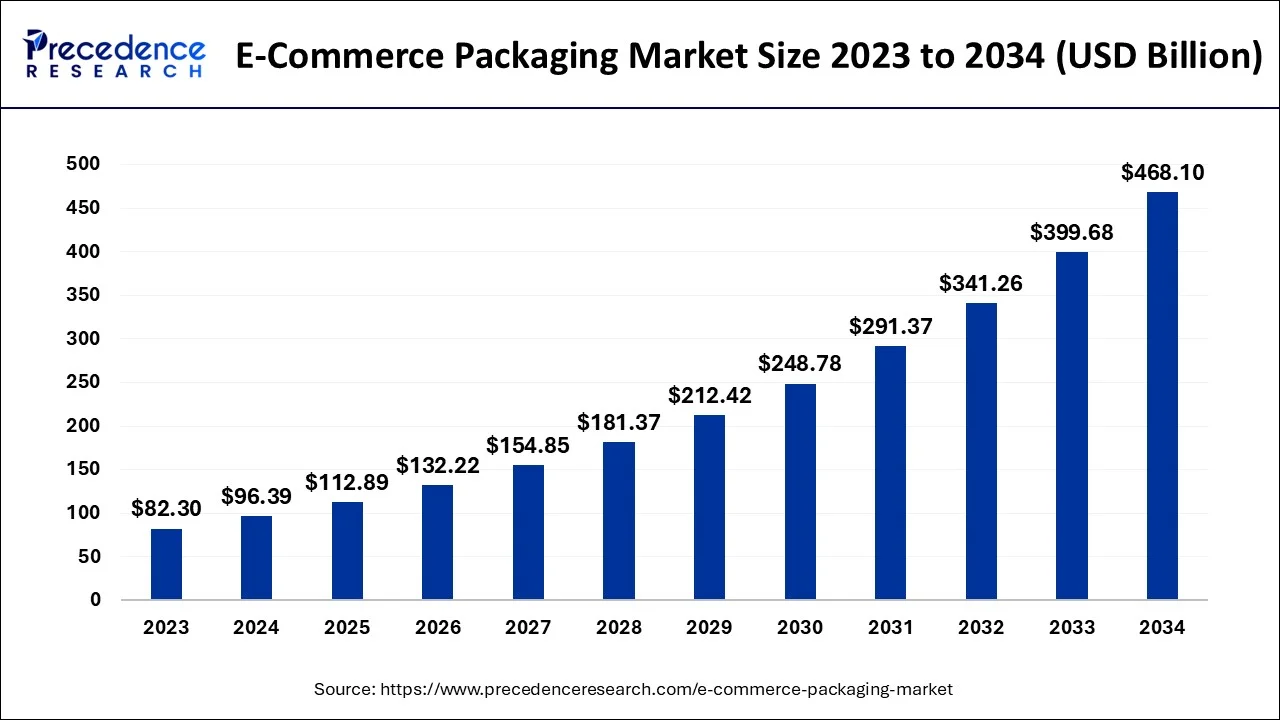

The global e-commerce packaging market size accounted for USD 96.39 billion in 2024, grew to USD 112.89 billion in 2025 and is projected to surpass around USD 468.1 billion by 2034, representing a healthy CAGR of 17.12% between 2024 and 2034.

The global e-commerce packaging market size is estimated at USD 96.39 billion in 2024 and is anticipated to reach around USD 468.1 billion by 2034, expanding at a CAGR of 17.12% from 2024 to 2034.

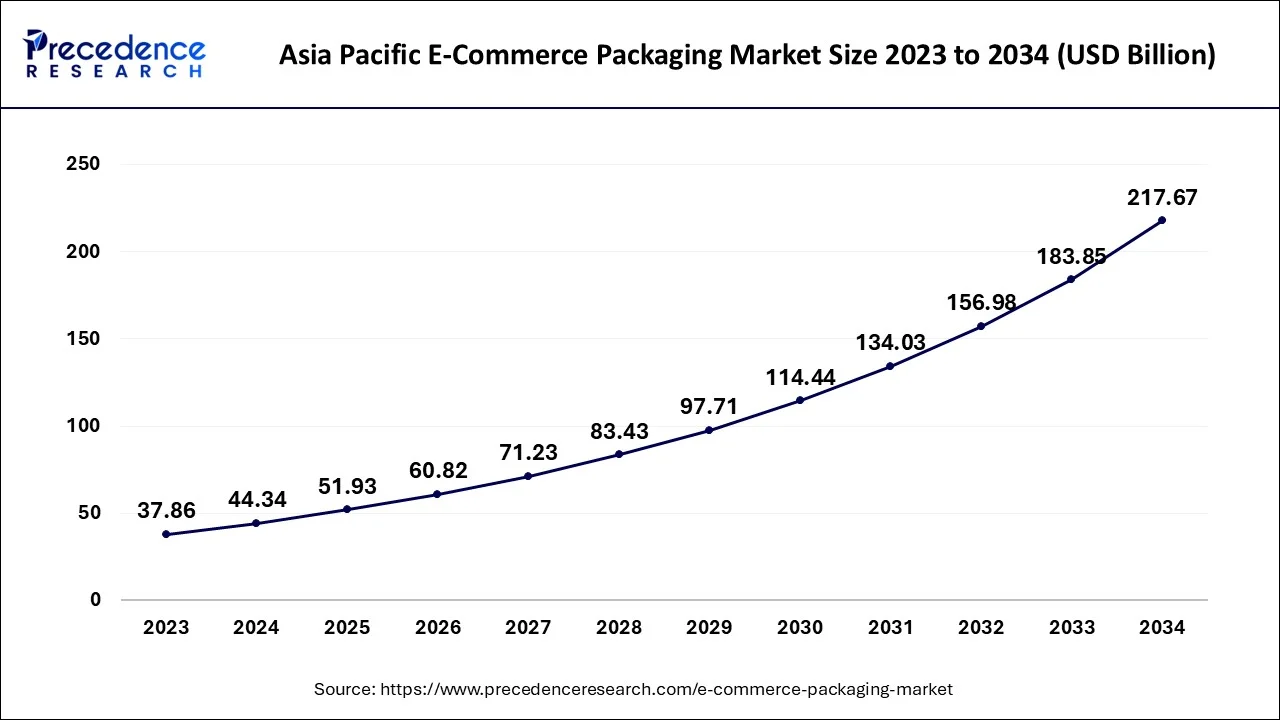

The Asia Pacific e-commerce packaging market size reached USD 44.34 billion in 2024 and is expected to be worth around USD 217.67 billion by 2034, growing at a CAGR of 17.24% from 2024 to 2034.

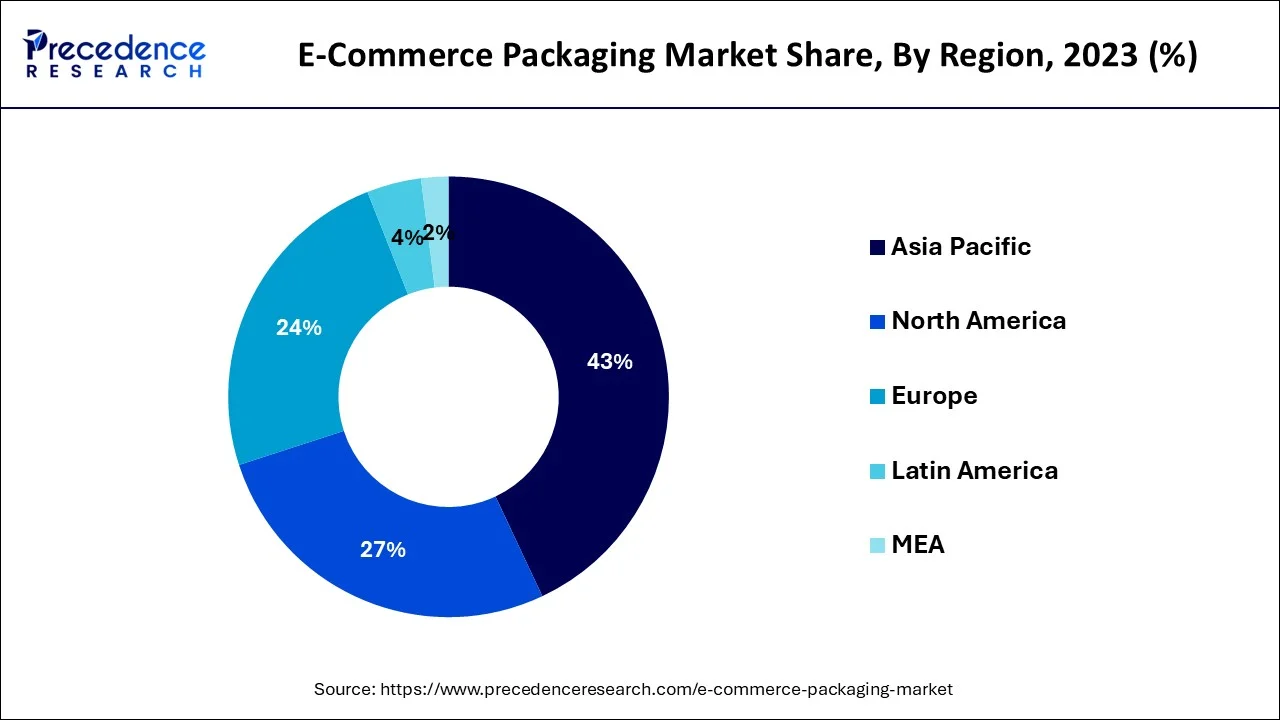

The Asia Pacific is expected to dominate the market during the forecast period. The growth in the region is attributed to the growing e-commerce industry along with the increasing penetration of smartphones. For instance, The greatest e-commerce market in the world, where over half of all transactions take place, is China. According to eMarketer, China's online retail sales reached more than 710 million digital users in 2020, totaled $2.29 trillion, and are projected to reach $3.56 trillion by 2024. China surpassed the US as the largest market in 2021 with e-commerce sales of $1.5 trillion. Moreover, the growing government regulation in the countries like China is expected to drive the growth of the market during the study period. China's State Council unveiled the "Antitrust Guidelines for the Platform Economy" in February 2021. The Chinese government claims that this measure was taken in response to the growth of the digital economy to put an end to monopolistic practices and foster the sustainable and healthy growth of online trade. Thus, these facts support the market growth during the forecast period.

North America is expected to capture the second-largest position in the e-commerce packaging industry over the forecast period. The growth in the region is attributed to the rapid expansion of the e-commerce industry during the COVID-19 pandemic. E-commerce sales rose from $571.2 billion in 2019 to $815.4 billion in 2020, the first year of the pandemic, according to the most recent 2020 ARTS release, a surge of $244.2 billion or 43%.

Europe is expected to grow at a significant rate over the forecast period owing to the rapid growth in the 5G infrastructure. For instance, according to the 2023 Mobile Economy Report Europe, 108 operators had deployed commercial 5G services by the end of June 2022 in 34 locations throughout Europe, and consumer adoption had increased gradually to 6% of the mobile subscriber base. Norway has the highest rate of 5G adoption at 16%, although there is also growth in Switzerland (14%), Finland (13%), the UK (11%) and Germany (10%). Thus, the rapid growth in 5G infrastructure the growth of the e-commerce industry.

The components of the packet are moved, stored, and protected using the e-commerce packaging approach until the provider of the package delivers it to the consumer. Depending on the product's contents and demand, these goods' sizes, shapes, quality, and stiffness vary. Demand for both effective and high-quality packaging is increasing as cross-border shopping becomes more and more popular. The demand for high-quality, reasonably priced packaging has grown significantly as cross-border shopping becomes more and more common. The e-commerce packaging market is being driven by various factors such as growing demand for food & beverage products, increasing penetration of 5G networks, growing adoption of smartphones, increasing e-commerce industry, growing millennial population and rising disposable income of the population.

As per India Brand and Equity Foundation, Indian consumers are rapidly buying 5G smartphones even before the country's next-generation mobile broadband infrastructure is available. Smartphone shipments hit 169 million in 2021, with 5G shipments increasing by 555% year on year. Smartphone shipments exceeded 150 million units in 2020, with 5G smartphone shipments exceeding 4 million due to significant customer demand following the partial government shutdown.

According to NASSCOM, India's $14 billion Indian e-commerce business, which began as a niche industry a few years ago, has gained traction and is growing at a rate of more than 25%. Online travel is the largest category, accounting for over 70% of the industry, a proportion that is expected to rise. E-commerce is reaching out to the general public through social media, which not only allows for advertising but also for getting comments, creating a brand image, and promoting new product releases. Online businesses also utilize social media to track first-time and repeat customers. Social media has evolved into a platform for researching consumer lives and purchasing habits.

| Report Coverage | Details |

| Market Size in 2024 | USD 96.39 Billion |

| Market Size by 2034 | USD 96.39 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 17.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 To 2034 |

| Segments Covered | By Product, By Material, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for food & beverages from online channels

The increasing demand for food and beverages on e-commerce platforms will probably increase the need for suitable packaging in the e-commerce industry. Grocery demand has grown significantly as a result of internet buying. The simplicity of placing online orders for food and beverage goods has increased demand for their packaging. Through several rules under the Fair Packaging and Labeling Act, the Food and Drug Administration has made it obligatory and maintains the guarantee that the food sold is correctly packed and labeled. Therefore, it is anticipated that increased demand for food and beverages on e-commerce platforms would fuel market expansion.

The environmental impact

Sustainability and environmental effect are two of the most significant areas of concern when it comes to e-commerce packaging materials and procedures, just like they are in almost every other sector of the vast world of packaging supplies. Reducing waste and needless packing is one of the key demands that many businesses are seeing from customers when it comes to online buying. Thus, the environmental impact of the e-commerce packaging material is expected to hamper the growth of the market during the forecast period.

Increasing smartphone users

The need for e-commerce packaging is anticipated to rise soon as a result of the expanding availability of the internet and the rising number of smartphone users throughout the world. According to Oberlo's research, there will be 3.6 billion smartphone users worldwide in 2020. From 2013 to 2020, the number climbed by 16.86% yearly. As a result, the market's potential is expanded over the projection period due to the growing number of smartphone users.

Based on the product, the global E-commerce Packaging market is segmented into protective packaging, poly bags, tapes, corrugated box, mailers and others. The corrugated box segment is expected to dominate the market over the forecast period. The segment growth is attributed to the rise in demand for eco-friendly packaging products with high strength and sustainability, including corrugated boxes. Additionally, consumers' increasing reliance on online delivery of goods is probably going to increase demand for corrugated box packing. On the other hand, the mailers segment is expected to grow at a significant rate over the forecast period.

The segment growth is attributed to the high performance and functionality of mailers as compared to the corrugated box. E-commerce mailers require less storage space than corrugated cardboard and fill and close more quickly in logistics facilities. Since the material conforms to the shape of the goods, the consumer simply has to pay for the real product's delivery expenses rather than an additional fee for air shipping a bigger box. Thus, this is expected to drive the segment growth over the forecast period.

Based on the material, the global E-commerce Packaging market is divided into corrugated board, plastic, paper and paperboard and wood. The plastic segment is expected to hold the largest market share over the forecast period. The segment growth is owing to the various benefits of plastic packaging including durability, safety, hygiene, security, lightweight and others. Moreover, it has a contribution towards sustainable developments such as it saves energy, optimal use of resources, preventing food waste and others. Besides, the paper and paperboard segment is growing at the highest CAGR over the projection period. Paper containers, sometimes referred to as paper packaging, are a high-efficient and affordable option that people may use to move, carry, and store a variety of things. Paper-based packaging is increasingly being used because it can be customized to meet the demands of a particular product or consumer and is designed to be strong yet lightweight. Paper-based packaging, which is made from renewable resources, has several advantages, including a sustainable, safe, and healthy environment.

Based on the application, the global E-commerce Packaging market is divided into food and beverages, apparel and accessories, personal care, household, electronics and electrical, pet food, pharmaceutical and others. The apparels and accessories segment is expected to dominate the market over the forecast period. The growth in this segment is owing to the growing disposable income along with increasing fast fashion trends among young populations. Fast fashion refers to inexpensive and stylish clothing. The popularity of fast fashion is significantly growing as a result of social media and celebrities' growing impact. Additionally, the convenience of customers being able to buy online from the comfort of their homes is helping to increase product sales through online channels.

Segments Covered in the Report:

By Product

By Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

March 2025