January 2025

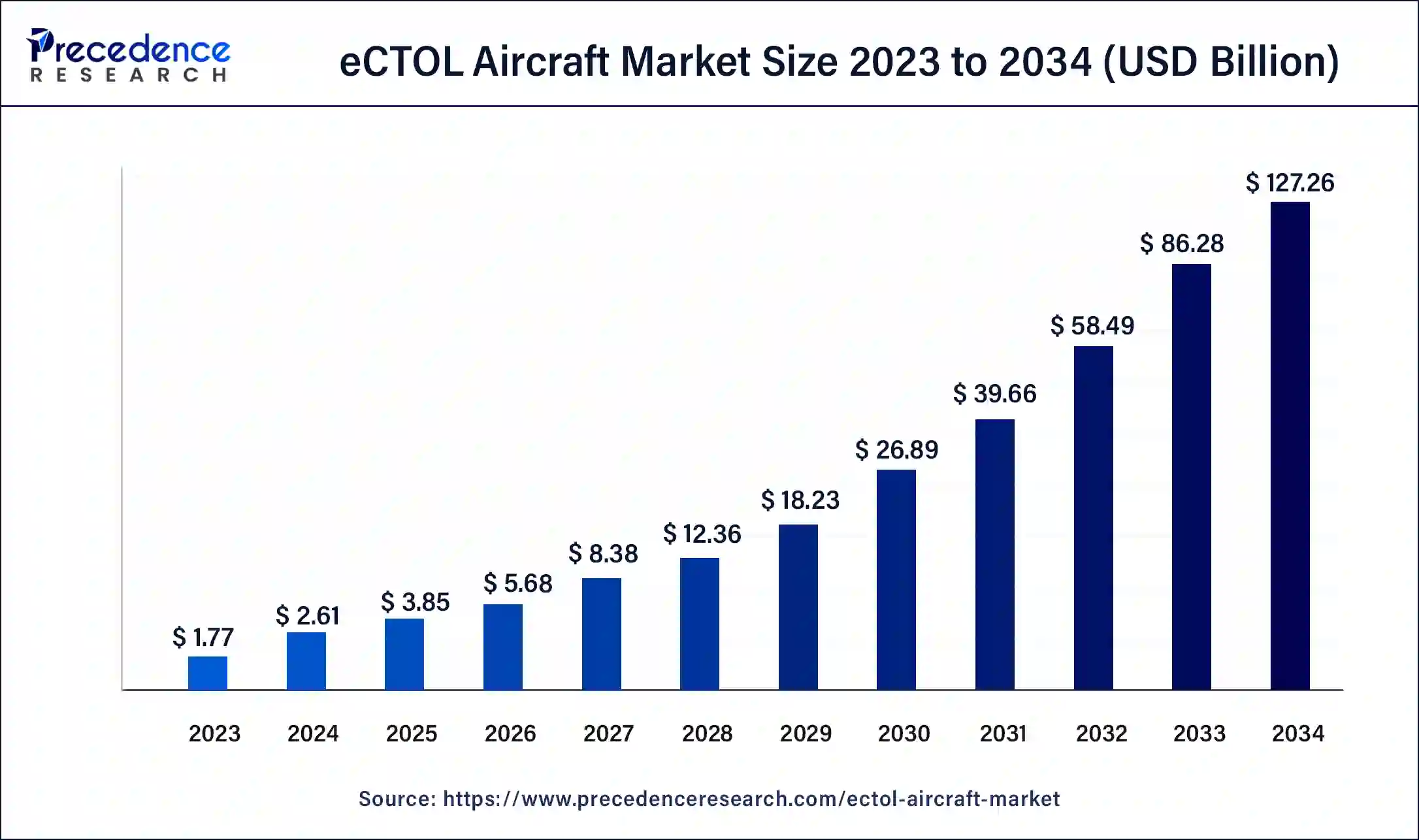

The global eCTOL aircraft market size was USD 1.77 billion in 2023, calculated at USD 2.61 billion in 2024 and is projected to surpass around USD 127.26 billion by 2034, expanding at a CAGR of 47.5% from 2024 to 2034.

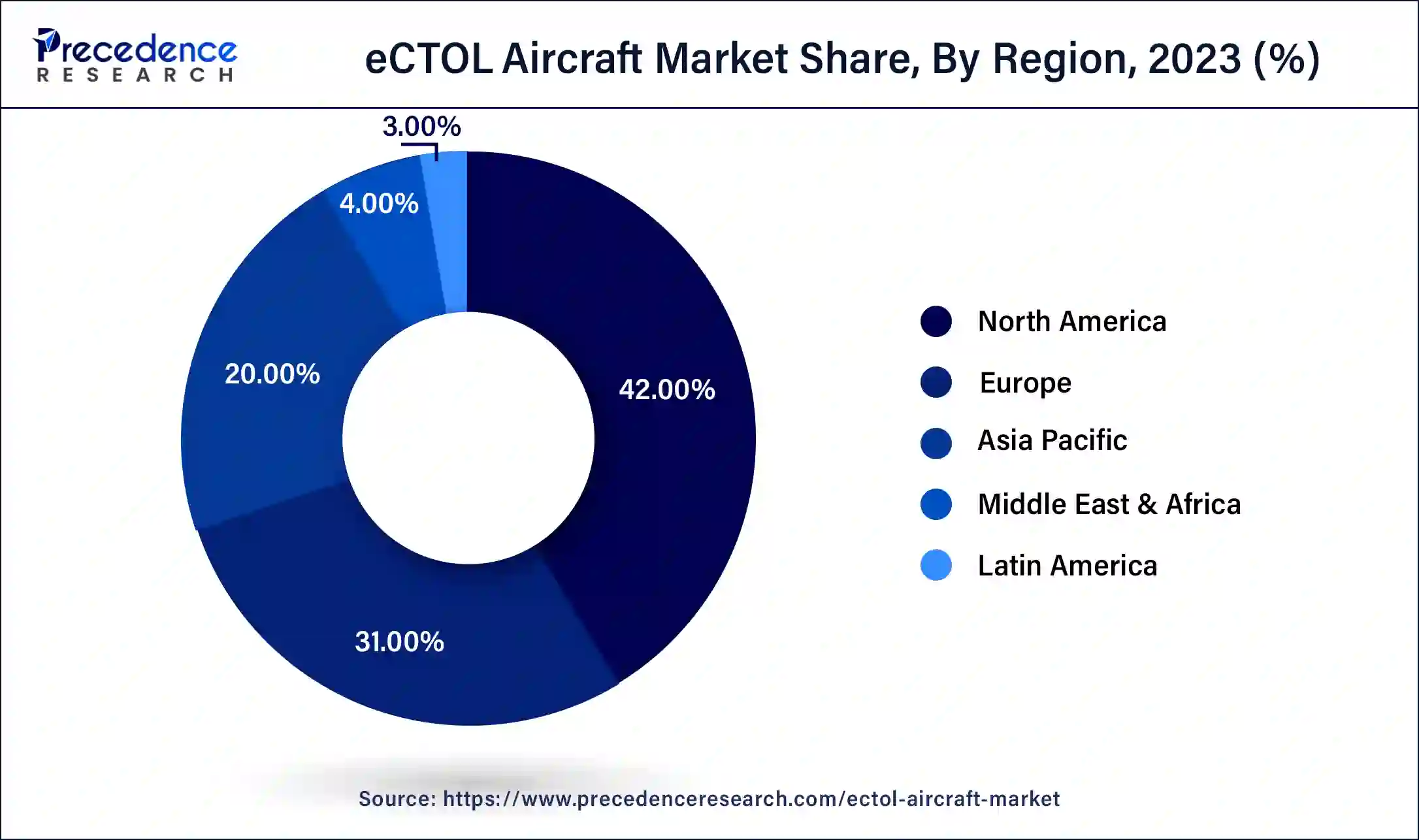

The global eCTOL aircraft market size accounted for USD 2.61 billion in 2024 and is expected to be worth around USD 127.26 billion by 2034, at a CAGR of 47.5% from 2024 to 2034. The North America eCTOL aircraft market size reached USD 740 million in 2023.

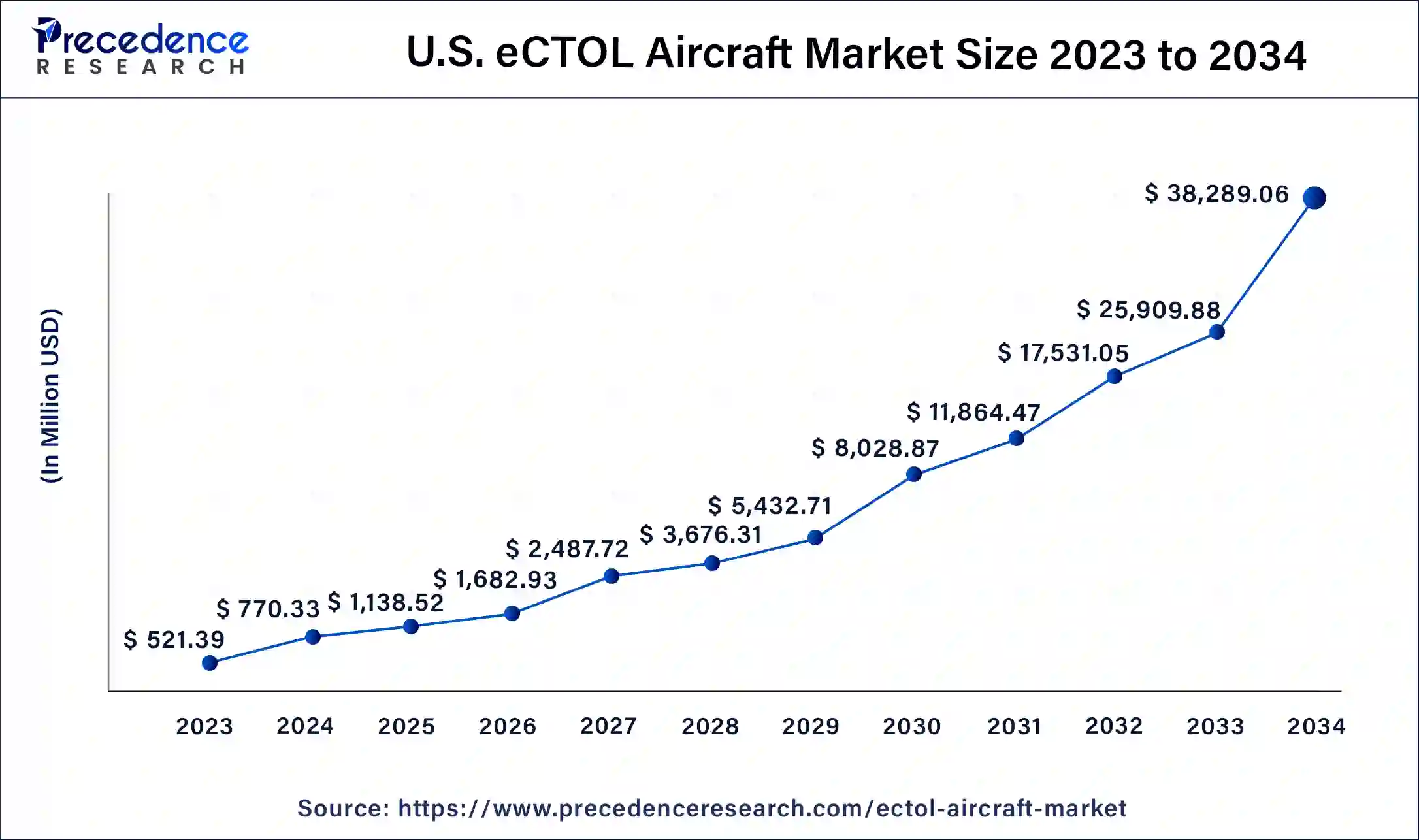

The U.S. eCTOL aircraft market size was estimated at USD 521.39 million in 2023 and is predicted to be worth around USD 38,289.06 million by 2034, at a CAGR of 47.8% from 2024 to 2034.

North America holds a share of 42% in the eCTOL aircraft market. The dominance of North America in the eCTOL (electric Conventional Takeoff and Landing) aircraft market is anticipated due to the concentration of key manufacturers like Joby Aviation, Bell Textron Inc., Kitty Hawk, and others in the United States. This region is at the forefront of electric aviation innovation and urban air mobility development.

Furthermore, the significant investments made by the U.S. government in the development of Vertical Takeoff and Landing (VTOL) aircraft, including eCTOL variants, are expected to drive substantial market growth. The collaborative efforts between government initiatives and industry leaders position North America as a key hub for advancing and commercializing electric aircraft technologies.

Asia-Pacific is poised for rapid growth in the eCTOL (electric Conventional Takeoff and Landing) aircraft market due to several factors. The region's increasing urbanization, population density, and demand for efficient transportation solutions drive the need for innovative air mobility. Moreover, rising investments in electric aviation technologies, supportive government initiatives, and the presence of emerging economies eager to embrace sustainable transportation contribute to the favorable environment. Asia-Pacific's strategic position as a burgeoning market for eCTOL aircraft is underscored by a confluence of economic, demographic, and technological factors propelling the region's aerospace industry forward.

Meanwhile, the eCTOL aircraft market in Europe is poised for substantial growth, driven by the active participation of several European cities in the Urban Air Mobility (UAM) Initiative, a key component of the European Innovation Partnership on Smart Cities and Communities (EIP-SCC). This strategic collaboration demonstrates Europe's commitment to advancing sustainable and efficient urban transportation solutions. The UAM Initiative fosters an environment conducive to the integration of eCTOL aircraft, aligning with Europe's focus on smart city development and the promotion of innovative, environmentally friendly modes of transportation. The involvement of cities in this initiative positions Europe as a promising market for the adoption and deployment of eCTOL aircraft in the context of evolving urban mobility strategies.

An eCTOL (electric Conventional Takeoff and Landing) aircraft is an electrically powered aircraft that follows the conventional takeoff and landing procedures, similar to traditional airplanes. Unlike its vertical takeoff and landing (VTOL) counterpart, eCTOL aircraft require a runway for takeoff and landing. These aircraft maintain the familiar fixed-wing design of conventional airplanes but are powered by electric propulsion systems, contributing to reduced carbon emissions and environmental sustainability.

The eCTOL concept is applicable across various aviation sectors, including regional travel and cargo transport, leveraging the efficiency of traditional airport infrastructure. As the aviation industry continues to explore electric propulsion technologies, eCTOL aircraft represent a key innovation in the pursuit of cleaner and more sustainable air transportation solutions.

eCTOL Aircraft Specifications

| Type | eCTOL | Hybrid-electric | Hybrid-electric | eVTOL |

| Capacity | 1 pilot + 4 passengers | 9 passengers | 4-9 passengers | 5-7 passengers |

| Range | 250 miles (402 kilometers) | 296 miles (476 kilometers) | 300 miles (483 kilometers) | 200 miles (322 kilometers) |

| Gross weight | 7,000 lb (3,175 kg) | 14,000 lb (6,350 kg) | 5,290 lb (2,400 kg) | 8,000 lb (3,629 kg) |

| Propulsion | 5 electric motors | 1 combustion engine + 1 electric motor | 1 combustion engine + 3 electric motors | 3 electric motors |

| Power source | Lithium-ion battery pack | Lithium-ion battery pack | Lithium-ion battery pack + fuel tank | Lithium-ion battery pack |

| Charging time | 1 hour | 30 minutes | 1 hour | 1 hour |

| Wing span | 50 ft (15.24 meters) | 38 ft (11.58 meters) | 48 ft (14.63 meters) | 26 ft (7.92 meters) |

| Tail | V-tail | Conventional horizontal and vertical stabilizers | V-tail | V-tail |

| Landing gear | Fixed tricycle gear | Fixed tricycle gear | Fixed tricycle gear | Fixed tricycle gear |

| First flight | Dec-21 | October 8, 2020 | Jul-21 | Dec-20 |

| Expected entry into service | 2025 | 2024 | 2025 | 2024 |

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 47.5% |

| Market Size in 2023 | USD 1.77 Billion |

| Market Size in 2024 | USD 2.61 Billion |

| Market Size by 2034 | USD 127.26 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Lift Technology, By Maximum Take-off Weight (MTOW), and By Range |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancements in battery technology

Battery technology is crucial for the performance of eCTOL aircraft. Ongoing improvements in energy density and cost reductions are notable.

Advancements in battery technology play a pivotal role in surging market demand for eCTOL (electric Conventional Takeoff and Landing) aircraft. As battery energy density improves, these aircraft can achieve longer ranges and higher performance levels, addressing critical limitations that have historically constrained the viability of electric aviation. Enhanced energy storage capacity allows eCTOL aircraft to cover more substantial distances on a single charge, making them increasingly practical for regional and commercial applications.

Moreover, as battery costs continue to decline, the overall affordability of eCTOL aircraft improves, driving market accessibility. The synergy of increased energy density and reduced costs aligns with global efforts to transition toward sustainable transportation, fostering a greater demand for electric aircraft. With ongoing innovations in battery technology, the eCTOL market is poised to benefit from the dual advantages of extended operational capabilities and improved cost-effectiveness, thereby accelerating its growth in the broader aerospace industry.

Weight and payload capacity

Weight and payload capacity limitations pose significant restraints on the market demand for eCTOL (electric Conventional Takeoff and Landing) aircraft. The inclusion of heavy battery systems required for electric propulsion can result in a substantial increase in the overall weight of these aircraft. This additional weight negatively impacts payload capacity, limiting the amount of cargo or passengers that eCTOL aircraft can transport. Such restrictions make these electric aircraft less competitive and viable for applications where carrying larger loads or accommodating more passengers is crucial.

The reduced payload capacity also affects the economic feasibility of eCTOL aircraft, particularly in commercial and cargo transport sectors. Industries dependent on transporting significant loads over longer distances may find the limited payload capacity of eCTOL aircraft a deterrent, slowing down the widespread adoption of electric aviation in certain market segments. Addressing these weight and payload challenges is essential for enhancing the competitiveness and versatility of eCTOL aircraft, ultimately driving greater market demand.

Cargo transport and logistics

Cargo transport and logistics play a pivotal role in shaping opportunities for the eCTOL (electric Conventional Takeoff and Landing) aircraft market. The continual surge in online shopping and the demand for swift, eco-friendly delivery solutions underscore the necessity for efficient cargo transport. eCTOL aircraft, designed to operate seamlessly from existing airports and reach even remote locations, emerge as a transformative solution for the final leg of delivery, addressing needs in both urban and rural areas.

These electric aircraft can overcome traditional transportation constraints, reducing delivery times and costs while minimizing environmental impact. As the logistics industry increasingly focuses on sustainability and meeting stringent emission standards, the eCTOL aircraft market stands to benefit from the evolving requirements of a dynamic and environmentally conscious cargo transport sector, creating ample opportunities for growth and innovation.

The vectored thrust segment had the highest market share of 40% in 2023. The vectored thrust segment dominated the sequencing consumables market in 2023; the segment is observed to continue the trend throughout the forecast period. In the eCTOL (electric Conventional Takeoff and Landing) aircraft market, vectored thrust is a lift technology that involves the redirection of thrust to control the aircraft's attitude and provide vertical or short takeoff and landing capabilities. Vectored thrust enables enhanced maneuverability and agility in eCTOL aircraft, making them suitable for urban air mobility applications. The trend in the market indicates a growing interest in vectored thrust technology as it contributes to improved operational versatility, addressing challenges related to urban congestion and enabling more precise and flexible flight control.

The multirotor segment is anticipated to expand at a significant CAGR of 51.4% during the projected period. On the other hand, the multirotor segment is expected to grow at a significant rate throughout the forecast period. The multirotor segment in the eCTOL (electric Conventional Takeoff and Landing) aircraft market refers to vehicles with multiple rotors, typically four or more, enabling vertical takeoff and landing capabilities.

This lift technology is commonly associated with electric vertical takeoff and landing (eVTOL) and urban air mobility (UAM) concepts. Trends in the multirotor eCTOL segment include a focus on improving energy efficiency, extending flight ranges, and addressing urban air traffic challenges. Industry players are actively investing in the development of advanced multirotor eCTOL technologies to enhance their viability for short-distance urban transportation and logistics applications.

According to the maximum take-off weight, the <250 kg segment has held 28% revenue share in 2023. The <250 Kg segment in the eCTOL (electric Conventional Takeoff and Landing) aircraft market pertains to vehicles with a maximum take-off weight of less than 250 kilograms. This lightweight category is gaining prominence for applications such as urban air mobility, surveillance, and small-scale cargo transport. The trend in this segment involves the development of compact, energy-efficient eCTOL aircraft to comply with regulatory restrictions and capitalize on the flexibility and accessibility offered by smaller, lighter electric aircraft, fostering innovation and growth in this weight class.

The 250-500 kg segment is anticipated to expand fastest over the projected period. The 250-500 kg segment in the eCTOL (electric Conventional Takeoff and Landing) aircraft market encompasses vehicles with a maximum take-off weight ranging between 250 and 500 kilograms. This weight class is gaining traction for applications such as regional transportation and medium-sized cargo delivery. With the eCTOL market expanding, Frost & Sullivan estimates that electric aircraft with a take-off weight of 250-500 kg will witness significant growth, reaching a compound annual growth rate (CAGR) of 18.3% by 2030. This segment's trend involves the development of versatile, mid-sized electric aircraft catering to regional mobility needs and addressing the demand for sustainable transportation solutions.

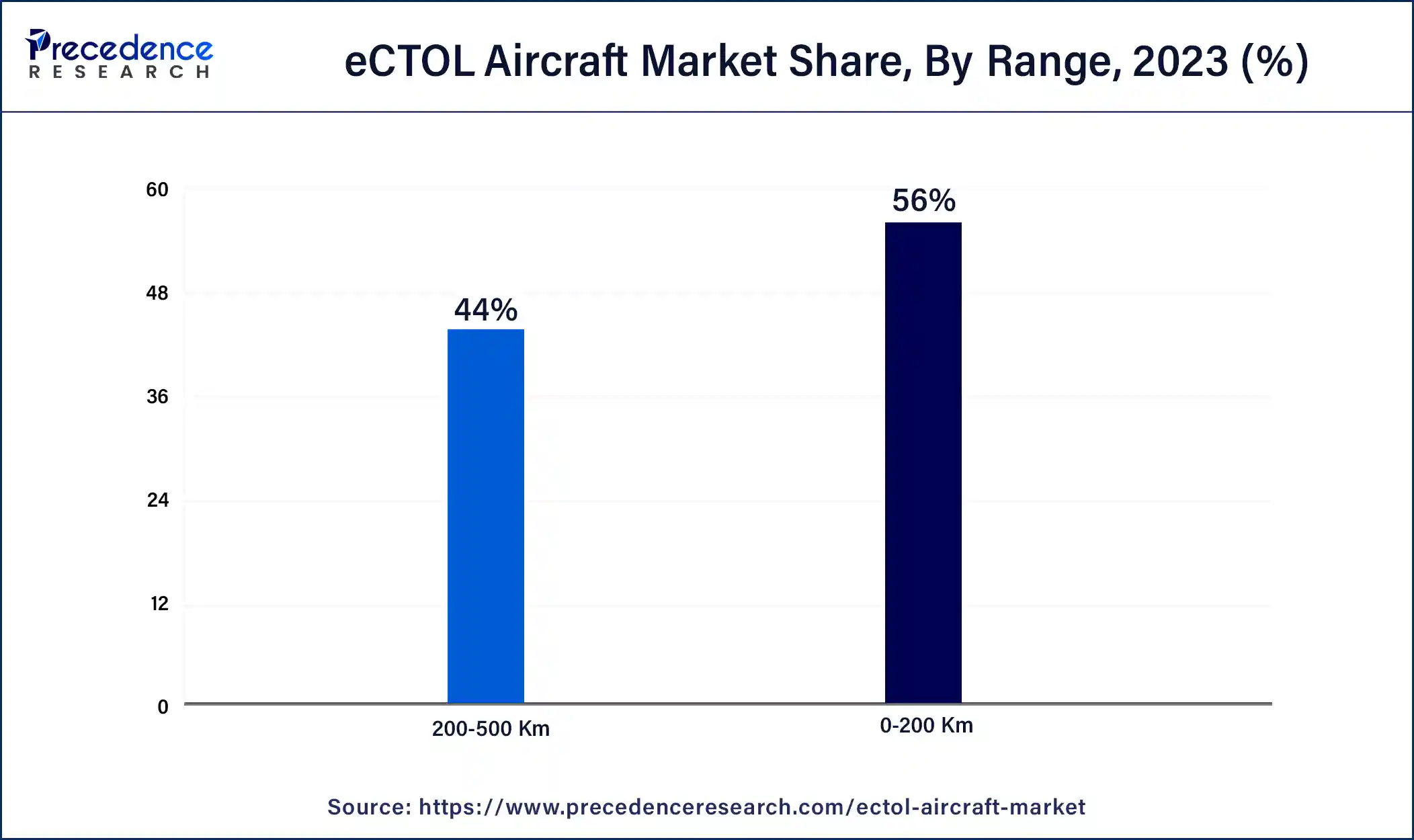

According to the range, the 0-200 km segment held a 56% revenue share in 2023. The 0-200 km segment is observed to hold the dominating share of the eCTOL aircraft market during the forecast period. The 0-200 km range segment in the eCTOL (electric Conventional Takeoff and Landing) aircraft market comprises vehicles designed for short to medium-haul distances, catering to regional travel and urban air mobility. This segment is characterized by the ability to cover distances up to 200 kilometers on a single charge. Trends in this range category include advancements in battery technology, aerodynamics, and energy efficiency, aiming to extend the operational range of eCTOL aircraft. Innovations within the 0-200 km segment align with the growing demand for sustainable, point-to-point transportation solutions in both urban and regional settings.

The 200-500 km segment is anticipated to expand fastest over the projected period. The 200-500 km range segment in the eCTOL (electric Conventional Takeoff and Landing) aircraft market pertains to electric planes designed to cover distances between 200 and 500 kilometers on a single charge. This range is significant for regional transportation and inter-city travel. Trends in this segment involve ongoing efforts to enhance battery efficiency and energy density, allowing eCTOL aircraft to extend their operational ranges. Industry focus includes innovations in aerodynamics and battery technologies to optimize electric aircraft performance and contribute to the sustainable development of regional air travel solutions.

Segments Covered in the Report

By Lift Technology

By Maximum Take-off Weight (MTOW)

By Range

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

October 2024

August 2024

January 2025