Edible Insects Market (By Product: Caterpillar, Beetles, Cricket, Others; By Application: Powder, Protein Bars, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

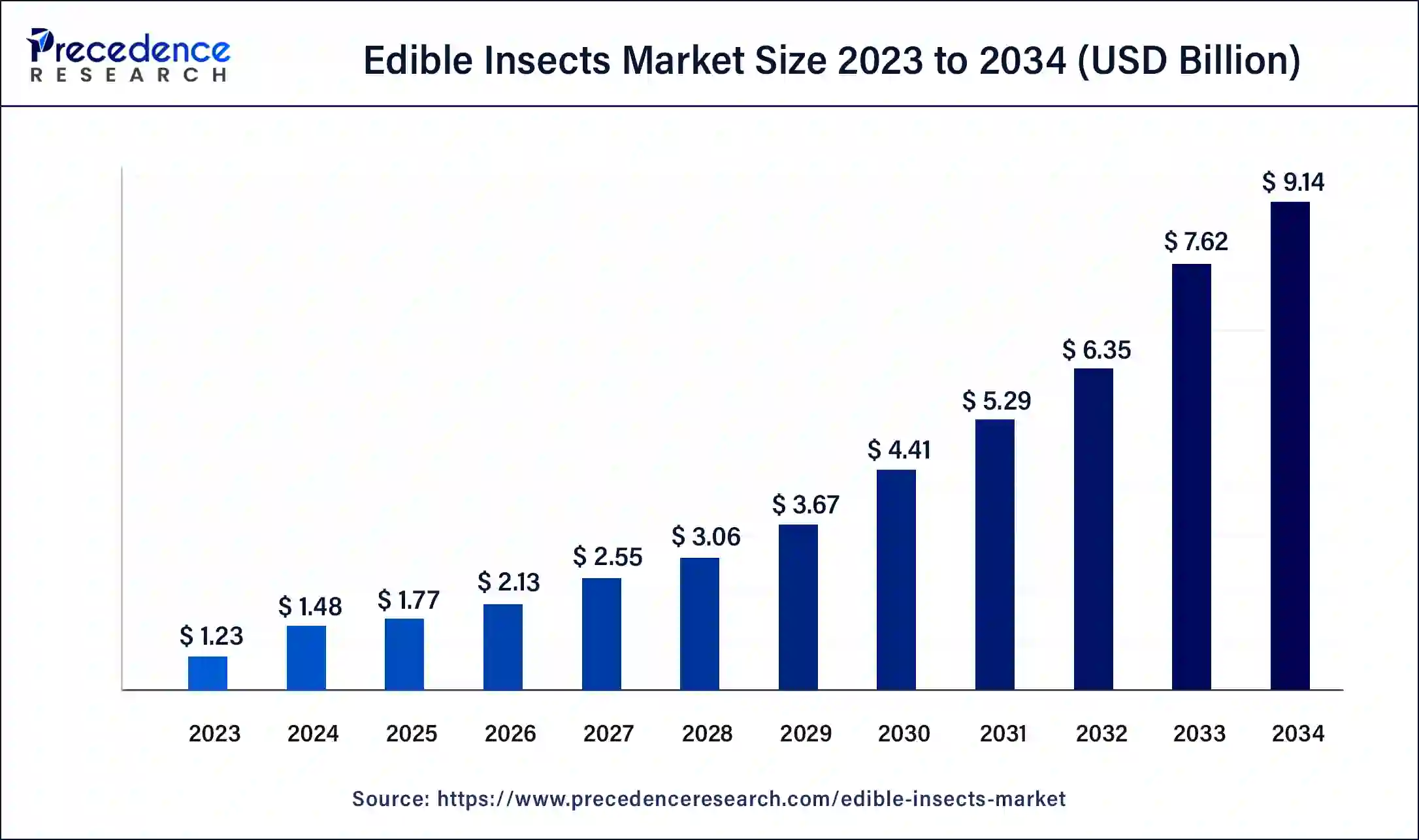

The global edible insects market size was USD 1.23 billion in 2023, accounted for USD 1.48 billion in 2024, and is expected to reach around USD 9.14 billion by 2034, expanding at a CAGR of 20% from 2024 to 2034. The North America edible insects market size reached USD 420 million in 2023. The edible insects market is driven by high insect nutritional value.

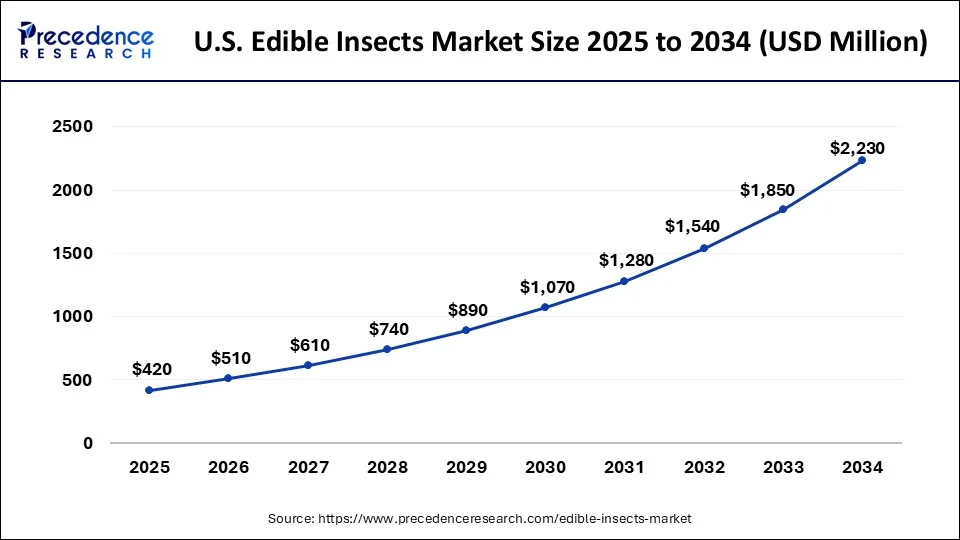

The U.S. edible insects market size was estimated at USD 290.00 million in 2023 and is predicted to be worth around USD 2,230.00 million by 2034, at a CAGR of 20.3% from 2024 to 2034.

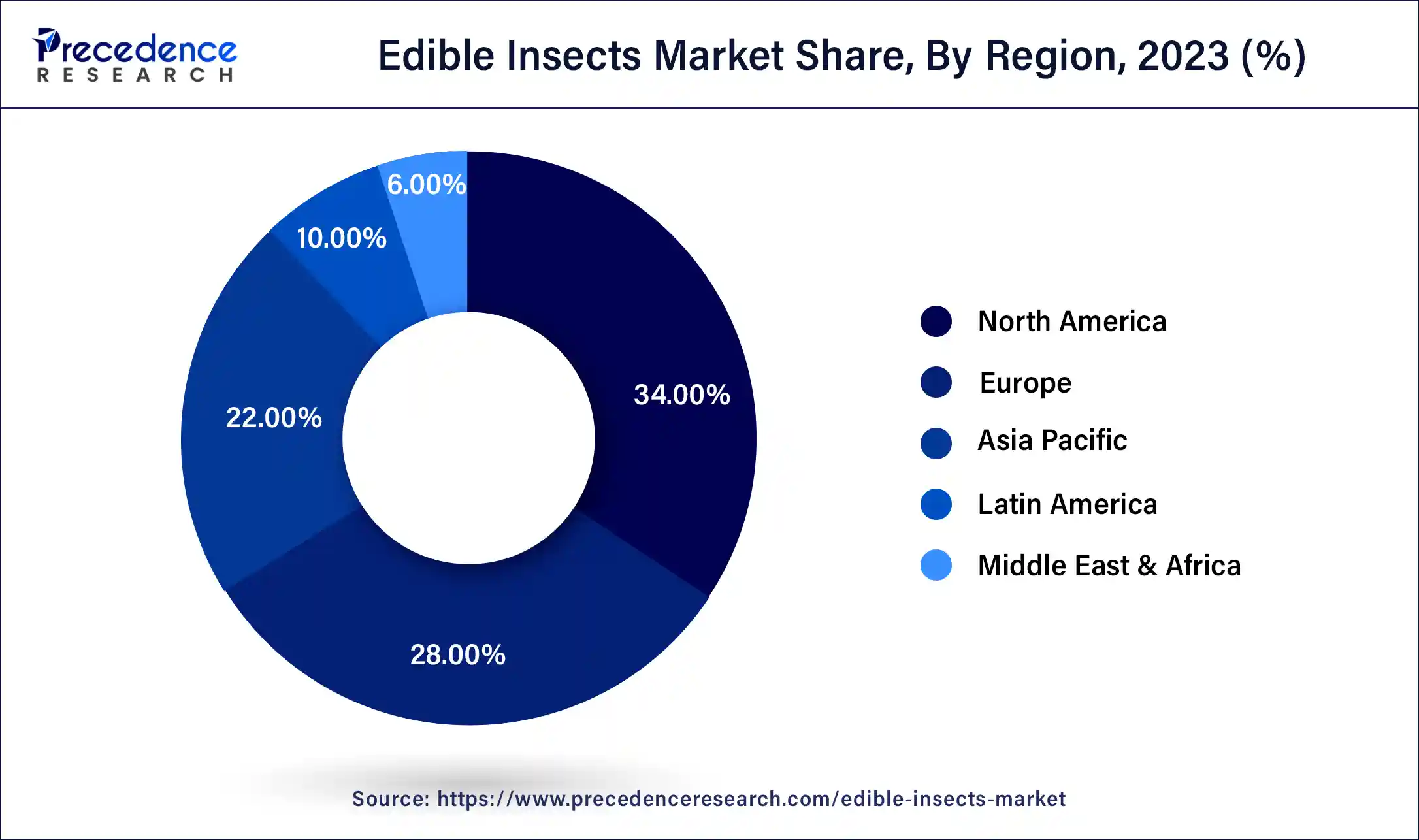

North America has its largest market share of 34% in 2023 in the edible insects market. Consumer perceptions of alternative and sustainable protein sources have significantly changed in the last several years. Because of their high nutritional content, environmental friendliness, and ability to help with food security issues, edible insects have become increasingly popular. Food producers and eateries have responded to consumer demand for sustainable and healthful food options by introducing novel insect-based products and menu items.

Research centers and colleges in North America, which have addressed issues with food safety, nutrition, and mass production, have also helped advance insect farming techniques.

Europe shows a significant growth in the edible insects market during the forecast period. Food tech startups, traditional food manufacturers, and venture investors have substantially invested in the European edible insect sector. This financial inflow has brought about advancements in processing technology, product development, and insect farming practices, creating a wide variety of insect-based food products that appeal to various customer segments. More and more people consider edible insects sustainable and viable food sources since they are high in protein, good fats, vitamins, and minerals.

Asia Pacific is observed to witness a notable rate of growth in the edible insects market during the forecast period. Food companies and entrepreneurs in Asia Pacific are increasingly incorporating edible insects into innovative food products, such as snacks, protein bars, and baked goods. These novel food offerings appeal to adventurous consumers and provide new market opportunities for edible insect producers in the region. Some countries in Asia Pacific have implemented supportive policies and regulations to promote the edible insect industry. For example, Thailand has established insect farming standards and regulations to ensure food safety and quality, while also providing financial incentives to encourage insect farming and research.

Product development for the edible insects market has seen great creativity, with businesses producing a wide range of food items based on insects, including protein bars, snacks, pasta, burgers, and more. These products appeal to consumers willing to test insect-based components in conventional food formats but may be reluctant to eat complete insects. Foods high in protein are becoming more and more popular as the world's population rises. Since edible insects are a great source of high-quality protein, people searching for wholesome and sustainable protein substitutes find them appealing.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 20% |

| Global Market Size in 2023 | USD 1.23 Billion |

| Global Market Size in 2024 | USD 1.48 Billion |

| Global Market Size by 2034 | USD 9.14 Billion |

| U.S. Market Size in 2023 | USD 290.00 Million |

| U.S. Market Size by 2034 | USD 2,230.00 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of edible insects in food application as protein supplement

Many societies around the world have traditionally used insects as food. As globalization blurs cultural boundaries, eating meals based on insects is becoming increasingly common. This cultural acceptance is critical to driving market expansion since consumers are growing more receptive to experimenting with novel and diverse protein sources. Edible insects are rich in essential nutrients such as protein, vitamins, minerals, and healthy fats. They offer a high-quality protein source that is comparable to traditional animal protein sources like meat, poultry, and fish. As consumers become more health-conscious and seek nutritious food options, edible insects present a sustainable and nutrient-dense alternative.

In many cultures around the world, insects have been consumed as a traditional food source for centuries. As global food cultures intermingle and consumer preferences diversify, there is a growing acceptance of edible insects in mainstream diets. Additionally, the novelty factor and adventurous eating trends contribute to increased interest and experimentation with insect-based foods among consumers.

Lack of regulatory clarity

Eating insects as food is either not explicitly prohibited in many nations or is covered by vague legal provisions. It is difficult for businesses to guarantee legal compliance regarding sourcing, preparing, and selling edible insects because there aren't defined norms. For a product to be trusted by customers and accepted in the market, it must have certifications such as organic, halal, and kosher or meet specific food safety regulations. However, producers encounter difficulties getting and presenting such credentials without legislation that clearly defines the requirements for these certifications about insects.

Growing demand owing to high nutritional value

High-quality proteins, necessary amino acids, good fats, vitamins, and minerals are abundant in edible insects. For instance, mealworms and crickets include essential minerals like iron and zinc, protein, healthy fats, and vitamin B12. Edible insects are a significant addition to diets due to their nutritional benefits, particularly for people who want to increase their protein consumption without excessively depending on traditional meat sources.

Consumers are searching for natural, nutrient-dense foods as they emphasize health and wellness more. Since edible insects don't contain hormones, antibiotics, or other additives frequently used in conventional livestock, they fit in with these trends. They are a better option for those who care about the environment because they are low in saturated fats and provide a sustainable source of omega-3 fatty acids.

The beetles segment dominated the edible insects market in 2023. Beetles are high in protein, vitamins, minerals, and good fats, just like many other edible insects. Particularly when contrasted with traditional livestock like cattle or poultry, they are frequently promoted as a sustainable alternative source of protein. Regarding greenhouse gas emissions and resource use (land, water, feed), beetles are also less harmful to the environment, making them appealing from a sustainability perspective. Over time, the beetle and other edible insect supply chain has been more efficient and well-organized.

Now, dedicated insect farms and businesses focus on producing, growing, and processing beetles for human consumption. Improved agricultural techniques, such as automation and insect diet optimization, have achieved higher yields and constant quality, guaranteeing a steady supply for the market.

The cricket segment is the fastest growing edible insects market during the forecast period. According to conventional cattle farming, cultivating crickets for food uses fewer resources. Compared to larger livestock animals, crickets have a higher feed conversion efficiency, allowing them to turn feed into edible body mass quickly. Cricket farming is a more sustainable method of producing food since it uses less water and land, emits less greenhouse gases, and produces less greenhouse gas emissions.

Insects have long been a staple of traditional diets in many civilizations. Incorporating unusual and exotic ingredients into modern cuisine is becoming increasingly popular as global culinary trends change and become more diverse. The market for edible insects is growing due to this acceptability in culture and culinary innovation, with crickets being popular.

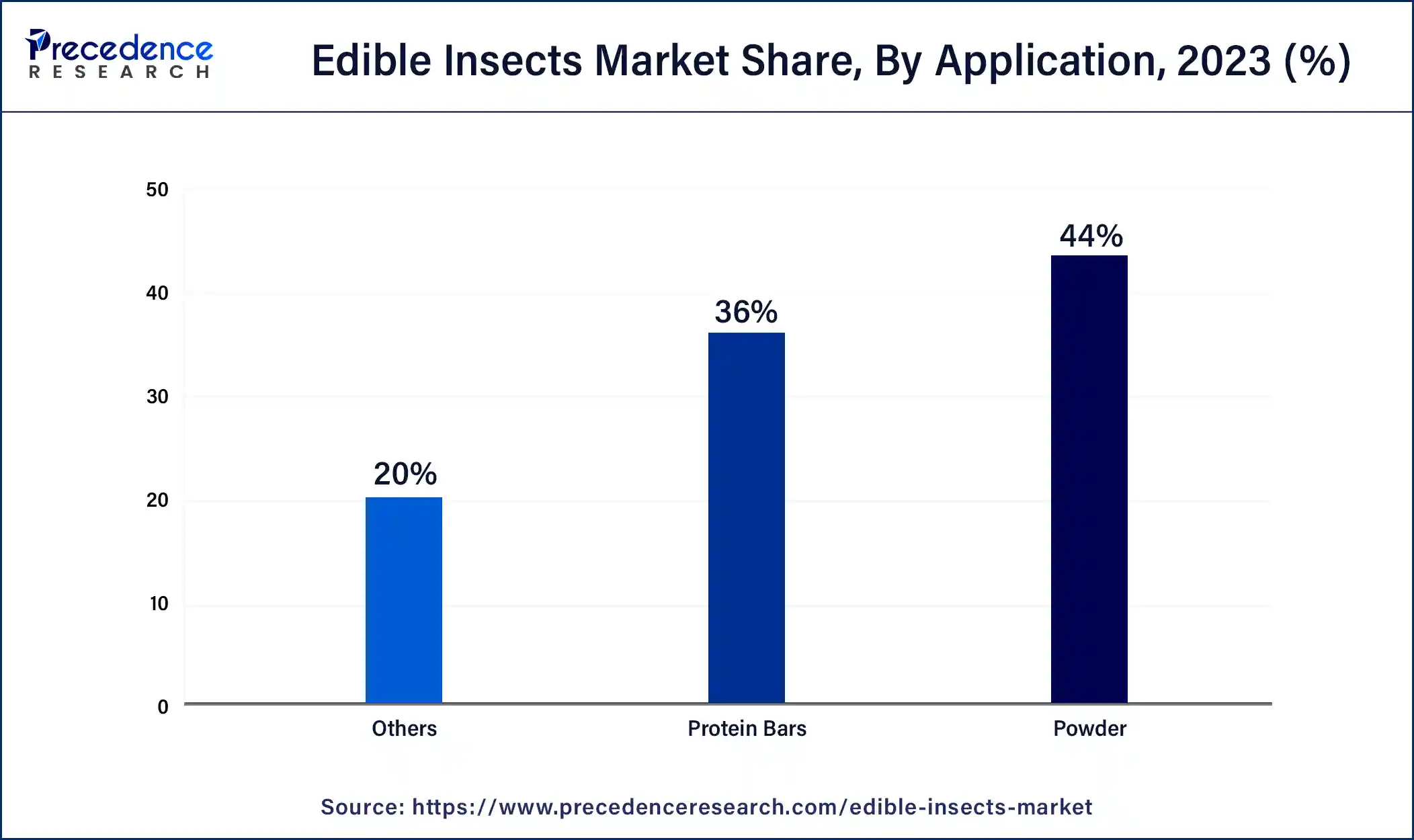

The powder segment dominated the edible insects market in 2023. Powdered insects that may be eaten are high in protein, an essential human food. Exceptionally high in protein are insects such as mealworms, grasshoppers, and crickets; these can have up to twice the protein content of more conventional animal sources like beef or chicken.

Adding insect powders to various food items, including protein bars, baked goods, pasta, snacks, and drinks, is simple. Because of their adaptability, food producers who want to improve the nutritional value of their goods find them appealing. Since insect powders are naturally devoid of common allergens like dairy and gluten, anyone with dietary restrictions or allergies can use them.

The protein bars segment is the fastest growing in the edible insects market during the forecast period. Edible insects are becoming increasingly popular as alternative protein sources as people grow more health-conscious and look for protein-rich diets. Protein bars are a popular choice for athletes, fitness enthusiasts, and health-conscious consumers since they provide an easily digestible and convenient shape for people who want to increase their protein intake. The market for protein bars is growing due to ongoing advancements in food processing and formulation.

Food technologists and producers are creating novel methods to enhance the flavor, texture, and general palatability of insect-based goods. These improvements facilitate the growing acceptability and adoption of insect-based protein bars, which cater to consumers' taste and convenience demands.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client