April 2025

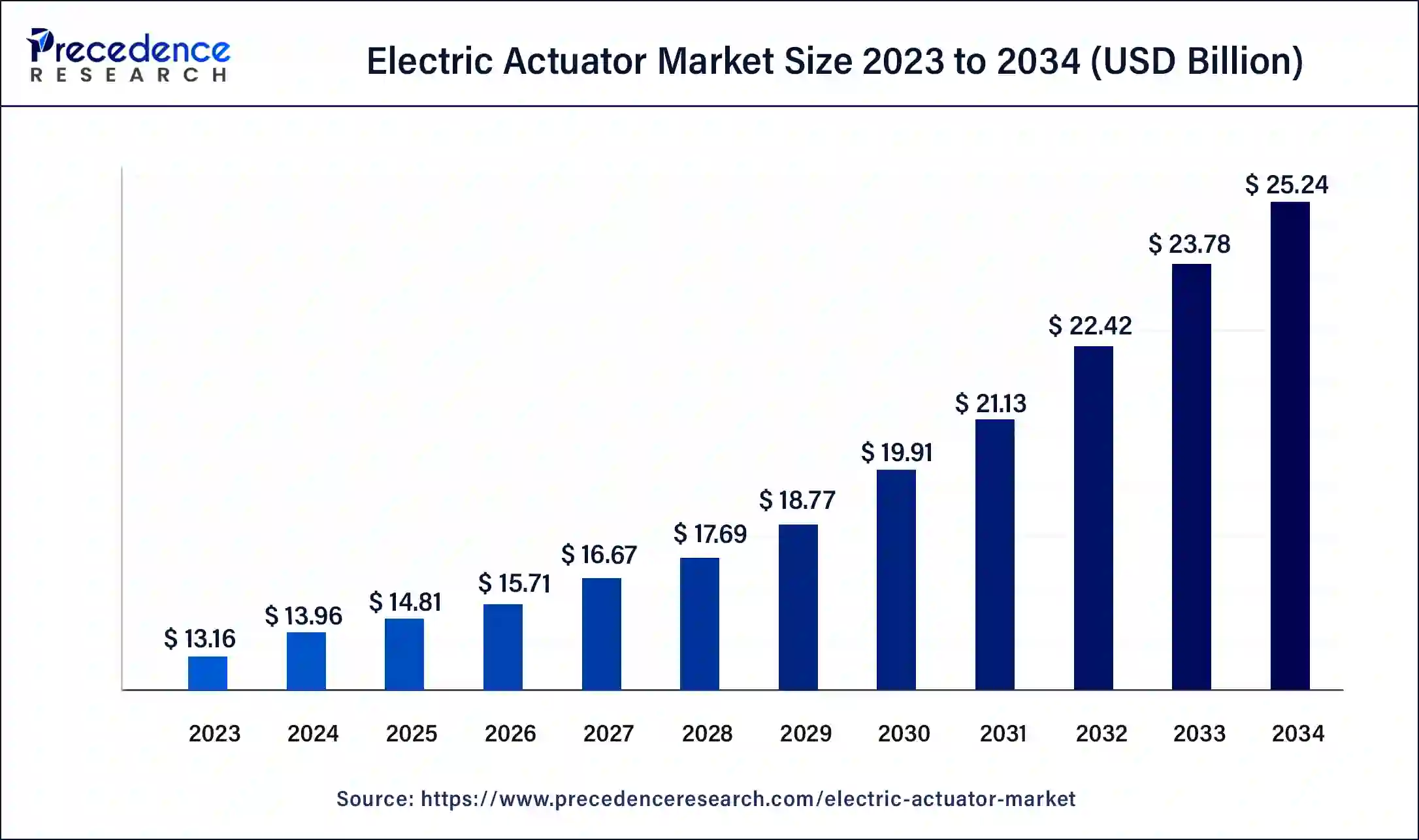

The global electric actuator market size surpassed USD 13.16 billion in 2023 and is estimated to increase from USD 13.96 billion in 2024 to approximately USD 25.24 billion by 2034. It is projected to grow at a CAGR of 6.11% from 2024 to 2034.

The global electric actuator market size is predicted to reach around USD 17.01 billion by 2034 from USD 9.13 billion in 2024, at a CAGR of 6.42% from 2024 to 2034. The increase in demand from the gas and oil industry and rising safety and purity standards for water and wastewater treatment plants eventually affect the demand for electric actuators, which are the major driving factors of the electric actuator market.

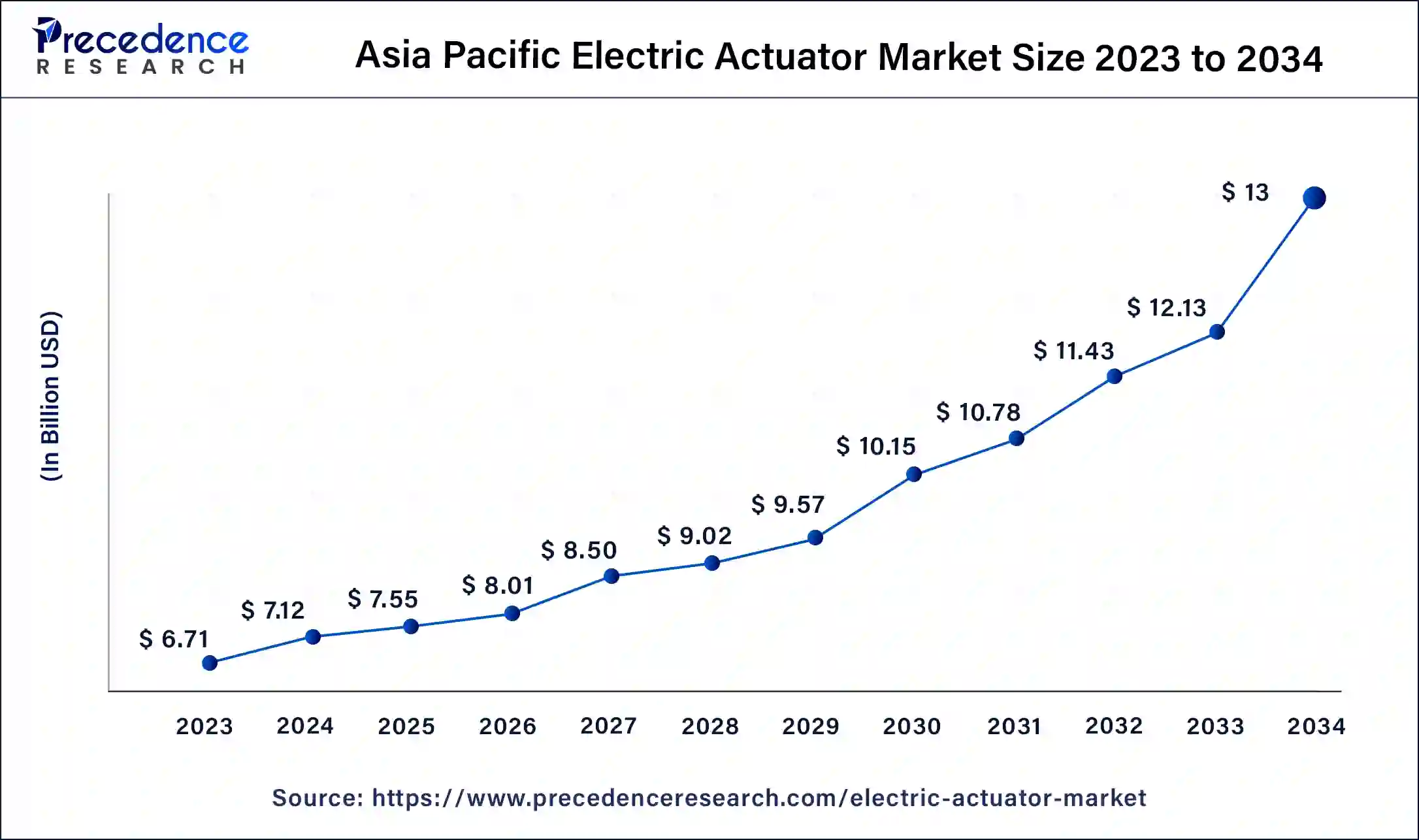

The Asia Pacific electric actuator market size was exhibited at USD 6.71 billion in 2023 and is projected to be worth around USD 13 billion by 2034, poised to grow at a CAGR of 6.19% from 2024 to 2034.

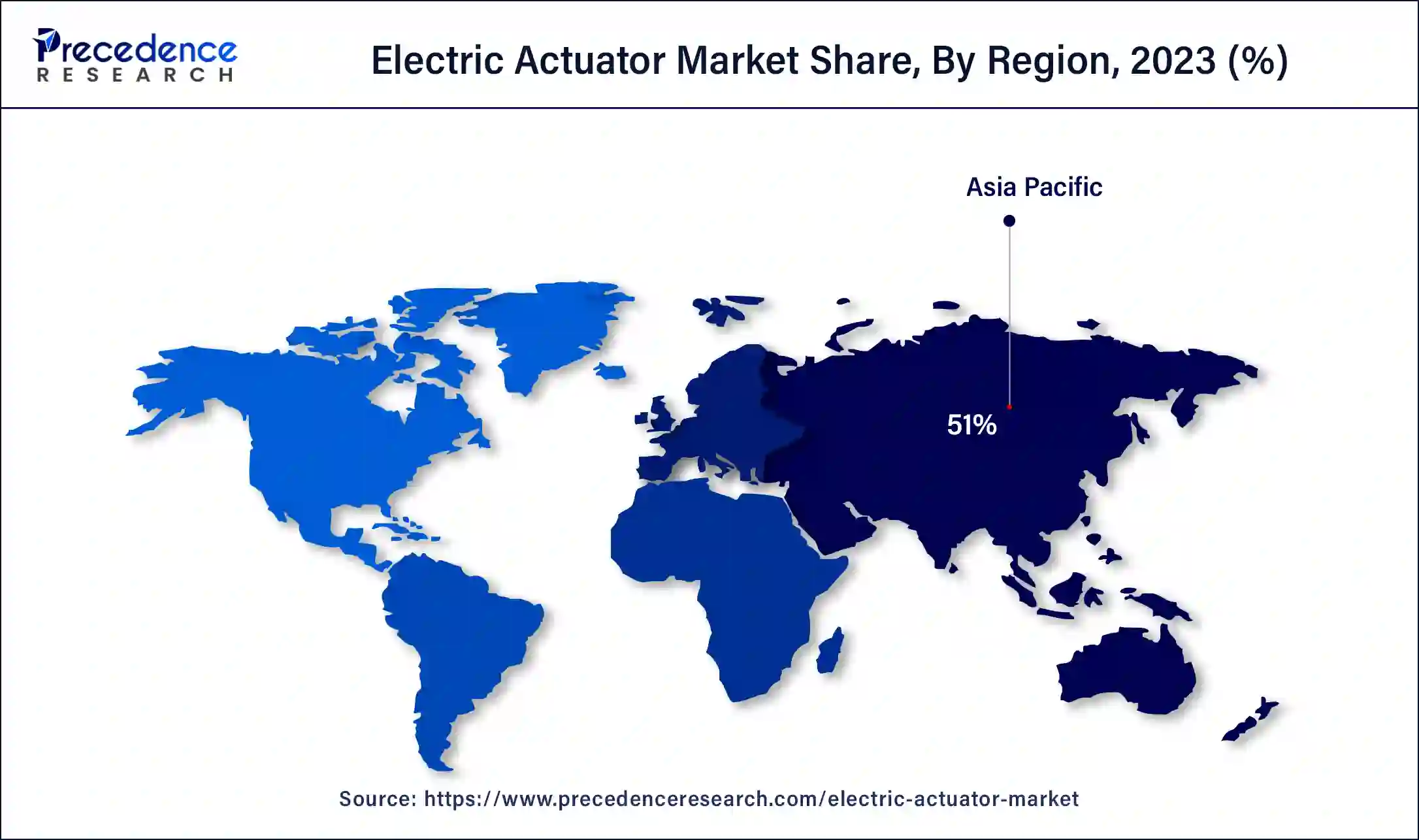

Asia Pacific accounted for the largest share of the electric actuator market in 2023. The growth of this region is due to emerging economies like India and China expanding into the automotive industry with the increasing speed of industrialization. China is a major contributor to the growth of the market as it should diversify its energy sources. Moreover, Japan is also a leading nation due to its rapid urbanization and technological advancements, with innovative industrial products launched frequently in this region, further fueling the market growth globally.

Moreover, economically expanding nations like India have been frontiers in pipeline transportation as they have abundant fossil fuel resources and frequently discover reservoirs for oil and gas, further fueling the region's growth in the electric actuator market. Also, the chemical industry is proliferating in Asian countries due to the rapid industrialization and urbanization leading the way in the major countries of the region, eventually fuelling the market on a large scale.

North America is registered as the fastest-growing electric actuator market during the forecast period. The growth of this region is attributed to the extensive infrastructure development for activities in the gas and oil industry, maturing the global electric actuator market. North America is, thus, more developed than any other region in the market as it is aggressively the frontier of unconventional oil and gas upstream activities. Natural gas is the most widely adopted energy generator in North America due to its low cost and easy availability in this region.

The electric actuator market is experiencing significant growth due to increasing automation across various industries, including automotive, aerospace, and manufacturing. These actuators are favored for their precision, efficiency, and ability to integrate with smart technologies. The market is driven by the rising demand for energy-efficient systems and the shift towards electric vehicles. Asia Pacific is the fastest-growing region, fuelled by industrial expansion and technological advancements in countries like China and India.

Key players in the electric actuator market are focusing on innovations, mergers, and acquisitions to strengthen their market position. However, challenges such as high initial costs and technical complexities persist. Despite these, the market is poised for robust growth, supported by the continuous advancements in automation and robotics and the global push for sustainable and energy-efficient solutions.

AI Impact on the Market

Artificial Intelligence (AI) is poised to significantly impact the electric actuator market by enhancing efficiency, precision, and predictive capabilities. AI can be integrated with electric actuators to enable advanced control algorithms that optimize performance in real-time, adapting to changing conditions and minimizing energy consumption. This leads to improved operational efficiency and cost savings, which are crucial for industries aiming to maximize productivity.

AI-driven predictive maintenance is another key benefit, as it allows for the monitoring of actuator performance and the early detection of potential issues. By analyzing data from sensors embedded in actuators, AI can predict failures before they occur, reducing downtime and maintenance costs. This predictive capability is particularly valuable in critical applications where unexpected failures can be costly and disruptive.

Moreover, AI facilitates enhanced automation by enabling actuators to learn from past operations and adapt to new tasks with minimal human intervention. This adaptability is crucial for industries such as manufacturing, where flexibility and responsiveness to market demands are essential. As AI technology continues to evolve, its integration with electric actuators will drive innovation and growth in the electric actuator market.

| Report Coverage | Details |

| Market Size by 2034 | USD 25.24 Billion |

| Market Size in 2023 | USD 13.16 Billion |

| Market Size in 2024 | USD 13.96 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.11% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, End-use Industry, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing automation across various industries

The surge in automation across diverse sectors such as automotive, aerospace, and manufacturing is a pivotal driving factor for the electric actuator market. Automation enhances efficiency, precision, and productivity, which are crucial for maintaining competitiveness in today’s industrial landscape.

Electric actuators play a vital role in automated systems by providing accurate control over movements and processes. In the automotive industry, for instance, they are essential for advanced driver-assistance systems and electric vehicles, ensuring optimal performance and safety. In aerospace, electric actuators contribute to the development of more sophisticated aircraft systems, enabling better control and reduced manual intervention.

The manufacturing sector benefits from the electric actuator market through improved automation of assembly lines, reducing errors, and increasing output. As industries continue to embrace automation to meet the demands of high-quality production and operational efficiency, the reliance on electric actuators is set to grow, thereby driving the market forward.

Rising demand for energy-efficient systems

The growing emphasis on energy efficiency across various industries is significantly propelling the electric actuator market. As global energy consumption continues to rise, there is a pressing need to adopt energy-efficient technologies to reduce environmental impact and operational costs. Electric actuators are inherently more energy-efficient compared to their pneumatic and hydraulic counterparts, as they convert electrical energy directly into mechanical motion with minimal losses. This efficiency is particularly valuable in applications requiring precise control and frequent adjustments, such as in robotics and renewable energy sectors.

Furthermore, the transition towards electric vehicles (EVs) underscores the demand for energy-efficient components, with electric actuators playing a crucial role in EV powertrains and control systems. Regulatory frameworks and government incentives promoting energy conservation, as well as the use of renewable energy sources, further bolster the adoption of electric actuators. As industries strive to meet stringent energy standards and reduce carbon footprints, the demand for energy-efficient electric actuators is expected to surge, driving the electric actuator market growth.

High initial costs and technical complexities

One significant restraint for the electric actuator market is the high initial costs and technical complexities associated with their implementation. Unlike traditional pneumatic and hydraulic actuators, electric actuators require advanced electronic components and sophisticated control systems, which can lead to higher upfront investment. This cost factor can be a barrier for small and medium-sized enterprises (SMEs) that operate on limited budgets and may find it challenging to justify the expenditure without immediate and clear returns on investment.

Additionally, the integration and maintenance of electric actuators necessitate specialized technical knowledge and expertise, which may not be readily available in all industries or regions. This technical complexity can deter some organizations from adopting electric actuators, as they may face difficulties in installation, troubleshooting, and ensuring seamless operation. Furthermore, the need for continuous training and upgrading of skills to keep pace with technological advancements adds to the operational burden. These factors collectively act as a restraint for the electric actuator market, slowing down the widespread adoption of electric actuators despite their long-term benefits.

Integration with the Internet of Things (IoT) and smart technologies

The integration of electric actuators with the Internet of Things (IoT) and smart technologies presents a significant opportunity for the electric actuator market. IoT-enabled actuators can offer real-time monitoring, control, and diagnostics, enhancing operational efficiency and predictive maintenance capabilities. In industrial automation, IoT integration allows for seamless communication between devices, optimizing processes and reducing downtime.

Smart actuators equipped with sensors can provide valuable data on performance and health, enabling proactive maintenance and minimizing unexpected failures. This integration is particularly beneficial in critical applications such as manufacturing, where maintaining continuous operation is vital. Additionally, the adoption of Industry 4.0 practices, which emphasize the use of smart technologies and data-driven decision-making, further drives the demand for IoT-enabled actuators.

Expansion in emerging markets

The expansion of electric actuators in emerging markets offers a promising opportunity for substantial growth. Countries in Asia-Pacific, Latin America, and Africa are experiencing rapid industrialization and infrastructure development, creating a significant demand for automation solutions. These regions are investing heavily in modernizing their manufacturing processes, automotive industries, and renewable energy projects, all of which rely on efficient actuator systems. Moreover, government initiatives aimed at promoting industrial automation and energy efficiency further support the adoption of the electric actuator market.

As emerging markets continue to develop, they present a fertile ground for market players to introduce advanced actuator technologies. Establishing a strong presence in these regions can lead to significant market share gains and long-term growth. The ongoing urbanization and increasing focus on smart city projects also contribute to the rising demand for electric actuators, making emerging markets a crucial area for future expansion.

The liner actuator segment held the largest share of the electric actuator market in 2023. The growth of this segment is attributed to the feature of the electric linear actuator, which converts the rotational motion of the electric motor into straight/linear motion, which helps to automate the machine further with the desired speed. This can be achieved by actuators, linear guides, motors, and mechanisms for driving that collectively create the push-pull movement in a straight line.

Electric actuators are precisely generating an action proportional to the position and movement of the machine. Hence, these actuators have been found to be useful in diverse industries, such as industrial machinery, valves, and computer peripherals, to generate linear motion with accuracy. Moreover, factors like the rising pace of industrialization in emerging countries and automation in the manufacturing industry across the globe are the major driving factors of the linear actuator segment growth that fuels the market growth on a broader scale.

The hybrid actuator segment is anticipated to witness notable growth in the electric actuator market during the forecasted years. Hybrid actuators use classical robotics for movement and apply them in innovative ways. Some of the significant applications of hybrid actuators are pneumatics, hydraulics, and nylon coil actuators. The growth of this segment is related to the rising demand for soft intelligent systems that can be used in diverse fields, amplifying the growth of the market on a larger scale.

The energy segment held the dominant share of the global electric actuator market in 2023. The growth of this segment can be attributed to the various benefits offered by electric actuators that hold prominent positions in the energy sector, such as easy integration and high precision level, as they come with programmable controllers and microprocessors that make energy applications easier. The electric actuators are ideal for power plants that require highly precise valve and damper operations. They are also cost-effective and have low maintenance, thus fuelling this segment's growth in the market.

The oil & gas segment is observed to grow at the fastest rate in the electric actuator market during the foreseeable period. Companies in the oil and gas sector utilize the pipeline method for the refining and distribution process. Thus, a robust infrastructure that supports this process is required, which fuels the demand for electric actuators as they are flexible and resistible to any thermal changes. These actuators play prominent safety measures for pipeline systems. They are used to control the overall flow of the oil and gas distribution process. This process ensures the safety of the pipeline system as well as the people working around it.

The direct sales segment held the largest share of the electric actuator market in 2023. The growth of this segment is attributed to the various benefits offered by direct sales of electric actuators, such as flexibility in the schedule, regulation in supply and demand, multiple business strategies, and it provides direct customer feedback, which is necessary to develop a relationship with customers that aid in business growth.

Segments Covered in the Report

By Product Type

By End-use Industry

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

October 2024

February 2025